Goldshore Resources Inc.

Goldshore Resources Inc. is a billboard sponsor of Streetwise Reports and paid a fee for this company profile page. Please refer to the important disclosures below for additional details.

Recent Articles:

Exploration Begins to Unlock New Gold Potential in Ontario

Goldshore Resources Inc. (TSXV: GSHR; OTCQB: GSHRF ; FWB: 8X00) has officially commenced its winter exploration program at the Moss gold project in Ontario, Canada. Read more to find out how this initiative aims to uncover new gold resources and expand existing deposits.Major Gold Exploration Push Unveils Promising Targets in Ontario

Goldshore Resources Inc. (TSXV: GSHR; OTCQB: GSHRF ; FWB: 8X00) has announced the awarding of contracts for its upcoming winter exploration programs at the Moss Gold Project in Ontario. Find out how these strategic programs aim to expand resources, improve project economics, and uncover new gold targets in one of Ontario's most promising gold districts.New Exploration Targets Set to Expand Resource Potential at Moss Deposit

Goldshore Resources Inc. (TSXV: GSHR; OTCQB: GSHRF ; FWB: 8X00) announced ongoing efforts to uncover new mineral resources at the Moss Deposit in Ontario. Read why the company CEO says this program is essential for the project's growth.$12.5 Million Raised To Accelerate Exploration at Ontario Gold Deposit

Goldshore Resources Inc. (TSXV: GSHR; OTCQB: GSHRF ; FWB: 8X00) has announced a US$12.5 million private placement to advance its Moss Gold deposit in Ontario. See what the company CEO says is the aim of this program.Positive Gold Intercepts Boost Exploration Amid Economic Assessment Progress

Goldshore Resources Inc. (TSXV: GSHR; OTCQB: GSHRF ; FWB: 8X00) has extended mineralization along the Moss Deposit and Kawa trends. Read why investors are taking interest in this and other recent company announcements.Gold: Is US$3,000 in Sight?

Several months ago, it seemed easy to dismiss predictions of US$3,000 per ounce gold as wishful thinking. Now some experts are starting to say the milestone could be within sight.More Articles

Expert Comments:

| "Goldshore Resources Inc.'s fundamentals are positive, which of course increases the chances of improvement in the stock price soon. . .being still very close to the second low of a large-ish double bottom at a time when the sector is really coming to life, the company is viewed as being a very attractively priced junior here. It is rated an immediate Strong Speculative Buy." | |

|

|

|

| "For the quarter ending September 30, 2022, Goldshore Resources Inc. has current assets of CA$5.95M. . .working capital is CA$4.32M. . .the company has enough money to finance its operations for a year and does not need to raise capital in the immediate future." | |

|

|

Experts Following This Company

|

Barry Allan, Managing Director, Mining Analyst, Institutional Equity Research – Laurentian Bank Securities |

| Clive Maund – CliveMaund.com | |

| Paul O'Brien, Analyst – Velocity Trade Capital | |

Company News

12/9/2024 – Goldshore Commences Winter Exploration Program

12/2/2024 – Goldshore Adds Key Personnel to Support Project Advancement and Corporate Objectives

11/25/2024 – Goldshore Awards Contracts for Resource Expansion & Discovery Focused Winter Exploration Programs

10/10/2024 – Goldshore Set For Discovery-Focused Winter Exploration Program

10/1/2024 – Goldshore Announces $12.5 Million Private Placement to Accelerate Strategic Plan at the Moss Gold Deposit

Important Disclosures

Goldshore Resources Inc. is a Billboard advertiser of Streetwise Reports and pays a flat fee. Fees fund both sponsor-specific activities and general report activities. Sponsor-specific activities may include aggregating content and publishing that content on the Streetwise Reports site, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases.

The fees also cover the costs for Streetwise Reports to publish and syndicate investment opinion and comments, and also to curate or create sector-specific content.

Billboard advertising monthly fees range from $3,000 to $5,000.

This landing page contains a summary of the company that was prepared by that company.

Some landing pages contain investing highlights and a catalyst calendar that are prepared by that company.

The Expert Comments and Experts Following This Company sections of the landing page are compiled by Streetwise Reports.

There may be other information about the company that is not placed on the landing page, and Streetwise Reports does not guarantee the accuracy or thoroughness of the information contained on the landing page.

Readers should conduct their own research for all information publicly available concerning the company.

This landing page may be considered advertising for the purposes of 18 U.S.C. 1734.

| Current Mineral Resource Estimate (January 2024) of 1.54M oz Au (Indicated) at 1.23 g/t Au and 5.20M oz Au (Inferred) at 1.11 g/t Au* | |

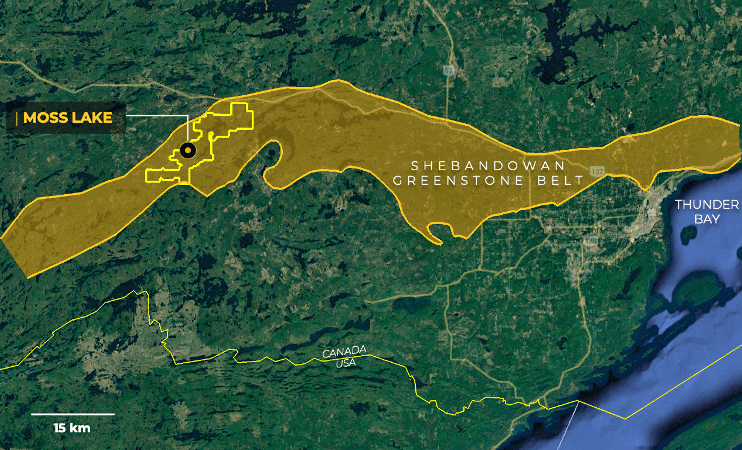

| Potential Resource expansion in the surrounding area of the Moss Deposit ? covering a cumulative 23km strike length in surrounding corridors | |

| New targets within the pit have the potential to add ounces and reduce strip ratio | |

| PEA planned to be completed by Q1 2025. Evaluating phased production approach | |

| Strong management, technical team and board, strategically backed with proven experience and track record of value creation | |

| Low risk jurisdiction of Ontario, which is a major global gold producer with a rich mining history |