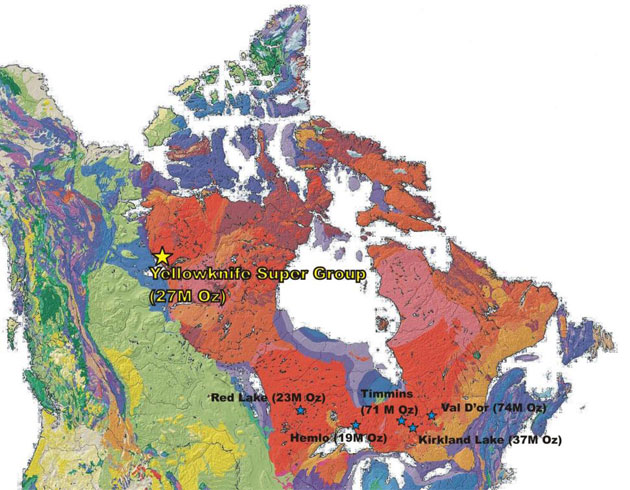

High-Grade Gold Camps in Canada

The Gold Report: You follow a large number of junior mining companies. Would you tell us about a few that you expect to create value through the drill bit?

Mick Carew: I'll start with TerraX Minerals Inc. (TXR:TSX.V; Not Rated), which has the Yellowknife City Gold Project (YCGP) in the Northwest Territories. YCGP is located in one of the six major high-grade gold camps in Canada, the Yellowknife greenstone belt, which hosts the past-producing Con and Giant gold mines. Both deposits are situated along several shear zones, with numerous historical gold showings and high-grade drill results that have been the focus of TerraX's exploration program to date. YCGP exhibits a number of similarities to the Timmins gold camp, including timing of gold mineralization and the deposition of temporally associated sedimentary host rocks.

Owing to its proximity to Yellowknife, the project is readily accessible via an all-season road and is close to infrastructure, including hydroelectric power, and a skilled workforce. Osisko Gold Royalties Ltd. (OR:TSX; Buy; $19/share Target Price) is a 16% shareholder, after investing in the company in June 2015.

TGR: TerraX recently released drill results. What do you make of them?

MC: TerraX released assay results from six drill holes at its Homer Lake target within YCGP. The intersection of gold mineralization along the north-south-trending structure at Homer Lake confirms earlier rock-chip and trench sampling results collected in 2014 and 2015. Additional intersections of lower grade and/or narrower intersections of gold and silver mineralization indicate that multiple subparallel structures could be present.

"TerraX Minerals Inc. released results from its Mispickel target, where drilling has defined a series of high-grade gold zones."

This week, TerraX also released results from its Mispickel target, where drilling has defined a series of high-grade gold zones within a wider zone of lower-grade mineralization associated with a north- to north-northwest-trending subvertical shear zone. Higher-grade gold intersections include 8.00 meters (8.00m) grading 60.60 grams per tonne (60.60 g/t) gold, including 2.25m grading 212.48 g/t gold.

The latest drill results were part of a 7,000m drill program, which is now completed. The results from Mispickel were definitely a highlight, and will likely be a key focus for the company during a summer drill program that should commence in the next couple of months.

TGR: You cover a number of companies active in Canada. Would you talk about another one?

MC: Pure Gold Mining Inc. (PGM:TSX.V; Not Rated) owns a land package, the Madsen gold project, comprising approximately 45 square kilometers of ground within the Red Lake district in northwestern Ontario, making it the third largest landowner in the area. A new interpretation of the role of ultramafic contacts and structural controls has resulted in multiple discoveries in the Red Lake district.

The geological environment and gold mineralization at Madsen's 8 Zone are similar to other recent high-grade gold discoveries in the district. The 10-kilometer-long ultramafic contact is highly prospective for additional high-grade discoveries, and Pure Gold believes the Madsen project has the potential to host the next multimillion-ounce gold deposit in the Red Lake district.

Pure Gold released additional drill results from the McVeigh Horizon, part of the Madsen gold project. The latest results are part of an ongoing drill program that continues to support the interpretation that McVeigh is the fold continuation of the Austin Horizon. The McVeigh Horizon remains open at depth and drilling continues to test the downward plunge of these high-grade gold shoots.

TGR: There are historical results at Madsen. How does that affect the upside?

MC: The Austin Horizon alone was responsible for approximately 2 million ounces (2 Moz) of gold production. Historic results and production combined with recent results provides confidence that the current resource estimate at Madsen could grow significantly. This, in turn, could provide plenty of upside to the preliminary economic assessment (PEA) recently released, which defined a project with a 1.5-year payback period over a mine life of 6.5 years, and an upfront capital cost estimate of $20.1 million (utilizing existing mining, milling and tailings management infrastructure).

This week, Pure Gold increased its 2016 drill program to 51,000m. An additional 30,000m has been set aside for McVeigh, where two drill rigs are currently active. A further 5,000m will also be completed at the company's Russet South target.

TGR: The market seems to have responded well to drill results put out by Balmoral Resources Ltd. (BAR:TSX; BALMF:OTCQX; Not Rated). Can you give us your thoughts?

MC: Balmoral has been drilling on its Bug Lake Gold Trend, part of the broader Martiniere Property in Quebec. The initial three holes were drilled along the southern portion of Bug Lake, where previous drilling in 2014 encountered high-grade gold intercepts within widely spaced drill holes; the latest results suggest these high-grade gold zones are continuous down dip and along strike.

"The latest results from Balmoral Resources Ltd. demonstrate the continuity of high-grade gold mineralization within the southern Bug Lake Zone."

In addition to Bug Lake, two holes were drilled on the Grasset property to confirm the presence of a gold-bearing shear zone in the hanging wall to the Grasset Nickel Deposit. Both holes returned gold mineralized intersections over 6m. More drilling is required to determine the extent and distribution of higher-grade gold mineralization at Grasset. The gold-bearing zone is located ~1,700m east of Balmoral's Grasset nickel deposit.

The latest results from Balmoral demonstrate the continuity of high-grade gold mineralization within the southern Bug Lake Zone. The results from Grasset also demonstrate the potential for high-grade gold mineralization elsewhere within Balmoral's land package. Results from eight drill holes are expected over the next month. Balmoral is also preparing to follow up these encouraging results with a fully funded, $4 million (20,000m) drill program scheduled to commence within the next month.

TGR: The companies you've discussed so far are all working in Canada. What about companies in other countries?

MC: SilverCrest Metals Inc. (SIL:TSX.V; Not Rated) is active in Mexico. It was spun out from SilverCrest Mines Inc. when that company was acquired by First Majestic Silver Corp. (FR-T, Not Rated) last year for $154 million. Through the same management team and board of directors, the company's focus remains in Mexico on several legacy properties not included in the First Majestic acquisition/merger.

The company's flagship project, Las Chispas, is a historical mine in Sonora first discovered in the 1600s, and renowned for its world-class silver mineral specimens, many of which are on display in a number of museums around the world.

The Las Chispas property is situated along the Santa Elena Trend. Some 14 epithermal veins were the focus of historical production, of which two have been mined out; the remaining 12, plus an additional five veins identified elsewhere in the property, are the focus of exploration efforts this year.

SilverCrest's rehabilitation program at Las Chispas is progressing as scheduled, with 2km of the estimated 6km of underground workings now completed. The latest channel sampling results continue to confirm the high-grade silver potential and continuity of mineralization within a low-to-intermediate-sulphidation epithermal vein system at Las Chispas, and suggest a similar geochemical signature to the Santa Elena deposit.

As SilverCrest continues to undertake its channel sampling program, a surface drill program has commenced that will further aid in determining the continuity of the mineralized veins, as well as identify extensions to mineralization; the company also has an underground drilling application submitted that is awaiting approval.

TGR: Would you talk about one more company that is active with the drill bit?

MC: Cordoba Minerals Corp. (CDB:TSX.V; Not Rated) is an exploration company focused on the San Matias porphyry copper-gold project in Colombia. The company has tied up a significant land package along the northern extension of the Mid Cauca Gold Belt.

Last year, Cordoba achieved a couple of important milestones, including a joint venture agreement with High Power Exploration Inc. (HPX), a private mineral exploration company indirectly controlled by Robert Friedland; exploration work at San Matias is fully funded by High Power. Cordoba also signed an option agreement with Sociedad Ordinaria de Minas Omni (OMNI) for the Alacran deposit. Cordoba has just completed a 3,000m drill program at Alacran in conjunction with High Power, and a new program is currently being planned. Drill results from Alacran include: Hole ACD006A (109m grading 0.95% copper and 0.35 g/t gold) and ASA051 (111m grading 1.01% copper and 0.38 g/t gold). Note that Hole ASA051 was initially drilled by the former operator, but was never assayed.

A Typhoon (deep-penetrating induced polarization) geophysical survey is underway. This work will be followed by an initial resource estimate for Alacran in early H2/16, while drill testing a number of targets defined by the Typhoon program is expected to also commence in H2/16.

TGR: Thanks for sharing your insights.

Mick Carew is a research analyst with Haywood Securities. Carew has mineral exploration experience on three continents, Asia, Australia and North America, with specific expertise in a variety of uranium, base and precious metal ore deposits. He also brings extensive technical experience in the evaluation of potential targets and geological properties. Carew holds an Honors Bachelor of Science degree from Monash University of Melbourne and a Ph.D. from James Cook University.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo compiled this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in this interview are sponsors of Streetwise Reports: Balmoral Resources Ltd. and TerraX Minerals Inc. The companies mentioned in this interview were not involved in any aspect of the article preparation so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Mick Carew: I or my family own shares of the following companies mentioned in this interview: None. I personally am or my family is paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this article: Balmoral Resources Ltd. (BAR-T) and Pure Gold Mining Inc. (PGM-V). I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.