TICKERS: AREVA, BHP; BHPLF, CCO; CCJ, CVV; CVVUF; DH7, ECX-H, , , 9501; TKECF, URG; URE, WTN

Mark Lackey: Bright Future for Uranium?

Interview

Source: Brian Sylvester of The Energy Report (1/13/11)

Mark Lackey, with Toronto-based financial services company Pope & Co., admits he's in the minority. He believes the Street is too optimistic about production in Saskatchewan and Kazakhstan heading off a uranium shortage. In this exclusive interview with The Energy Report, Mark explains why he believes Cigar Lake won't save the day and why uranium could hit $100 a pound.

Mark Lackey, with Toronto-based financial services company Pope & Co., admits he's in the minority. He believes the Street is too optimistic about production in Saskatchewan and Kazakhstan heading off a uranium shortage. In this exclusive interview with The Energy Report, Mark explains why he believes Cigar Lake won't save the day and why uranium could hit $100 a pound.

The Energy Report: Last summer, big uranium players like Cameco Corp. (TSX:CCO; NYSE:CCJ) and BHP Billiton Ltd. (NYSE:BHP; OTCPK:BHPLF) bought uranium off the spot market because it was cheaper than boosting production. It's estimated that those two companies bought as much as a quarter of the supply that was out there to meet their supply contracts. Are we seeing ripple effects in the uranium market now?

Mark Lackey: When those two big players were buying in the spot market, it signaled that the price was too low because they would have boosted production if that had been cheaper. But then those purchases started to move the price and China and South Korean started coming into the market to do some deals. Then, of course, there were other issues with AREVA (PAR:CEI) trying to ensure that it could get deals. Everyone was looking for uranium at the same time; consequently, the price moved $22/lb. in about three months. Earlier this week it was at $62.50.

TER: Roughly 15% of the world's electricity comes from nuclear power; 60 more nuclear power plants are being built and another 152 are on the drawing board. On the supply side, the Australians—at least those in the Northern Territories—have rejected a proposed uranium mine there, and some African jurisdictions are becoming quite dangerous. These factors seem to be signaling an impending, dramatic rise in the uranium price. Should we expect an even greater increase than what we've seen in the last couple of months?

ML: We're forecasting $65–$70 this year and probably $75 next year. A big difference could come in 2013 due to some of the issues you pointed out. There are some real potential supply constraints. Russia has said it's not going to export any more of the high-quality uranium from its weapons in 2013 when that agreement runs out. The consensus forecast for 2013 on the Street is still $75.

A lot of people think, "Well, Kazakhstan will continue to rapidly increase production." We don't tend to agree with that. Some people believe we'll saved by Cigar Lake—the high-grade uranium mine in Northern Saskatchewan owned by Cameco (50%), AREVA (37%), Idemitsu Kosan Co. (8%) and Tokyo Electric Power Company (OSX:9501, OTCPK:TEPCO) (5%)—but we don't know if that's going to be up and running in 2013 for sure. Our view, and admittedly it's a minority view, is that the price could easily spike above $100 in 2013 and go somewhat higher in the next few years until supply can catch up. That could take until 2015 or 2016 at least, and it may be longer due to the growth in demand. But the real argument is on the supply side, and some people are just too optimistic about where that new supply is going to come from.

TER: Cigar Lake has had all kinds of underground water issues, which delayed production time after time. As you mentioned, it's scheduled to come online in 2013. Why don't you think that's a realistic deadline?

ML: Those problems have been extremely difficult to handle. It wouldn't surprise a lot of people, including us, if that date was pushed back a year or two. If that's the case, the uranium price has a good chance of spiking because there will be a shortfall in the market.

Only 2% of the costs of running a nuclear plant are the feedstock. I'm not saying utilities will pay any price but, clearly, they don't get as concerned about price as they do about supply. Obviously, you can't run your plant if you don't have the supply.

TER: The big expenses are the fixed costs like labor, infrastructure and capital.

ML: One of the things that caused Ontario Hydro some problems was when it built a plant in the late '70s and all of a sudden, there were 20% interest rates. The cost of capital caused some significant problems because that was the biggest cost by far. If it had been fuel costs, there wouldn't have been anywhere near those cost overruns, but the problem became financing it with those kinds of interest rates.

TER: I've heard Cameco is having trouble finding enough people to make this all work. There aren't enough people qualified in these areas to be moving at the pace the company would like. Have you heard that?

ML: We've heard some rumors. But I must admit, that is a problem in mining in general—not just at Cameco. For more than 20 years, few people went to schools of geology when the mining sector was dormant. Trying to find the number of people Cameco would like has been an issue and there's a lot of competition. Mind you, Cameco will be able to pay and get some pretty good people relative to other companies; nevertheless, there is a lot of competition out there.

TER: What makes you sit up and take note when you start looking into a uranium explorer and its particular projects?

ML: The very first thing I look for is a stable political jurisdiction wherein a company can get mining permits to go forward. I don't want to go to places where they're going to pull permits, there could be protests or the government is not very stable. Those problems do exist in many of the uranium mining jurisdictions. A jurisdiction needs a pro-uranium view. Even within the U.S., some states are much more pro-uranium than are others.

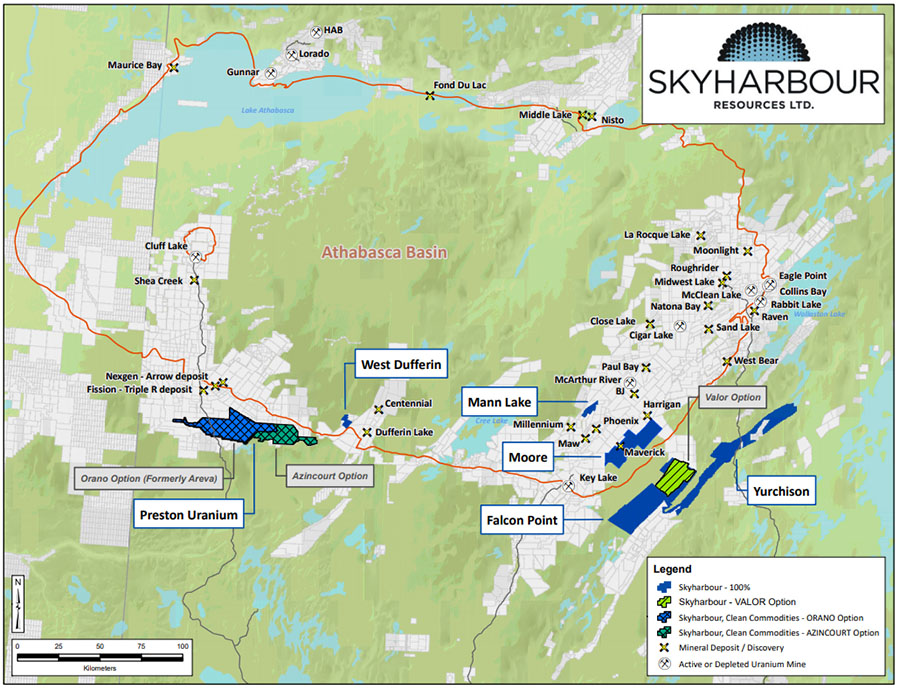

The project, land position, management, proximity to major players—those all come into play. A lot of what we like is in the Athabasca Basin, Wyoming and New Mexico because those have been the best-producing areas for uranium and have major players in all three of those jurisdictions. Less work has been done in places like Nunavut, Canada; however, some work was done there in the past and I think that's one of the reasons we like that area so well.

TER: The major player there is Kivalliq Energy Corp. (TSX.V:KIV). What are your thoughts on Kivalliq?

ML: If you go back to the '70s, a lot of mom-and-pop mining was done in Nunavut. A number of small companies were trying to find a small amount of uranium. The problem was a lot of these companies had trouble obtaining financing because none of them was going to be big enough to interest the institutions. The one thing that Kivalliq did was to develop the company over time and get the biggest land position in Nunavut. In fact, in Lac Cinquante, it has a grade that is the best deposit outside the Athabasca Basin. The company has done a lot of work to build a pretty solid operation, has a very experienced management team and has raised some money. The government is pro-uranium and First Nations is solidly behind the project.

Kivalliq's going to go forward and do a lot more drilling this year. It has an estimate of 22 million pounds (22 Mlb.), but that's not NI 43-101-compliant because the drilling was done 25 years ago. The company will have an NI 43-101 completed on its Lac Cinquante property in the first quarter of this year. Kivalliq had a lot of foresight to acquire all this property, which totals 225,000 acres. Now, with what we think is going to be a major uranium bull market, Kivalliq is sitting in the driver's seat.

TER: Lumina Capital Limited Partnership just did a $5 million private placement with Kivalliq, so there are some other people on the Street who agree with you. What are some other micro caps that you're bullish on or think have some potential?

ML: I like Strathmore Minerals Corp. (TSX:STM; OTCPK:STHJF), a Wyoming- and New Mexico-based explorer. It has an indicated resource of 46 Mlb. U308 and an inferred resource of 26 Mlb. U308. Those are some big numbers for a junior company. A lot of people ask why its stock price hasn't reacted as well as that of Ur-Energy Inc. (NYSE.A:URG; TSX:URE), which is also in Wyoming. URG doesn't have nearly as much uranium, but it's going to be in production this year. The market gave the stock a much bigger boost because it knew that the company is going to produce this year, whereas Strathmore is going to be producing in late 2014 or 2015. It's a longer-term investment. But if I'm right about the uranium price going way up, and Strathmore starts some significant production just after the price spikes, I think it's the one that the market will pick up on. Strathmore looks like it could be a significant winner for a patient, long-term investor.

TER: Given its price is somewhat low relative to its resource, could Strathmore be a takeover target?

ML: I've looked at about 60 uranium companies. Quite frankly, if I had to pick one that jumps out as a potential takeover candidate, it would be Strathmore. It's especially appealing if the acquirer didn't need the production right away. Look at the reserves it has and it's in mining-friendly jurisdictions.

TER: It has an interesting management team from the perspective that it has both the geological expertise and experience of the Street selling its story and getting investors to buy it.

ML: I would completely agree with that. That's probably why it's one of the companies that really jumps out at me. It's got very experienced, well-known management and it's got a great opportunity over the next few years.

TER: What are some other highlights in the uranium space?

ML: CanAlaska Uranium Ltd. (TSX.V:CVV) has one of the largest land positions in the Athabasca Basin, which is the preeminent area in the world for uranium. It's certainly been the most potent supply area, and there are very high-grade deposits in Athabasca and some of the largest mines in the world. CanAlaska has 20 exploration projects, most of which have joint-venture agreements. CanAlaska should be doing a lot more drilling on some of the prospects along with its JV partners this year. Again, this could easily be another potential takeover candidate; but it has to go further in terms of its drilling before somebody's going acquire it.

TER: Does its proximity to other players in the Basin make that easier, too?

ML: Absolutely. Cameco, AREVA and Denison Mines Corp. (TSX:DML; NYSE.A:DNN) all have properties right there. They know the area quite well and easily could be looking at the company as it reaches a more advanced state, has an NI 43-101 and has proven a resource.

TER: Let's talk about another one of your specialties—coal. You're bullish on metallurgical coal and believe it could reach $300 a ton next year. That forecast is helped by the flooding in Australia. Can you give us an overview of what we can expect from the coal market in 2011?

ML: Flooding has been an issue, but that's going to be a short-term phenomena. The flooding will end and they'll get the mines back and operating. However, Australia's port facilities are at full capacity, so getting new production out of the country is extremely difficult. It would take at least a couple of years to build some new port facilities. Some are under construction, but Australian coal is pretty much maxed out. With demand rising as quickly as it is, coal is going to have to come from some other areas.

The steel industry is doing very well in South Korea, Japan, China and India; and we do see some improvement in Europe and North America, as well. There are even port-facility issues in the U.S., so there are some limitations these days with such bottlenecks that will add to a higher price. Not only will that impact metallurgical coal but also thermal prices are being quoted nearly as high as $130 a ton now.

TER: What are some junior coal players with anthracite or metallurgical coal plays that could see some value creation in the next few months?

ML: Fortune Minerals Limited (TSX:FT) has quite a significant play in northwestern British Columbia that is largely metallurgical coal. It has 231 million tons (Mt.) indicated and measured—one of the largest undeveloped deposits in the world. One of the places that doesn't have problems with port facilities is Canada, especially in Prince Rupert, which is what Fortune would use given its physical location. That's a really big advantage. It has deepwater shipping ports there all year round and there's some railway expansion. The infrastructure issue there is not a problem. It's high-quality coal and the size of the reserve is significant as opposed to a number of smaller coal companies that have very limited reserves and production. From an investor viewpoint, you're not going to look at companies with limited upside.

TER: Any other small players like that that you're following?

ML: Lysander Minerals Corp. (TSX.V:LYM) has a near-term production property in the Ukraine. We took a long, hard look at the Ukraine and recognized it has improved considerably in the last 5–10 years—the gross domestic product is better; there are rising incomes. The thing that caught our eye about Lysander was John Conlon, who runs the company. He came to us a few years back with Western Coal Corp. (TSX:WTN) when it was a $0.30 stock. It's now trading at $12.71. It was one of the best performers on the Toronto Stock Exchange during the last three years.

Lysander has some significant numbers. It is taking over the Verticalnaya mine and is reopening it on a significant basis. We think production will be up to 3 Mt. in the next few years. About 25% of that will go to the steel plants and the other 75% will go to the power plants. Currently, 16 million tons are proven and the total resource is about 76 Mt. Those are good numbers for a small company. All the coal will be sold in the Ukraine, so the shipping savings are great. There's such a large demand that the country has been importing coal—from Russia—for its power plants. If we have a company like Lysander producing in the local market, the shipping costs will be next to nothing. So, the netbacks are going to be a lot better than the Canadian companies that must ship to China.

TER: I guess the biggest risk for Lysander is its jurisdiction.

ML: In all the work that we've done looking at more than 100 countries, we've come to the view that Eastern Europe has improved significantly. We looked at the Ukraine long and hard because this is a great project, but I want to make sure I feel comfortable in the country. It passed our tests; we feel comfortable in the Ukraine; I am not going to suggest that it's Alberta, but I do think that it's a fairly stable place. Frankly, there are some coal opportunities in Africa and even South America that I am not quite as enthralled with as compared to the Ukraine. From a political viewpoint, we thought it was fairly good compared to some of the other opportunities we were looking at.

TER: That's great. Some parting comments on mineable energy commodities?

ML: One of the reasons we're so positive on both uranium and coal is where the world markets are going for both of these commodities. They both have some different issues. Obviously, it's hard to get permits for uranium and there are countries, like Australia, where there's a significant anti-nuclear view. There are a lot of problems with some of the uranium-producing countries in Africa. So, we're kind of sticking to North America; and I think there's going to be some significant opportunities, given the uranium supply/demand balance.

Coal is being driven by significant demand growth coming out of Asia for both metallurgical and thermal, as well as limited global opportunities to find all of this coal and actually ship it. Both uranium and coal have very good outlooks during the next five years.

TER: Thanks, Mark.

Mark Lackey, currently the investment strategist at Pope & Company Limited, has 30 years of experience in energy (oil and gas; hydro), mining, central and corporate banking and investment research and strategy. He worked at the Bank of Canada where he was responsible for the production of U.S. economic forecasting, briefing Governor Gerald Bouey on U.S. economic developments on a weekly basis. Mr. Lackey was a senior manager of commodities at the Bank of Montreal where he helped to determine whether or not the bank would loan money to companies in the commodity space. He spent 10 years in the oil industry with Gulf Canada, Chevron Canada and Petro Canada where his main responsibility was developing corporate plans. This involved forecasting oil and natural gas prices, oil and natural gas demand, oil and natural gas supply, downstream products and their competitive position versus other oil companies. During his tenure at Trans Canada Pipelines and Ontario Hydro, Mr. Lackey helped develop corporate plans while also working closely with each company's pension funds.

In the investment community, Mr. Lackey was director of research at Brawley Cathers and the investment strategist at both Blackmont Capital and Hampton Securities. He is a regular guest on BNN, having made more than 200 appearances in the last 10 years (more than 40 of which were in 2010). On his most recent appearance, Mark discussed his new role at Pope & Company and branded Pope as an up-and-coming institutional resource boutique dealer.

Learn more about companies in the uranium sector now. . .

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

DISCLOSURE:

1) Brian Sylvester of The Energy Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: Strathmore and Ur-Energy.

3) Mark Lackey: I personally and/or my family own shares of the following companies mentioned in this interview: Lysander Minerals. I personally and/or my family am paid by the following companies mentioned in this interview: None.

Mark Lackey: When those two big players were buying in the spot market, it signaled that the price was too low because they would have boosted production if that had been cheaper. But then those purchases started to move the price and China and South Korean started coming into the market to do some deals. Then, of course, there were other issues with AREVA (PAR:CEI) trying to ensure that it could get deals. Everyone was looking for uranium at the same time; consequently, the price moved $22/lb. in about three months. Earlier this week it was at $62.50.

TER: Roughly 15% of the world's electricity comes from nuclear power; 60 more nuclear power plants are being built and another 152 are on the drawing board. On the supply side, the Australians—at least those in the Northern Territories—have rejected a proposed uranium mine there, and some African jurisdictions are becoming quite dangerous. These factors seem to be signaling an impending, dramatic rise in the uranium price. Should we expect an even greater increase than what we've seen in the last couple of months?

ML: We're forecasting $65–$70 this year and probably $75 next year. A big difference could come in 2013 due to some of the issues you pointed out. There are some real potential supply constraints. Russia has said it's not going to export any more of the high-quality uranium from its weapons in 2013 when that agreement runs out. The consensus forecast for 2013 on the Street is still $75.

A lot of people think, "Well, Kazakhstan will continue to rapidly increase production." We don't tend to agree with that. Some people believe we'll saved by Cigar Lake—the high-grade uranium mine in Northern Saskatchewan owned by Cameco (50%), AREVA (37%), Idemitsu Kosan Co. (8%) and Tokyo Electric Power Company (OSX:9501, OTCPK:TEPCO) (5%)—but we don't know if that's going to be up and running in 2013 for sure. Our view, and admittedly it's a minority view, is that the price could easily spike above $100 in 2013 and go somewhat higher in the next few years until supply can catch up. That could take until 2015 or 2016 at least, and it may be longer due to the growth in demand. But the real argument is on the supply side, and some people are just too optimistic about where that new supply is going to come from.

TER: Cigar Lake has had all kinds of underground water issues, which delayed production time after time. As you mentioned, it's scheduled to come online in 2013. Why don't you think that's a realistic deadline?

ML: Those problems have been extremely difficult to handle. It wouldn't surprise a lot of people, including us, if that date was pushed back a year or two. If that's the case, the uranium price has a good chance of spiking because there will be a shortfall in the market.

Only 2% of the costs of running a nuclear plant are the feedstock. I'm not saying utilities will pay any price but, clearly, they don't get as concerned about price as they do about supply. Obviously, you can't run your plant if you don't have the supply.

TER: The big expenses are the fixed costs like labor, infrastructure and capital.

ML: One of the things that caused Ontario Hydro some problems was when it built a plant in the late '70s and all of a sudden, there were 20% interest rates. The cost of capital caused some significant problems because that was the biggest cost by far. If it had been fuel costs, there wouldn't have been anywhere near those cost overruns, but the problem became financing it with those kinds of interest rates.

TER: I've heard Cameco is having trouble finding enough people to make this all work. There aren't enough people qualified in these areas to be moving at the pace the company would like. Have you heard that?

ML: We've heard some rumors. But I must admit, that is a problem in mining in general—not just at Cameco. For more than 20 years, few people went to schools of geology when the mining sector was dormant. Trying to find the number of people Cameco would like has been an issue and there's a lot of competition. Mind you, Cameco will be able to pay and get some pretty good people relative to other companies; nevertheless, there is a lot of competition out there.

TER: What makes you sit up and take note when you start looking into a uranium explorer and its particular projects?

ML: The very first thing I look for is a stable political jurisdiction wherein a company can get mining permits to go forward. I don't want to go to places where they're going to pull permits, there could be protests or the government is not very stable. Those problems do exist in many of the uranium mining jurisdictions. A jurisdiction needs a pro-uranium view. Even within the U.S., some states are much more pro-uranium than are others.

The project, land position, management, proximity to major players—those all come into play. A lot of what we like is in the Athabasca Basin, Wyoming and New Mexico because those have been the best-producing areas for uranium and have major players in all three of those jurisdictions. Less work has been done in places like Nunavut, Canada; however, some work was done there in the past and I think that's one of the reasons we like that area so well.

TER: The major player there is Kivalliq Energy Corp. (TSX.V:KIV). What are your thoughts on Kivalliq?

ML: If you go back to the '70s, a lot of mom-and-pop mining was done in Nunavut. A number of small companies were trying to find a small amount of uranium. The problem was a lot of these companies had trouble obtaining financing because none of them was going to be big enough to interest the institutions. The one thing that Kivalliq did was to develop the company over time and get the biggest land position in Nunavut. In fact, in Lac Cinquante, it has a grade that is the best deposit outside the Athabasca Basin. The company has done a lot of work to build a pretty solid operation, has a very experienced management team and has raised some money. The government is pro-uranium and First Nations is solidly behind the project.

Kivalliq's going to go forward and do a lot more drilling this year. It has an estimate of 22 million pounds (22 Mlb.), but that's not NI 43-101-compliant because the drilling was done 25 years ago. The company will have an NI 43-101 completed on its Lac Cinquante property in the first quarter of this year. Kivalliq had a lot of foresight to acquire all this property, which totals 225,000 acres. Now, with what we think is going to be a major uranium bull market, Kivalliq is sitting in the driver's seat.

TER: Lumina Capital Limited Partnership just did a $5 million private placement with Kivalliq, so there are some other people on the Street who agree with you. What are some other micro caps that you're bullish on or think have some potential?

ML: I like Strathmore Minerals Corp. (TSX:STM; OTCPK:STHJF), a Wyoming- and New Mexico-based explorer. It has an indicated resource of 46 Mlb. U308 and an inferred resource of 26 Mlb. U308. Those are some big numbers for a junior company. A lot of people ask why its stock price hasn't reacted as well as that of Ur-Energy Inc. (NYSE.A:URG; TSX:URE), which is also in Wyoming. URG doesn't have nearly as much uranium, but it's going to be in production this year. The market gave the stock a much bigger boost because it knew that the company is going to produce this year, whereas Strathmore is going to be producing in late 2014 or 2015. It's a longer-term investment. But if I'm right about the uranium price going way up, and Strathmore starts some significant production just after the price spikes, I think it's the one that the market will pick up on. Strathmore looks like it could be a significant winner for a patient, long-term investor.

TER: Given its price is somewhat low relative to its resource, could Strathmore be a takeover target?

ML: I've looked at about 60 uranium companies. Quite frankly, if I had to pick one that jumps out as a potential takeover candidate, it would be Strathmore. It's especially appealing if the acquirer didn't need the production right away. Look at the reserves it has and it's in mining-friendly jurisdictions.

TER: It has an interesting management team from the perspective that it has both the geological expertise and experience of the Street selling its story and getting investors to buy it.

ML: I would completely agree with that. That's probably why it's one of the companies that really jumps out at me. It's got very experienced, well-known management and it's got a great opportunity over the next few years.

TER: What are some other highlights in the uranium space?

ML: CanAlaska Uranium Ltd. (TSX.V:CVV) has one of the largest land positions in the Athabasca Basin, which is the preeminent area in the world for uranium. It's certainly been the most potent supply area, and there are very high-grade deposits in Athabasca and some of the largest mines in the world. CanAlaska has 20 exploration projects, most of which have joint-venture agreements. CanAlaska should be doing a lot more drilling on some of the prospects along with its JV partners this year. Again, this could easily be another potential takeover candidate; but it has to go further in terms of its drilling before somebody's going acquire it.

TER: Does its proximity to other players in the Basin make that easier, too?

ML: Absolutely. Cameco, AREVA and Denison Mines Corp. (TSX:DML; NYSE.A:DNN) all have properties right there. They know the area quite well and easily could be looking at the company as it reaches a more advanced state, has an NI 43-101 and has proven a resource.

TER: Let's talk about another one of your specialties—coal. You're bullish on metallurgical coal and believe it could reach $300 a ton next year. That forecast is helped by the flooding in Australia. Can you give us an overview of what we can expect from the coal market in 2011?

ML: Flooding has been an issue, but that's going to be a short-term phenomena. The flooding will end and they'll get the mines back and operating. However, Australia's port facilities are at full capacity, so getting new production out of the country is extremely difficult. It would take at least a couple of years to build some new port facilities. Some are under construction, but Australian coal is pretty much maxed out. With demand rising as quickly as it is, coal is going to have to come from some other areas.

The steel industry is doing very well in South Korea, Japan, China and India; and we do see some improvement in Europe and North America, as well. There are even port-facility issues in the U.S., so there are some limitations these days with such bottlenecks that will add to a higher price. Not only will that impact metallurgical coal but also thermal prices are being quoted nearly as high as $130 a ton now.

TER: What are some junior coal players with anthracite or metallurgical coal plays that could see some value creation in the next few months?

ML: Fortune Minerals Limited (TSX:FT) has quite a significant play in northwestern British Columbia that is largely metallurgical coal. It has 231 million tons (Mt.) indicated and measured—one of the largest undeveloped deposits in the world. One of the places that doesn't have problems with port facilities is Canada, especially in Prince Rupert, which is what Fortune would use given its physical location. That's a really big advantage. It has deepwater shipping ports there all year round and there's some railway expansion. The infrastructure issue there is not a problem. It's high-quality coal and the size of the reserve is significant as opposed to a number of smaller coal companies that have very limited reserves and production. From an investor viewpoint, you're not going to look at companies with limited upside.

TER: Any other small players like that that you're following?

ML: Lysander Minerals Corp. (TSX.V:LYM) has a near-term production property in the Ukraine. We took a long, hard look at the Ukraine and recognized it has improved considerably in the last 5–10 years—the gross domestic product is better; there are rising incomes. The thing that caught our eye about Lysander was John Conlon, who runs the company. He came to us a few years back with Western Coal Corp. (TSX:WTN) when it was a $0.30 stock. It's now trading at $12.71. It was one of the best performers on the Toronto Stock Exchange during the last three years.

Lysander has some significant numbers. It is taking over the Verticalnaya mine and is reopening it on a significant basis. We think production will be up to 3 Mt. in the next few years. About 25% of that will go to the steel plants and the other 75% will go to the power plants. Currently, 16 million tons are proven and the total resource is about 76 Mt. Those are good numbers for a small company. All the coal will be sold in the Ukraine, so the shipping savings are great. There's such a large demand that the country has been importing coal—from Russia—for its power plants. If we have a company like Lysander producing in the local market, the shipping costs will be next to nothing. So, the netbacks are going to be a lot better than the Canadian companies that must ship to China.

TER: I guess the biggest risk for Lysander is its jurisdiction.

ML: In all the work that we've done looking at more than 100 countries, we've come to the view that Eastern Europe has improved significantly. We looked at the Ukraine long and hard because this is a great project, but I want to make sure I feel comfortable in the country. It passed our tests; we feel comfortable in the Ukraine; I am not going to suggest that it's Alberta, but I do think that it's a fairly stable place. Frankly, there are some coal opportunities in Africa and even South America that I am not quite as enthralled with as compared to the Ukraine. From a political viewpoint, we thought it was fairly good compared to some of the other opportunities we were looking at.

TER: That's great. Some parting comments on mineable energy commodities?

ML: One of the reasons we're so positive on both uranium and coal is where the world markets are going for both of these commodities. They both have some different issues. Obviously, it's hard to get permits for uranium and there are countries, like Australia, where there's a significant anti-nuclear view. There are a lot of problems with some of the uranium-producing countries in Africa. So, we're kind of sticking to North America; and I think there's going to be some significant opportunities, given the uranium supply/demand balance.

Coal is being driven by significant demand growth coming out of Asia for both metallurgical and thermal, as well as limited global opportunities to find all of this coal and actually ship it. Both uranium and coal have very good outlooks during the next five years.

TER: Thanks, Mark.

Mark Lackey, currently the investment strategist at Pope & Company Limited, has 30 years of experience in energy (oil and gas; hydro), mining, central and corporate banking and investment research and strategy. He worked at the Bank of Canada where he was responsible for the production of U.S. economic forecasting, briefing Governor Gerald Bouey on U.S. economic developments on a weekly basis. Mr. Lackey was a senior manager of commodities at the Bank of Montreal where he helped to determine whether or not the bank would loan money to companies in the commodity space. He spent 10 years in the oil industry with Gulf Canada, Chevron Canada and Petro Canada where his main responsibility was developing corporate plans. This involved forecasting oil and natural gas prices, oil and natural gas demand, oil and natural gas supply, downstream products and their competitive position versus other oil companies. During his tenure at Trans Canada Pipelines and Ontario Hydro, Mr. Lackey helped develop corporate plans while also working closely with each company's pension funds.

In the investment community, Mr. Lackey was director of research at Brawley Cathers and the investment strategist at both Blackmont Capital and Hampton Securities. He is a regular guest on BNN, having made more than 200 appearances in the last 10 years (more than 40 of which were in 2010). On his most recent appearance, Mark discussed his new role at Pope & Company and branded Pope as an up-and-coming institutional resource boutique dealer.

Learn more about companies in the uranium sector now. . .

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

DISCLOSURE:

1) Brian Sylvester of The Energy Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: Strathmore and Ur-Energy.

3) Mark Lackey: I personally and/or my family own shares of the following companies mentioned in this interview: Lysander Minerals. I personally and/or my family am paid by the following companies mentioned in this interview: None.