The Life Sciences Report: Robotic catheter developer Hansen Medical Inc. (HNSN:NASDAQ) is one of the pioneers of interventional radiology. How are robotic procedures helping new surgical approaches to emerge or providing alternatives to open surgeries?

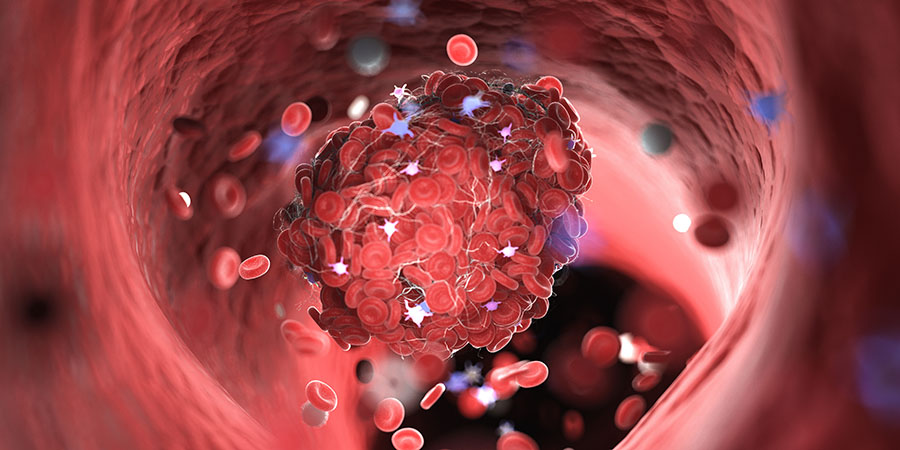

Cary Vance: In key areas, intravascular robotics are leading the way to less invasive treatments of certain disease states. For example, robotic prostatic artery embolization is a possible treatment for benign prostatic hyperplasia (BPH) or enlarged prostate. Robotics help the interventional radiologist perform this challenging procedure, which deals with tortuous anatomy where catheter stability is paramount. Patients are eager to learn more about this approach. They're very excited about the smaller incisions, possible quicker recovery times and the potential for fewer complications, compared to such conventional approaches as transurethral resection of the prostate or other invasive procedures.

In women's health, uterine artery embolization is a potential alternative to hysterectomy for symptomatic fibroids. Interventional radiologists are demonstrating an ability to effectively access the uterine arteries, even though this is typically associated with very difficult and tortuous anatomy. Many women have been drawn to the less invasive nature of uterine fibroid embolization versus hysterectomy or myomectomy.

"For physicians and patients both, the predictability of robotics is very attractive."

Intravascular robotics are valuable for procedures like transarterial chemoembolization (TACE) or radioembolization, to treat tumors in various organs. In these procedures, the robotic catheter navigates through the vasculature to reach, and then treat, the tumor. We also furnish the Magellan Robotic System to vascular surgeons. With our devices, the surgeons can perform complex vascular procedures in a minimally invasive way, avoiding much more invasive surgical procedures.

For physicians and patients both, the predictability of robotics is very attractive, as is the potential for shorter recovery times and fewer complications.

TLSR: What is the potential market for interventional radiology?

CV: The potential market is extremely large given the size of the patient populations. For example, in the United States alone there are 20 million (20M) men with BPH, more than 15M women with symptomatic fibroids and more than 40,000 people with metastatic liver cancer who can benefit from the procedures we just discussed—prostatic artery embolization, uterine artery embolization and either TACE or radioembolization.

There also is quite a large market for interventional radiology in that the physicians want to reduce their own exposure to radiation throughout their careers. They have a desire to move away from the radiation source, and robotic surgery allows them to do that. Robotic procedures also reduce the chronic orthopedic issues caused by standing for extended periods as they perform these procedures. With our robot and robotic catheters, the benefits clearly extend beyond the patients to physicians and their staff. With these new devices, physicians and staff members can be seated comfortably away from the radiation source, thereby improving quality of life and the working environment. This also improves their ability to concentrate, because they now can perform their procedures more comfortably.

TLSR: What factors are limiting the growth of robotics in interventional radiology?

CV: There are several limiting factors, but they're changing as people become more familiar with the concept of interventional radiology and the new tools that support it.

One of the first limitations is the traditional role of the radiologist. Many radiologists do not have an office-based patient source like other specialists. Their referrals are quite often from other specialties. That's changing as interventional radiology is expanding, but it can be limiting if the infrastructure is lacking for direct patient referral. Interventional radiologists (IRs) are addressing that limitation by marketing directly to patients, highlighting their abilities to perform cutting-edge robotic procedures.

"With our devices, the surgeons can perform complex vascular procedures in a minimally invasive way."

For interventional radiology to reach its potential, the hospital strategic planning processes also must evolve. Today, for example, major capital purchases tend to take time and generally don't consider the complete robotic system acquisition process. Capital purchases for interventional radiologists generally involve imaging systems and large central purchases. But also purchasing our Magellan Robotic System oftentimes isn't included in the original budgeting, although this system helps healthcare providers maximize the return on investment of their imaging systems. As a result, we—along with clinical stakeholders—may need to intervene and become involved in the whole capital equipment purchasing and budgeting process to ensure the necessary elements are included for a comprehensive solution, and to help speed the purchasing process.

TLSR: Is there anything specific that can be done to improve the planning and acquisition process?

CV: Our goal is to help physicians, staff, department heads and administrators all understand the value of the robotic system from a clinical, financial, operational, competitive, technological, and safety standpoint. They have a significant opportunity to reduce costs, experience more predictable interventional lab times, and increase revenues by drawing incremental patients into the system. Healthcare providers further benefit from a "halo effect" when these newer patients continue with ancillary treatments offered at the facility. For us to drive the level of urgency and interest alongside a better understanding of the value of our system, it's important for us to communicate those benefits and to validate that value for the hospital, the radiologist, the patient and the community.

TLSR: What are your top new products or product candidates?

CV: The Magellan™ Robotic System and Magellan™ Robotic Catheter are designed to enable physicians to remotely manipulate robotically steerable catheters and standard guidewires with precision. It features a variety of catheter sizes. The 6 French (6Fr), 9 French (9Fr) and 10 French (10Fr) robotic catheters allow physicians to use the smaller catheters to navigate smaller vessels during embolization procedures, and to use the larger catheters during more complex vascular procedures. It was developed in partnership with Philips Medical Systems.

We also have our Sensei X Robotic System and Artisan catheter. This system makes it easier for radiologists to accurately position catheters and manipulate them during electrophysiology procedures.

TLSR: What can you tell us about some of the products still in development?

CV: Hansen is very focused on improving the customer experience, so we're in constant development to improve work flow for physicians and their staffs. We're consistently looking for ways to engineer our costs down and our margins up. We're doing that in two ways in the coming months, by introducing new products. Our new, next-generation microcatheter driver will allow physicians to robotically navigate the vasculature using most off-the-shelf microcatheters. We're also developing an electromagnetic-sensing driver system and smaller, steerable catheters. In addition, we're working on image tracking to allow visualization of our robotic catheters in 3-D imaging systems.

TLSR: How would the imaging tracking system work?

CV: Our robotic catheter is paired with the facility's existing imaging systems. Electromagnetic sensors are built into the catheter, which are read by existing 3-D imaging systems. We are working together with some of our imaging partners as we develop our technology so that interventional radiologists will be able to see catheter motion in 3-D.

TLSR: You mentioned imaging partners. How are you partnering with other technology companies to enhance value and grow markets?

CV: We maintain close communication with the major imaging and therapeutic equipment manufacturers to ensure compatibility with their tools and devices. Several imaging companies' products are used alongside our equipment. Therapeutic devices developed by several large and small companies also are used with our catheters. Therefore, it's important for us to partner with them to understand their technology and their next-generation innovations and, in some cases, to work together to distribute products or to educate customers regarding the abilities of the two technologies when they are working together closely. In some cases, we collaborate with our imaging and therapeutic partners on designs and structures. We also communicate regularly with key opinion leaders and early adopters in this industry. Their insights help us in the design and implementation of our systems.

TLSR: Your partners include St. Jude Medical Inc. (STJ:NYSE), Philips Healthcare (Koninklijke Philips N.V.: PHG:NYSE), GE Healthcare (GE:NYSE) and Siemens Healthcare (Siemens AG: SIE:ETR, SIEGY:OTC, SIE:GR). Are these distribution or development partnerships?

CV: Hansen Medical has a distribution agreement with St. Jude Medical in France. Additionally, St. Jude Medical makes an ablation catheter that is used within our electrophysiology catheter, so it's important that we have a relationship with the company, and that we stay in close communication with St. Jude and with other key companies like Biosense Webster, a Johnson & Johnson (JNJ:NYSE) company, and other therapeutic companies in the vascular space.

"We anticipate FDA approval and EU approval (CE mark) on additional technology throughout 2016."

Philips Healthcare, GE Healthcare and Siemens Healthcare are imaging companies. It's important that our robot is able to communicate with their systems, and to ensure that all the components—our robots, their imaging systems, their tables, etc.—work optimally for the physician. The objective for each of us is to ensure physicians see what needs to be seen so they can perform their procedures to the best of their abilities.

TLSR: What catalysts can investors expect from Hansen Medical in the coming quarters?

CV: We anticipate FDA approval and EU approval (CE mark) on additional technology throughout 2016. We expect to receive a CE mark and FDA approval for our microcatheter driver in early 2016. For our Sensei Electrophysiology Robot, we expect to submit a pre-market approval application to the FDA in the first half of 2016. In the near term, investors can expect to see new technology introduced and for emerging technology to be moved along in the approval process.

From a financial standpoint, we feel very good about our investor base and our ability to access necessary capital in the months ahead, and I think investors will see that. I also think investors will see us gain further traction and success in the U.S. market, with system placements and procedure growth in both endovascular and embolization segments.

TLSR: What are the goals for Hansen Medical Inc. for the next year or two, and how do you plan to meet those goals?

CV: We anticipate generous geographic and global expansion in the next year or so as we enter markets with large populations in Asia and other parts of the world. We also anticipate high levels of patient and physician interest. With that, I expect more systems to be sold. We expect to increase the number of procedures performed using our robots and catheters. I expect each robotic system already in the field to increase its use of catheters.

We plan to increase work flow, sales and profitability. We expect to move closer to profitability to dramatically decrease our level of spend and cash burn, to dramatically improve our return on investment on new technologies and to ramp up awareness and adoption as we educate patients and providers about the benefits of our robotic systems. That will improve our adoption rate exponentially.

"Our goal is to help physicians, staff, department heads and administrators all understand the value of the robotic system from a clinical, financial, operational, competitive, technological, and safety standpoint."

We anticipate investing in next-generation technology that will expand our installed base of users. We believe that introducing new technology, like the microcatheter driver and small robotic catheters, will improve our profit margin, as well as the usability and effectiveness of our products. I also expect that patients will begin, at a much greater rate, to demand our technology for procedures they want to have performed robotically.

TLSR: How much do the patients know about this? How are you educating them?

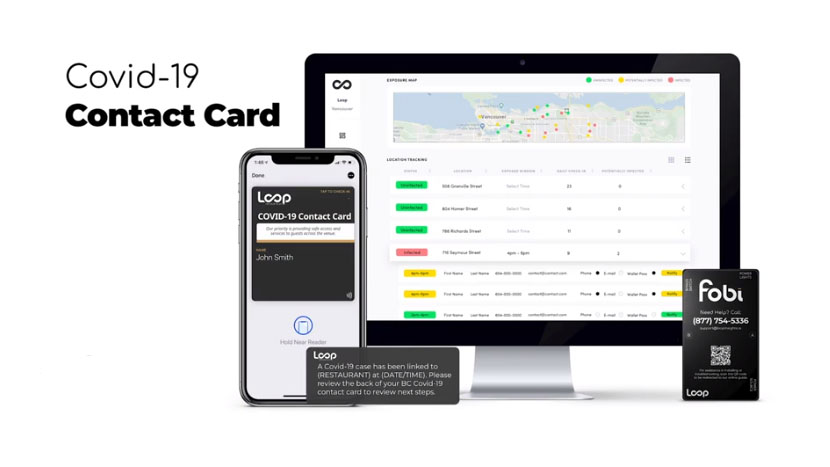

CV: On a local level, we work with hospitals to create awareness that robotic technology for interventional radiology exists in their communities. We also have a robust social media presence and a direct patient campaign, so patients can learn which procedures can be performed robotically, research their options and go to our website to find a physician who performs those procedures near them.

TLSR: There are many companies that say they are in the interventional radiology market, so why will you succeed?

CV: Well, there really are no other robotic companies effectively competing in this space. There are some quasi-robotic companies out there, but they don't offer a true robotic catheter. They really aren't in the peripheral vascular space doing these types of procedures.

I will say, in all honesty, that our lack of competitors creates a challenge for us. We are alone right now in trying to educate physicians to change the way they practice medicine. I believe we will be successful by leading, by continuing to come up with disruptive and next-generation technology, and by continuing to make our products easier to use, more clinically efficacious and more cost-effective for hospitals.

TLSR: Is there anything else you'd like to tell our readers?

CV: We're an innovative company. We develop creative ideas and help bring them to market, and we rigorously solve problems faced by healthcare providers and patients. It's what we call purpose-driven innovation.

At Hansen Medical, we start our processes and projects by asking ourselves the question, "Why? For what purpose are we here, and for what purpose do we strive to innovate?" Any company can explain what it does, or how it does what it does, but it's the "why"—the reason behind that activity—that is at the core of this company. That purpose-driven mindset drives the innovators who are here. We will continue the relentless pursuit of unmet clinical needs—and they are out there—in a way that benefits patients, providers and society. That's why we're here.

"We maintain close communication with the major imaging and therapeutic equipment manufacturers to ensure compatibility with their tools and devices."

Patients and providers, customers and clinicians, are all waiting for what we have or will have in the near future. Often, they don't even really know they're waiting, but they are waiting. They're looking for something better. Clinicians have been practicing medicine the same way, in many cases, for decades. For that reason alone, people are counting on us.

The use of robotics and robotic catheters will be the way interventional medicine is practiced in the months and years to come, and we are leading that effort. Along with some of our early adopters, we will continue to dominate the space. We will continue to have a robust, highly profitable business with huge impact on the lives of patients around the world.

TLSR: When do you think the wide-scale adoption of robotics for interventional radiology will occur?

CV: It will all happen sooner than most people imagine. Most people think it won't happen for decades, but I believe we'll see the broad adoption of interventional radiology within the next decade. If you walk into a hospital in the year 2025, it will be filled with computers and robots and, when it comes to vascular robotics, Hansen Medical will be there.

TLSR: Thank you for talking with us today.

Cary G. Vance was appointed president and chief executive officer of Hansen Medical on May 23, 2014. Vance served as president of the anesthesia and respiratory global business at Teleflex Inc. for three years and as executive vice president North America in 2010. Before joining Teleflex, Vance was an executive at Covidien, and served as vice president and general manager of Interventional Oncology–Americas, and was vice president and general manager for the energy-based Devices unit since 2007. Vance served in a series of roles with progressive responsibility at GE Healthcare from 1997 to 2007, principally in diagnostic imaging sales, sales and marketing management and executive leadership. He holds a B.A. in economics and an M.B.A from Marquette University.

Read what other experts are saying about:

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Gail Dutton conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as an independent contractor. She owns, or her family owns, shares of the company mentioned in this interview: None.

2) Hansen Medical Inc. is a sponsor of Streetwise Reports.

3) Cary Vance had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Cary Vance and not of Streetwise Reports or its officers.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.