This looks like the optimal point for investors to buy Goldshore Resources Inc. (TSXV: GSHR;OTCQB: GSHRF ;FWB: 8X00), which is believed to be at the very start of a major bull market following a long and grueling bear market that has erased most of its value.

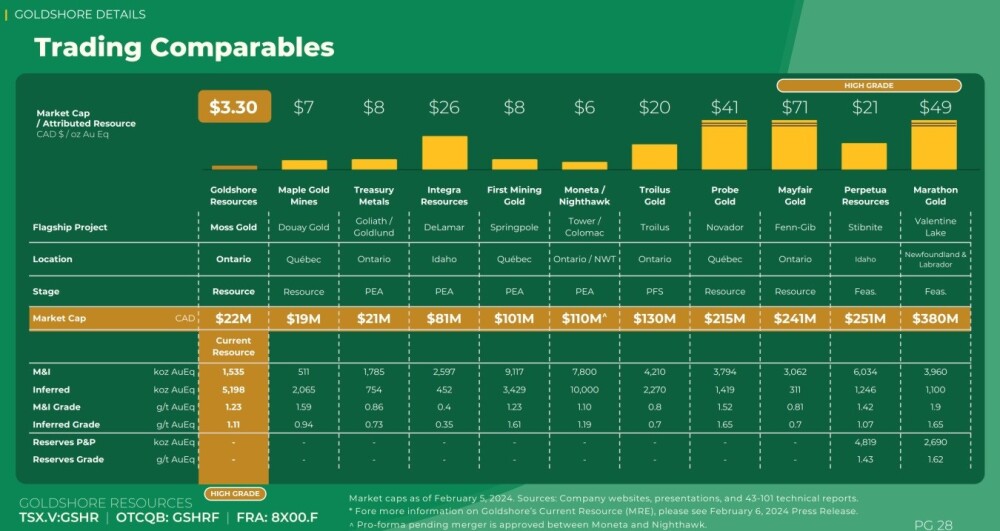

With respect to the fundamentals, Goldshore stated in early November that it had engaged with a strategic natural resources private capital group (the "Strategic Advisor") participating, in aggregate, in the Private Placement for $3,000,000 or 30,000,000 Units, with a long-term financial commitment to unlocking the value of its Moss Gold Project and delivering increased return to all stakeholders and it worth perusing the following "Trading Comparables" table which makes Goldshore look exceedingly attractive when placed alongside its peers.

Similarly, the following table shows the very low value currently being placed by the market on Goldshore's mineral resources.

These tables certainly make Goldshore look very attractive indeed.

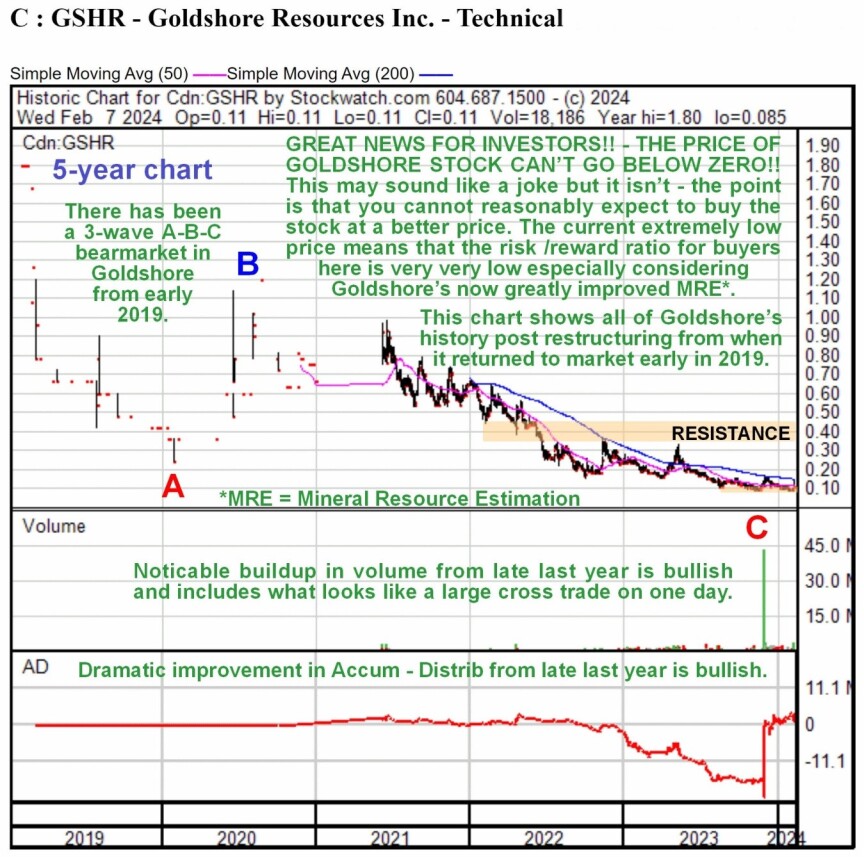

Turning now to the charts, we will start by looking at the 5-year chart, which shows all of the action in the stock following its return to market after what looks like a lengthy period of major restructuring of the company.

This post-breakout dip has afforded would-be buyers the perfect opportunity to swoop in and pick up the stock at a very low price before the expected new bull market gets going in earnest.

After it started trading again at a relatively high price early in 2019, it plunged over the next 12 months on light volume to hit a low early in 2020, by which time it had lost most of its value.

Because it had dropped too far too fast, there was a secondary rally in 2020 before it was again halted or suspended during the first half of 2021.

When it resumed trading towards mid-2021, the bear market resumed in earnest, and it dragged on and on until late last year, by which time the stock was getting close to being worthless.

Then, at last, it stabilized.

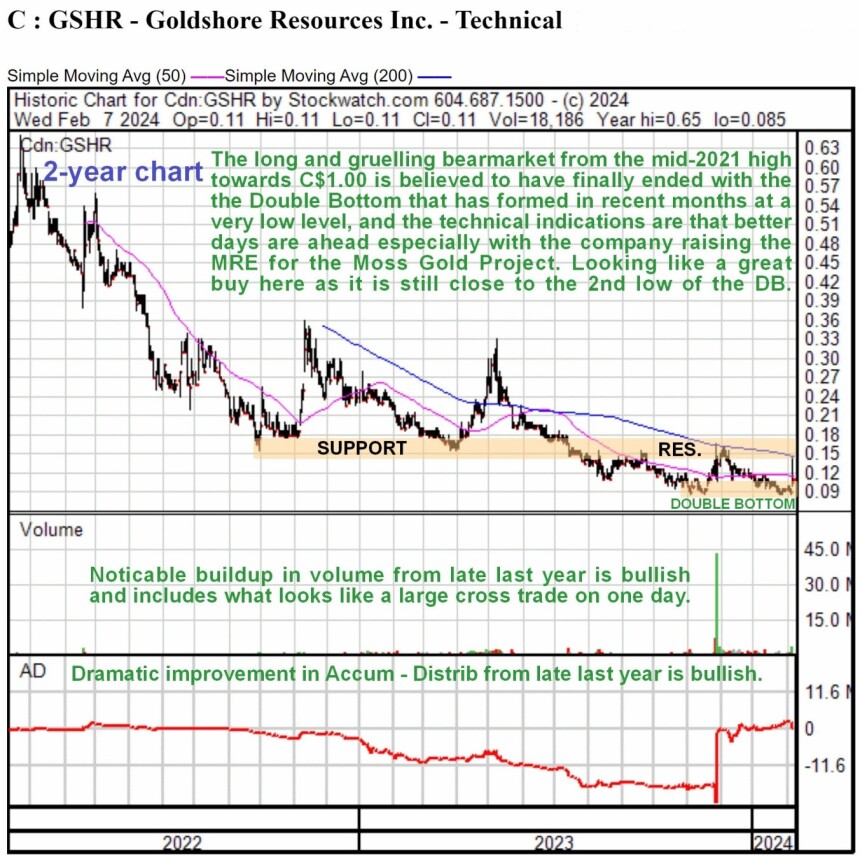

We will now look at the latter part of the bear market and recent action in more detail on a 2-year chart. Early last year, it had looked like it might be making a Double Bottom with its 2022 lows, but the Accumulation line was weak, and so the rally out of the second low of the potential Double Bottom proved to be a false dawn, and it broke to new lows.

Things started to get more interesting late last year when, after hitting bottom at the miserable price of about 9 cents, it had a sharp recovery rally on strong volume that brought it up to resistance, where it reversed to the downside again and proceeded to drop back to the vicinity of its lows of late last year, with the positive volume action and resilient Accumulation line strongly suggesting that it was in the process of completing a Double Bottom with its earlier lows — and the breakout a couple of days ago on the release of positive fundamental news confirms that this is indeed the case. So, will will now proceed to look at recent action in much more detail on a 6-month chart.

On the 6-month chart, there are various bullish points to observe. The first is that the downtrend from early December through late January to form the second low of the Double Bottom took the form of a bullish Falling Wedge, implying that it would end in an upside breakout, and it has. This outcome was also strongly suggested by the resilient Accumulation line, which did not drop at all during this downtrend and actually rose.

So, it broke out and rose sharply intraday a couple of days ago on the release of the positive news by the company about the upscaled MRE for the Moss Gold Project, but then it gave back most of the gains.

Was this action negative?

No, not at all. All it means is that the rally brought out overhanging supply from stale holders of the stock who have had enough and want out for what they can get, failing to understand the significance of the news and more than that, it makes no sense to sell the stock at such low prices, especially as things are now taking a much more positive turn.

The point to grasp here is that this post-breakout dip has afforded would-be buyers the perfect opportunity to swoop in and pick up the stock at a very low price before the expected new bull market gets going in earnest.

The conclusion must be that GoldShore Resources is a Strong Buy here for all timeframes and is equally attractive for investors or speculators at this juncture. Its stock trades in light but acceptable volumes on the US OTC market, where liquidity can be expected to improve significantly as the bull market takes hold. There are a rather weighty 247 million shares in issue, but of these, 55% are owned by the board, management, insiders, and institutional investors.

GoldShore Resources closed at CA$0.10, $0.076 on February 7, 2024.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Goldshore Resources Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.