TICKERS: ATRC, EW, HTWR, SPNC, NAS, THOR, VOLC

Deep Value Found in Small Medtech: Jason Mills

Interview

Source: George S. Mack, The Life Sciences Report (4/19/12)

Medical device companies need to demonstrate four qualities to be good investment ideas, according to Senior Medical Devices Analyst and Managing Director Jason Mills of Canaccord Genuity. In this exclusive interview with The Life Sciences Report, Mills shares his precise criteria and pinpoints specific growth names that are trading at value levels.

Medical device companies need to demonstrate four qualities to be good investment ideas, according to Senior Medical Devices Analyst and Managing Director Jason Mills of Canaccord Genuity. In this exclusive interview with The Life Sciences Report, Mills shares his precise criteria and pinpoints specific growth names that are trading at value levels.

The Life Sciences Report: Do you have a theme currently?

Jason Mills: With medical devices, investors must be cognizant of regulatory and reimbursement themes. Overall that environment has been somewhat arduous over the last couple of years, perhaps even more arduous than in the past. Investors are not surprised by this. In addition, some larger medical device markets are seeing more intense competition and resultant price pressures. They are also seeing declining procedural growth, coming down from historic highs. That's the case in some of the areas I follow in cardiology medtech, such as interventional cardiology, drug-eluting stents, electrophysiology with the implantable cardioverter defibrillators (ICDs) and even in atrial fibrillation.

I think medical devices tend to be a stock picker's environment, in which not all stocks are attractive at any given time. There are some obvious reasons for the trough valuations that we're seeing, but these also create opportunities.

TLSR: Negative headwinds are obvious and baked in, but beyond that do you see some of these stocks trading at deep value?

JM: Yes. The valuations for the medical device sector are at levels we haven't seen for years. Back in the early part of the last decade—2001 and 2002, when the tech stock boom was coming off its highs—we saw valuations in small- and large-cap companies down at trough levels, but we're trading well below those levels today.

TLSR: Given these negative factors, what do you look for in a medical device company?

JM: We believe that the most attractive medical device companies possess a few specific characteristics.

First, we favor growth. Growth is at a premium in medical devices today, given that there are fewer markets where critical mass has been achieved in terms of size and continued good growth prospects. Continued growth must be based on a large underpenetrated patient population in which the clinical data suggests the therapeutic modalities have improved patient care. In our view, few medtech companies have prospects for 15%+ revenue growth over the next couple of years. We use that as a screen in our coverage to identify strong growth companies.

Second, we look for an emerging leadership position. We favor companies that are not just players in hot or potentially hot markets, but that are also set to be market leaders for several years. This status is based on differentiated technologies used to treat conditions that are ubiquitous and for which reliable data shows that they are doing a good job for patients.

Third, we look for a pipeline. In order to maintain a leadership position over a long period of time, a company has to continue to innovate. Having new, innovative products in the pipeline is important to maintaining a competitive advantage in some of the nascent markets over time.

Fourth, as far as being attractive for investors, we look for companies that would fit strategically and synergistically within a larger medical device company. The larger medical device companies are generally growth-starved but cash-rich. They have the wherewithal and propensity to do more acquisitions to augment the growth profile of their large medtech franchises.

TLSR: So, growth via penetration is number one; number two is emerging leadership through innovation; number three is the existence of a deep pipeline; and number four is desirability as an acquisition candidate.

JM: That's right.

TLSR: When doing channel checks, you speak to physicians actually using the new technologies. They are by definition more adventurous, and I wonder how you discern if their experiences might translate to the bread-and-butter interventional cardiologist, cardiovascular surgeon or electrophysiologist?

JM: The Edwards Lifesciences Corp. (EW:NYSE) transcatheter heart valve recently went through a very large clinical trial called PARTNER. The company released some data from one arm of that study, and we saw outcomes for physicians who were involved early on and could be considered experts. Then we saw data from physicians who were relatively new to the technology. What we saw was that newer physicians did just as well in delivering care as the more experienced ones. That's one way to get a sense for whether or not a medical device and therapy are transferrable to physicians out in the field once it becomes commercial.

The other way to discern whether a medical device will ultimately become ubiquitous is by talking to the thought leaders and asking them about the pitfalls and snags they encountered early on in delivering therapy.

TLSR: It always strikes me that these interventional cardiovascular procedures are so technique sensitive that the adoption curve is going to be related to ease of use. Where are you currently seeing vigorous uptake of technology?

JM: In medtech, the most excitement exists in areas where delivery of care is becoming less invasive. If patients can spend less time in the hospital and get an outcome that’s as good as or better than that of a patient receiving a more invasive treatment, that's ideal. It also works from a health economics standpoint because hospital stays are typically the most expensive component of an intervention, whether for a surgical or a less-invasive percutaneous medical device intervention.

From an investor's standpoint, what we typically look for is a new device that is at least as good as the competitive, older-generation technology. Does it address a larger patient population? Can you deliver a superior result to the patient? Those are some of the issues you look at, but minimally invasive technologies have been, in general, an area that folks look to invest in.

TLSR: Jason, can we talk about some examples of successful innovation and vigorous uptake?

JM: Yes. The first would be transcatheter heart valves. If a patient's aortic valve is not functioning properly, you have a very symptomatic condition that is not only life-threatening but also affects quality of life. Typically the condition has been treated with a very invasive, open surgical procedure—and it still is treated that way very effectively. However, Edwards Lifesciences and others are developing a percutaneous valve that can be delivered much less invasively and has proven in clinical trials to be superior in treating some patients, especially those who are too old, too sick or too weak to be surgical patients.

Another example is mechanical circulatory support for very sick, end-stage heart failure patients. These left ventricular assist devices (LVADs) have really been miniaturized. Thoratec Corporation (THOR:NASDAQ) and HeartWare Int. (HTWR:NASDAQ) have done a good job of reducing the size of LVADs and making them significantly more durable. We are talking about a very invasive surgical procedure here, but it has been made much easier and has resulted in fewer hospital stays and improved outcomes for those patients.

Peripheral artery disease (PAD) is another area in which we're seeing growth. Treatment involves the use of percutaneous devices to clear out arteries encumbered by plaque and calcium-containing thrombi, and all the other nasty stuff that can build up in leg arteries. Innovative devices are being developed, including new atherectomy catheters, or new drug-coated balloons, that really tackle the issue of PAD and, more specifically, the bad outcome of amputations, of which there are still a couple hundred thousand done annually in this country alone.

TLSR: Can we speak about some of your specific ideas for investors?

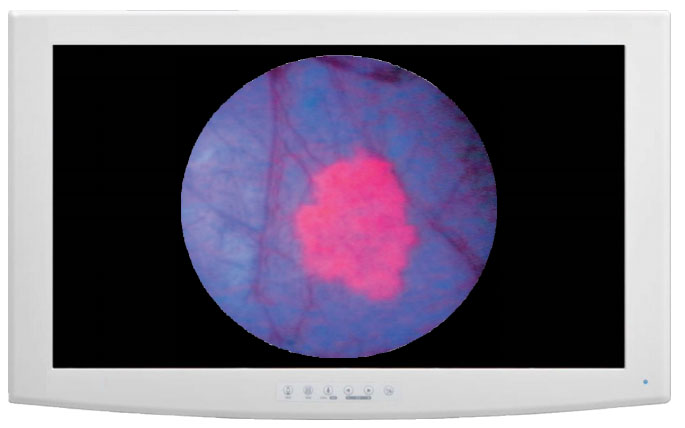

JM: I like Edwards Lifesciences, the leader in the transcatheter heart valve segment; HeartWare, which is one of the emerging companies in the LVAD heart-failure segment; and Spectranectics Corp. (SPNC:NASDAQ), which is an emerging company delivering technology for excimer laser energy to treat PAD. STAAR Surgical Company (NAS:STAA) is in the ophthalmology field and is at an inflection point right now with a technology called the implantable Collamer lens (ICL). Some like to refer to it as the implantable contact lens, which gives you the context. It is an emerging competitor to laser-assisted in situ keratectomy (LASIK) eye procedures, which have complications. ICL is an interesting technology that has been around for a while but is now being positioned as a really solid, first-line alternative to patients who want a permanent fix for refractive error.

TLSR: We've discussed Edwards, but tell me the growth story.

JM: The growth story for Edwards is driven by its leadership position in the transcatheter aortic valve replacement market. We think that market will grow to $1.5–2B worldwide, with Edwards leading over the next half-decade. We're modeling its earnings growth over the next couple of years to reflect its penetration of this market. We're looking for its transcatheter valve franchise to grow 40–50% over the next two years and really drive that earnings growth. We think that could be a catalyst for the stock.

TLSR: I keep hearing that the transcatheter heart valve market is really "hot." Has there been any overhype in the amount of the growth that could occur in this realm?

JM: I don't know that I would call it overhype. I think it's been well debated. There are solid arguments on both sides. I don't think anyone argues that the transcatheter valve market treats patients who don't otherwise have options. For those patients, it can never be overhyped.

TLSR: The second company you mentioned is HeartWare International. What is the growth story there?

JM: It starts with our bullish stance on technologies that can be advantageous to an ever-increasing percentage of end-stage heart failure patients. Thoratec, which I cover as well, has done a fantastic job of developing the market. HeartWare is following in Thoratec's footsteps. We expect U.S. Food and Drug Administration (FDA) approval for HeartWare's HVAD left ventricular assist device to come later this year, likely in September. That would put it into competition with Thoratec in the U.S. market. We see market growth for these devices being faster than in most medtech markets over the next several years because the patient population is so severely underpenetrated. We estimate that there are about 40,000 (40K) applicable patients for LVADs in this country, with less than 10% penetration to date. We think the penetration level can rise to as much as 30–40% before we should start to worry about growth decelerating markedly. We have a long way to go. Both Thoratec and HeartWare should compete successfully in this market, but HeartWare is going to grow from very little share right now.

TLSR: What percentage of LVAD candidates are awaiting heart transplants?

JM: Theoretically all of them, but donor hearts are not available. Heart transplants would be ideal, but there are somewhere between 2–3K hearts, at the very most, available at any given time. The likelihood of getting a donor heart is very low. The LVAD companies are working on improving the therapy to make it less invasive and more effective.

TLSR: HeartWare recently announced an agreement to acquire WorldHeart Corp. (WHRT:NASDAQ) for $8 million. The company's shares had been beaten down hard. What does HeartWare get out of this? Is it basically just intellectual property?

JM: This deal triples HeartWare's intellectual property portfolio. It is getting technology in the magnetic levitation (mag lev) field, which is one way to move blood. It previously did not have specific technology on the mag lev side prior to the acquisition. It's another arrow in the quiver of its armamentaria. Whether or not anything comes of it, who knows? But at the valuation it acquired WorldHeart, it seems to be worth the money spent.

TLSR: What is your growth theory on Spectranetics?

JM: The PAD market remains underpenetrated. The end market for procedures to treat PAD is still growing nicely—we think over 10%—which makes it one of the better growth markets in medtech. Spectranetics has a litany of devices based on its excimer laser and catheter technology to provide therapy. It has what could be a "killer app" for treating peripheral in-stent restenosis, which is the bane of interventional cardiology. There aren't too many good options for this problem. The excimer laser catheter from Spectranetics could prove to be a nice option for clinicians treating that condition. We think that kind of application drives the vascular intervention business over the long term.

On the lead management side, Spectranetics has a frontline technology to extract expired leads. Many thousands of ICDs and pacemakers have been implanted over time. Some good quality clinical data proves that taking the leads out, especially when they're infected, improves a patient's survival rates markedly. Spectranetics has seen positive tailwinds in that business. We think both of those areas are primed for accelerating growth over time.

TLSR: This question applies to both Spectranetics and Volcano Corp. (VOLC:NASDAQ). Are either of these companies developing diagnostic or therapeutic tools for vulnerable plaques?

JM: Volcano has been very active in the area of detecting vulnerable plaques. Spectranetics, to my knowledge, has not been involved in the diagnosis of vulnerable plaques.

TLSR: Do you have a story on Volcano, which is in the invasive intravascular imaging and precision guidance market?

JM: We have a Hold rating on the stock. We've been on the sidelines given the general sluggishness in the underlying growth of percutaneous coronary interventions (PCI). The company has done a phenomenal job of outgrowing the underlying trend in the PCI market, which has been weighed down by reports of overutilization of stents. But Volcano has risen above the fray. There has been underpenetration in the use of intravascular imaging, and the company has done a phenomenal job of developing that market. It has an emerging leadership position in fractional flow reserve (FFR), which is another intravascular imaging diagnostic that has proven in clinical trials to be very advantageous. This market is growing, and we anticipate the company growing in the low- to mid-teens for the next couple of years. I think it's one of the best-managed medtech companies in my universe. But we see it as being near full valuation right now, so we're looking for a better entry point for our investors.

TLSR: Any other company that you would like to comment on?

JM: Another big medical device growth area is atrial fibrillation. I follow AtriCure Inc. (ATRC:NASDAQ), which just received FDA approval for a surgical medical device to treat the problem. I think AtriCure has some fantastic prospects over the longer term. It is trying to put its training and education initiatives in place to develop the market, which is challenging for any company, let alone a small company. But I think it will get there. I think it is very well managed with tremendous prospects for growth given that the market presents a big frontier for medical devices and remains underpenetrated.

TLSR: Does AtriCure get a bad rap because of the U.S. Department of Justice issues that it faced?

JM: No. I think that is largely behind the company. The stock experienced a big impact from that, but the management team was open with the Justice Department and answered all its questions. ArtiCure paid a small fine and is now moving forward as a better, stronger, quality-controlled company.

TLSR: Many thanks to you. I've enjoyed this.

JM: I appreciate it.

Jason R. Mills joined Canaccord Genuity after leaving First Albany Capital, where he was managing director and senior analyst covering the medical devices sector, with a specific focus on the areas of cardiovascular health, ophthalmology and sleep disorders. Mills previously served as a vice president and senior research analyst with Thomas Weisel Partners, where he covered companies in the ophthalmology and sports medicine/arthroscopy sectors. Mills holds a master's degree in sports administration from Ohio University and a bachelor's degree in economics from Yale University.

Want to read more exclusive Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) George S. Mack of The Life Sciences Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Life Sciences Report: None. Edwards Lifesciences Corp. is not affiliated with Streetwise Reports. Streetwise Reports does not accept stock in exchange for services.

3) Jason Mills: I personally and/or my family own shares of the following companies mentioned in this interview: None. I personally and/or my family am paid by the following companies mentioned in this interview: None.

Jason Mills: With medical devices, investors must be cognizant of regulatory and reimbursement themes. Overall that environment has been somewhat arduous over the last couple of years, perhaps even more arduous than in the past. Investors are not surprised by this. In addition, some larger medical device markets are seeing more intense competition and resultant price pressures. They are also seeing declining procedural growth, coming down from historic highs. That's the case in some of the areas I follow in cardiology medtech, such as interventional cardiology, drug-eluting stents, electrophysiology with the implantable cardioverter defibrillators (ICDs) and even in atrial fibrillation.

I think medical devices tend to be a stock picker's environment, in which not all stocks are attractive at any given time. There are some obvious reasons for the trough valuations that we're seeing, but these also create opportunities.

TLSR: Negative headwinds are obvious and baked in, but beyond that do you see some of these stocks trading at deep value?

JM: Yes. The valuations for the medical device sector are at levels we haven't seen for years. Back in the early part of the last decade—2001 and 2002, when the tech stock boom was coming off its highs—we saw valuations in small- and large-cap companies down at trough levels, but we're trading well below those levels today.

TLSR: Given these negative factors, what do you look for in a medical device company?

JM: We believe that the most attractive medical device companies possess a few specific characteristics.

First, we favor growth. Growth is at a premium in medical devices today, given that there are fewer markets where critical mass has been achieved in terms of size and continued good growth prospects. Continued growth must be based on a large underpenetrated patient population in which the clinical data suggests the therapeutic modalities have improved patient care. In our view, few medtech companies have prospects for 15%+ revenue growth over the next couple of years. We use that as a screen in our coverage to identify strong growth companies.

Second, we look for an emerging leadership position. We favor companies that are not just players in hot or potentially hot markets, but that are also set to be market leaders for several years. This status is based on differentiated technologies used to treat conditions that are ubiquitous and for which reliable data shows that they are doing a good job for patients.

Third, we look for a pipeline. In order to maintain a leadership position over a long period of time, a company has to continue to innovate. Having new, innovative products in the pipeline is important to maintaining a competitive advantage in some of the nascent markets over time.

Fourth, as far as being attractive for investors, we look for companies that would fit strategically and synergistically within a larger medical device company. The larger medical device companies are generally growth-starved but cash-rich. They have the wherewithal and propensity to do more acquisitions to augment the growth profile of their large medtech franchises.

TLSR: So, growth via penetration is number one; number two is emerging leadership through innovation; number three is the existence of a deep pipeline; and number four is desirability as an acquisition candidate.

JM: That's right.

TLSR: When doing channel checks, you speak to physicians actually using the new technologies. They are by definition more adventurous, and I wonder how you discern if their experiences might translate to the bread-and-butter interventional cardiologist, cardiovascular surgeon or electrophysiologist?

JM: The Edwards Lifesciences Corp. (EW:NYSE) transcatheter heart valve recently went through a very large clinical trial called PARTNER. The company released some data from one arm of that study, and we saw outcomes for physicians who were involved early on and could be considered experts. Then we saw data from physicians who were relatively new to the technology. What we saw was that newer physicians did just as well in delivering care as the more experienced ones. That's one way to get a sense for whether or not a medical device and therapy are transferrable to physicians out in the field once it becomes commercial.

The other way to discern whether a medical device will ultimately become ubiquitous is by talking to the thought leaders and asking them about the pitfalls and snags they encountered early on in delivering therapy.

TLSR: It always strikes me that these interventional cardiovascular procedures are so technique sensitive that the adoption curve is going to be related to ease of use. Where are you currently seeing vigorous uptake of technology?

JM: In medtech, the most excitement exists in areas where delivery of care is becoming less invasive. If patients can spend less time in the hospital and get an outcome that’s as good as or better than that of a patient receiving a more invasive treatment, that's ideal. It also works from a health economics standpoint because hospital stays are typically the most expensive component of an intervention, whether for a surgical or a less-invasive percutaneous medical device intervention.

From an investor's standpoint, what we typically look for is a new device that is at least as good as the competitive, older-generation technology. Does it address a larger patient population? Can you deliver a superior result to the patient? Those are some of the issues you look at, but minimally invasive technologies have been, in general, an area that folks look to invest in.

TLSR: Jason, can we talk about some examples of successful innovation and vigorous uptake?

JM: Yes. The first would be transcatheter heart valves. If a patient's aortic valve is not functioning properly, you have a very symptomatic condition that is not only life-threatening but also affects quality of life. Typically the condition has been treated with a very invasive, open surgical procedure—and it still is treated that way very effectively. However, Edwards Lifesciences and others are developing a percutaneous valve that can be delivered much less invasively and has proven in clinical trials to be superior in treating some patients, especially those who are too old, too sick or too weak to be surgical patients.

Another example is mechanical circulatory support for very sick, end-stage heart failure patients. These left ventricular assist devices (LVADs) have really been miniaturized. Thoratec Corporation (THOR:NASDAQ) and HeartWare Int. (HTWR:NASDAQ) have done a good job of reducing the size of LVADs and making them significantly more durable. We are talking about a very invasive surgical procedure here, but it has been made much easier and has resulted in fewer hospital stays and improved outcomes for those patients.

Peripheral artery disease (PAD) is another area in which we're seeing growth. Treatment involves the use of percutaneous devices to clear out arteries encumbered by plaque and calcium-containing thrombi, and all the other nasty stuff that can build up in leg arteries. Innovative devices are being developed, including new atherectomy catheters, or new drug-coated balloons, that really tackle the issue of PAD and, more specifically, the bad outcome of amputations, of which there are still a couple hundred thousand done annually in this country alone.

TLSR: Can we speak about some of your specific ideas for investors?

JM: I like Edwards Lifesciences, the leader in the transcatheter heart valve segment; HeartWare, which is one of the emerging companies in the LVAD heart-failure segment; and Spectranectics Corp. (SPNC:NASDAQ), which is an emerging company delivering technology for excimer laser energy to treat PAD. STAAR Surgical Company (NAS:STAA) is in the ophthalmology field and is at an inflection point right now with a technology called the implantable Collamer lens (ICL). Some like to refer to it as the implantable contact lens, which gives you the context. It is an emerging competitor to laser-assisted in situ keratectomy (LASIK) eye procedures, which have complications. ICL is an interesting technology that has been around for a while but is now being positioned as a really solid, first-line alternative to patients who want a permanent fix for refractive error.

TLSR: We've discussed Edwards, but tell me the growth story.

JM: The growth story for Edwards is driven by its leadership position in the transcatheter aortic valve replacement market. We think that market will grow to $1.5–2B worldwide, with Edwards leading over the next half-decade. We're modeling its earnings growth over the next couple of years to reflect its penetration of this market. We're looking for its transcatheter valve franchise to grow 40–50% over the next two years and really drive that earnings growth. We think that could be a catalyst for the stock.

TLSR: I keep hearing that the transcatheter heart valve market is really "hot." Has there been any overhype in the amount of the growth that could occur in this realm?

JM: I don't know that I would call it overhype. I think it's been well debated. There are solid arguments on both sides. I don't think anyone argues that the transcatheter valve market treats patients who don't otherwise have options. For those patients, it can never be overhyped.

TLSR: The second company you mentioned is HeartWare International. What is the growth story there?

JM: It starts with our bullish stance on technologies that can be advantageous to an ever-increasing percentage of end-stage heart failure patients. Thoratec, which I cover as well, has done a fantastic job of developing the market. HeartWare is following in Thoratec's footsteps. We expect U.S. Food and Drug Administration (FDA) approval for HeartWare's HVAD left ventricular assist device to come later this year, likely in September. That would put it into competition with Thoratec in the U.S. market. We see market growth for these devices being faster than in most medtech markets over the next several years because the patient population is so severely underpenetrated. We estimate that there are about 40,000 (40K) applicable patients for LVADs in this country, with less than 10% penetration to date. We think the penetration level can rise to as much as 30–40% before we should start to worry about growth decelerating markedly. We have a long way to go. Both Thoratec and HeartWare should compete successfully in this market, but HeartWare is going to grow from very little share right now.

TLSR: What percentage of LVAD candidates are awaiting heart transplants?

JM: Theoretically all of them, but donor hearts are not available. Heart transplants would be ideal, but there are somewhere between 2–3K hearts, at the very most, available at any given time. The likelihood of getting a donor heart is very low. The LVAD companies are working on improving the therapy to make it less invasive and more effective.

TLSR: HeartWare recently announced an agreement to acquire WorldHeart Corp. (WHRT:NASDAQ) for $8 million. The company's shares had been beaten down hard. What does HeartWare get out of this? Is it basically just intellectual property?

JM: This deal triples HeartWare's intellectual property portfolio. It is getting technology in the magnetic levitation (mag lev) field, which is one way to move blood. It previously did not have specific technology on the mag lev side prior to the acquisition. It's another arrow in the quiver of its armamentaria. Whether or not anything comes of it, who knows? But at the valuation it acquired WorldHeart, it seems to be worth the money spent.

TLSR: What is your growth theory on Spectranetics?

JM: The PAD market remains underpenetrated. The end market for procedures to treat PAD is still growing nicely—we think over 10%—which makes it one of the better growth markets in medtech. Spectranetics has a litany of devices based on its excimer laser and catheter technology to provide therapy. It has what could be a "killer app" for treating peripheral in-stent restenosis, which is the bane of interventional cardiology. There aren't too many good options for this problem. The excimer laser catheter from Spectranetics could prove to be a nice option for clinicians treating that condition. We think that kind of application drives the vascular intervention business over the long term.

On the lead management side, Spectranetics has a frontline technology to extract expired leads. Many thousands of ICDs and pacemakers have been implanted over time. Some good quality clinical data proves that taking the leads out, especially when they're infected, improves a patient's survival rates markedly. Spectranetics has seen positive tailwinds in that business. We think both of those areas are primed for accelerating growth over time.

TLSR: This question applies to both Spectranetics and Volcano Corp. (VOLC:NASDAQ). Are either of these companies developing diagnostic or therapeutic tools for vulnerable plaques?

JM: Volcano has been very active in the area of detecting vulnerable plaques. Spectranetics, to my knowledge, has not been involved in the diagnosis of vulnerable plaques.

TLSR: Do you have a story on Volcano, which is in the invasive intravascular imaging and precision guidance market?

JM: We have a Hold rating on the stock. We've been on the sidelines given the general sluggishness in the underlying growth of percutaneous coronary interventions (PCI). The company has done a phenomenal job of outgrowing the underlying trend in the PCI market, which has been weighed down by reports of overutilization of stents. But Volcano has risen above the fray. There has been underpenetration in the use of intravascular imaging, and the company has done a phenomenal job of developing that market. It has an emerging leadership position in fractional flow reserve (FFR), which is another intravascular imaging diagnostic that has proven in clinical trials to be very advantageous. This market is growing, and we anticipate the company growing in the low- to mid-teens for the next couple of years. I think it's one of the best-managed medtech companies in my universe. But we see it as being near full valuation right now, so we're looking for a better entry point for our investors.

TLSR: Any other company that you would like to comment on?

JM: Another big medical device growth area is atrial fibrillation. I follow AtriCure Inc. (ATRC:NASDAQ), which just received FDA approval for a surgical medical device to treat the problem. I think AtriCure has some fantastic prospects over the longer term. It is trying to put its training and education initiatives in place to develop the market, which is challenging for any company, let alone a small company. But I think it will get there. I think it is very well managed with tremendous prospects for growth given that the market presents a big frontier for medical devices and remains underpenetrated.

TLSR: Does AtriCure get a bad rap because of the U.S. Department of Justice issues that it faced?

JM: No. I think that is largely behind the company. The stock experienced a big impact from that, but the management team was open with the Justice Department and answered all its questions. ArtiCure paid a small fine and is now moving forward as a better, stronger, quality-controlled company.

TLSR: Many thanks to you. I've enjoyed this.

JM: I appreciate it.

Jason R. Mills joined Canaccord Genuity after leaving First Albany Capital, where he was managing director and senior analyst covering the medical devices sector, with a specific focus on the areas of cardiovascular health, ophthalmology and sleep disorders. Mills previously served as a vice president and senior research analyst with Thomas Weisel Partners, where he covered companies in the ophthalmology and sports medicine/arthroscopy sectors. Mills holds a master's degree in sports administration from Ohio University and a bachelor's degree in economics from Yale University.

Want to read more exclusive Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) George S. Mack of The Life Sciences Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Life Sciences Report: None. Edwards Lifesciences Corp. is not affiliated with Streetwise Reports. Streetwise Reports does not accept stock in exchange for services.

3) Jason Mills: I personally and/or my family own shares of the following companies mentioned in this interview: None. I personally and/or my family am paid by the following companies mentioned in this interview: None.