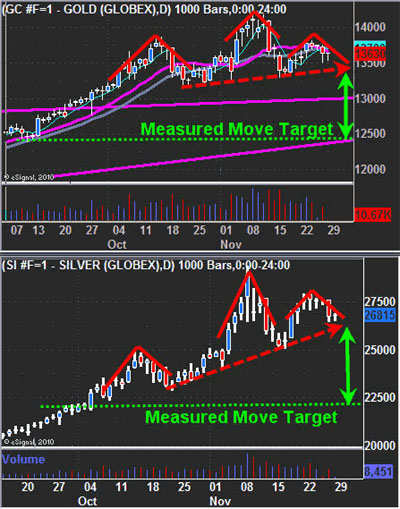

Below are a few charts showing my intermediate term outlook for gold and silver.

Gold & Silver Futures—Daily Chart

You can see both metal are showing a possible reversal head and shoulders pattern. While they have yet to confirm and close below the neckline, we must be aware of this pattern and the risk/potential it provides us with. Both metals are still in an uptrend but showing signs of weakness.

U.S. Dollar Index—Weekly Chart

This chart is not all that helpful for trading stocks or commodities right now but I wanted to post it because it allows me to show you how I analyze the market and my trades.

As you can see, the past three weeks have been in a strong uptrend reaching the first resistance level. The point of this chart is to show you that if you step out to the next longer timeframe you can get a solid feeling of where an investment will find major support and resistance levels. Any investment—no matter if it's a stock, commodity or currency—if the price is trading in the middle of a large range like this chart, you should not take large positions. If you do, it almost becomes a 50/50 bet on the market, which is not a good winning strategy unless you are very experienced at managing your trades and money.

If you are going to trade, you want to focus on the underlying trend and you do that by looking at the next larger timeframe. For example: If you focus on trading the daily chart, then you must step back each week and review the weekly chart to be sure you are trading with the underlying trend which is up for the dollar right now.

Weekend Trading Ideas

Tuesday morning we saw the SP500 gap lower and continue to sell off. Traders started panicking out of their long positions and we could see it using the intraday market internals charts, which I cover each morning in the pre-market trading videos. Me being a contrarian (buying into market fear, selling into market strength) I used that high level of fear in the market along with the expected light volume holiday week ahead as an excuse to book profits near the lows on SP500 using the SDS bear fund allowing us to profit from the falling market. I feel we are going to have some crazy moves on the markets going into year-end and it should be a lot of fun if done correctly.

Trading in general is a very difficult task especially if you are doing it for a living and planning on using your monthly income to pay bills, salaries etc. We all know the stress which comes with trading and if do not have a solid trading strategy, rules and cannot properly manage yourself (emotions) then you are most likely running into problems like over-trading, getting shaken out of trades easily, and taking bigger risks than your account can handle. Each of these causes more traders to blow up their accounts and big up on trading.

I am giving away my book on how you can control your trades, money and emotions. This short and to-the-point guide is full of my trading techniques, tips and thoughts, which will help you get a handle of your emotions turning the market noise into music.

Download Book: http://www.thegoldandoilguy.com/trade-money-emotions.php

http://www.thegoldandoilguy.com/trade-money-emotions.php

Chris Vermeulen

www.TheGoldAndOilGuy.com