The Gold Report: Clean TeQ Holdings Limited (CLQ:ASX) was founded in 1990 as an air-purification business; a quarter-century later it's now in the water purification and metals business. Tell us about the evolution of your company.

Sam Riggall: By 2000, Clean TeQ had become Australia's largest air-treatment company for biological odor control. The company then looked to expand its technology base. It identified very promising technologies around ion exchange and moved to license them. The next decade was devoted to developing, modifying and improving our proprietary continuous-ion exchange process and applying it to those industries where it demonstrates the greatest value.

TGR: You're no longer in the air purification business?

SR: Even though this was Clean TeQ's sole revenue-generating business, we sold it earlier this year for around AU$2 million (~AU$2M) with an arrangement for future payments contingent on future performance. The problem was that its business model was cost-plus-margin in a quite competitive industry. We decided that our resources and capital were better directed to the core technology of continuous-ion exchange. So, we are now focused on water treatment and metals recovery.

TGR: Tell us about your history in business.

SR: My career has been spent mostly in the mining sector. I worked for the Rio Tinto Group (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) for almost 15 years, first in exploration, then business development, project generation and project development—the last six years mainly for Rio's copper group, leading the negotiations with the Mongolian government for the development of the Oyu Tolgoi project now owned by Turquoise Hill Resources Ltd. (TRQ:TSX; TRQ:NYSE). After leaving Rio Tinto I ran business development and strategy for Ivanhoe Mines Ltd. (IVN:TSX) until Rio bought that company.

I moved to Clean TeQ as chairman in 2013 as a result of Ivanhoe's founder, Robert Friedland, becoming Clean TeQ's biggest shareholder.

TGR: Talk about the other members of your management team and what they bring to the table.

SR: Our founder, Peter Voigt, is now an executive director. He is a biochemist with a long track record of successful technology development. His passion is solving seemingly intractable environmental problems. He believes that good economic outcomes and good environmental outcomes can be compatible.

Ealden Tucker, VP/GM Global Water, has had a long career in this sector, much of it spent in China. John Carr, our GM of Metals, is an extremely accomplished chemical engineer who worked formerly for Rio Tinto. Ben Stockdale, our new CFO, has 16 years of experience in mining.

Our team demonstrates a good balance of technological expertise and business acumen.

TGR: What is continuous-ion exchange?

SR: An extremely selective and efficient process that extracts materials from solutions, either water or acid leaches, using resin beads that have been produced to hold a particular ionic charge. Imagine one continuous flow of resin extracting target metals or cleaning water, being removed, regenerated and then recirculated into a system.

"Continuous-ion exchange is highly effective in desalination, which is needed in the development of northern Australia's coal-seam gas fields."

This is a superior alternative to membrane or filtration processes, which squeeze materials through meshes or filters with the expectation of extraction based on size. These can be effective processes, but they tend to be extremely energy intensive because of the high pressure required to force the materials through the membranes or filters. The beauty of ion exchange is that all the mechanical work is affected by the resin's chemistry.

The selectivity of our process is crucial to its value. We can expressly extract specific materials, such as gold, copper, particular organics or salts in commercially viable amounts.

TGR: Is this a proprietary process?

SR: Ion exchange has been well known for decades, but our continuous-flow process is proprietary. Our technology is much superior to traditional batch processing and is the result of the $10M+ we have invested in it.

TGR: To what commercial uses does Clean TeQ employ continuous-ion exchange?

SR: It is highly effective in desalination, which is needed in the development of northern Australia's coal-seam gas fields, where gas is often trapped underground under pressure by large amounts of water with a significant salt content. Freeing the gas brings this salty water to the surface, which leads to environmental problems with soil erosion and salt pans. We have operated a sizable demonstration plant in Queensland that demonstrates how efficiently our technology removes the salt from the gas field brine.

In industrial applications, our technology can treat organics in water and extract heavy metals and other pollutants from industrial waste streams. In mining, it abets recycling and is used to treat water tainted with acids and sulfides so it can be safely discharged into the environment.

With metals, it's simply a matter of looking at the periodic table. Most carry an ionic charge that makes them amenable to extraction using continuous-ionic exchange.

TGR: Can ionic exchange be used to remove precious and base metals from mine tailings?

SR: It is exceptionally good at this, for two reasons. First, our process is efficient with low-grade material, which tailings typically are. Second, our process is exceptionally good with oxidized material, which tailings typically are as well.

TGR: What is the present and future of Clean TeQ's water-purification efforts in China?

SR: One year ago, we signed an agreement with the Shanghai Investigation, Design and Research Institute (SIDRI), a subsidiary of China Three Gorges Corp., China's largest power generator. This agreement anticipates the formation of a joint venture (55% SIDRI, 45% Clean TeQ) to leverage the cost and environmental benefits of our continuous-ion exchange technology in the mitigation of the degrading water quality of China's rivers, lakes and groundwater systems. The technology also can be used for metals recovery.

After eight months of trials, SIDRI has confirmed that the necessary technical verification steps have been achieved. We are now negotiating with SIDRI the structure and documentation of the joint-venture agreement that would apply within China.

TGR: Given the Chinese government's commitment to environmental remediation, this is a vast market, correct?

SR: It is. But we must be pragmatic and understand that it will take time for markets to place a value on water. China has taken the view, and I think this will be confirmed in the next five-year plan, that the environment in general and water in particular will be key investment priorities.

"Ionic exchange is exceptionally good at removing precious and base metals from mine tailings."

We don't profess to have a technology that will solve all of China's water problems, but we can say that we have a versatile technology that can be employed successfully in many different applications. Our relationship with SIDRI and Three Gorges will facilitate a significant transfer of knowledge and expertise in the water-treatment space. We are positioning our company for the future of water, and we are working with partners in China that will make this reality.

TGR: How much cash does Clean TeQ have?

SR: At the end of August, we had ~AU$9.5M in the bank.

TGR: When do you expect that Clean TeQ will become profitable?

SR: We expect the details of our Chinese joint venture to be determined by the end of 2015 or early 2016. Our ramp up in China will be progressive, and we should have our first batch of projects underway by next year.

But so far I've described only half our business. We have the scandium side as well.

TGR: What is the business opportunity for scandium?

SR: Scandium is a rare earth element, one that is rarely found in nature in appreciable concentrations. It is a metal little known even to industrial chemists. What we have known about scandium for half a century is that it is the best alloy for aluminum. It is also used in the manufacture of solid-oxide fuel cells.

We decided to buy the Syerston mine in New South Wales from Ivanhoe in order to produce scandium with supply reliability delivering known pricing to markets, thus making it an attractive metal for deployment in aluminum-based applications, principally transportation. We believed that by combining a large, high-grade resource with Clean TeQ's proprietary technology we could unlock latent value.

TGR: Given that scandium makes aluminum lighter yet stronger, why isn't all aluminum treated this way? Is it a shortage problem?

SR: Yes. Those companies that would wish to use scandium alloys for mainstream industrial applications, such as building cars or airplanes, have always lacked confidence that sufficient scandium would be available. That is because no mine has ever been built that produces scandium as a primary product. To date, most scandium has been produced as a by-product of the treatment of industrial waste, mostly in the titanium pigment industry. Clean TeQ has successfully produced scandium in this manner through the application of our continuous-ion exchange process in Japan.

But what we are offering now at Syerston is something radically different. We propose the development of the world's first mine devoted 100% to scandium production, by first leaching the scandium into a solution, then using ion exchange to extract it and yield scandium oxide for commercial use.

TGR: The published prices for scandium metal are wildly variable.

SR: There's not an openly traded price in the market, as all contracts are private. Published figures I have seen vary from anywhere between $1,700 per kilogram ($1,700/kg) and $6,000/kg. That says to us that this is quite a dysfunctional market. In order to create a viable scandium market, we must not only establish supply reliability but also establish a price that creates value for customers and creates end users. Scandium is now a niche rare metal. Our objective is to commoditize it with reliable supply, consistent product specifications and significantly lower pricing.

To achieve that, we need a scandium mine. The benefits of a minable supply of scandium are clear. First, a known, reliable production base that is not dependent on by-product production, which is subject to indirect, secondhand reduction. Second, a reliable production base leads to cost certainty, as well as significant cost reduction.

We have a valuable proposition for industry with Syerston: stable production with lower costs. And we intend to supply key players in the transportation sector.

TGR: How does the Syerston site stand for permitting and infrastructure?

SR: Exceptionally well placed, as it is fully permitted for a mining development. Even better, it has a government granted water allocation, which is essential, considering both the hydrometallurgical process we will employ and the region of Australia where it will be employed.

The Syerston mine is in a remote location with virtually no population, but there is extensive copper mining there, which means access to infrastructure and a trained workforce.

TGR: You issued a maiden Syerston resource in January. What do you have there?

SR: We examined two potential scenarios: a global resource with a lower cut-off and a high-grade resource with a higher cut-off. We hope to maximize grades and therefore recoveries in the early years. Globally, there are ~16 kilotonnes of contained scandium oxide in the ground. This estimate is based principally on historic drilling. We are also undertaking our own drilling, and we believe the potential exists to increase the resource.

"We propose the development of the world's first mine devoted 100% to scandium production."

To put the above figure in context, the global market for scandium today is only 15 tonnes. It's a niche market because users cannot obtain the metal at a desired price. Once operational, Syerston will exploit the latent demand in the market.

TGR: How close is Syerston to releasing a feasibility study?

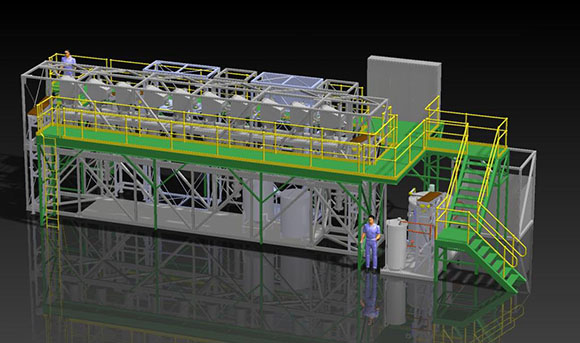

SR: We are aiming to complete the feasibility study by the middle of 2016. We are just completing a crucial piloting program in Perth. Its purpose is to provide input and feedback for our metallurgical testing, to measure leaching efficiency, recoveries and extraction throughout the process. This program processed around 12 tonnes of ore directly from the site.

We are committed to providing samples for potential customers to test and verify for product qualification purposes, and our pilot program has positioned us to produce these samples on a relatively large scale.

TGR: Could you give us a ballpark capital expenditure (capex) figure for Syerston?

SR: It would be a very small mine with a very small footprint and a relatively modest capex: ~$70–80M. We aim to develop a facility that will produce 30–40 tonnes of scandium oxide per annum at a cost of US$400–500 per tonne.

Initially, Syerston would process only 65,000 tonnes of ore annually. This is so small as to cause some to wonder why we would bother. The answer is that this is incredibly high-value material, which fully justifies such a small footprint and development plan. Of course, once we begin delivering scandium reliably and cheaper than ever before, what would happen to demand then? And what would our expansion plans look like?

TGR: What is the significance of Clean TeQ's agreement with Airbus APWorks GmbH and KBM Affilips BV?

SR: Airbus is, as you know, one of the world's largest aircraft manufacturers. APWorks is an Airbus division that commercializes technologies developed by Airbus, in particular manufacturing technologies focused on 3-D printing. KBM is one of the world's largest manufacturers of master alloys, which that company calls the "spice rack for the metal industry." In other words, the particular composition of a master alloy fine tunes the properties of the metal product.

Scandium's challenge is not in permitting, mining or processing; it is in marketing. As Clean TeQ progresses the development of Syerston, we must prove a demand for the scandium it produces. From the start of this process, it was clear we needed to engage with end users all along the supply chain. The significance of our agreements with Airbus APWorks and KBM is that they demonstrate our eagerness to work with major end users and persuade them of our ability to provide a reliable supply of scandium at the right price.

TGR: With 17% ownership, Robert Friedland is your company's biggest shareholder. What does his name bring to Clean TeQ?

SR: It brings a great deal of attention to who we are and what we do. Just as important, however, is that Robert is a long-term advocate in the resource-preservation movement. He is keenly interested in employing emerging technology to make mining cleaner and more efficient, and to develop metals and minerals that assist in making the world a cleaner place.

I believe Robert's investment track record often anticipates his expectations for significant shifts in society, whether they be driven by urbanization, technology or trends in global wealth transfer. Some of these will require delivery of more base and precious metals, some will depend on more exotic metals. But the key for our industry is to produce with minimal environmental impact and at a cost that justifies the end use. We will always look to develop synergies where we can, whether it be in electric vehicles, aerospace or any future transportation applications. We wish to leverage our relationship with all parties the better to secure Clean TeQ's future.

TGR: Where do you see your company in three years?

SR: I would like to think we would be the world's first producer of scandium from standalone mining after having established important offtake and supply arrangements in key industrial markets. We believe the future of scandium will be bright indeed. It is the best aluminum alloy available today. It adds strength and weldability, while reducing weight and resisting corrosion. Its applications are almost limitless to improve the current performance of conventional alloys.

In three years, we should also have built a valuable partnership with China and demonstrated the flexibility of our continuous-ion exchange process in treating that country's water problems.

Clean TeQ has a vision. It has two key focuses. It is now our job to deliver.

TGR: Sam, thank you for your time and your insights.

Sam Riggall is the chairman of Clean TeQ Holdings Limited. He was previously executive VP of business development and strategic planning at Ivanhoe Mines and before that worked for over a decade at Rio Tinto in a variety of roles. He led the Oyu Tolgoi Investment Agreement negotiations with the government of Mongolia for Rio Tinto and Ivanhoe Mines to develop one of the world's largest copper-gold mines. Mr. Riggall is a director of Syrah Resources Ltd., which is currently constructing the world's largest graphite mine in Africa. A graduate of the University of Melbourne, he was awarded bachelor degrees in commerce and law.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Kevin Michael Grace conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as an independent contractor. He owns, or his family owns, shares of the following companies mentioned in this interview: None.

2) Clean TeQ Holdings Limited paid Streetwise Reports to conduct, produce and distribute the interview.

3) Sam Riggall had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Sam Riggall and not of Streetwise Reports or its officers.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.