Seabridge Gold Inc. is a billboard sponsor of Streetwise Reports and paid a fee for this company profile page.

Please refer to the important disclosures below for additional details.

Streetwise Reports (02/16/2024)

Seabridge Gold Inc. has updated a three-dimensional view of its 3 Aces project in the Yukon Territory as it looks for continuous gold mineralization. See why one newsletter writer is "table-pounding bullish" on the company.

Research Report

Mike Kozak (02/09/2024)

This is another of the Canadian company's steps taken toward making its massive copper-gold project attractive to prospective partners, noted a Cantor Fitzgerald report.

Streetwise Reports (02/06/2024)

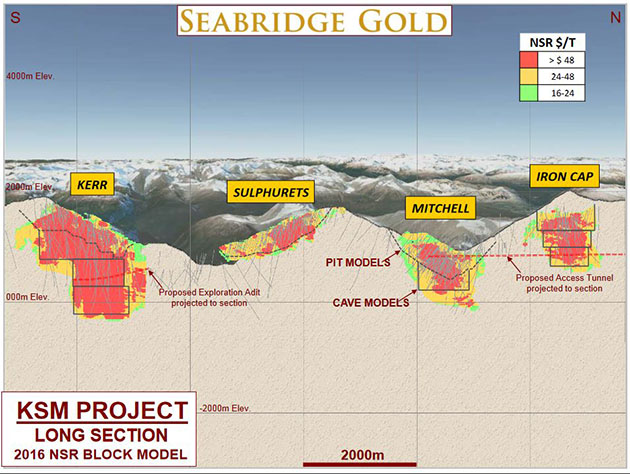

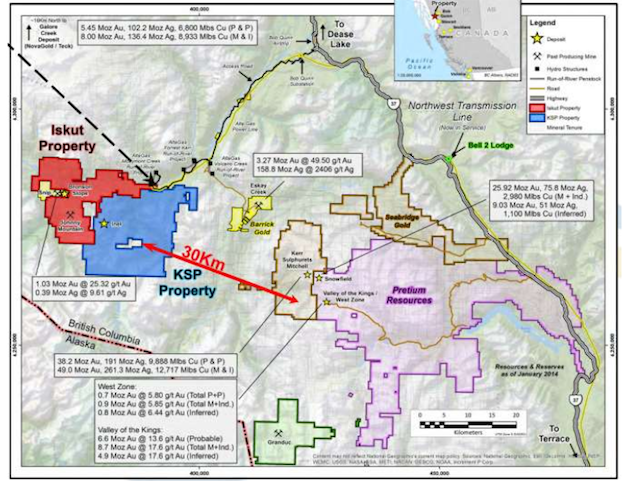

Seabridge Gold Inc. releases updated mineral resource estimates for deposits at its massive KSM gold and copper project in British Columbia. See why one analyst said the move "makes sense."

Contributed Opinion

Chris Temple (01/29/2024)

Chris Temple of The National Investor shares why he believes Seabridge Gold Inc. is one to watch.

Streetwise Reports (01/24/2024)

Seabridge Gold Inc. has applied for "substantially started" status for flagship KSM project in the Golden Triangle. One analyst has noted KSM could be a "top-five annual gold producer."

Research Report

Mike Kozak (01/19/2024)

A new prefeasibility study proposes an operation that is smaller but with better economics than the one outlined in 2012, noted a Cantor Fitzgerald report.

Streetwise Reports (01/18/2024)

Seabridge Gold Inc. announces a new feasibility study for the Courageous Lake Project. See why analysts like this company's stock.

Research Report

Taylor Combaluzier (01/18/2024)

Seabridge Gold Inc. recently released an updated PFS, according to a Red Cloud Securities report.

Research Report

Michael Siperco (01/17/2024)

Seabridge Gold Corp.'s application for "substantially started" status for its KSM project in British Columbia has been submitted, according to RBC Capital Markets.

Research Report

Taylor Combaluzier (12/27/2023)

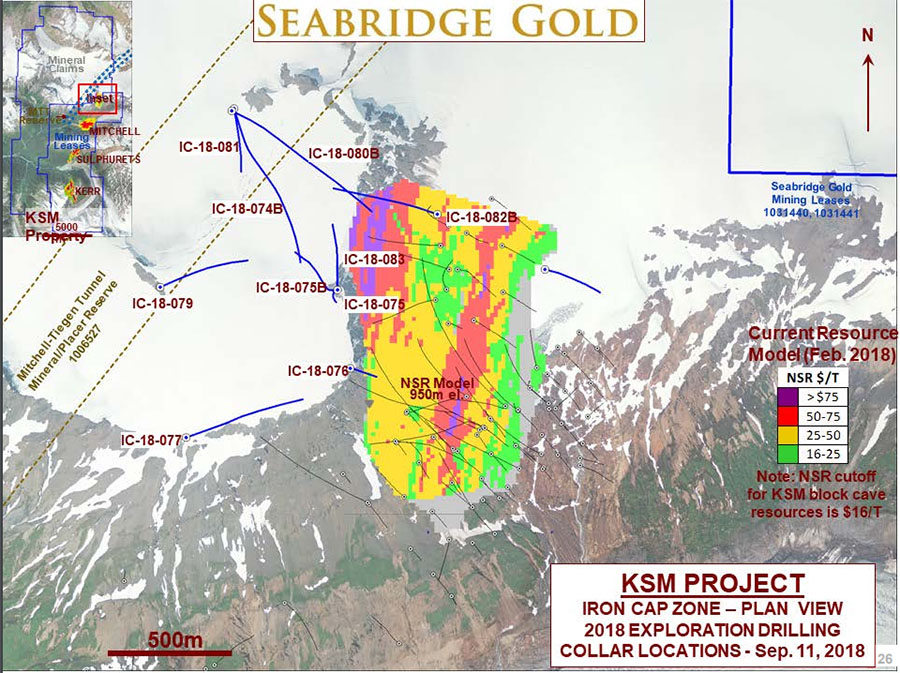

The data suggest a larger porphyry system exists at this British Columbian mining project, noted a Red Cloud Securities report.

Streetwise Reports (12/20/2023)

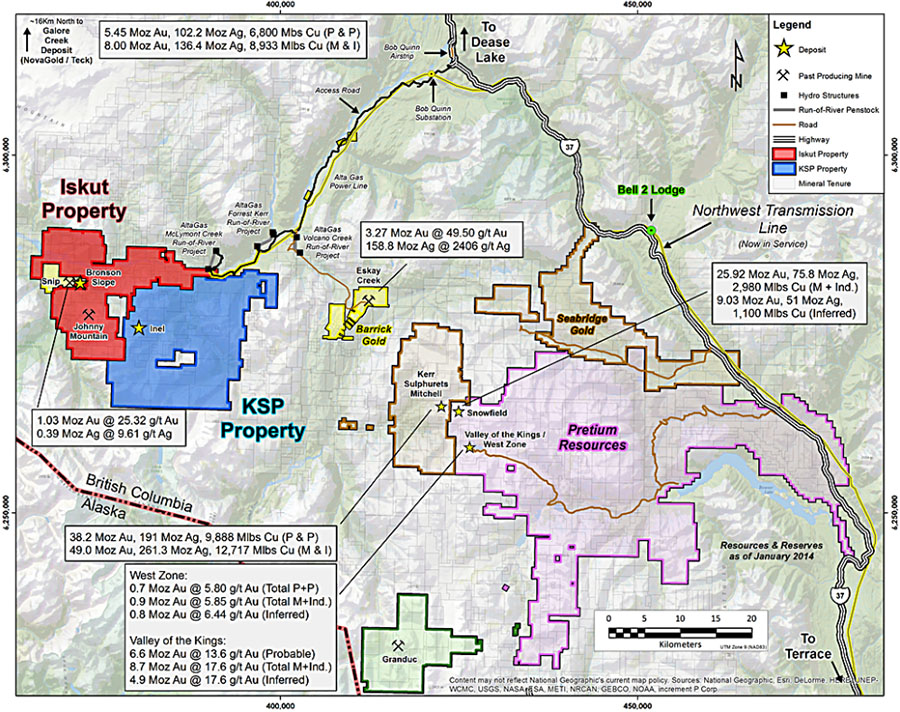

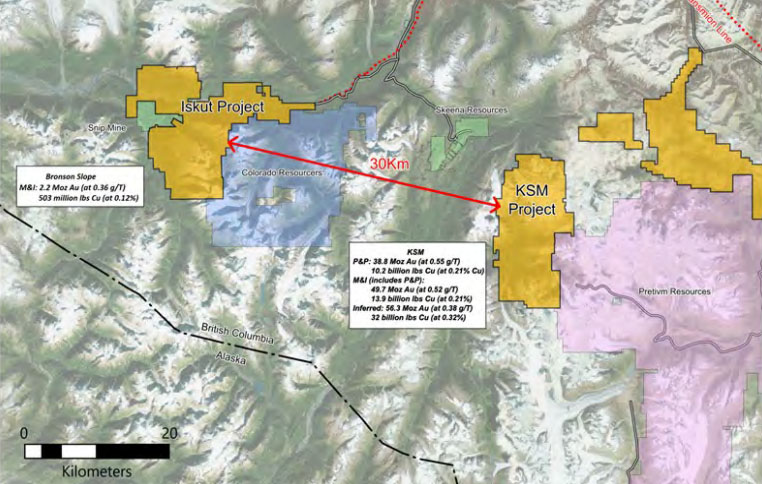

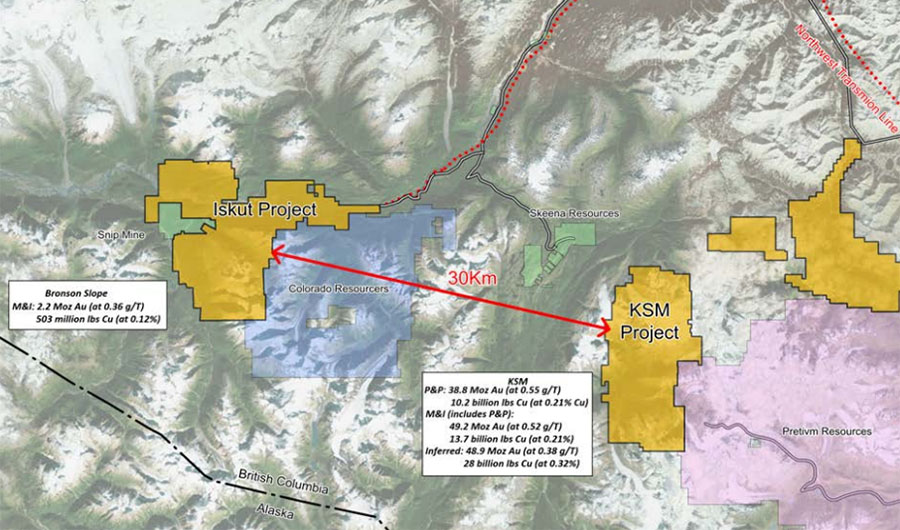

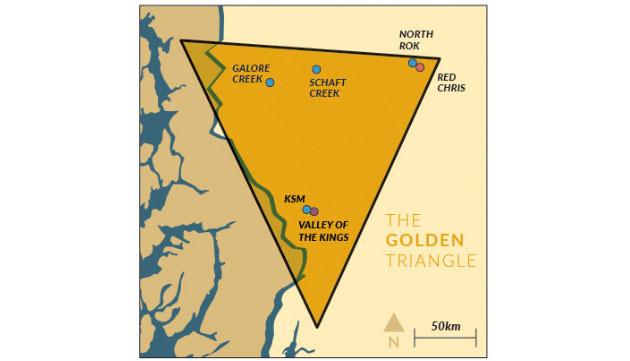

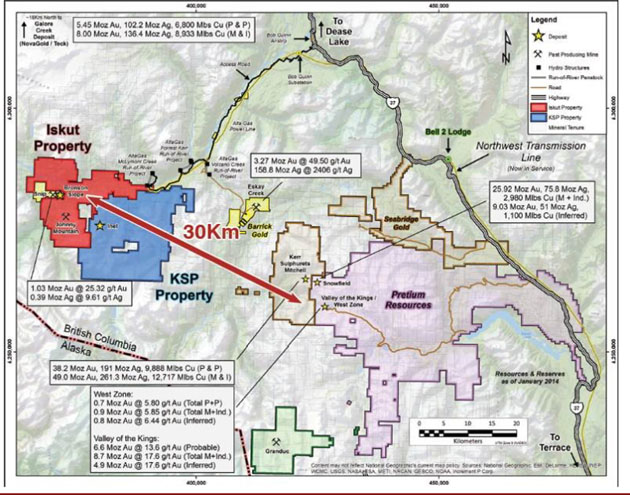

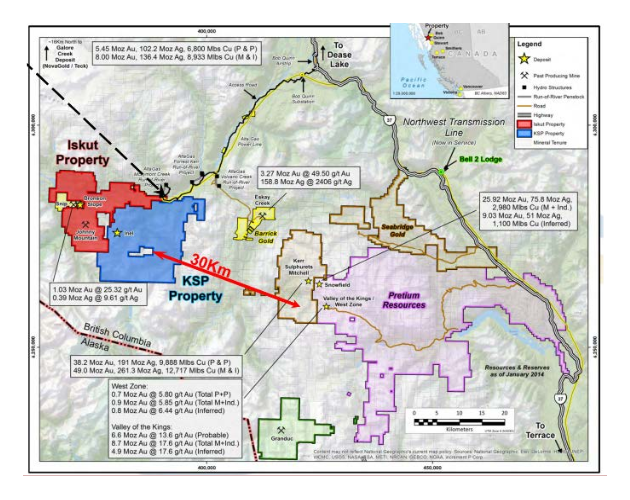

Seabridge Gold Inc. announces results from drilling and survey work on its 100%-owned Iskut property in northwest British Columbia's Golden Triangle.

Research Report

Taylor Combaluzier (12/15/2023)

Recently, Seabridge Gold announced positive results from its Snip North target at the Iskut project in British Columbia's Golden Triangle, noted a Red Cloud research note.

Research Report

Mike Kozak (12/15/2023)

Early drill data show the presence of gold mineralization at this explorer's second asset, noted a Cantor Fitzgerald research report.

Streetwise Reports (11/28/2023)

Mining is a competitive industry, with firms often actively seeking to undermine and take over each others' claims and approvals. Seabridge Gold Inc. recently announced that it was able to defeat one such attempt.

Research Report

Taylor Combaluzier (11/24/2023)

Recently, Seabridge Gold Inc. announced Tudor Gold's request to cancel its license of occupation and permit was not victorious, reported Red Cloud analysts Taylor Combaluzier and David A. Talbot in a November 21 research note.

Streetwise Reports (11/14/2023)

This company is planning to submit its application early next year for the "substantially started" designation for its flagship project in the Golden Triangle. One newsletter write says this mine could become an "anchor project" for copper and gold worldwide.

Streetwise Reports (10/09/2023)

Seabridge Gold Inc. is picking up more interest from analysts and newsletter writers, including an analyst who says its flagship project would be a "top-five annual gold producer" at full production.

Research Report

Michael Siperco (09/25/2023)

The mining company is developing and seeking a partner to advance its large-scale, British Columbia mine offering long-term upside potential, noted an RBC Capital Markets report.

Streetwise Reports (09/15/2023)

This gold company has filed its report to shareholders and management's analysis for the second quarter. Find out why one analyst says it has a "clear vision" for a potential partnership agreement.

Streetwise Reports (08/28/2023)

This company has begun a formal process to search for suitable companies to partner with, and several have put boots on the ground at the explorer's projects.

Streetwise Reports (08/18/2023)

Seabridge Gold Inc. files its second-quarter report and earnings for the three-month period ending June 30, and says it has engaged a firm to help it search for joint venture partners at its flagship property.

Research Report

David Talbot (07/24/2023)

Two firms are at odds over permissions allowing one of them to build tunnels in an area where the other one owns mining claims, noted a Red Cloud Securities report.

Streetwise Reports (07/18/2023)

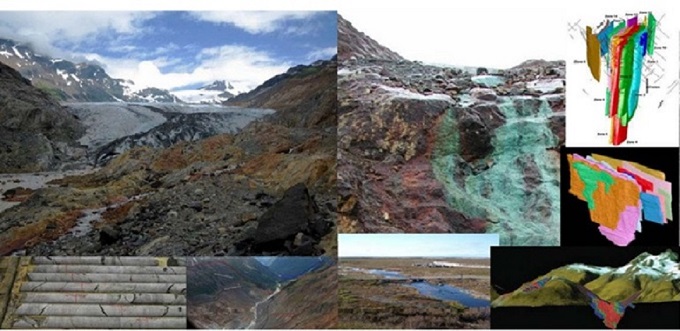

This gold explorer has started drilling at its Yukon Territory project, hoping to find the continuity it needs for a resource estimate.

Streetwise Reports (06/30/2023)

This gold company announced it has restructured and closed on the sale of a US$150 million note and royalty agreement as it works to get the attention of possible buyers or joint venture partners.

Streetwise Reports (05/30/2023)

This gold explorer has begun its 2023 drilling campaign at a 100%-owned project in British Columbia's Golden Triangle.

Streetwise Reports (05/26/2023)

Several analysts agree that this gold company with a large British Columbia resource is a Buy and that it's in a great position for possible joint ventures.

Streetwise Reports (05/25/2023)

Seabridge Gold Inc. is preparing for drill testing of its comprehensive exploration model at its 100%-owned 3 Aces project in the Yukon Territory, which the company believes could be a world-class deposit.

Research Report

Sadif Research (05/22/2023)

Current efforts strengthen the attractiveness of the KSM project during joint venture discussions, reported a B. Riley Securities research note.

Streetwise Reports (05/12/2023)

Seabridge Gold Inc. is raising US$150 million from Sprott Resource Streaming and Royalty Corp. in exchange for a 1.2% net smelter return (NSR) royalty on production at its KSM project in British Columbia.

Research Report

Mike Kozak (05/12/2023)

The US$150 million Seabridge Gold Inc. will receive from this deal will be used to finish physical work at the site that Kozak expects "will support Seabridge achieving the "substantially started" project designation well before the July 2026 date required by the B.C. government to keep its Environmental Assessment Certificate (EAC) valid for the life of the project," noted a May 12, Cantor Fitzgerald report.

Streetwise Reports (05/03/2023)

Seabridge Gold Inc. says joint venture discussions with larger companies have "taken on a new life."

Research Report

Lucas Pipes (05/02/2023)

This mining firm advanced this project, "in a league of its own," to the "substantially started" stage to enhance its attractiveness to prospective players, noted a B. Riley Securities report.

Streetwise Reports (04/04/2023)

Planning is "well advanced" for an "extensive" drill program at Seabridge Gold Inc.'s 100%-owned Iskut property in British Columbia's Golden Triangle.

Streetwise Reports (02/17/2023)

Seabridge Gold Inc. has received the assay results from its limited drill program at its 3 Aces project in Yukon. The company will explore the site deeper this year.

Research Report

Joe Reagor (01/19/2023)

Data from the drill program also suggest a porphyry deposit exists at the property at depth, ROTH Capital Partners wrote in a company update.

Streetwise Reports (01/12/2023)

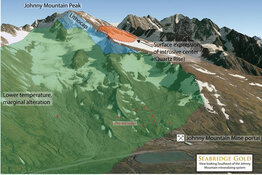

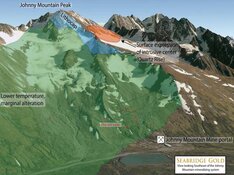

Seabridge Gold Inc. says it has identified a large, mineralized breccia pipe as the source of a major deposit at one of its Golden Triangle projects.

Research Report

Mike Kozak (01/11/2023)

This property, near the company's flagship and one of the world's largest gold-copper projects, returned drill results that warrant following up, noted a Cantor Fitzgerald report.

Research Report

Lucas N. Pipes (12/19/2022)

The company's Q3/22 performance along with mine plan and gold resource revisions drove the target price increase, noted a B Riley Securities report.

Streetwise Reports (12/15/2022)

Seabridge Gold Inc. sees a net profit in the third quarter as it continues to advance its flagship KSM project in British Columbia's Golden Triangle and drill at its 3 Aces project in the Yukon Territory.

Streetwise Reports (10/21/2022)

Seabridge Gold Inc. has received its permit and started drilling at its 3 Aces project in the Yukon. It plans to expand its exploration of the site in 2023.

Streetwise Reports (09/07/2022)

One analyst says the work Seabridge Gold Inc. is putting in to get a permanent environmental certification could help it attract a large-tier partner in British Columbia’s Golden Triangle.

Research Report

Mike Kozak (08/30/2022)

A project site visit revealed the explorer is working to achieve this goal, necessary for an environmental certificate extension, Cantor Fitzgerald noted in a report.

Research Report

Joe Reagor (08/17/2022)

The new figure takes into account recently determined economics and upside of the world's largest undeveloped gold project along with future precious metals prices, noted a ROTH Capital Partners report.

Research Report

David Talbot (08/04/2022)

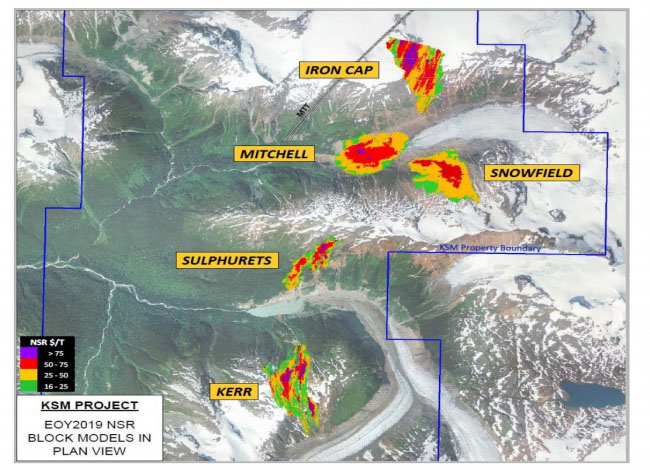

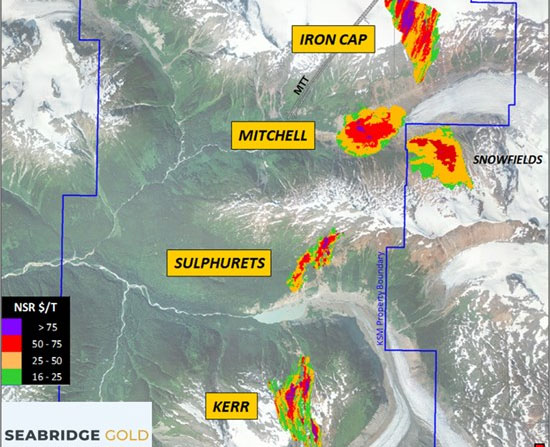

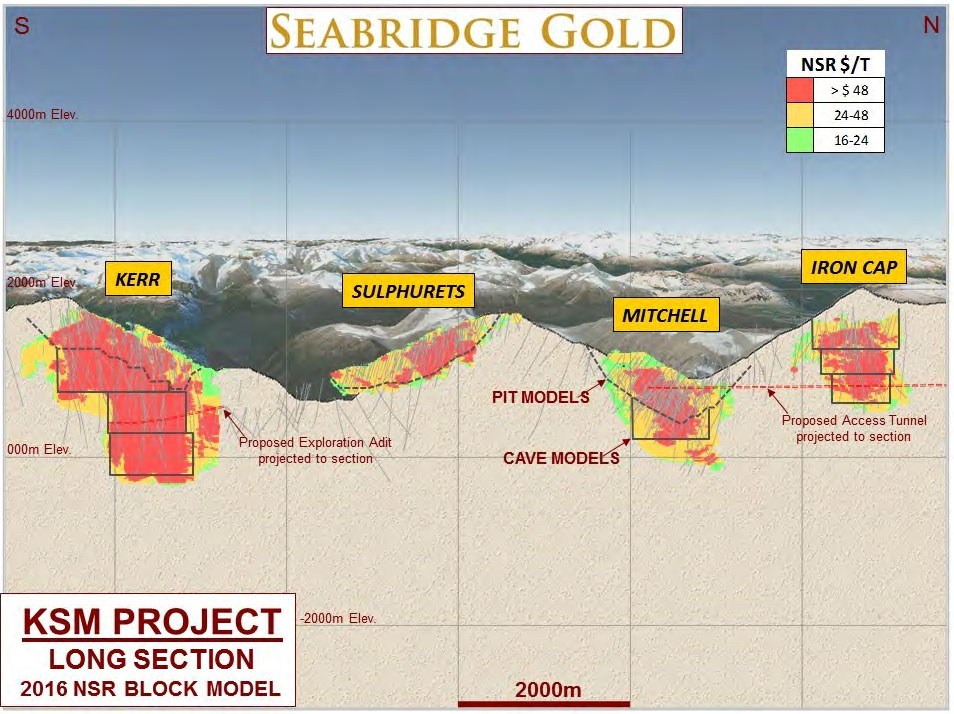

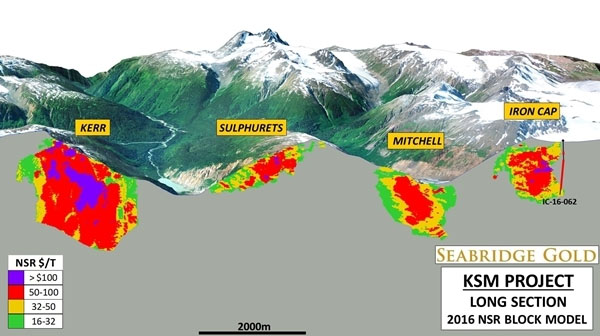

Seabridge Gold Inc.'s copper-rich expansion at its KSM project in the Golden Triangle gets one analyst to raise his target price for the company.

Analyst Update

Streetwise Reports (08/04/2022)

This junior releases a preliminary economic assessment focusing on new copper-rich deposits on its massive KSM site in the Golden Triangle.

Streetwise Reports (07/13/2022)

A simpler open-pit only mine plan for Seabridge Gold’s massive KSM copper-gold project in northern B.C. could attract a joint-venture partner. But it might not be the company you think.

Research Report

(05/06/2022)

The study is expected to reflect improved project economics, afforded by updated resources and synergies between the incorporated deposits, noted a Singular Research report.

Research Report

(04/22/2022)

This development-stage mining company upgraded the mineral resources for two deposits at its B.C. project, noted a Red Cloud Securities report.

Research Report

Streetwise Reports (04/20/2022)

The upgrading of resources from Inferred to Measured and Indicated "should allow the company to demonstrate improved economics compared to [its] previous prefeasibility study," noted a ROTH Capital Partners report.

Research Report

Streetwise Reports (04/18/2022)

"Contained metal on a gold equivalent basis increased by 8.4% over the previous 2020 resource estimate," noted a Cantor Fitzgerald report.

Streetwise Reports (03/05/2022)

Given current geopolitical conflicts and rising inflation, investors should put their capital in precious and base metals as they are excellent stores of value during times like this, Ross Beaty said at a March 2022 mining industry event.

Research Report

Streetwise Reports (03/04/2022)

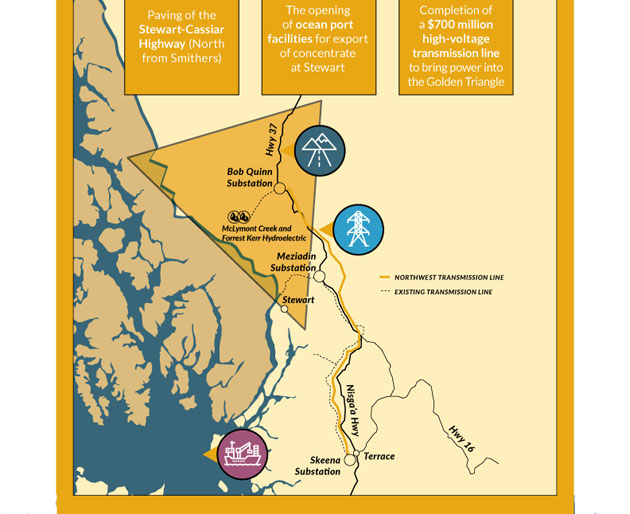

With a recent agreement for greener electricity, this company has abandoned its previous plan to use diesel-generated power for its mining project, noted a Red Cloud Securities report.

Research Report

(03/02/2022)

A gold mining company enters into two agreements for funding and power, helping to advance and de-risk one of its projects, noted a ROTH Capital Partners report.

Research Report

(02/08/2022)

Seabridge Gold recently announced drill results from nine holes at its KSM property in British Columbia. ROTH Capital Partners noted in a research note that the company intends to complete a new PFS for the project that could prove to be a strong future catalyst for the company. ROTH Capital Partners currently has a "Buy" rating and US$27 price target for Seabridge Gold.

Research Report

Streetwise Reports (11/16/2021)

"A joint venture partnership would arguably be the single largest and most important derisking event in Seabridge Gold's history and as such, the upside ahead of a partnering event is potentially massive," noted a Cantor Fitzgerald report.

Streetwise Reports (06/08/2021)

In this broadcast, host Cyndi Edwards interviewed metals expert Matt Badiali who discussed a gold company he is watching that is also a green energy play.

read more >

Research Report

Streetwise Reports (04/08/2021)

The potential benefits of Snowfield on Seabridge Gold's KSM project are discussed in a Singular Research report.

read more >

Streetwise Reports (01/08/2021)

In a StreetSmart Live! Broadcast on Jan. 7, Rick Rule of Sprott Inc. and Rudi Fronk, chairman and CEO of Seabridge Gold, address the future of the gold price and precious metals assets and discuss Seabridge, its Snowfield acquisition and its KSM project.

read more >

News Update

News Update

Streetwise Reports (12/21/2020)

Through the transaction, Pretium Resources improves its balance sheet and Seabridge Gold gains mineral resources.

read more >

Research Report

Streetwise Reports (12/14/2020)

The transaction details and benefits to acquirer Seabridge Gold are discussed in a Canaccord Genuity report.

read more >

Contributed Opinion

Chris Temple for Streetwise Reports (12/14/2020)

Chris Temple, editor and publisher of The National Investor, outlines his investment thesis for Seabridge Gold.

read more >

News Update

News Update

Streetwise Reports (12/07/2020)

Pretium Resources agrees to sell Snowfield to Seabridge Gold.

read more >

News Update

News Update

Streetwise Reports (11/16/2020)

Seabridge Gold reported net income of CA$5.0 million in Q3/20 and ended the quarter with one of the strongest working capital positions in its 21-year history.

read more >

Research Report

Streetwise Reports (11/16/2020)

These factors, positively impacting Seabridge Gold, are reviewed in a ROTH Capital Partners report.

read more >

News Update

News Update

Streetwise Reports (11/12/2020)

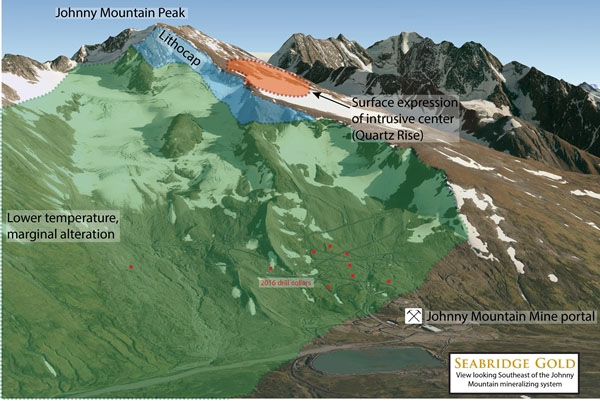

Seabridge Gold reported that its 2020 drill program identified a potentially large gold-copper porphyry system at its Iskut project located near Stewart, British Columbia.

read more >

News Update

News Update

Streetwise Reports (08/06/2020)

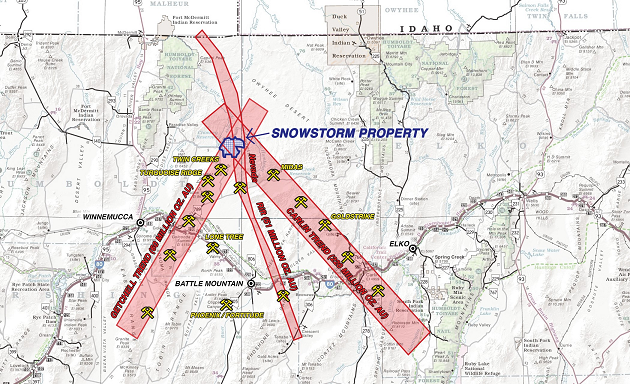

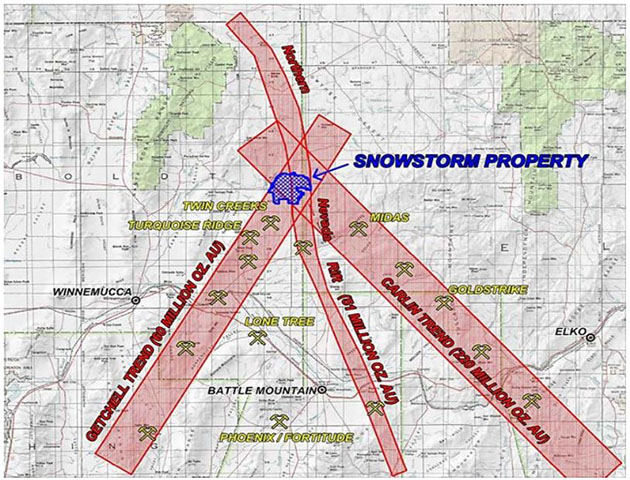

With the drill bit, Seabridge Gold intends to follow up on confirmed host stratigraphy and test new structures at its Snowstorm property.

read more >

News Update

News Update

Streetwise Reports (07/18/2020)

Seabridge Gold is testing for a gold-copper porphyry mineral system similar to its KSM project.

read more >

News Update

News Update

Streetwise Reports (07/13/2020)

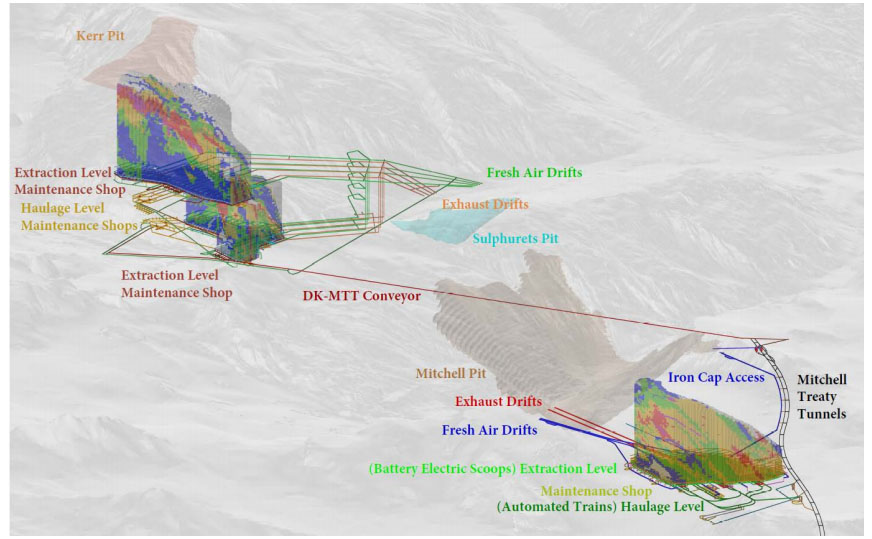

Seabridge Gold will carry out geotechnical drilling in the proposed area for the tunnel that will connect the mine and mill at its KSM gold-copper project.

read more >

News Update

News Update

Streetwise Reports (05/28/2020)

Seabridge Gold intends to initiate data collection and analysis on this orogenic gold asset.

read more >

News Update

News Update

Streetwise Reports (05/20/2020)

Seabridge Gold's goal is to determine if the Iskut property contains a copper-gold porphyry system.

read more >

News Update

News Update

Streetwise Reports (04/28/2020)

Seabridge Gold compares the new and previous values for its flagship project in British Columbia.

read more >

News Update

News Update

Streetwise Reports (03/31/2020)

Seabridge Gold will start work on the project with a review of historical data.

read more >

News Update

News Update

Streetwise Reports (03/26/2020)

Seabridge Gold reports that it expects the technical report update on one of its B.C. projects to be completed as scheduled, in 30–45 days.

read more >

News Update

News Update

Streetwise Reports (01/30/2020)

The company makes the changes to manage its "broad and responsible approach to advancing projects with community support."

read more >

News Update

News Update

Streetwise Reports (01/24/2020)

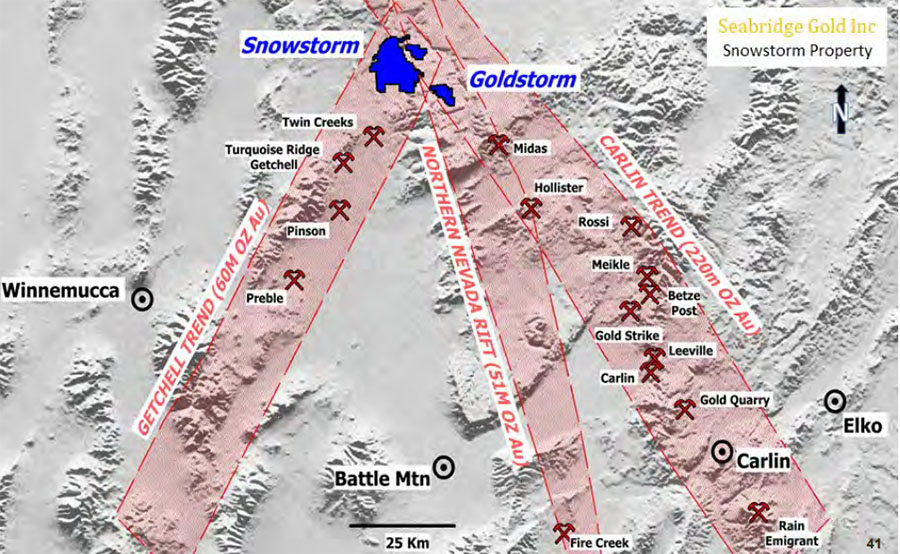

Company has noted that drilling has confirmed the presence of structures and stratigraphy similar to neighboring Turquoise Ridge and Twin Creeks gold mines.

read more >

News Update

News Update

Streetwise Reports (12/19/2019)

The firm states the new targets could "contribute to the multi-generational life" of the district.

read more >

Streetwise Reports (11/18/2019)

Over the past 20 years, this company's shares have outperformed gold by more than five to one.

read more >

News Update

News Update

Streetwise Reports (10/21/2019)

The company is now planning a drill campaign there.

read more >

News Update

News Update

Streetwise Reports (09/02/2019)

The transaction enhances the company's existing nearby project, where maiden drilling recently started.

read more >

News Update

News Update

Streetwise Reports (08/29/2019)

The purpose of the work is to build a high-grade resource there.

read more >

News Update

News Update

Streetwise Reports (08/16/2019)

The Canadian company is testing for the presence of Getchell-style, high-grade gold there.

read more >

News Update

News Update

Streetwise Reports (06/19/2019)

The goal now is to understand the entire project and its potential.

read more >

News Update

News Update

Streetwise Reports (06/13/2019)

Company is in the final stages of determining drill targets.

read more >

News Update

News Update

Streetwise Reports (06/11/2019)

The document serves as the foundation for a continuing partnership.

read more >

News Update

News Update

Streetwise Reports (06/06/2019)

The transaction will enhance this company's nearby existing project.

read more >

News Update

News Update

Streetwise Reports (03/13/2019)

The company noted that the results justify moving the deposit into an early position in the British Columbia's project's mining sequence.

read more >

Streetwise Reports (01/10/2019)

Discoveries, 2019 exploration plans and financings fill the agenda for this gold explorer/developer that has the attention of numerous analysts.

read more >

Research Report

Streetwise Reports (11/03/2018)

A ROTH Capital Partners report discussed the new drill results.

read more >

News Update

News Update

Streetwise Reports (09/25/2018)

After delays caused by adverse weather and fires, the company announced that its summer program is meeting its objectives.

read more >

News Update

News Update

Streetwise Reports (08/22/2018)

The drill program confirms the presence of a gold-bearing system.

read more >

Research Report

Streetwise Reports (08/14/2018)

A ROTH Capital Partners report relayed the key points from the company's quarterly update.

read more >

News Update

Streetwise Reports (06/13/2018)

Exploration is set to begin at a recently acquired Nevada gold project.

read more >

News Update

Streetwise Reports (06/07/2018)

Drilling at KSM has begun and several more rigs are expected to come online as well.

read more >

Streetwise Reports (05/15/2018)

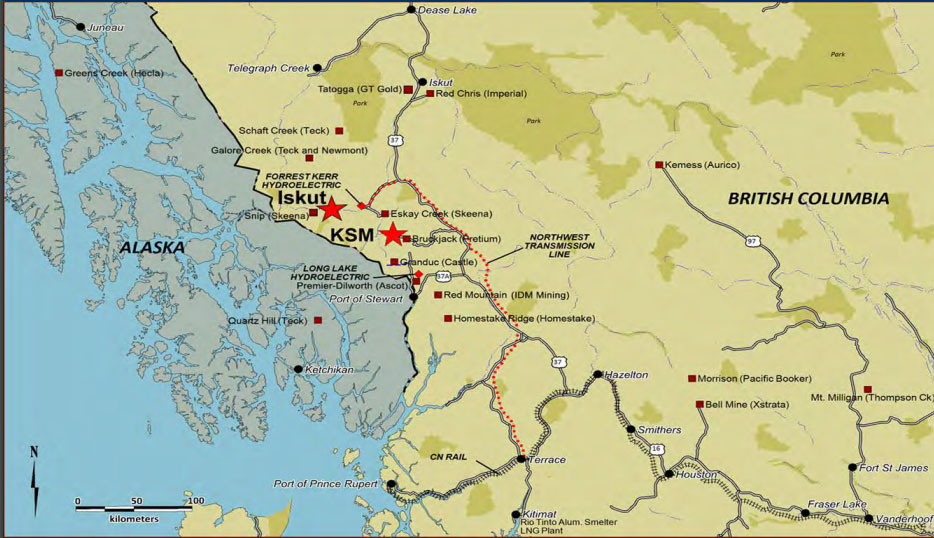

Once seen as remote, British Columbia's Golden Triangle has opened up dramatically, with two mines now in production, three new hydro-power facilities, a link to the provincial power grid, and roads throughout the region. Lawrence Roulston, managing director of WestBay Capital Advisors, discusses the changing mining landscape there and profiles a number of companies exploring that highly prospective region.

read more >

Contributed Opinion

Rick Mills for Streetwise Reports (05/07/2018)

Rick Mills, founder of Ahead of the Herd, discusses the Golden Triangle region of northwest BC and some junior companies gearing up to explore new and existing targets.

read more >

Streetwise Reports (03/08/2018)

This company had news on two fronts: drilling at its Northwest Territories deposit could change the economics of that project while a massive increase in its resource in its British Columbia project could be the catalyst that brings a major partner to the table, according to industry analysts.

read more >

Streetwise Reports (12/07/2017)

With an advanced project being looked at by potential partners and a newer project producing precious metal results, several analysts rate this precious metals explorer a "Buy."

read more >

Research Report

Streetwise Reports (09/12/2017)

Tony Lesiak, a Canaccord Genuity analyst, reported and analyzed recent results from this miner's 2017 deep drill program.

read more >

Streetwise Reports (08/24/2017)

A site visit to a copper-gold project in northern British Columbia has two analysts speaking highly of this exploration company.

read more >

Streetwise Reports (07/03/2017)

As this gold explorer expands its base into Nevada by acquiring the Snowstorm property from John Paulson, it also moves forward with exploration and permitting at its KSM project in northwestern British Columbia.

read more >

Source:

The Gold Report (03/23/2017)

Seabridge's Iskut project has the potential to be another success story like its flagship, 100%-owned KSM project.

read more >

Source: The Gold Report (02/23/2017)

Seabridge Gold's recent announcement of an increased resource estimate at its KSM project caught the attention of one analyst, and follows another announcement that the company intends to purchase a project that potentially intersects three of Nevada's well-known gold trends.

read more >

Source: The Gold Report (10/27/2016)

Calling the new preliminary economic assessment for Seabridge Gold's KSM "a big improvement for a unique massive Au-Cu project," Paradigm Capital believes the company will continue to build value for investors.

read more >

Managment Q&A: View from the Top

Source: The Gold Report (08/04/2016)

Seabridge Gold hosts one of the world's largest gold resources, offering shareholders exceptional leverage to a rising gold price. Chairman and CEO Rudi Fronk explains his company's value-enhancing strategy of obtaining resources at low cost and spinning them into gold.

read more >

Source: The Gold Report (07/05/2016)

Seabridge closed on its SnipGold acquisition last week in British Columbia's "Golden Triangle," a transaction that Canaccord Genuity says has potential for a large impact.

read more >

Source: Brian Sylvester of The Gold Report (12/07/2015)

Amid a tempestuous year for the U.S. dollar gold price, gold has quietly moved up about 6% in Canadian dollar terms, squarely placing the focus on gold producers with Canadian operations that generate cash flow, says Ryan Hanley, mining analyst with Mackie Research Capital.

read more >

Managment Q&A: View from the Top

Source: Kevin Michael Grace of The Gold Report (11/05/2015)

With Proven and Probable reserves of 38 million ounces of gold and 10 billion pounds of copper, the potential of Seabridge Gold's KSM project in British Columbia has long been sky-high. In this interview, Chairman/CEO Rudi Fronk explains that his company has always maximized its leverage to the price of gold.

read more >