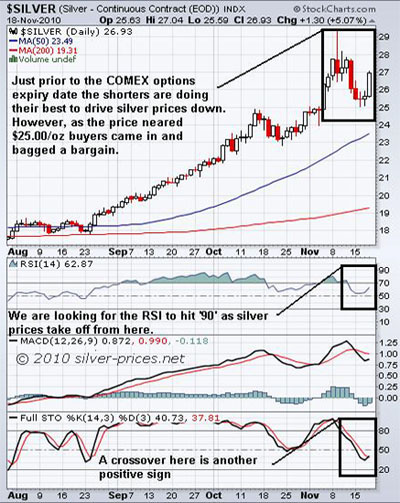

We know it has been a rough couple of days, however, the silver price showed its true strength Friday as it bounced back to close in New York at $26.93/oz., registering a gain of $1.30/oz or 5.07%. The recovery began in Sydney—three cheers for the Aussie gold bugs—and carried through in Hong Kong and Singapore—three cheers there, too. It then went on to London managing to push prices higher. Well done to all the buyers out there.

The stage is set for some fireworks either way you slice it. The shorters may give it one last thumping in the hope of getting their positions covered before silver rockets, as well as to satisfy their year-end bonus aspirations. The thirst of the longs has not yet been slaked and appears to be building. The next few days could be electric, as the possibility exists that that the shorters could capitulate and be forced to buy silver at the very same time as the Longs are buying. In a tiny market place where the physical supply is said to be rather tight, this could push prices to new record levels. And that is just what we will think will happen. Be warned though, we have been wrong before.

Taking a quick peek at the above chart, we can see that just prior to the COMEX options expiry date on November 23rd, the shorters are doing their best to drive silver prices down. However, as the price neared $25.00/oz., buyers came in and bagged a bargain. We are looking for the RSI to hit 90 as silver prices take off from here. The STO is forming a nice crossover here, which we interpret as another positive sign.

The table below is a snapshot of some of the silver producers and reveals just how well they fared Friday. As we can see, there are some jolly good gains being made.

Our old favorite, Silver Wheaton is also playing a good game and doing wonders for our trading account.

Over in the options trading pit, the team has just updated the progress chart to include Thursday's closed trades—now 51 winners out of 53 trades, the latest two trades were written up on gold-prices later Friday.

The above progress chart is being updated constantly. However, to see exactly how it is going, please click this link.

So, the question is: Are you going to make the decision to join us today?

Stay on your toes and have a good one.

Got a comment? Please add it to this article; all opinions are welcome and very much appreciated by both our readership and the team here.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address.

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

For those readers who are also interested in the nuclear power sector you may want to subscribe to our Free Uranium Stocks Newsletter, just click here.

Bob Kirtley

www.skoptionstrading.com

(Winners of the GoldDrivers Stock Picking Competition 2007)

DISCLAIMER

Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.