Intra-Sector Correlation

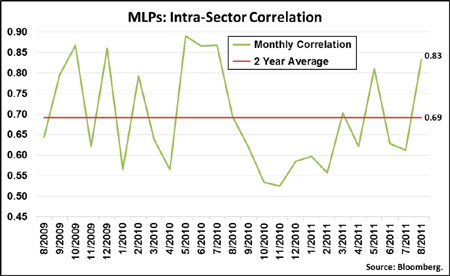

Naturally, I started to think about what those numbers would look like with my MLP goggles on. . .in other words, how correlated are individual MLPs to the Alerian MLP Index? Well, in August, the 50 members of the MLP Index had correlation of 0.83 with the Index. It makes sense that the number should be higher than the S&P 500, given MLP Index is very industry specific, as opposed to the S&P 500. Like any single number, it's hard to tell what it means with no context, so below is a chart of the monthly intra-index correlation for the MLP Index for the past 2 years.

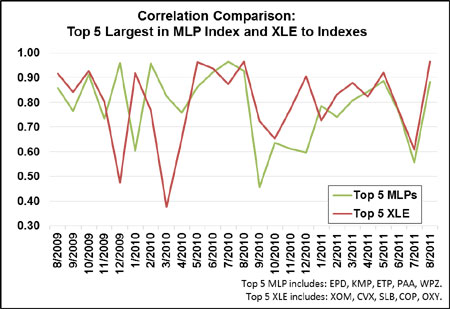

Ok, so that tells us that MLP correlation was at elevated levels in August, but what I'd really like to know: Is the intra-index correlation for MLPs lower than it is in other sectors? If I knew that, I could make a case that the MLP sector has better opportunities for active management (stock picking) than other industries. It is my hypothesis that the MLP sector is generally more inefficient than the broader market and provides more opportunities for the active manager. Below is a simple (and definitely statistically insignificant) chart where I take a look at the top five largest components of XLE, the Energy sector ETF, and compare the correlation of those five with the XLE, and I do the same for the five largest components of the MLP index. The results are varied, but generally, the XLE components are more correlated than the MLP components. Over the past two years, the top five components of XLE have averaged monthly correlation with XLE of 79.9%, compared with 78.4% for the five largest MLPs and the MLP index.

I imagine the disparity would be wider for the bottom five of each index, but given how often those five change, that's a little more complicated. So even if this doesn't prove my hypothesis, it's at least a worthy sanity check that indeed, MLP components aren't overly correlated to the index, which may be surprising to some given how large the biggest five MLPs are in market cap relative to other MLPs.

Correlation of MLPs to Other Securities

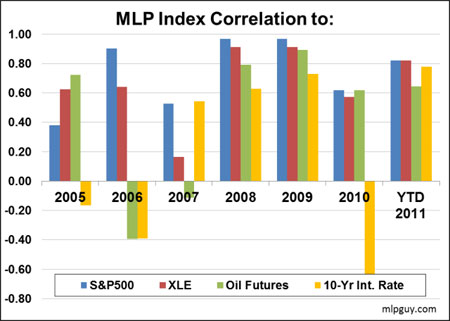

Given all this talk of correlation, it probably makes sense to update how correlated MLPs are to broader indices and other securities. There are different ways of looking at correlation, but for purposes of this post, I went yearly for the past five years. I stuck with daily changes in MLP index compared to daily changes in the 10-year treasury interest rate, the S&P 500, oil futures (cushing), and XLE.

So, 2005-2007, MLPs weren't too correlated with stocks, then in 2008 and 2009, correlation jumped, and has remained elevated into 2011. Days like today certainly add to that correlation. Should be an interesting rest of the year. I believe in Q411 this correlation relationship will break down, but I don't have much evidence to base that on at this point.