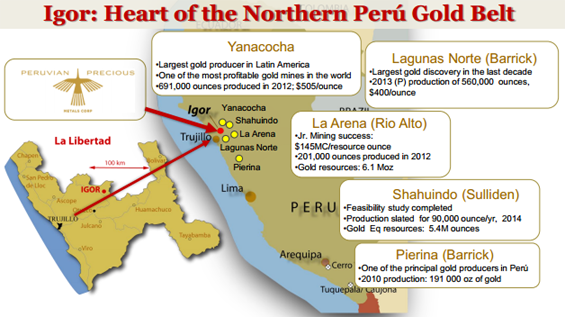

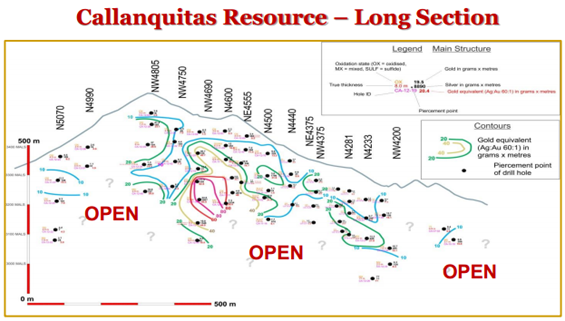

Brian Maher: Peruvian Precious Metals is essentially a brand new company. The new management—Kimberly, CFO Tony Wood, and I—took over earlier this year. We were drawn to this company because of the outstanding project located in the northern Peru copper-gold belt. It's called Igor and it is located in an area that has some of the largest gold mines in the world. The project includes a brand new discovery on what we call the Callanquitas structure with over 700,000 ounces (700 Koz) gold equivalent in the NI 43-101 Inferred category.

But what really drew us to this project was the ability for it to be fast tracked to production. The Callanquitas structure is high grade, sub-vertical and topographically well positioned such that it could potentially be developed as a low-cost underground mining operation. The project mirrors where our last company, Prodigy Gold, was when we took over—two and a half years before it was bought out. We feel that our experience at Prodigy is directly applicable to making this project as successful as Prodigy's flagship project, Magino. We look forward to rapidly moving from drilling, through a preliminary economic assessment (PEA) to a prefeasibility study (PFS). That is a formula that builds shareholder value quickly.

TGR: Given that background, what features set Peruvian Precious Metals and this project apart from other junior miners?

BM: The first point is the project itself. Peruvian's flagship Igor project has an ideal location with infrastructure in place ready for development. The deposit is high grade and potentially low cost to mine. The second point is management. Our team is very experienced in developing similar projects, having successfully brought a company from the exploration stage through development and sale to a major gold company. The third standout feature of Peruvian Precious Metals is our strong support from shareholders and the board of directors. The board has unrivaled experience not only in the mining industry, but with operations in Peru.

TGR: You mentioned Prodigy's history and how you're trying to repeat that success. Can you give us a little background on how you got involved in Prodigy and what was the situation that enabled you to take that to the next level?

BM: For a number of years, I was the vice president of exploration with the predecessor company of Prodigy called Kodiak Exploration. The board asked me to take over running the company. Kimberly joined me to help with the marketing and business development. We identified an asset in northern Ontario called the Magino mine. Through a merger with the owner of that project, we formed Prodigy Gold. In a 26-month period we took Prodigy from a 1.6 million ounce (1.6 Moz) resource to a more than 6 Moz resource and developed a PEA that established the economic viability of the project. Prodigy's share price went from $0.19 to over $1. The market capitalization went from $25 million ($25M) to $340M when Prodigy was bought by Argonaut Gold. We are building on the success of that formula to advance this project and create wealth to the shareholders.

TGR: What were the challenges you faced at Prodigy and do you have a similar set of challenges with Peruvian Precious Metals?

Kimberly Ann: At Prodigy, one of the challenges was the former CEO promoted one of the projects beyond what could be delivered. When we came onboard, there was no flagship property and the company had lost focus. Yet the promotion had talked the stock from $0.55 to over $5. The company did a financing for $55M, but the share price came down to below $0.45 when the resource estimate came in at approximately 300 Koz. That was far away from the story of several million ounces that had been the company line. As a management team, we inherited a disappointed board, disappointed shareholders and disappointed employees.

We recognized that Prodigy needed a flagship property to succeed. When we closed the transaction to buy Magino, we chose to reorient the company with a new direction. We spent two years on the road building trust in the management team and in the company vision.

It took us a year to get analyst coverage. Eventually, we had eight analysts covering the company. That took a commitment, getting them out to the project, having them come back every few months and showing them how management was delivering on benchmarks. Engaging the analysts wasn't about asking for money; it was about demonstrating a track record of setting and achieving benchmarks. Having a track record of doing what we say we're going to do is unique in the junior mining industry. Over-promoting is not in anybody's long-term interest. We stick to the facts.

TGR: Peruvian has the project, management and board in place—so what is the concrete next step? What are your goals and how are investors going to know that you are achieving them?

KA: Our immediate goals are to capitalize the company and to meet with long-term shareholders to clearly communicate our new vision. For instance, by the time this interview is released, we will be in Colombia to meet with long-term shareholders. We're strengthening long-term relationships that have been through a lot of corporate changes and we are meeting with new shareholders to communicate our excitement about advancing this project. We plan on drilling 6,000 meters in 2013 and soon thereafter updating our resource. Those efforts will give us some clear benchmarks of success on the ground.

TGR: When will results be announced?

BM: The goal is to resume drilling no later than this October. Six thousand meters can be drilled fairly quickly. We'd like to have that resource update done by the end of this year but realistically it will probably be in Q1/14. That resource estimate will be the basis for the PEA. Releasing a PEA in 2014 is critical because it will differentiate the company by establishing the economic parameters of this resource.

There are hundreds of companies with resources out there: copper, diamonds, any mineral commodity. But is it economic? Can you extract that material and make a profit? The PEA establishes the baseline economics of a project; it allows analysts and investors to come up with a net asset value for the company and to judge that in terms of the share structure. A PEA shows a roadmap of where the company is going. The next steps are to complete the drilling, update the resource and release a PEA. Those are the steps that will give everybody a chance to look at the value of the company. We've already done back-of-the-envelope calculations on what those numbers could look like, and that's what really attracted this management team to that project. We think we will have a robust PEA that will demonstrate strong economics.

TGR: In this market, the big question is: How much financing is it going to take you to get the PEA out? How much additional financing beyond the cash you have in the bank now and the recently announced financing?

BM: The first order of business for our new management team was to get our financial house in order from the previous management. We've done that. We reduced our burn rate to a very low $90,000 a month for all of our Peruvian operation.

TGR: Does that include any exploration expenditures?

BM: That includes keeping the camp open, keeping the people on the ground mapping, sampling and preparing for drilling. So, yes, it includes some exploration. It lets us continue to make progress but it is also a burn rate that is very sustainable. We recently announced a $1.5M financing. When completed, that money will be used to start drilling. Because of the nature of the drilling program we designed—it's essentially an infill program with short stepout holes to increase the resource—it has a high probability of producing excellent news flow, which will verify and validate our resource. With that news flow, we anticipate a recovery in share price, and if we do need additional money by the end of the year, say $1M or $2M, we should be able to raise a much more favorable share price level and minimize possible dilution. In a nutshell, we can get to a PEA with only modest amounts of additional funding.

TGR: You mentioned that Peruvian Precious Metals, at least from a management point of view, could be called a "turnaround." What is it like to manage a turnaround situation?

BM: It's the same in any business environment, whether you are talking the junior mining segment or you are trying to get Chrysler back on track. The first thing is to straighten out the problems inherited from past management. That can be very challenging. There are issues with creating corporate culture, honoring past obligations that you might not agree with, effectively managing contactors and simply paying the bills. In this case, we also had to reduce staff. If everyone recognizes that the key asset of our company is a great project, a project that will likely become a mine, then we can build the company around that unified vision. Once that is in place, shareholders gain confidence, employees gain confidence and our own confidence is reinforced. While the overall equity marketplace has made the whole process a little more difficult, the reality is we are moving forward and looking toward doing more work on the ground.

TGR: You seem to have a very strategic approach to drilling. Would you explain how you plan to approach the next round?

BM: We have been very deliberate and very systematic in drilling the existing resources.

Drill hole spacing is 50 to 75 meters, so it is very tightly drilled. Because of that, we have a great deal of confidence in the continuity of mineralization. Beyond that, we have the ability to step away from the main drill areas to potentially quickly add ounces. To date, we have encountered some very high-grade intercepts and some very distinct raking ore chutes. When we plan the next round of drilling, we aren't moving hundreds of meters away from existing resource. We are stepping out incrementally—50 to 75 meters—and as a consequence it should be straight forward for us to quickly add ounces to our resource.

TGR: Let's discuss the exit strategy. Are you going from PEA to PFS to a bankable feasibility study to potentially production? Or are you going to look to combine with one of the larger companies already well established in Peru? How are you positioning the company to address the uncertainty of the exit strategy?

BM: Again, we reference the strategy we used at Prodigy, and it's really quite simple: We will continue to advance the project through the PEA to a full feasibility study and as we go through each one of those steps we will continue to grow the company to support our ability to put it into production ourselves. Raising money with each of these steps becomes easier because the risk decreases.

This method gives us all options for generating shareholder value. If the best option for the shareholders is to build a mine and operate it ourselves, then so be it. Because that outcome is a possibility, we will make sure that we've gone through the proper steps to get there. If in the process of taking away risk from the project by taking it through feasibility another mining company comes up and says, "We really like you guys, we're going to pay you a 60% premium to your share price to acquire this asset," then that may be the most appropriate path for our shareholders. But if we don't target production, we don't give ourselves that flexibility. As soon as we put that flag out that says "Developed Resource For Sale," we have limited our ability to grow value.

TGR: Let's wrap it up with a summary of the high points of investors should know about Peruvian Precious Metals.

BM: It goes back to the three points: Igor is a top quality project with plenty of blue-sky potential in a great geopolitical jurisdiction that's ready to move forward. Peruvian Precious Metals has a management team with successful background experience, including financial, corporate, marketing and mine operations. Lastly, we have a strong board with experience in mine development and operations in Peru that can support us and give us guidance. When you have all three of those working together, you have the building blocks for a great company.

TGR: We look forward to watching you advance this project.

BM: Thanks for the chance to get the message out.

Brian Maher, president, CEO and director of Peruvian Precious Metals Corp., is an economic geologist with over 34 years of experience in the international mining and exploration industry. Most recently, he was the president, CEO and director of Prodigy Gold Inc. He received a Bachelor of Arts degree in geology from California State University, Chico and a Master of Science degree in economic geology from Colorado State University. After working for ASARCO and as a consultant, Maher joined Hochschild Mining Plc in 2005, where he headed its North American exploration program.

Kimberly Ann, Peruvian Precious Metals Corp.'s vice president of corporate development, is a corporate development and communications specialist with over 20 years of marketing experience in branding, investor relations and finance. In the past three years, Ann has assisted in raising over $90M in equity financing and directed three major junior mining rebranding projects. While at Prodigy Gold, Ann was responsible for all aspects of the company's corporate communication program, facilitating equity financings, generating analyst coverage, participating in key aspects of corporate M&A activities and generating widespread recognition of the company's successful transition from explorer to mine developer. Ann attended the University of Washington, majoring in business and marketing.

DISCLOSURE:

1) J. Alec Gimurtu conducted this interview for The Gold Report and provides services to The Gold Report as an independent contractor. He or his family own shares of the company mentioned in this interview: None.

2) Peruvian Precious Metals Corp. paid The Gold Report to conduct, produce and distribute the interview.

3) Peruvian Precious Metals Corp. had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Peruvian Precious Metals Corp. and not Streetwise Reports or The Gold Report or its officers.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.