The Gold Report: The event that launched Gold Standard Ventures Corp. (GSV:TSX.V; GSV:NYSE) into the limelight was the spectacular drill results of the high-grade and long interval at the Railroad project in Nevada. That was about two years ago. Since then, what have you learned about the deposit and how has the company evolved to take advantage of the situation?

Jon Awde: The intercepts that you are referring to were quite spectacular. In 2012, we had four wide and high-grade holes. At that time it was called the Railroad project. It's recently been renamed the Railroad/Pinion project. Two of the better holes had 164 meters (164m) of 3.38 grams per ton (3.38 g/t) and 124m of 4.05 g/t. One of those holes included a high-grade intercept of 42.7m of 9.4 g/t. That was a blind discovery and opened up this target. Since then, we have drilled at least 30 more holes into that target.

What have we learned? The deposit has complex geology. The deposit is open-ended. Both of those attributes describe a typical Carlin system, and they apply to the Railroad/ Pinion project. Late last year we discovered a new lower breccia zone that appears to be the flat lying collapse breccias that occur in an idealized North Carlin system. These are all characteristics that historically have represented a very large, robust Carlin system.

TGR: What was the depth from surface to the high-grade intervals? One of the many attractions of Carlin-style mines is that many are near surface.

JA: The depth of those specific holes was about 160 meters. We have found shallower portions of the deposit to the southwest, where we see mineralization starting at about 90 to 100 meters. If you look at other operating mines in the Carlin Trend, there are many that operate with similar depths to ore from surface.

TGR: Haven't the majors locked up all the Carlin Trend? Is there any room left for new big discoveries?

JA: Yes, absolutely, sometimes districts can remain underexplored because of complex land ownership issues or stacked royalties–both were the case at Railroad-Pinion. The Carlin Trend is the most prolific gold belt in the Western Hemisphere. The majority of the current production from the Carlin comes from the northern end of the trend. Gold Standard Ventures Railroad/Pinion District is in the southern portion of the Carlin Trend, immediately south of Newmont Mining Corp.'s (NEM:NYSE) Rain District.

Our chief geologist, Dave Mathewson, when he worked for Newmont, tried to get a toehold in the Railroad/Pinion District for years. Ultimately, his efforts were not successful. The land package was owned by various interests that could not work out a deal to advance exploration in the district. In the meantime, the majors developed several operating mines on the northern portions of the Carlin Trend and let this area sit under or unexplored.

Times change and we were highly opportunistic and diligent in working out terms with new owners in the area to move forward with exploration. In fact, the Railroad/Pinion District wasn't really explored with modern exploration techniques until we got to it. Gold Standard Ventures was the first company to do controlled source audio-frequency magneto tellurics (CSAMT) and gravity surveys at the district level. We were also the first to do soil sampling and geologic mapping across the entire Railroad/Pinion District.

TGR: What are some of the things you have found that indicate that Railroad/Pinion is the southernmost district in the Carlin?

JA: One distinctive feature of Carlin-style deposits is the presence of collapse breccias along major west-northwest trending fault zones. We discovered two such features at our North Bullion deposit. That is just the beginning, as we are getting a better handle on the structural controls to the geology. It's wide open and complex geology. Just when you think you have these Carlin systems figured out, they throw you a curve ball. Our team of exploration geologists, including Dave Mathewson, Mac Jackson and Steve Koehler, has been phenomenally successful in Nevada with several discoveries to their credit. The team has the expertise to model and interpret the new data that we have been able to obtain by consolidating these projects into one district. Such a districtwide view simply hasn't been possible in the past; while we are prioritizing three targets this year, the district remains target rich and highly prospective.

TGR: Who are the significant players in the Carlin Trend?

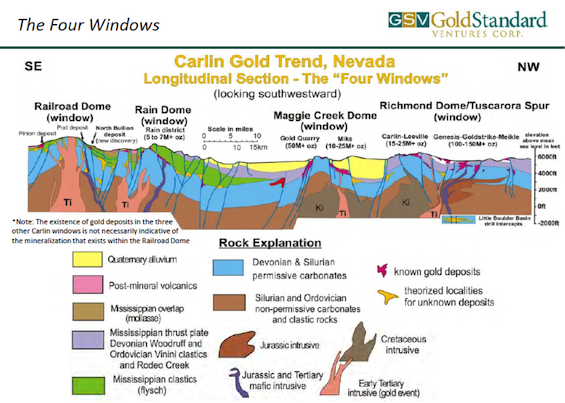

JA: Most of the Carlin Trend is controlled and operated by Barrick Gold Corp. (ABX:TSX; ABX:NYSE) and Newmont. In the northern part of the Carlin Trend is the Richmond Dome, which has the Goldstrike, Leeville and Meikle mines. Moving farther south down the trend is the Maggie Creek Dome, which is controlled and owned by Newmont. That's the massive Gold Quarry deposit. Next is the Mike deposit. Further south is the Rain District, which is primarily owned by Newmont, although the majority of the Saddle deposit is owned by Premier Gold Mines Ltd. (PG:TSX). Then within the Rain District is the Emigrant mine that Newmont put into production a couple of years ago. That is a near surface, run-of-mine heap-leach operation that is generating good cash flow for Newmont. A good portion of the Emigrant deposit was discovered by Dave Mathewson of Gold Standard Ventures.

The most southerly district of the Carlin Trend is the Railroad/Pinion District. With the recently closed Pinion acquisition, Gold Standard Ventures now controls almost 40 square miles of wholly owned ground in the district. Each of the main districts in the Carlin Trend are all centered on a large dome or intrusive pluton. Gold Standard Ventures now controls the entire "fourth window," which represents the area where one of these large domes come close to surface and is most available for exploration and mining (see illustration below).

TGR: How does an exploration company cope with the tough gold market of the past two years—even though Gold Standard Ventures had great exploration success and blue-sky potential?

JA: The overall market tone for the last two years for anything to do with gold has been dreadful. Then as you go down the food chain from producer to developer to junior to junior explorer, it's been tougher and tougher to raise capital. The capital market environment for exploration stories is still very challenging. You're right, this is a very large district-scale opportunity and it's daunting because it is a target-rich environment. We're seeing a lot of the same or similar characteristics that you need to see to host a district. It is a challenge to have multiple target opportunities. Every month we gain more knowledge about the district, and it validates our thinking that we do have a district in the Carlin Trend akin to the larger, robust districts in the northern part of the trend.

But to answer your question, how are we coping? We're focusing on building a district. The acquisition of Pinion completes our land consolidation. We started almost four years ago with 12 square miles. We have now almost quadrupled the size of the land package to nearly 40 square miles. We have narrowed in on three main targets, North Bullion, Pinion and Bald Mountain. Bald Mountain and Pinion are two oxide targets while North Bullion is a classic Carlin sediment-hosted refractory gold system.

To cope with the volatile gold market, it helps to have supportive shareholders. We have several shareholders who have been with us for a long time. We have been able to get a couple of large U.S. institutions to support us. We have a very large shareholder in Toronto, FCMI, led by Albert Friedberg. It owns about 15% of the company. FCMI came in after some early exploration success, but before our high-grade discovery at North Bullion. In August 2013 we were able to get a 5% investment from a mining company.

TGR: You did a recent deal to round out your land package with the acquisition of Bald Mountain. Can you just give us a few high points about that transaction and specifically what you're going to be doing next at Bald Mountain?

JA: The acquisition of Pinion closed in early March. As a part of the deal to acquire the interest that we didn't own at Pinion, we entered into an agreement with Scorpio Gold Corp. (SGN:TSX.V) to purchase approximately 16% of one section. This is important because approximately 300 meters away was a drill hole that we announced in early October, where we hit 56m of 1.47 g/t gold. It was all oxide with an underlying copper zone. Our exploration team is very excited about this target.

Approximately 300 meters away from that drill hole, there was a section of land that we did not have complete ownership. In fact, we owned about 84% of it. To prevent a future royalty issue, we elected to purchase the remainder of the land. Based on our geochemistry and soils analysis, our team strongly believes that the target was heading in the direction of that boundary.

In order to drill the highest probability portion of that target, we needed to wrap up the land ownership issue. Now that we've closed on that land acquisition, we have the whole district under one roof for the first time ever. This is a big accomplishment because of the multiple owners of surface, mineral and water rights that we've had to deal with to get this far. It wasn't easy, but we have made the investment in consolidating the land package. Now we can properly go after the Bald Mountain target. We are going to get a reverse circulation (RC) rig in there in late June or early July after the exploration program of phase 1 at Pinion is complete.

TGR: What should investors be looking for in news flow for near term or longer term?

JA: First, in early May we started the phase 1 drilling program at the Pinion Deposit. It is a 15 hole program designed to do a couple of things. First and foremost, we want to make the historical resource NI 43-101 compliant. We also want to test a few targets that are just outside of the historical resource.

Second, we are looking forward to drilling Bald Mountain. The target is highly prospective and should begin drilling by early July.

The third task the company will be working on is to go back to North Bullion and make that resource NI 43-101 compliant, which will take about another 8 to 10 holes. An exploration company with a near-term oxide development asset like Pinion is attractive. It complements our other exploration that is targeting much larger, blue-sky deposits.

Across all the targets, the data supports our plan to explore and build this district. The data validates our investment in building the land package we have worked out with multiple owners of surface, mineral and water rights. The structural interpretation that we've done on the Bald Mountain target has helped us get a better understanding of the potential of the district. Building on the results at Bald Mountain from this January, we have opened up a new prospective west-northwest direction of that target. Expect more drill results from all these targets this year.

TGR: Is a preliminary economic assessment (PEA) on the horizon?

JA: Yes. The PEA will happen at some point after the initial resource at Pinion. The initial drill program will concentrate on making the historical resource NI 43-101 compliant. However, given we think there is a lot of exploration upside, a second drill program will be designed to test its potential. Therefore, we will have to figure out how to incorporate the right level of data into the PEA.

We have a large amount of data that we have to work into the initial resource. For example, we have 90+% of all the cuttings and chips from substantially more than 300 reverse circulation holes. We thought we were going to receive two core holes and instead received 12. At least 40% of the core from those 12 holes was not assayed. Many of the holes were shallow and bottomed in mineralization. Plus, we have a massive geochem data set. Resolving all the historical and modern data into a comprehensive resource is a large undertaking.

TGR: What are the three reasons an investor should take a look at Gold Standard Ventures?

JA: First, we're in the Carlin Trend. It's one of the best exploration and mining jurisdictions in the world. Nevada has great infrastructure, clear and transparent mining code, and is very supportive of exploration development and mining. We have an entire district in the Carlin Trend locked up for the first time ever.

Second, we have three exciting targets, two of them oxide, one of them refractory. This provides us with a combination of near-term and long-term mining potential.

Last, we have a phenomenal world-class exploration team you typically would not find in a junior. Our exploration staff is complemented by an excellent board and advisory team with a lot of merger and acquisition and capital market experience.

Putting all of those characteristics into a junior is a rare and unique opportunity.

TGR: Thanks for taking the time to talk to us.

JA: It has been a pleasure.

Jon Awde is cofounder, president/CEO and a director of Gold Standard Ventures where he oversees all financing, corporate activities and developments for the company. He has spent the last 12 years financing junior resource companies and has focused on institutional accounts, raising over $100 million for public and private companies in the resource sector. Awde received his Bachelor of Arts in economics and finance from Acadia University and is a former sales and trading professional at a CDN Broker Dealer.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) J. Alec Gimurtu conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an independent contractor. He owns, or his family owns, shares of the companies mentioned in this interview: None.

2) Gold Standard Ventures Corp. paid Streetwise Reports to conduct, produce and distribute the interview.

3) Gold Standard Ventures Corp. had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Gold Standard Ventures Corp. and not of Streetwise Reports or its officers.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.