TICKERS: CCO; CCJ, CSO, DML; DNN, FIS, FT, NDX, PDN, RIO; RTPPF, ,

The Nuclear Revival: Mark Lackey

Interview

Source: Brian Sylvester of The Energy Report (3/8/12)

Emerging from the shadow of Fukushima, the nuclear sector is on the cusp of a comeback, according to Mark Lackey, chief investment strategist with Toronto-based Pope & Company. Nuclear plants have been reopened, and as many as 200 new plants worldwide are scheduled to come online. At the same time, uranium supply shortages loom on the horizon, making for bullish fundamentals for uranium miners. Lackey's faith in the coal sectors also burns brightly. He reveals his favorites in both sectors in this exclusive Energy Report interview.

Emerging from the shadow of Fukushima, the nuclear sector is on the cusp of a comeback, according to Mark Lackey, chief investment strategist with Toronto-based Pope & Company. Nuclear plants have been reopened, and as many as 200 new plants worldwide are scheduled to come online. At the same time, uranium supply shortages loom on the horizon, making for bullish fundamentals for uranium miners. Lackey's faith in the coal sectors also burns brightly. He reveals his favorites in both sectors in this exclusive Energy Report interview.

Mark Lackey: The fundamentals of the uranium sector still look good. Worldwide, 1.3 billion (B) people lack electricity. In China, load growth for electricity is 10% annually; in India, 8%. That growth is unlikely to diminish any time soon. Nuclear power has to be considered as an option to meet demand.

I would remind you the nuclear industry did not end after the accident in Fukushima, Japan. Yes, there was a reaction; plants were shutdown in Japan and Germany. Subsequently, some startup of those same plants is planned. Furthermore, construction on 65 plants around the world did not stop.

There have been more inspections in China, India and France and that reassures people that everything has been built to specifications.

As many as 200 new nuclear plants are being planned in Asia, Brazil and even Saudi Arabia. The week of Feb. 13, China announced its long-term goal to increase installed nuclear capability by an additional 30%. Their original goal was 65 million (M) kilowatts (KW) by 2020; now it is 80M KW. Clearly, the country does not plan to stop or change direction.

TER: What impact did the U.S. Nuclear Regulatory Commission's approval of construction of two nuclear reactors in the state of Georgia have on the uranium sector?

ML: It did not move the spot price, but the industry views this as a positive. Recent growth has been largely in Asia and South America. We will have to wait and see if this leads to more positive announcements in the U.S.

TER: Do you expect more licenses to be granted in the U.S.?

ML: Even though U.S. load growth will grow only in the 1% range, the country will need additional capacity in the next 10 to 15 years. It is very hard to build coal plants in the U.S. and the hydroelectric sites are pretty well maxed out. The other option is to burn natural gas. All of this puts nuclear power back in vogue.

TER: Among commodities, is uranium the most sensitive to world events or would you put gold in that category as well?

ML: I would put uranium up there. But it is not the only commodity that is event driven. Gold really reacts to events. You can see that in its volatility related to events in Europe. Silver is also event-driven because it tends to follow the gold market. Base metals are not all that event-driven, although oil has been lately.

TER: In 2010, the nuclear industry used 152 million pounds (Mlb) of uranium. Yet uranium suppliers only produced a total of about 118 Mlb. The shortfall was covered by reprocessing nuclear weapons. When will those finite sources run out?

ML: Russia will stop exporting the highly enriched uranium it has been processing from its nuclear warheads by 2013. Unless a new source is found, a potential shortfall could happen over the next two or three years.

TER: It is now almost a year since Fukushima. The spot price for uranium is now $52 a pound. Has that spot price resumed an upward push?

ML: No, our 2011 forecast would have been correct if the earthquake and tsunami had not happened. The price fell from $72 to the $40s and has remained at $52 the for last six months.

The decision to shut down some plants in Germany and Japan took away short-term demand. During the recent cold weather, Germany restarted a few of those plants, and the Japanese are looking at proposals to restart some as well. As that trend continues and new plants are commissioned, demand should rise.

TER: Just about a year ago, the spot price and the long-term price for uranium crossed paths on the charts. Ever since, they have diverged. When do you think those two lines will meet up again?

ML: Interestingly enough, most uranium sells in the long-term market. The equities all follow the short-term price, partly because that is what the market follows. In the next couple of years, I expect spot prices and long-term prices to rise. We anticipate they will be trading in the same relative price range by 2014.

TER: What range do you expect the spot price to trade in this year?

ML: By the end of 2012, we anticipate $65, moving into the mid-$70s in 2013. That upward pressure is due to the fact that the Russians will no longer export highly enriched uranium starting next year.

TER: What are some different ways to gain exposure to the uranium sector?

ML: Investors could go a couple of different ways. They could buy mutual funds that specialize in the uranium market. Investors also could buy into companies involved in building nuclear plants or other related industries. We tend to focus more on uranium mining companies themselves.

TER: What are some companies you follow?

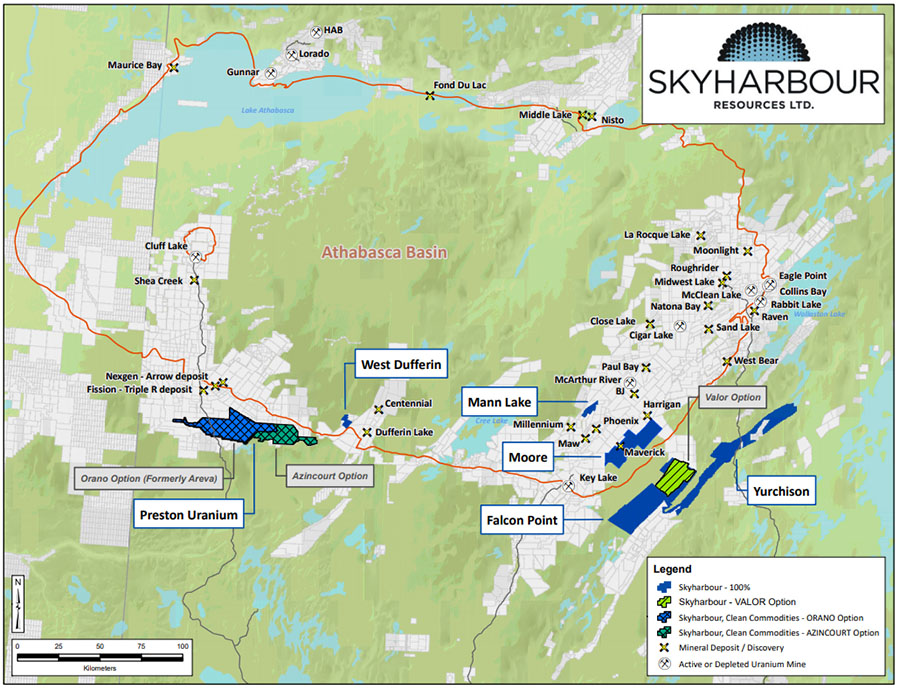

ML: We like Fission Energy Corp. (FIS:TSX.V; FSSIF:OTCQX), a play in the Athabasca Basin. A number of people caught on to Fission after Hathor Exploration Ltd. was taken out because Fission has the adjacent property. The numbers on its Waterbury Project are impressive. Fission also has interesting projects in Saskatchewan and Québec. From our perspective, this would appear to be a takeover candidate, depending on its success drilling the Waterbury Lake property.

TER: Waterbury Lake is owned by a consortium, which is headed by the Korean Electric Power Corp. or KEPCO. Do you view that as a positive or negative?

ML: I view it as a positive. I do not buy the idea that the presence of KEPCO means Fission is less likely to get a takeover offer. I think KEPCO's presence tends to derisk the project and reduces Fission's financial requirements in the future.

TER: Does it make sense to develop Hathor's Roughrider Project without having what is believed to be its extension, which Fission owns, in the J Zone?

ML: Ultimately, the more work that is done at Hathor—especially if the numbers remain as good as they are and the trend continues to move toward Fission—the greater the likelihood that somebody would want to acquire Fission. Rio Tinto (RIO:NYSE; RIO:ASX) is an obvious candidate, given that it won the Hathor stake and clearly wants to extend its presence in North America.

Cameco Corp. (CCO:TSX; CCJ:NYSE), another significant player in the basin, would not sit idly by if a company like Fission was put into play.

TER: Fission also has the Dieter Lake Project in Québec. Is the market crediting Fission for the value of that property or is the valuation based solely on Waterbury Lake?

ML: I would say that few people give the Québec project a whole lot of credit; not enough people have looked at it. The market is not paying attention to the real promise of the Québec property. That is partly because people believe that the Athabasca situation is what will make Fission. In the short run, that is where the company is concentrating as well. Another factor is that there just are not many uranium players in Québec.

TER: What other companies are you following?

ML: We like Strathmore Minerals Corp. (STM:TSX; STHJF:OTCQX), a company with significant land positions in New Mexico and Wyoming, the two states that have had the most production in U.S. history and have by far the biggest reserves of uranium. We believe the company could have production as soon as early 2015. The company has low capital costs and Strathmore has significant in situ recovery (ISR) expertise on staff. The market has not completely recognized its Church Rock project as a much larger and cheaper source of uranium. The focus has been on Roca Honda and its Gas Hills play in Wyoming.

TER: How sensitive are uranium juniors to the spot price?

ML: In general, the correlation on uranium stocks is fairly high. The junior stocks tend to move after the big market has shown recovery.

For example, if we see continued movement in Cameco, Denison Mines Corp. (DML:TSX; DNN:NYSE.A) and Paladin Energy Ltd. (PDN:TSX; PDN:ASX), I think the juniors will start to follow. If the uranium price gets to where we believe it will be by the end of 2012, the juniors that are in production or relatively close will move with the market.

When you get a company like Strathmore, as you get closer to 2014 and if we are right about uranium prices, there should be considerable gains in Strathmore's share price. It will be a significant uranium producer as we get to the latter part of this decade.

TER: What is the next near-term catalyst for Strathmore?

ML: It is probably getting all of its permitting done so the company can get into production by 2015. Given that its projects are in mining- and uranium-friendly jurisdictions, I would not anticipate any major impediments to this process.

TER: KEPCO recently acquired 14.5M shares of Strathmore at $0.55/share. What did you make of that move?

ML: I think it is positive for Strathmore, because it reaffirms the KEPCO commitment to the company and it now owns about 14% of the company.

This has become a trend in the base metals, whether it is China, Korea or India. In cases where there is an offtake agreement, countries secure some of the uranium themselves. Korea, Japan, India and China want to make sure that uranium opportunities are out there, that the physical supply will be there.

TER: Can you give us one off-the-radar name our readers may not know about?

ML: They may not be aware of Tigris Uranium Corp. (TU:TSX.V), run by Bill Sheriff. Bill built Energy Metals Corporation, which Uranium One took over four or five years ago. He brought in Dennis Stover, who was COO of Energy Metals. Dennis knows ISR better than most people.

TER: Given your expertise in coal, we have to talk a little bit about that. Prices for thermal coal and metallurgical (met) coal remain healthy despite reports about the contribution of greenhouse gases generated by coal-burning power plants and steel mills to global warming. What are your outlooks for thermal and met coal?

ML: The met coal market looks pretty good. We expect steel production to grow in the 6% range over the coming four to five years. European steel production shows some weakness right now, but there is no significant slowdown in India, Korea or China. Even in the U.S., it looks like steel production will be OK, given the expected decent year for auto sales. We expect met coal to trade in the $200–225/ton (t) range, which will be very positive for met coal producers.

Thermal coal is a little more diverse. It can be as low as $15/t and as high as $120/t, depending on the British thermal units (BTUs), sulfur and ash content. At the upper end, the markets for thermal coal look very good. The lower end is always more problematic. Environmentalists have the most problems with this coal, particularly in developing countries. And, it is a little more difficult to develop plants.

TER: What do you like to see in a coal play?

ML: All things being equal, my preference is to be in the met coal market or the upper-end thermal market. We tend to be in North America, where we are familiar with the permitting processes and government issues.

I also look for good infrastructure. Without rail or water or power, having a big coal deposit is not very useful. You also want companies in places where there are lots of people who understand the geology in that jurisdiction.

TER: What names are you following in the coal space?

ML: We like Fortune Minerals Ltd. (FT:TSX). The company has its Mount Klappan project, a met coal deposit in British Columbia. It has access to infrastructure and ports. Being in the western part of Canada, its market is Asia. This is one of the world's premiere met coal development projects. There is obviously a lot of expertise in the area, given all the met coal that has been developed around British Columbia and Alberta.

TER: Fortune is trading at about half its 52-week high, after taking a bit of a beating in 2011. Is this a good entry point?

ML: If you look at when this stock peaked and you look at what took place in the Venture Exchange, which is down about 35% to 40% from its peak last April, Fortune has really followed that trend. Many people moved out at tax-loss selling time. Production will not start for a few years, and some people want to be in coal plays that are in or near production. But if you take a longer-term view and look at the size of the reserves, you recognize the significant potential three or four years from now.

TER: The Canadian subsidiary of the Korean steel-maker, POSCO, owns 25% of the Mount Klappan project. Why are Korean companies so consumed with North American energy plays?

ML: I think they recognized that areas of the world you can go to are limited. The Koreans like the stability of Canada, that we do not change legislation a lot. You can find a lot of strong, competent people to run companies. China and Korea probably have the most joint deals in the North American energy sector; China probably more than Korea in the last year.

TER: What other coal plays can you tell us about?

ML: We like Corsa Coal Corp. (CSO:TSX), a met coal play with an operation in Pennsylvania. Management has a successful track record in the state. Don Charter, who was one of the senior guys at Dundee for years, runs it. It is in production and the potential is there to get higher levels over the next few years. This is a company that is not on a lot of people's radar screens.

TER: The company produced about 250,000t coal last year, with an average realized price of $167/t. What do you think the average realized price will be in 2012?

ML: The met market has not been as high as in China, but then you have to ship it to China. You need to realize that, if we quote a price of $225, you need to deduct the shipping costs. The price Corsa is getting is in line with what you get in the U.S.

If we had a decent year in the U.S., the price could go slightly higher. It will not skyrocket. A lot of met coal producers would be happy if they saw $150/t or $140/t. I would suggest prices will stay at the $170/t level, or slightly higher.

TER: Corsa expects to produce 695,000- 765,000 raw tons of met coal in 2012 at a cash cost of roughly $50/t. Are those reasonable estimates?

ML: The cost numbers look good and the production numbers look reasonable. Of course, there is always execution risk, which management has helped lower.

TER: Do you have any other coal names?

ML: NovaDx Ventures Corp. (NDX:TSX.V) is a met coal play in Alabama and Tennessee. It picked up a lot of top management from coal companies in both states. The company expects good production increases down the road. We think that these significant production increases will likely result in a much higher share price in the next few years.

TER: Do you have any parting thoughts to share?

ML: We put world growth in 2012 at around 3.5%, down from almost 4.5% last year and almost 5% in 2010. That is better than forecasters who peg world growth as low as 1.5% to 2%. Clearly, if you believe the latter outlook, it will not be a great year for the energy space.

But if you believe our 3.5% forecast, we expect to see good opportunities in both uranium and coal. And, we expect appreciation of these equities as we go through the year.

TER: Mark, thank you for your time and insights.

Mark Lackey, currently the investment strategist at Pope & Company Limited, has 30 years of experience in energy (oil and gas; hydro), mining, central and corporate banking and investment research and strategy. He worked at the Bank of Canada where he was responsible for the production of U.S. economic forecasting, briefing Governor Gerald Bouey on U.S. economic developments on a weekly basis. Mr. Lackey was a senior manager of commodities at the Bank of Montreal where he helped to determine whether or not the bank would loan money to companies in the commodity space. He spent 10 years in the oil industry with Gulf Canada, Chevron Canada and Petro Canada where his main responsibility was developing corporate plans. He is a regular guest on BNN, having made more than 200 appearances in the last 10 years (more than 40 of which were in 2010). On his most recent appearance, Lackey discussed his new role at Pope & Company and branded Pope as an up-and-coming institutional resource boutique dealer.

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) Brian Sylvester of The Energy Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: Fission Energy Corp. and Strathmore Minerals Corp. Streetwise does not accept stock in exchange for services.

3) Mark Lackey: I personally and/or my family own shares of the following companies mentioned in this interview: None. I personally and/or my family am paid by the following companies mentioned in this interview: None. I was not paid by Streetwise for participating in this story.