Gordon Holmes: Steve, a real pleasure to speak with you today. Integra Gold Corp. (ICG:TSX.V; ICGQF:OTCQX) recently released an updated preliminary economic assessment (PEA) for your project in Val d'Or, Quebec. Would you give us some highlights and how it compares to the older PEA?

Stephen de Jong: The updated PEA/mine plan is a completely new plan. The old mine plan was a five-year life of mine with 100,000 ounces (100 Koz) gold per year, so essentially the project would produce 500 Koz. Half of that would come from Triangle, and half would come from other deposits, including the Parallel. That PEA was done in 2015, based on a resource from 2014.

We've been one of the most active exploration companies in the industry over the last few years, and we've seen substantial growth at Triangle. The Triangle resource in the most recent PEA would produce over 1 million ounces (1 Moz) by itself. So on the updated PEA, 1.3 Moz would be recovered, and we're continuing to grow that resource as we go.

The other big difference in the updated PEA is that the bulk of the mining done at Triangle now is done within steeper structures, where we'll be able to use the long-hole mining method. That is lower cost and makes it easier to get our tons out. The old mine plan was about 70% room-and-pillar mining and 30% long-hole mining. The new mine plan at Triangle is about 90% long-hole mining. It's safer for our people, easier to get tonnage out and substantially cheaper as well.

Not only are we talking about a mine that's substantially bigger, but it's also a lot more efficient. That comes through in both the internal rate of return (IRR), 55% (pre-tax), and the net present value (NPV) in the project. The NPV was $184 million ($184M) pre-tax in 2015, and now it's just over $600M just a few years later.

GH: You mentioned that previously the life of mine was going to be five years, 100 Koz per year. How does that translate now? I understand that 105,000 meters (100,000m) of drilling at Triangle is not included in the updated PEA.

SD: Because we have a fully permitted mill already and it's a larger mill than what we need right now—we'll end up around 1,700 or 1,800 tons per day (1,700 or 1,800 tpd) and the mill is 2,400 tpd—we don't have that bottleneck. As we continue to grow our resource, we don't just have to add it to the mine life. If we can access that material, we can front-end load that into our mine plan.

The mine plan now is the first eight years are 135 Koz/year, and over the 11-year mine life, 125 Koz/year. The resource used in the updated PEA was from 2016. On March 22, we announced an updated resource as well. So on the Triangle deposit, which recovered 1 Moz in the PEA, we just added another 700 Koz. The mine plan at Triangle has continued to grow.

We think we'll be able to extend the mine life beyond its current 11 years but, also, front-end load some of that production and increase the annual throughput as well. So we are pushing forward, but you're going to continue to see this project grow, both in annual production and in mine life.

GH: You started construction of your ramp last summer. How is it progressing? And then help our readers get a better understanding of how this ramp is giving you the opportunity to take a look at these veins.

SD: The ramp or the decline that we're building now is going into the upper zone, called the C2 zone. Picture a series of structures. The C1 is the closest to surface and going down from there are C2, C3, C4. The C2 and the C4 zones are the largest. The C2 structure, because it's closer to the surface, is easier to get at, and it's the one we're going toward now. We've already put 750m of development into the ramp, and we're right on the edge of that C2 structure now. We've been drilling the C2 structure from surface, and in the resource update we put out March 22, we added 160 Koz just within that upper structure.

In the coming weeks we will continue to push that ramp forward but also set up our first drill station. We'll be able to drill the C2 structure at 10m centers. Drilling from surface, we're drilling between 25 and 40m centers, and as you go deeper into the deposit, your drill spacing widens out and you get anywhere from 40 up to 100m spacings. We'll have a much better idea of what we're actually dealing with when we drill off this deposit at 10m centers. That's the first step.

The second step is to do a bulk sample. We have a resource estimate, and it's based on drill cores and the hundreds of thousands of meters of completed drilling. But the next step is to take a bulk sample and see how that bulk sample and the gold within that sample reconcile to a resource and see if we have to make any tweaks. It's one thing to do a resource estimate off drill core; it's another thing to do your bulk sample.

What we've seen in the drilling that we've done in this upper zone is actually the grade has been going up, which isn't usual in infill drilling. But for this type of deposit, you do have these high-grade areas where that can really have a significant impact on the overall grade of the deposit.

Fortunately for us, as we do this bulk sample and if it goes well, that same decline could be used down the line in a potential production scenario. With this nine-month program to do the bulk sample, we are also taking about six to nine months off the schedule for the construction period.

GH: As I'm sure you know, a lot of exploration companies stop there and then look for somebody else to take the project into production. What's your view at present?

SD: You have to almost ask yourself why would you stop and get someone else to put your project into production. The two main hurdles are technical experience or ability to actually build it and money.

GH: Capex.

SD: Yes. If we look at a capex-NPV ratio or a capex:market cap, we have the lowest ratio in the entire industry. Net of the preproduction revenue that we'll get over the coming 18 months as we move forward with the project, we're looking at about a CA$110M capex, net of pre-production revenue, to build a project that's going to produce 135 Koz/year. Looking at pre-tax cash flows, there are years that are over $130M themselves. This is a very financeable project. The company right now has about $35M in cash, and we're pushing forward.

We also have a team of just over 80 people in Val-d'Or, and we're sitting 2 kilometers (2km) from a mining community of 35,000 people. We have phenomenal people at our project, and we have actually about 2,000 resumes right now. So having that team to build a project is not an issue for us either.

We are going forward because Canadian producers demand a big premium in the market. There's a rerating that will happen if we are successful in our transition from an explorer to a developer and an eventual producer as well. To have a project that can be put into production for just over CA$100M that produces over 100 Koz/year and could be in production within two years, that's not only rare. You've almost moved into unicorn territory, especially considering it's in a very safe jurisdiction, sitting 2km from a mining community.

We think the most value for our shareholders is going to be to push this project toward production and, at the same time, continue to explore and expand resources and show the larger production profile for the project.

GH: Would you give a quick timeline to production?

SD: The timeline to production is to finish the bulk sample, look at the results and make the decision, at which point we're likely somewhere around 9 to 12 months away from a potential production scenario. We'll do that bulk sample in late Q3 or early Q4/17. If everything goes according to plan, we'd could be in production in H2/18.

GH: Any other catalysts that are coming here?

SD: There's no shortage of news flow at Integra. We continue to be one of the more active explorers. It's the slow season for us right now, and we have five drill rigs turning. There will always be a steady flow of drill results.

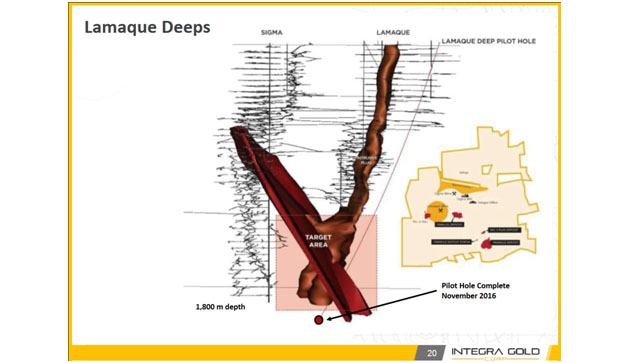

One of the drills turning right now is testing the Lamaque Deep target, underneath the old Lamaque mine. On our property are the Sigma and Lamaque mines that each produced 4.5 Moz. The Sigma mine went down 1,800m, but the Lamaque mine only went down 1,100m. We're testing the lower extension of the Lamaque mine because the concept is that the Sigma host structures come across and potentially intersect what would be the lower portion of the Lamaque mine. So it's a big program. The drill hole has gone as deep as 2,500m. We're pulling that drill hole out now and wedging on our way out.

There is no resource in place at Lamaque. Because we have a large mill, if we are able to prove up Lamaque Deep, that's something we could front-end load again and potentially process material from both. So we will be testing other targets.

Later in Q2/17, we will rebuild the Sigma resource. When we acquired the Sigma mill out of bankruptcy and with it came the Lamaque and Sigma mines, we acquired a resource at Sigma which was 1.8 Moz Inferred and 600 Koz Indicated. We're completely rebuilding the geological model, and we'll come out with that in Q2/17. Looking at the proximity of that resource next to the Lamaque Deep target, we're going to see if we can increase the throughput on the project.

GH: So this is part of the blue sky, I would say.

SD: How we like to present it to our investors is we have a bit of everything. We do have an advanced exploration, bulk sample, potential near-term production story, but we also have phenomenal exploration targets as well.

As we build the project, there is the Lassonde Curve, where you make your discovery, then you calculate your resource, and then during the construction period, all the excitement goes away and the stock price falls. And then during production, you finally get it back. What we're trying to do is, as we go forward and do our bulk sample and advanced exploration work and eventual development, continue to keep that exciting exploration part of our story going as well.

GH: Last year you had some fun by sponsoring the Gold Rush Challenge. What did you learn from crowdsourcing the analysis of the historic data of the Lamaque?

SD: 1,400 people signed up from 90 countries, and we received just over 100 submissions. They were going through the 6 terabyte database of the Lamaque and Sigma mines, which historically had been run by two different companies, so that database had never been combined. We combined them and made it public.

Through these 100 submissions, we ended up with just over 3,000 pages of exploration ideas. Some of them were proximal to the Lamaque and the Sigma mines. Others were more regional, within a 1 or 2km halo. A lot of these submissions had detailed targets for Lamaque Deep. So we used a lot of the various submissions to help really home in on exactly where we wanted to drill on the Lamaque Deep target.

We actually have about 300 targets that we need to test. So far we've tested Lamaque Deep, and we've tested one other target right across the street from our exploration office. But we've been so busy at Triangle and with some of our other targets, we actually haven't had a chance to start testing some of these other targets. We were really impressed with the results, the level of detail, and some of the new ideas that came into generating those targets.

GH: Then, not to have any grass grow under your feet, you sponsored #DisruptMining with Goldcorp Inc. (G:TSX; GG:NYSE) to showcase innovation and mining. Can you tell us a little bit about that competition and what you expect to learn from it?

SD: When we did the Gold Rush Challenge, it was not dissimilar to what Goldcorp did 15 years earlier with its Goldcorp Challenge, where it put a prize out. The Goldcorp Challenge had submissions from all over the world. And this was when the Internet was just picking up steam prior to the explosion of social media. Goldcorp was still able to receive submissions from all over the world for exploration ideas for the Red Lake project.

From the Gold Rush Challenge we actually saw a lot of new ways to look at exploration. There were new things like artificial intelligence and machine learning algorithms that were combined with traditional geology to come up with targets. We saw that as a real opportunity to look at other ways to disrupt the mining industry.

We had a conversation with Goldcorp, and came up with #DisruptMining. The concept was to find new ideas that could be applied to mining. It could be exploration, processing, mining extraction, marketing, etc., just about every aspect of our industry.

We were very impressed with what we saw and were surprised by the spectrum of ideas that came out of it. We put this together quite quickly. We announced it in December, and the finale was in March at the Prospectors & Developers Association of Canada meeting. In a three-month period, we had 155 submissions, and they covered that entire spectrum.

One of the winners was Cementation Canada with its injection hoisting. So, instead of using a shaft, you create almost a slurry underground and bring ore up through a vertical pipeline. Ideas like that are quite simple but, because of the lack of collaboration in the industry, have never really been given a chance to be tested. We saw both some very out-there ideas and some very basic ideas that could be disruptive to what we do and hopefully make our industry a little more efficient.

GH: Just wrapping up, as we've talked, typically a company is an explorer or a developer, but Integra seems to be both. Last year you constructed a ramp, yet at the same time drilled 120,000m. What's the magic that enables Integra to do this, because it seems to make you, as you said before, a unique investment opportunity that offers exposure to near-term production as well as exploration upside? How would you summarize to investors why and how you're able to do that versus the majority of the other companies?

SD: I don't know if there's a magic to us. Because of the success we've had in exploration, we've been able to leverage off that to raise money to fund both programs. In doing so, we've been rewarded both in the market and in success at our own project. And we'll continue to do that.

You don't come along with opportunities like Integra every day, where you've got infrastructure and permits and access to a mining community sitting right next to a deposit. We evaluate our exploration program and our development almost separately. We see huge opportunity with both to create value for our shareholders.

One thing that makes us unique is that, usually, the expertise of any given company is restricted to one area, developers or builders or operators or explorers. We've been able to build a phenomenal exploration team and an incredible operations team as well. That allows us to go forward with both, and we're not cannibalizing one program to take care of the other.

From an investment standpoint, there are very few strategies out there, either because they're restricted by expertise or restricted by capital or just don't have a project that fits the bill for both exploration and development at the same time. It does make Integra a very unique investment opportunity.

GH: I appreciate you giving us your time.

Stephen de Jong has been the CEO and president of Integra Gold Corp. since 2012. De Jong has held director, senior management and advisory positions at publicly listed Canadian mineral exploration and development companies. He has successfully led companies through financings, acquisitions, exploration and development programs and restructurings. Under his leadership, Integra has attracted a high caliber team of geologists, engineers, entrepreneurs and consultants to advance the Lamaque project toward production. He has been instrumental in the financing of the company, having raised $120 million in equity since assuming the CEO position, despite the recent challenges faced by the mining sector. De Jong is also a director of GFG Resources Inc. and Eastmain Resources Inc., and holds a Bachelor of Commerce degree from Royal Roads University.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Gordon Holmes, the founder of Streetwise Reports, conducted this interview. He owns, or his family owns, shares of the following companies mentioned in this interview: None. He is, or members of his immediate household or family are, paid by the following companies mentioned in this article: None.

2) Integra Gold Corp. is a sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Integra Gold Corp. had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Stephen de Jong and not of Streetwise Reports or its officers.

4) Stephen de Jong: I was not paid by Streetwise Reports to participate in this interview. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview. I or my family own shares of the following companies mentioned in this interview: Integra Gold Corp.

5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

6) This interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.