An investor's MO is to maximize profits while limiting the amount of risk that they take. We're all looking for the next 10-bagger with little to no risk. The issue is that there just aren't many of them out there.

To find opportunities like this in the resource sector, you are most likely looking at subgroups of companies whose focus metal is out of favor. Good examples today might be the PGM or lithium markets — both metal prices are at their multi- year lows and their corresponding equities are in even worse shape. These are the asymmetric opportunities that contrarian investors look for.

The fact remains that you still have to pick right and have the fortitude to hold your position until the metal price environment improves.

This is much harder than it sounds!

Today, I have for you an opportunity that isn't contrarian but still displays the downside protection and upside potential of an asymmetric bet.

The company is Aurion Resources Ltd. (AU:TSX.V) and the bet is that their 30% stake in the Helmi project will be acquired by Rupert Resources Ltd. (RUP:TSX; RUPRF:OTCQX).

Let me tell you why I think this has a good probability of occurring and why, if it doesn't, your downside is protected by Aurion's underlying value.

Helmi Project

Aurion is a hybrid project generation company, meaning that they have both 100% owned and explored properties, plus projects that they vend to partners for exploration. In Helmi's case, it's a joint venture with B2Gold Corp. (BTG:NYSE; BTO:TSX; B2G:NSX).

Last March, news was released that Rupert Resources had acquired B2's 70% stake in Helmi for 28.6M shares of Rupert — at the time, equivalent to $102.8M.

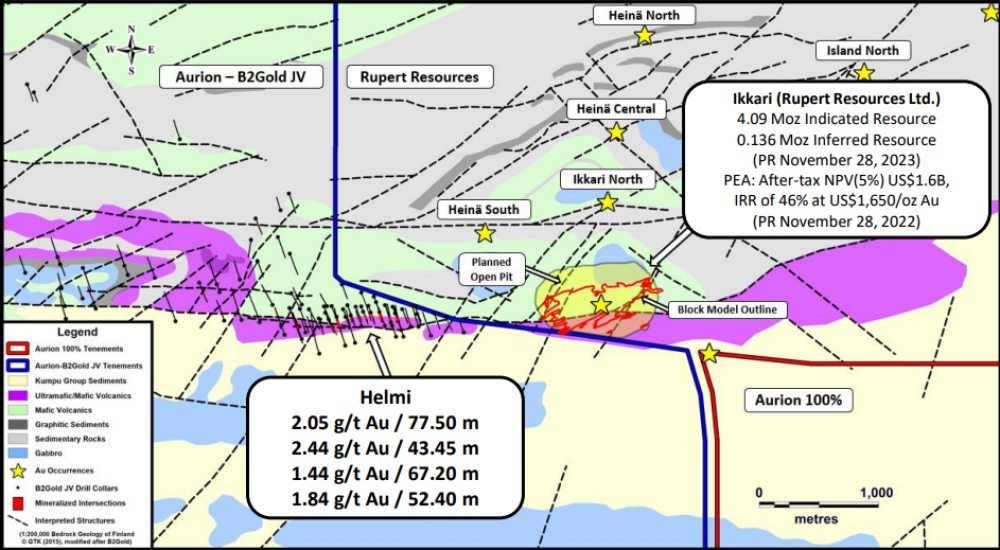

Rupert's interest is clear, their 4Moz Ikkari gold deposit lies in close proximity to Helmi's property boundary.

In my view, without getting technical, you can clearly see the proximity of the proposed Ikkari open pit to Helmi's ground.

The deal with B2 rightly sent Aurion's share price soaring. Aurion not only holds the remaining 30% of Helmi, but also the all-important Right of First Refusal (ROFR) on the deal.

The talks between Aurion and Rupert started not long after the announcement of the deal with B2, but unfortunately, they didn't go anywhere.

On July 8, Rupert announced that they were unable to reach acceptable terms to acquire the full 100% of Helmi.

Interestingly, in August, Rupert released the voting results from their annual meeting, which revealed that 31.61% of the votes for James Withall were withheld.

Was it because a good portion of Rupert shareholders were disappointed in the failed deal with Aurion?

In my view, yes.

That opinion was somewhat vindicated later in the month when Withall stepped down, making way for Graham Crew. Crew is a Mining Engineer with over 25 years of experience in the resource sector. His most recent experience was his tenure as CTO of La Mancha. For reference, La Mancha is one of the most respected resource-focused investment advisors in the business.

As a well-connected and unbiased friend described to me, they are one of the "premier deal makers" — their MO is to bring companies together.

Crew is now an employee of Rupert and, therefore, doesn't necessarily bring with him the same MO as La Mancha, but I would suggest that he is very aware of the technical benefits of acquiring Helmi.

This is where it gets very interesting.

This week, February 18, 2025, Rupert released a Preliminary Feasibility Study (PFS) on Ikkari. The study looks good, but it's clear that without Helmi's ground, the proposed Ikkari mining operation isn't optimized. The life of mine throughput has decreased from 3.5Mtpa (2023 PEA) to 2.6 Mtpa, and the saleable ounces dropped from 4.2Moz to 3.3Moz.

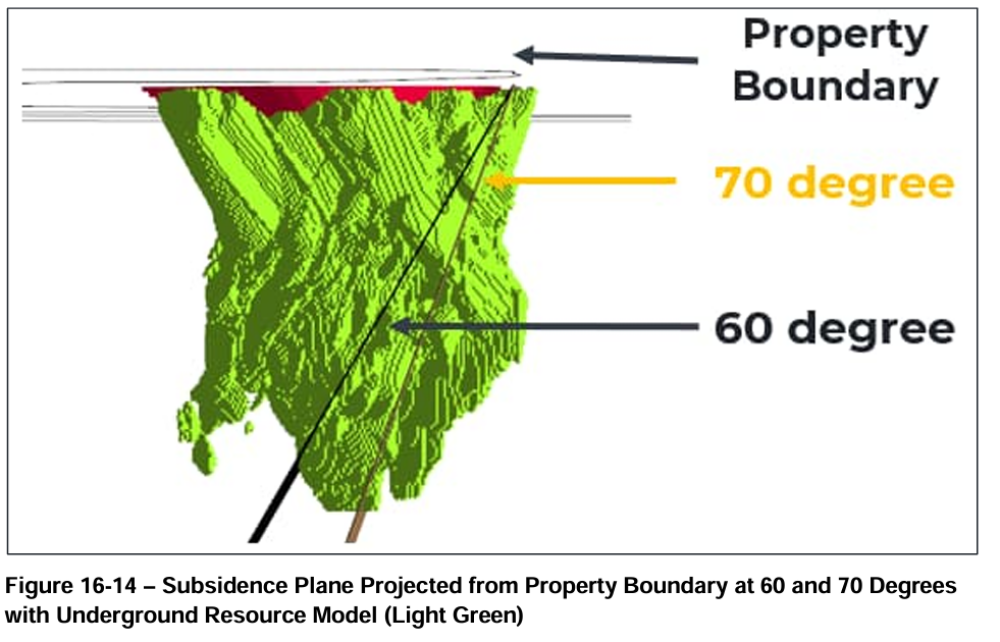

This is a significant drop, and I think it is directly correlated with this excerpt from the PFS:

"In the PEA (Tetratec, 2023), a Sub Level Caving (SLC) mining method at a 3 Mt/a production rate was selected primarily based on achieving maximum NPV and Internal Rate of Return (IRR). Review of the SLC mining method showed it was not a favourable method due to: The effect of subsidence and its interaction with the adjacent property, resulting in a significant loss to the mineable inventory. As shown in Figure 16-14, material below the subsidence planes would likely cause ground movement in the adjacent property not owned by Rupert Resources; The requirement for a crown pillar, if underground mining at the same time as the open pit. Reducing the mineable inventory further; and Variability in mineralisation and lack of selectivity meaning large quantities of internal waste would need to be caved and mined."

The inability to use the sub level caving method outlined in the PEA due to the property boundary restriction has cost Rupert in throughput and overall payable ounces. Not only do the report's words spell it out, but the image provided is very clear. Obviously, a deal for Helmi has to be made to make up on the short-fall on throughput and payable ounces.

Remember, in a discounted cash flow model (DCF), every year that cash flow is delayed into the future, the less it's worth in the NPV calculation. Optimized throughput and overall payable ounces early in the mine life are, therefore, paramount to achieving the highest NPV possible.

Putting it all together, I think a deal between Aurion and Rupert has a high probability of occurring.

With the gold price quickly approaching US$3,000/oz and the equities looking primed to close the gap in valuation, I think this is exactly the type of asymmetric bet that investors need to consider. The upside could be upwards of a doubling of the share price, while the downside is protected by Aurion's underlying value.

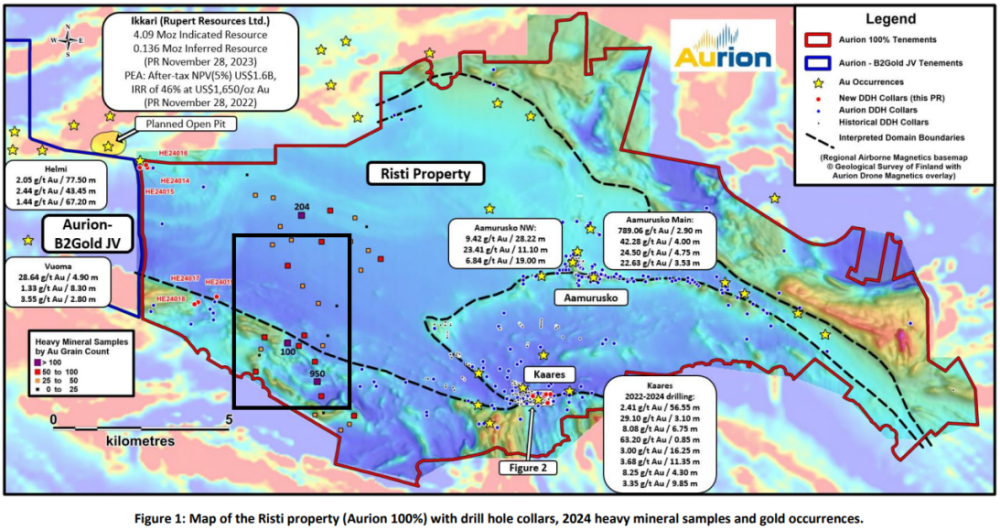

In a worst-case scenario, you're holding shares in a gold exploration company with a top-tier management team, which holds world-class potential in both its 100% owned Risti project and JVed projects — Helmi and Launi.

Risti itself already has a high-grade gold discovery at Aamursko. Intercepts of 9.42g/t gold over 28.22m, 23.41g/t gold over 11.10m, and 6.84g/t gold over 19.00m.

These are tremendous results and speak to the strength of the gold system that is present.

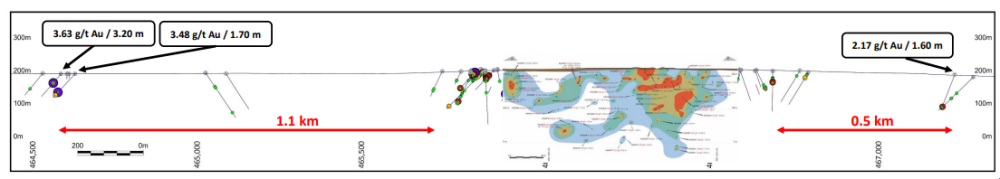

Further, over the last year Aurion has outlined roughly 800m of strike at their Kaares target area, with intercepts of 2.41g/t gold over 56.55m, 1.22g/t gold over 19.90m and 3.68g/t over 11.35m.

But, the mineralization doesn't stop there, with gold intercepts 1.1km to the west and 0.5km to the east.

This is a large gold system that has only seen minimal drilling.

Plus with a 900+ gold grain HMC sample to the west, the potential here is wide open and Kaares may only represent the weakness portion of the system.

To me, the value proposition is clear, and with a gold price ripping upwards, I have put my money where my mouth is and dramatically increased my shareholdings in Aurion over the last year.

Until next time.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Brian Leni: I or members of my immediate household or family, own securities of: Aurion Resources Ltd. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.