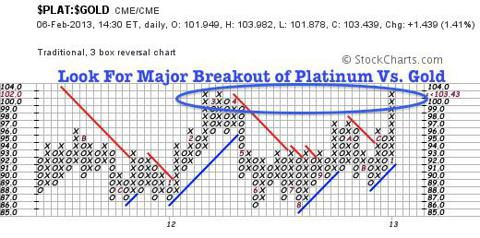

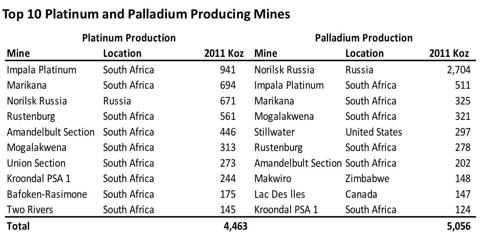

Platinum (PTM) is breaking out compared to gold (GLD) as South Africa, which supplies three quarters of world production, continues to struggle with labor issues and possible nationalization. Look for a major breakout of the platinum to gold ratio at 104. Platinum (PPLT) is about to break into new 52 week highs as demand increases due to the economic rebound in Asia, while at the same time supply is under major pressure. Observe the chart below which shows that the majority of production comes from questionable mining jurisdictions.

Platinum (PTM) is breaking out compared to gold (GLD) as South Africa, which supplies three quarters of world production, continues to struggle with labor issues and possible nationalization. Look for a major breakout of the platinum to gold ratio at 104. Platinum (PPLT) is about to break into new 52 week highs as demand increases due to the economic rebound in Asia, while at the same time supply is under major pressure. Observe the chart below which shows that the majority of production comes from questionable mining jurisdictions. The world's largest producer of platinum, Anglo American Platinum (AMS), reported a major loss for 2012 and warned of a potential supply shortfall as labor protests and nationalization fears continue to increase.

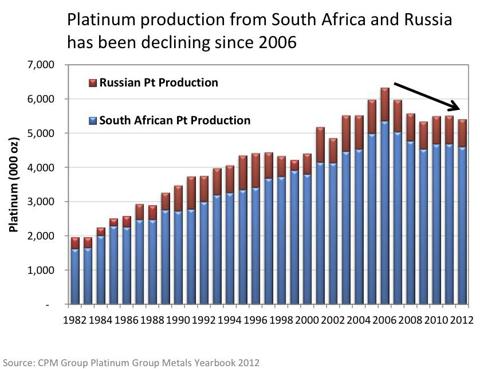

The world's largest producer of platinum, Anglo American Platinum (AMS), reported a major loss for 2012 and warned of a potential supply shortfall as labor protests and nationalization fears continue to increase.South Africa has become increasingly volatile and demand for platinum is picking up due to increased sales for new automobiles. A supply shortfall in platinum and potential price spike could happen in 2013 as a major deficit in PGM's could be developing.

Last fall during the beginning of the South African mining strikes I penned a bulletin on why platinum is providing investors a rare buying opportunity not seen in more than 25 years.

I also forecasted that platinum's discount to gold will not last long as we were in the beginning of a major rebound in the Far East and a risk on rally in housing (XHB) and financial (XLF) stocks.

This could boost inflationary forces for monetary metals such as platinum and silver (SLV) which also have a rising industrial use. When platinum and silver begins outperforming gold as it has been doing recently this may forecast that inflationary forces are beginning to take effect. This may also be bullish for the undervalued junior miners (GDXJ) who perform better during risk on cycles.

Platinum underperformed gold in 2011 and 2012 as a safe haven as a slowing economy and deflationary forces in Europe and the U.S. favored the yellow metal as a risk off investment vehicle.

However, that trend may be changing quickly as investors may be realizing that the Central Banks have used massive monetary weapons to fight deflation and that we are starting an inflationary cycle evidenced in the rebound in the most toxic sectors which the government has been bailing out since 2008.

The platinum to gold ratio is making a significant breakout as platinum's price moves above the price of gold. Investors who listened to our bullish report on platinum a few months ago realize that platinum's discount to gold was extremely unusual.

It happened before in 2008 and then back at the end of the year in 1996. Each time this represented a great buying opportunity as platinum supply is extremely tight and historically averages double the price of gold.

Of course in 2011 and 2012, the debt crisis in Europe and the U.S. led to a major safe haven rally where gold outperformed platinum and silver. I wrote a few months ago as soon as the strikes hit South Africa that we may be near the bottom.

Remember over 90% of world platinum supply comes from Zimbabwe, Russia and South Africa. These are not mining friendly jurisdictions.

This pressure on supply from Africa combined with a robust recovery in China manufacturing may be the factor for the outperformance of platinum.

Remember the cost of mining platinum in South Africa is marginally profitable at these prices as the costs are quite expensive as South Africa has the deepest and most dangerous mines in the world.

The fundamentals for platinum appear to be stronger than that of gold as there is great potential for lower mine supply from South Africa in 2013.

In conclusion, the price of platinum may be turning higher. Do not be surprised for major miners to cut back on platinum investments in South Africa and look for additional secure supply in North America where there are undervalued opportunities.

Disclosure: Author has no ownership of etf's mentioned and no business relationships with ETF companies.

Jeb Handwerger

Gold Stock Trades