The Life Sciences Report: Relmada Therapeutics Inc. (RLMD:OTCQB) started out as a privately held company, but then completed a reverse merger and went public. Can you provide a bit of background on that process, and tell us the meaning behind the company's name?

Michael Becker: In May 2014, Relmada completed a reverse merger and listed on the OTCQB at $7.50 per share. In connection with the going-public transaction and subsequent warrant exercises, Relmada raised approximately $51 million ($51M) in aggregate. With regard to the background behind the company's name, Relmada is an amalgamation of the phrase "relief armada," as the company is developing a pipeline of drug candidates to treat chronic pain.

TLSR: Let's talk about your new chemical entity, d-Methadone (dextromethadone; REL-1017), which is being developed for the treatment of neuropathic pain. Readers are familiar with traditional racemic methadone that is used in the treatment of various pain states and as a substitution therapy in heroin and other opioid addiction. How is your d-Methadone different?

"Relmada is focused on developing d-Methadone for the treatment of neuropathic pain, which represents a multibillion market opportunity."

MB: It is important to note that d-Methadone acts completely different from racemic methadone. As a single isomer of racemic methadone, d-Methadone has been shown to possess NMDA antagonist properties with virtually no opioid activity associated with the racemic molecule, or the l-Methadone isomer, at the expected therapeutic doses. The activation of NMDA receptors has been associated with neuropathic pain, and it is expected that d-Methadone will have a role in pain management by blocking this activity. In contrast, racemic methadone is a potent, long-acting narcotic producing typical opioid side effects, such as nausea, addiction, constipation, etc.

TLSR: There seems to be a fair amount of enthusiasm surrounding drugs that target the NMDA receptor following a number of acquisitions in the space in recent years, including Naurex Inc. being acquired by Allergan Plc (AGN:NYSE) for more than $560M and Avanir Pharmaceuticals Inc. being acquired by Otsuka America Inc. (Otsuka Holdings Co Ltd. [4578:Tokyo]) for $3.5 billion ($3.5B). Where would a drug like d-Methadone fit into this space?

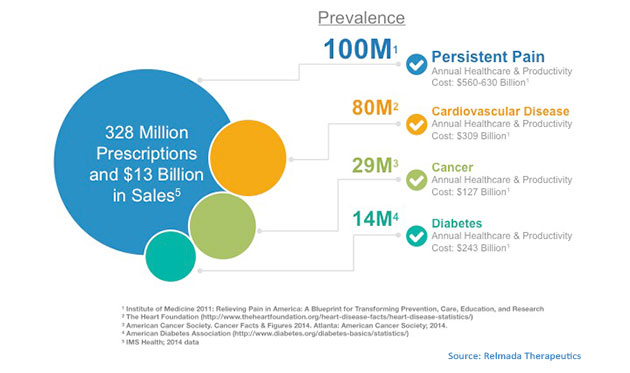

MB: Each company working with NMDA antagonists seems to have focused on their own lucrative niche. For example, Naurex was developing a pipeline of product candidates that utilize NMDA modulation as a potential new approach to the treatment of major depressive disorder (MDD), while Avanir advanced the first and only FDA-approved treatment for pseudobulbar affect (PBA) that acts on both NMDA receptors and sigma-1. Similarly, Relmada is focused on initially developing its NMDA receptor antagonist, d-Methadone for the treatment of neuropathic pain, which represents a multibillion market opportunity ready for a new effective entry.

TLSR: What is the rationale behind developing an NMDA receptor antagonist for pain?

MB: Ketamine hydrochloride (ketamine) is an NMDA receptor antagonist approved by the FDA as a rapid-acting general anesthetic that has also been shown to produce strong relief in neuropathic pain states. There is now ample evidence that NMDA receptor antagonists that block the NMDA receptor, such as ketamine, are able to halt the excessive barrage of nociceptive input to the brain, and are, therefore, potential alternatives to existing treatments of chronic pain syndromes.

However, the potential for widespread therapeutic use of ketamine is severely limited by its potential for dissociative and psychosis-like side effects. Orally available d-Methadone is among the new generation of pain medications with potential to deliver ketamine-like palliative effects without ketamine’s side effects.

TLSR: Where are you in the clinical development of d-Methadone?

MB: In November 2014, Health Canada approved a clinical trial application to conduct the first Phase 1 study with d-Methadone. This single ascending dose (SAD) study was followed by a multiple ascending dose (MAD) study, both in healthy volunteers.

The two studies were designed to assess the safety, tolerability and pharmacokinetics of d-Methadone in healthy subjects. The SAD study included single escalating oral doses of d-Methadone to determine the maximum tolerated dose. In the MAD study, healthy subjects received daily oral doses of d-Methadone for several days to assess its safety, pharmacokinetics and tolerability.

In June 2015, Relmada successfully completed the SAD study and subsequently received a No Objection Letter from Health Canada to conduct the MAD clinical study in August 2015. In January 2016, we reported results from the MAD study, which successfully demonstrated a potential therapeutic dosing regimen for d-Methadone with a very favorable side effect and tolerability profile. In fact, the maximum tolerated dose of d-Methadone was many-fold higher than that of racemic methadone in opioid-naïve patients. We are currently planning a subsequent Phase 2 proof-of-concept study in patients with neuropathic pain and potentially other large indications.

TLSR: Turning to the other side of Relmada's portfolio, tell us about the various product candidates being developed under the 505(b)(2) regulatory pathway.

"We are currently planning a Phase 2 proof-of-concept study of d-Methadone in patients with neuropathic pain and potentially other large indications."

MB: We have three products at various stages of development, including oral buprenorphine (BuTab; REL-1028), an oral ingestible dosage form of the opioid analgesic buprenorphine; LevoCap ER (REL-1015), an abuse-resistant, sustained-release dosage form of the opioid analgesic levorphanol; and topical mepivacaine (REL-1021), an orphan drug-designated topical formulation of the local anesthetic mepivacaine.

In the interest of time, however, I'm going to focus our discussion on the first two programs, which are more advanced: BuTab and LevoCap.

TLSR: Okay, let's start with BuTab, which is designed to deliver buprenorphine orally as a traditional tablet. Why is this delivery method unique? How does buprenorphine differ from other opioids?

MB: Buprenorphine is a partial opioid agonist that has been widely used through the sublingual and transdermal routes of administration, but was believed to be ineffective by the oral route due to first-pass metabolism in the upper gastrointestinal tract and liver. In fact, there are currently no commercially available oral formulations of buprenorphine that result in gastrointestinal absorption. Relmada's BuTab is designed to be delivered orally, and reach safe and effective blood levels of buprenorphine through the gastrointestinal route of administration due to its modified release profile.

Buprenorphine products are used to treat both opioid addiction and to treat pain. Although there is the potential for addiction to buprenorphine, the risk is lower with buprenorphine since it is a "partial agonist" of the mu opioid receptor, compared with "full agonist" opioids like heroin, morphine, oxycodone and hydrocodone.

Accordingly, products containing buprenorphine, such as Relmada's BuTab product candidate, have reduced risk of abuse and physical dependence and are controlled in Schedule III of the Controlled Substances Act, as opposed to the more restrictive Schedule II.

TLSR: Relmada recently announced topline results of a proof-of-concept pharmacokinetic study in healthy volunteers with BuTab. What comparators did you use?

MB: We initiated a Phase 1 pharmacokinetic study with BuTab in healthy volunteers in Q2/15, and completed the study in Q4/15. We are very pleased with the topline results of this proof-of-concept study, which demonstrated for the first time that buprenorphine can be delivered at therapeutic blood levels in an orally ingestible form. The absolute bioavailability of BuTab was compared against both intravenous (IV) and sublingual administration. The absolute bioavailability of BuTab relative to IV administration exceeded published data with "non-modified" buprenorphine, and also compared favorably with a currently marketed transdermal patch. The data generated by this study will inform the design of subsequent clinical pharmacology studies.

TLSR: What is the commercial landscape for buprenorphine in treating pain compared with the market for the opioid addiction indication?

MB: Purdue Pharma LP received FDA approval for the first buprenorphine formulation for the treatment of chronic pain, Butrans, in July 2010. Butrans is indicated for the management of moderate to severe chronic pain and delivers buprenorphine transdermally (through the skin) over a period of seven days. It is our view that a traditional oral tablet that is ingested and absorbed through the intestine could be a preferred formulation for a significant number of patients with chronic pain conditions.

BioDelivery Sciences International Inc. (BDSI:NASDAQ) and Endo Pharmaceuticals Inc. (ENDP:NASDAQ) received FDA approval of Belbuca, a buccal film that contains buprenorphine, for moderate to severe chronic pain that was launched commercially in early 2016.

The products currently marketed for the opioid addiction indication include Suboxone, a sublingual film formulation of buprenorphine and naloxone; a sublingual tablet called Zubsolv; and generic formulations. Suboxone film, the market leader, achieved sales of nearly $1.2B in the U.S. in 2014.

"We believe BuTab would have significant appeal given its traditional oral route of administration."

In June 2014, BioDelivery Sciences received FDA approval for Bunavail for the maintenance treatment of opioid dependence. Bunavail is a buccal film that contains the partial opioid agonist buprenorphine with naloxone, an opioid antagonist, included as an abuse deterrent. When used as directed, the naloxone is swallowed and minimally absorbed. However, if misused—for example, dissolved and injected—the naloxone rapidly precipitates withdrawal symptoms.

The total market for buprenorphine-containing products for opioid dependence approached $1.8B in 2014. The market has grown significantly as a result of the rapidly escalating problem of prescription opioid misuse and abuse, a recent resurgence of heroin use, the growing number of physicians treating opioid dependence, and the inclusion of addiction treatment as an essential benefit in the Affordable Care Act.

While we anticipate that the market for buprenorphine products will get increasingly more competitive, we believe BuTab would have significant appeal given its traditional oral route of administration. We also believe that the increased number of companies promoting the use of buprenorphine containing-products has the potential to create greater awareness, and could help to further expand what is already a significant and growing market.

TLSR: Let's talk next about your clinical program LevoCap ER. Developing an abuse-resistant form of an opioid pain medication seems timely in view of the FDA's support for such approaches.

MB: LevoCap ER is an extended-release, abuse-deterrent, patent-protected formulation of levorphanol, which is pharmacologically differentiated from morphine, oxycodone and other strong opioids. LevoCap ER is being developed for the management of pain severe enough to require daily, around-the-clock, long-term opioid treatment.

We are pleased to develop an abuse-deterrent formulation of levorphanol, and believe that our abuse-deterrent technology is state of the art, although we believe that such approaches represent only one piece of a broader strategy to combat the problem of opioid abuse.

"We believe that our abuse-deterrent technology is state of the art."

In fact, our main interest in developing LevoCap ER is the unique properties of levorphanol compared with other strong opioids. In particular, levorphanol binds to all three opioid receptor subtypes involved in analgesia (mu 1, kappa and delta), and is an antagonist at the NMDA receptor, norepinephrine and serotonin uptake sites, whereas morphine is relatively selective agonist for mu opioid sites. Due to this multimodal mechanism of action, in clinical studies to date levorphanol has demonstrated a remarkably broad spectrum of pain relief activity in neuropathic pain, post-surgical pain and chronic pain in patients refractory to other opioids.

TLSR: What are your development plans for LevoCap ER?

MB: We are preparing for a Phase 3 development program, and are planning to submit a request to the FDA to discuss the final regulatory and clinical plan for this product.

TLSR: In terms of financials, Relmada reported just over $15M in cash and equivalents at the end of 2015. That doesn't seem like enough to advance four drug programs—especially into Phase 2 and Phase 3 development. Do you anticipate partnering and/or raising capital?

MB: Like many other research and development (R&D) companies in our space, we're considering all options, but we definitely need to raise capital to advance our programs to significant value creation milestones in the next 12-24 months. We are not planning to dose the first patient in a Phase 2 or Phase 3 study unless we have the financial resources on hand.

TLSR: Relmada currently trades on the OTCQB market. Are there plans for the company uplisting to a national exchange, such as NASDAQ or NYSE?

MB: Yes. We submitted an application to uplist to NASDAQ and plan to do so as soon as feasible. In fact, last week Relmada issued a press release stating that the company now believes it satisfies each of the exchange's applicable listing requirements, with the exception of the $4/share bid price requirement. In according with the NASDAQ listing rules, the company's stock price must close at or above $4/share for 30 of the most recent 60 trading days for the company to be eligible to list.

TLSR: Thank you for your time.

Michael Becker joined Relmada Therapeutics Inc. in November 2014, and currently serves as the company's senior vice president of finance and corporate development. Mr. Becker brings more than 20 years of experience as a C-level industry executive and Wall Street securities analyst. Most recently, he was founder and president of the consulting firm MDB Communications LLC. In this position, he acted as a strategic advisor and partner servicing the life sciences industry by providing a full range of investor relations and public relations services to enhance client visibility and branding. Mr. Becker previously served as president, chief executive officer and member of the board of directors for publicly traded biotechnology companies including commercial-stage Cytogen Corp. (acquired by EUSA Pharma). He held positions of increasing responsibility prior to being appointed president and CEO of Cytogen in 2002, including vice president of business development, industry and investor relations, and CEO of AxCell Biosciences, a subsidiary of Cytogen. Prior to his industry career, Mr. Becker spent nine years in the financial services industry, which includes positions at Wayne Hummer Investments LLC, Kidder, Peabody & Co., Gruntal & Co. and Kemper Securities. He completed coursework in political science at DePaul University, and received an associate of science degree from the Art Institute of Pittsburgh.

DISCLOSURE:

1) Tracy Salcedo compiled this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) Relmada Therapeutics Inc. paid Streetwise Reports to produce and distribute this interview. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclaimers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Relmada Therapeutics had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Relmada Therapeutics and not of Streetwise Reports or its officers. Relmada Therapeutics was not paid by Streetwise Reports to participate in this interview. Relmada Therapeutics had the opportunity to review the interview for accuracy as of the date of the interview and is responsible for the content of the interview. Michael Becker or his family own shares of the following companies mentioned in this interview: None. Relmada Therapeutics has a financial relationship with the following companies mentioned in this interview: None.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.