The Energy Report: The year started with a very volatile Chinese stock market. Are we in crisis mode?

Chen Lin: That was actually mostly related to the Chinese currency. Every Chinese citizen is "entitled" to exchange $50,000 per year. At the end of last year and the beginning of this year, people rushed to use their quotas. I heard reports that the banks were crowded, the website was too busy, and people couldn't get their exchanges completed in time to catch the trend before it went down further. Yes, there was a little bit of panic in China that likely led to the stock market drop. Also, you need money to exchange for the U.S. dollar, so some investors may have sold stock. All this led to a very volatile Chinese market.

Are we in a crisis mode? That's hard to say. It's really up to the Chinese government and how it handles this situation. Right now, my view is as long as the Chinese renminbi goes down in an orderly fashion, we should view it as a positive for the rest of the world.

"Pan Orient Energy Corp. is a company you can hold and collect a dividend from."

China is in the very same situation Japan was in the early 1990s. There is a housing bubble and overcapacity. It took Japan about 20 years to slowly deflate its bubble. China probably needs to go through the same process. The only thing going for China is that the Chinese renminbi is depreciating. Japan didn't have that luxury. Japan's currency was appreciating when the bubble deflated, and it actually made it much worse. As I said, as long as it's orderly, it should be helpful for everybody.

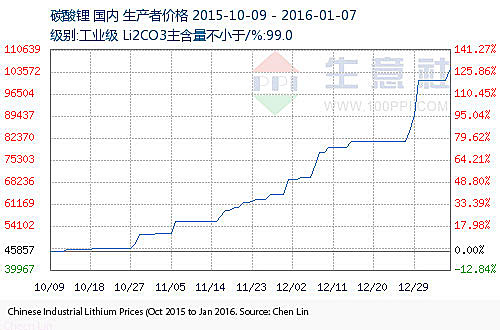

TER: Let's talk about the impact on some of the commodities. You recently shared with your readers an upward-climbing Chinese industrial lithium price chart. Do you still believe that China's prices will lead to stimulus activity that will further boost lithium prices?

CL: I believe there will be more stimulus coming. Rumor is that China's president, Xi Jinping, wants to be the Reagan of the East. He's going to work on the supply side. There will be a huge deficit in spending coming this year and reduced taxes, supposedly. Hopefully, he stimulates free enterprise. We will see.

One of the most burning issues when you talk to Chinese citizens is pollution. How do you reduce pollution? Electric cars are probably the only logical solution and the government could focus on that as an area for stimulus. Even today, lithium production cannot meet the demand. If more demand for lithium batteries is created, the supply problem could get much worse.

TER: There are two types of lithium. We talked about the industrial lithium, but how about battery-grade lithium? Is there even more upside for that in China and the U.S.?

CL: The spot price in China for battery-grade lithium already jumped, even with the weakness of the Chinese yuan. If you put it back in U.S. dollars, it quadrupled in a few weeks. It's a classic supply/demand imbalance issue. Industrial lithium didn't go up as much, but it has more than doubled. So it's still very strong. For those companies that can sell lithium at the spot price, their margin probably will lift to $10,000/ton or more. That is dramatic. Lithium has been trading around $6,000/ton for many years, and suddenly it quadrupled. Many of these lithium miners and producers are producing for costs of something like $5,000/ton. That means if their margin was $1,000/ton before, suddenly it becomes $10,000/ton or more. It's a dramatic increase.

TER: Is the imbalance coming more from the demand side—the need for lithium for electric car batteries—or the supply side—due to the shutdowns of some of the mines in Chile and changes in seller policies?

CL: It's both. There was flooding in Chile, so brine mines there had some interruptions. New mines have been having difficulty starting up. The breaking point was when FMC Lithium Corp. (FMC:NYSE), one of the top three lithium producers, announced an increase in the lithium price by 15% in September. Other lithium producers, namely Albemarle Corp. (ALB:NYSE), refused to sell the cheap lithium anymore, and instead paid a small cut to have the lithium processed and kept the profits. The whole market changed dramatically in the past few months.

TER: If prices continue to go up, are auto manufacturers going to find an alternative? Is there a demand-destruction challenge looming?

CL: No other technology is as compelling as lithium. Plus, the lithium itself is only 2% of the cost of manufacturing lithium batteries. Even if lithium prices go up tenfold, it will only increase the input cost from 2% to 20%. Battery users have to absorb it because there's no other alternative. That is why lithium producers are in happy land. Even if it's triple or quadruple, it's very, very profitable. However, there are other products such as lubricants and paint where some demand destruction is a concern.

"My view is as long as the Chinese renminbi goes down in an orderly fashion, we should view it as a positive for the rest of the world."

Eventually, the market will find equilibrium so we have enough lithium for all uses. As you know, it takes a few years to build a new mine. Until then, we may have to pay a little bit more.

TER: Some of the biggest lithium producers are polymetallic conglomerates. Can rising lithium prices make a difference in the bottom lines of these companies?

CL: The lithium part of their business will change dramatically. Albemarle, the largest lithium producer in the world, is also a chemical producer. Lithium is about 15% of its revenue. But if the margin on that 15% revenue suddenly increases by a few hundred percent, you can see it will impact the bottom line, though it won't be as big as for pure lithium players.

TER: What are some of the pure lithium players you're watching?

CL: There are many pure lithium players. I'm trying to cherry-pick after watching the recent mining crash. I try to pick either producers or very near-term producers with financing already lined up, so they don't need to come back to the market over and over again and dilute shareholders. I own Orocobre Ltd. (ORL:TSX; ORE:ASX) and Western Lithium USA Corp. (WLC:TSX; WLCDF:OTCQX).

TER: Orocobre just opened a mine in Argentina with help from Toyota Tsusho Group (TYHOF:OTCPK). Are you worried about political problems in that country?

CL: Argentina has a new president, Mauricio Macri, who removed repatriation rules so companies can ship money out of Argentina freely again. He removed the 5% tax on lithium exports as well. The new government seems to be quite pro-business. That is why it s a perfect opportunity for Orocobre to ramp up production. Orocobre has been ramping up production in the past year at what could be one of the largest lithium mines on earth, but it has been quite slow. The slowness of this ramp-up actually contributed to the current lithium shortage.

TER: Will the company be able to raise money in this market for operating capital? When will it be profitable?

CL: Orocobre was saying it planned to break even in December. It just announced that the break-even is delayed to January 2016 due to some technical issues. Some of its production has already pre-sold, but if the company can sell some on the spot market, it could be very profitable. Orocobre has a history of raising money every year. If it reaches breakeven and starts generating cash flow, I see that the company has a very great future. Remember, in a recent transaction, Albemarle bought Rockwood Holdings Inc. (ROC:NYSE) for over $6 billion. That's one of the largest lithium producers on earth. This can be one of the largest lithium mines on earth. Its market cap is less than 10% of that. If this mine goes into production and everything is on track, its upside is huge.

TER: How soon could Western Lithium be in production in Argentina and Nevada?

CL: It has the Argentina mine shovel-ready. It is finalizing financing with a Korean partner that has already committed to providing 100% financing for the mine and the production. The recent rise in the lithium price probably gave the Koreans more urgency to start the lithium mine as soon as possible because, unlike China, Korea cannot produce any lithium. All its lithium has to be imported, so it was probably hurt the most from the recent lithium squeeze. That means Western Lithium is in a very good position to negotiate the best terms, enabling it to move into production as soon as next year, 2017.

TER: What about Western Lithium's Nevada project? What is holding that up?

CL: That one is two to three years behind the Argentina one. The company is probably focused right now on getting Argentina into production, and then it will focus on Nevada again. It's a little bit behind, but again, it's a nice property and it's in the same state as the new Tesla Motors Inc. (TSLA:NASDAQ) battery gigafactory. Tesla last year was looking for partners to supply lithium for its gigafactory. It already signed some memos of understanding with a number of companies, including Pure Energy Minerals Ltd. (PE:TSX.V). I wouldn't be surprised if Tesla is interested in this property as well.

TER: Do you also own Texas Rare Earth Resources Corp. (TRER:OTCQX)? It has lithium.

CL: Texas Rare Earth is a very interesting company. It has almost everything. It has uranium and rare earths. It's located in a very good place in Texas. It's easy to get permits. It's on the mountain. The strip ratio is zero. It can heap leach. It's a property that eventually will shine. But in this market, nobody cares and the share price is very low. One day, it will show the value. It's just a little further away from production.

TER: You recently released your 2016 outlook. How can you be excited about the oil and gas space when experts are predicting $20/barrel ($20/bbl) oil?

CL: As an energy investor, frankly I love to ride the boom and bust of the cycle. Twenty-dollar oil actually is a dream situation for energy investors because it is not sustainable unless the world is really going into a very deep recession and we don't need to drive our cars and there's no need for energy. What $20/bbl oil will do is kill the U.S. fracking industry. That's a 9 million barrel per year industry that will be gone. It may not take a year. It may take a few years. But nobody will be drilling, and all the wells will decline and it will be gone.

"How do you reduce pollution in China? Electric cars are probably the only logical solution."

In the commodity business, the lower you go, the higher you bounce. So commodity investors want to see it go as low as it can to really push the boundary, and then you will have a very pleasant ride on the upside.

TER: You have written about taking advantage of opportunities opening up with the legalization of exporting U.S. petroleum products, particularly natural gas. How big of a game changer is that?

CL: Exports of U.S. petroleum products, both oil and gas, are negative for refiners. Refiners are taking advantage of cheap oil and cheap gas in the U.S., so opening up exports is hurting them. I shorted a few refiners last year, with limited success. Some did very well. Some I didn't sell fast enough for a profit, so I got caught a little bit. That was my thesis, to short refiners.

TER: What about select stocks that could do well in a situation where natural gas sells for a lot more in other countries than in the U.S.?

CL: It is very expensive to ship natural gas overseas. You need to liquefy it, use a special boat and then de-liquefy it, so the cost is over $4/thousand cubic feet ($4/Mcf). That actually supports a $6/Mcf natural gas price in any area where there's a natural gas shortage. That is why I am focusing on three companies in high natural gas price areas.

One is Canacol Energy Ltd. (CNE:TSX; CNNEF:OTCQX) in Colombia. Colombia has a natural gas shortage. It actually asked Venezuela for gas, but that country doesn't have the capital to export. So Colombia is short. It is an extreme situation. In the meantime, Canacol is starting its new natural gas pipeline in the next few weeks. So it can quadruple its natural gas production and can sell the gas for $5–6/Mcf. Its cost is only about $1/Mcf. So that's a dream situation because nobody on earth is making money these days at the current energy price, but this company can make a killing. The company can generate a lot of cash flow and use the money to pay back loans and/or buy a company out of bankruptcy. Last year, it bought bankrupt Orinoco energy assets for a penny on the dollar.

Pan Orient Energy Corp. (POE:TSX.V) is another company with a unique situation. It is trading at below cash. It is going to pay a dividend very soon, in a month or so, a $0.40/share dividend, which is very nice. After that, it is still trading at below cash. So it's a company with very limited downside. It is selling its business piece by piece. It recently just let go of its chief operating officer to further cut costs. It has properties in Canada, Thailand and Indonesia. If I'm right, by the end of 2016, most of its properties will be gone, and the company will have even more cash to distribute back to its shareholders.

"No other technology is as compelling as lithium."

In the meantime, Pan Orient's partner, Talisman Energy Inc. (TLM:TSX), is going to drill a very high-impact well in Indonesia. It is going to be fully paid for by Talisman for the first $10 million ($10M), which covers the initial drilling. So even in this market environment, it still is going to go ahead and drill the well. That's how exciting it is, even to Talisman. It's a very important well. Currently, it's not reflected in any way in Pan Orient's stock price, and it's a free option. Pan Orient is a company you can hold and collect a dividend from. There is only one way to go—up. Even in the worst situation, Talisman misses the well, and everything goes bust. You can see Pan Orient's probably going to distribute more money than its current market cap.

TER: What's the third one?

CL: The third one is Cub Energy Inc. (KUB:TSX.V), a tiny company in Ukraine. It's a natural gas company. Ukraine relies on importing natural gas from Russia, so its natural gas is priced very high. Recently, the Ukraine government cut the Ukraine royalty almost in half, so that opened up new opportunities. If you look at Cub's financial statement, it was cash flow positive even before the royalty cut. In this environment, Cub will be making a lot of money and it's not priced into the share price in any way. That's a very good opportunity for the company.

Also, Cub has another opportunity with a private company where Joe Biden's son's partner is the director. It tried to buy out Cub Energy's partner for $30M. That was last year, before the royalty cut. My understanding was that after the royalty cut, the price it paid was too low. It was at least 50% below the fair value, so it exercised a first right of refusal. We should know very soon what that means. It may be able to profit handsomely from this deal.

TER: Are you worried about more conflict in Ukraine?

CL: Yes, I am. I do worry about that, but that's life. Iran and Saudi Arabia are killing each other. There are a lot of risks in this business, but the fact that Joe Biden's son's company bought out Cub's partner for $30M means it sees strong opportunities in Ukraine. Cub's property has one eastern part and one western part. The western part, which it owns 100%, is very far away from the conflict zone. The eastern part, which it owns 30% of, is not. The partner of Joe Biden's son wants to buy the other 70%. That adds confidence for me to this investment thesis.

TER: Give us some final words of wisdom for investors who might be a little jittery from the start of the year.

CL: Commodities always go through the boom/bust cycle. Investors in the commodity business should expect this kind of cycle. It's always like that. However, each bust creates opportunity for the next boom. Right now, "commodity" is a bad word because the U.S. dollar is strong. So are all the mining companies going to go under? Are all the energy companies going to go under? Are we going to live without any minerals or oil? No. Obviously, that's not the case.

There is a lot of exploration everywhere in the mining business, a lot of exploration everywhere in the oil business. Demand will pick up. Lithium is a perfect example. Lithium has been in the $6,000/ton range for a long time, and a lot of lithium companies went bust. They tried to start new mines, and it was too difficult with so little margin. But then the demand overran supply, and we had lithium quadruple in the spot price in China. That's similar to copper. Remember, copper was $0.70 a pound ($0.70/lb) for a long time, and then suddenly it ran all the way to $4/lb. That was sevenfold. I think the quadruple in the lithium price was just the beginning. There is more upside to come. That is why I feel there are a lot of opportunities in the commodity business, especially for those investors who are willing to take a little bit of risk.

TGR: Thank you, Chen.

Chen Lin manages a family fund and writes about it in the popular stock newsletter What Is Chen Buying? What Is Chen Selling?, published and distributed by Taylor Hard Money Advisors, Inc. While a doctoral candidate in aeronautical engineering at Princeton, Chen found his investment strategies were so profitable that he put his Ph.D. on the back burner. He employs a value-oriented approach and often demonstrates excellent market timing due to his exceptional technical analysis.

Read what other experts are saying about:

Want to read more Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) JT Long conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Pan Orient Energy Corp. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Chen Lin: I own, or my family owns, shares of the following companies mentioned in this interview: Pan Orient Energy Corp., Canacol Energy Ltd., Cub Energy Inc., Albemarle Corp., Orocobre Ltd., Western Lithium USA Corp. and Texas Rare Earth Resources Corp. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.