I think Paul McCartney said it best: "You say yes and I say no, you say stop and I say go, go, go. . .You say goodbye and I say hello."

I'm always looking to get into a market speculation that is currently out of favor. I've been waiting for indication of a long-term upside movement in the natural gas market for over three years. But in this case, it has never looked prospective enough for me to venture in.

And frankly, that perplexes me.

Oil prices broached $100/bbl in May before a general market correction in commodities. Although oil did not approach its high of $145 exactly three years ago today, no producer is complaining about the current $90–$100 price. It seems logical that natural gas prices should follow suit. But the natural gas market has been stagnant for over two years and shows no evidence of rebounding. Here's a chart for NYMEX Henry Hub gas price for the past five years:

Now let's look at a chart of the North American benchmark oil, West Texas Intermediate Crude:

Since the nine-month long commodities collapse that began in the second half of 2008, oil prices have been on a relentless climb to the upside. Natural gas has been a laggard during this period.

The general ratio of oil to gas, in terms of energy produced, is determined by the following: Generally, 1 barrel of oil (bbl) produces the energy of 5487 cubic feet of natural gas (Mcf); on average, 1 Mcf equals 1.027 million BTU (MMBtu). Therefore, 1 standard unit of oil produces 5.6x the energy of 1 standard unit of gas.

Because of this relative energy output, petroleum explorers, developers and producers calculate oil and gas reserves and production in a unit called boe, or barrels of oil equivalent. The IRS uses a figure of 5.8 for financial statements; the USGS uses 6.0 to calculate resources.

Therefore, it stands to reason that the oil price/bbl should approximate 5.6– 6.0x the natural gas price/MMBtu. However, let's look at a chart of the oil:gas price ratio for the past five years:

This ratio presently is well over 20. Why has the natural gas price continued to suffer while oil has gone on a two-year run to the upside? In my opinion, several factors have combined to depress the natural gas industry in the United States since the record price of $13.31/MMBtu that occurred on July 2, 2008.

- Supplies: Geologists and engineers have been widely successful in developing new domestic natural gas supplies. This is not surprising, as recently developed shale gas fields are extensions of previously exploited reservoirs now made economical by horizontal drilling and fracturing technologies in low-permeability rocks.

- Risk/Reward: The ease of discovery has taken much of the inherent high risk out of new gas plays, so venture capital is readily available. In this game, the money-raising principals are not stereotypical cigar-smoking, Cadillac-driving, West Texas good ol' boys promoting a 25,0000-ft. deep wildcat gas target in the Anadarko Basin of southwest Oklahoma that costs many tens of millions of dollars and has a 15% chance of success. Rather, the new paradigm is a shallow-shale gas hole, at most a few thousand feet deep. And it's likely that the new discovery well sits adjacent to an old, rusting pump jack that was a stripper oil well in the mid- to late-1970s. For the most part, this is a development play requiring low-risk venture capital.

- Transportation: Natural gas is difficult to transport. Unlike oil, it cannot be loaded onto a tanker truck or railcar and transported to a refinery for processing. A dedicated pipeline to the wellhead is required. In many areas of the continental U.S. with new gas discoveries, there is little to no local infrastructure and/or additional pipeline capacity. As a result, many productive wells are drilled and promptly shut-in pending development of gas pipeline and well field-separation infrastructure.

- Storage: Natural gas is difficult to store. In its gaseous form, it cannot be stored in a giant oil tanker or in a tank farm at a refinery. In the U.S., natural gas is stored in huge manmade underground caverns dissolved out of salt formations in the Gulf Coast of SE Texas and Louisiana or, to a lesser extent, injected into depleted underground reservoirs for later recovery and use. It can be transformed at cryogenic temperatures into liquefied natural gas (LNG) and transported in seagoing tankers and tanker trucks, but there are no liquefication plants located in the continental U.S.

- Processing Capacity: The biggest and best shale gas play is the Marcellus Shale of the northeast U.S. Other significant discoveries are located in the south-central part of the country, roughly encompassing the area of east, central, and south Texas, Oklahoma, western Louisiana and northern Arkansas, and in the Rocky Mountain States. At this time, there is insufficient pipeline and nearby plant capacity to process the newly discovered gas and get it to market—especially for the giant Marcellus play that comprises over one-half of the current estimated recoverable resources in the coterminous U.S.

- Power Plant Capacity: Because of the USA's overwhelming dependence on coal-fired power plants, we don't have the needed capacity to burn more natural gas to generate electricity. When used in efficient combined-cycle power plants, natural gas combustion emits less than one-half as much carbon dioxide (C02) as coal combustion per unit of electrical output.

Although gas is environmentally friendlier in C02 emissions, it's mainly composed of methane, which is the world's real problem for greenhouse gas emissions. And converting an existing coal-burning plant to natural gas is a very expensive proposition requiring a huge capital expenditure. Both the will and way to do such conversions have not been forthcoming in a timely fashion.- Environmental Opposition to Drilling, Transportation, Processing and Storage: The newly developed hydrofracturing technologies necessary to produce gas from tight shale plays are undergoing close scrutiny. There is potential for contamination of local aquifers by chemicals used in the fracturing process and the produced petroleum products. Local populaces demand that their drinking water be protected and rightly so. Recent moratoria on drilling have occurred in the NE states. Industry is under increasing pressure to document the chemical concoctions used in fracturing processes.

Environmentalists continue to battle against Keystone XL, the proposed oil pipeline extension from Alberta's oil sands to Gulf Coast refineries, which they view as an unnecessary catalyst for continued U.S. oil consumption, adverse to an anti-climate change agenda and a safety risk. In New Jersey, opponents are calling on country government to oppose a pipeline to transport LNG from an offshore terminal to local distribution companies.

A large, new oil refinery hasn't been built in the U.S. since 1976. Most of our current oil-refining and natural gas-processing capacity is located near or along the Gulf Coast, in particular the Texas/Louisiana region, and that capacity is fully supplied at present.

The conversion of natural gas into liquefied form is a proven and safe technology and offers significant economic advantages for transportation and storage. There are 12 operating LNG-receiving terminals in the United States, mostly along the Gulf Coast, among 60 worldwide. However, recent proposals to build new terminals in the New York, Maine, and California have been opposed by environmentalists and politicians and subsequently scuttled.

There are 27 liquefication plants operating worldwide. Five are under construction, and 27 are planned. However, the U.S. has only one small LNG production facility (in Alaska) built in 1969. This gas is shipped to Japan.- Land Access: According to the NaturalGas.org, the federal government owns nearly 30% of the country's land where an estimated 40% of potential natural gas resources exist. Adding in federal offshore waters ups this resource figure to almost 60%. Essentially, no offshore drilling is allowed outside the western Gulf of Mexico and 41% of resource-bearing lands in the Rockies have access restrictions. The Energy Information Administration (EIA) estimates the U.S. has over 2.5 trillion cubic feet (Tcf) of gas resources, enough to last 110 years at current usage rates. However, executive and legislative leasing moratoria have severely affected the petroleum industry's ability to explore for hydrocarbons.

As of July 8, there were 1,880 rotary rigs exploring for or developing petroleum in the U.S.: 1,007 for oil and 873 for gas. That's 415 more rigs targeting oil than last year. The number of rigs currently drilling for gas is 91 lower than last year.

These rig-count changes have occurred mainly because the oil price rose 31% and natural gas price dropped 7%. The biggest current impediment to developing natural gas supply in the U.S. is the wellhead price of gas shown in the chart above. That directly reflects oversupply and lack of demand.

Let's dissect the current and projected supply and demand for natural gas in the United States.

The first commercial natural gas well field was drilled in 1821 in Fredonia, New York in the aforementioned Marcellus Shale and used to fuel street lamps. The more famous Drake oil well in Pennsylvania was not drilled until 1859.

Fossil fuels supply about 85% of the nation's energy, with natural gas 22% of the total:

The United States' Energy Budget

According to the Department of Energy's EIA, the U.S. became the world's largest natural gas producer in 2009 at 22.8 billion cubic feet (Bcf) and has the world's sixth largest reserve base, which is likely to grow in the coming years because, unlike oil, we have sufficient known resources to meet anticipated demand.

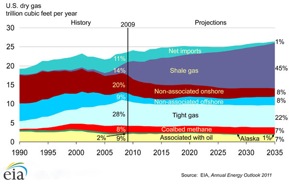

However, natural gas demand is projected to be relatively flat for the next 25 years at 0.5% annual growth. Unlike oil, our domestic natural gas supply is not dependent on unstable foreign countries. Natural gas imports are declining and this trend will continue in coming years. Shale gas will assume a much larger share of production, up from 14%–45%.

Shale gas is natural gas trapped in fine-grained, organic-rich sedimentary rocks called "shales" that can be rich sources of petroleum products. The combination of horizontal drilling and hydraulic fracturing technology over the past decade has allowed shale gas resources that previously were uneconomical to produce and rejuvenated the domestic natural gas industry. Again, significant shale gas plays occur widely throughout the U.S.

Domestic demand for natural gas comes from four general uses:

- Residential and commercial: 22%; space heating and cooking.

- Industrial: 38%; fuel for the pulp and paper, metal, chemical, petroleum refining and food-processing industries; feedstock for plastic, chemical and fertilizer production. These uses are projected to decline as the economy moves toward less energy-intensive manufacturing processes.

- Electrical generation: 37%; provides one-sixth of the electrical power in the U.S. That number is expected to grow because gas-fired plants are much more efficient, less polluting, require lower capex, are scalable and have demand flexibility that coal does not offer.

- Transportation: 3%; used mainly for moving hydrocarbons through pipelines. Potential for use in public mass-transportation and fleet vehicles is large and unrealized due to lack of refueling infrastructure.

With over 100 years worth of resources and immense potential to find more, the U.S. could easily become self-sufficient in natural gas and a net exporter to the world in the near term. Natural gas is cleaner burning and more efficient in electrical generation and transportation uses than other fossil fuels. Higher prices are required to stimulate development of well fields and infrastructure.

However, current limitations on domestic demand of natural gas are largely because of environmental opposition to the access of potential gas-bearing lands and waters and infrastructure to transport, store, and process.

The NIMBY (Not in My Back Yard) and BANANA (Build Absolutely Nothing Anywhere Near Anything) lobbies have been compromising United States energy independence since the Santa Barbara Channel oil spill in 1969 launched the modern environmental movement. Ironically, this spill occurred only ten km from where the world's first offshore oil well was drilled in 1896, its location chosen because of abundant underwater oil seeps.

Unfortunately, the resultant blind opposition by radical environmentalists to all domestic fossil fuel development has led to the U.S.' increased reliance and dependence on unfriendly, repressive and despotic OPEC governments for nearly 30% of our daily energy budget.

Although oil imports are down over the past year, we continue to export inflated dollars for 9.4 million barrels per day. Meanwhile, we have a treasure trove of cleaner-burning and cheap natural gas in the ground but lack the infrastructure and political will to develop it.

I sincerely hope that reason begins to prevail and natural gas will assume a bigger role in the future energy needs of America. I don't know about you, but I object to giving away another piece of our country to foreign interests each and every day.

I think it's time we develop our own abundant hydrocarbon resources and tell the arrogant Sheiks, the corrupt Mexican patrones petroleos, and that Venezuelan in-Fidel exactly where to shove it.

We have the goal, we have the means; but do we have the will?

Ciao for now,

Mickey Fulp

Mercenary Geologist

The Mercenary Geologist Michael S. "Mickey" Fulp is a Certified Professional Geologist with a B.Sc. Earth Sciences with honor from the University of Tulsa, and M.Sc. Geology from the University of New Mexico. Mickey has over 30 years experience as an exploration geologist searching for economic deposits of base and precious metals, industrial minerals, uranium, coal, oil and gas, and water in North and South America, Europe, and Asia.

Mickey has worked for junior explorers, major mining companies, private companies, and investors as a consulting economic geologist for the past 24 years, specializing in geological mapping, property evaluation, and business development. In addition to Mickey's professional credentials and experience, he is high-altitude proficient, and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile and British Columbia. Mickey is well known throughout the mining and exploration community due to his ongoing work as an analyst, writer and speaker. Contact: Contact@MercenaryGeologist.com

Disclaimer: I am not a certified financial analyst, broker or professional qualified to offer investment advice. Nothing in a report, commentary, this website, interview and other content constitutes or can be construed as investment advice or an offer or solicitation to buy or sell stock. Information is obtained from research of public documents and content available on the company's website, regulatory filings, various stock exchange websites and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. While the information is believed to be accurate and reliable, it is not guaranteed or implied to be so. The information may not be complete or correct; it is provided in good faith but without any legal responsibility or obligation to provide future updates. I accept no responsibility, or assume any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information. The information contained in a report, commentary, this website, interview and other content is subject to change without notice and may become outdated and will not be updated. A report, commentary, this website, interview and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, report, commentary, interview, and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, Mercenary Geologist.com LLC.

Copyright © 2011 MercenaryGeologist.com. LLC All Rights Reserved.