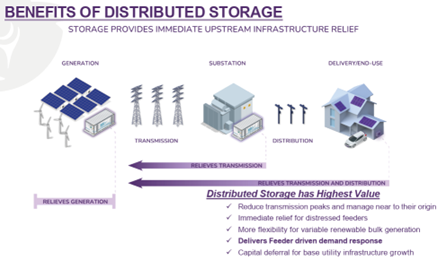

In the fast-evolving world of clean energy, one small company is quietly positioning itself to address a major challenge facing utilities across North America: an aging power grid struggling to keep pace with rising electricity demand from electric vehicles, data centers, and renewable energy integration.

This story is not about mining rare metals or drilling for oil. It is about smart technology that stores energy in homes and businesses, turning them into flexible assets that help stabilize the grid.

Enter Eguana Technologies Inc. (EGT:TSX.V; EGTYF:OTC), a Calgary-based developer of residential and small-commercial energy storage systems.

About the Company

Founded in 1999 and headquartered in Calgary, Eguana Technologies designs advanced battery systems for homes and small commercial buildings. These systems store electricity from solar panels or the grid and deliver it back when needed, whether during power outages or periods of peak demand.

What sets Eguana apart is that it does not stop at selling hardware. The company also develops the software that allows utilities to network thousands of batteries into coordinated fleets, commonly referred to as virtual power plants.

In simple terms, instead of relying on one large power plant to respond to demand spikes, utilities can draw power from hundreds or thousands of smaller batteries spread across their service area. According to the company's November 2025 investor presentation, Eguana has already deployed thousands of systems across North America, Australia, and Europe, and designs and manufactures its products in North America.

What Makes the Company Special?

Eguana's most important differentiator is its direct integration into utility systems.

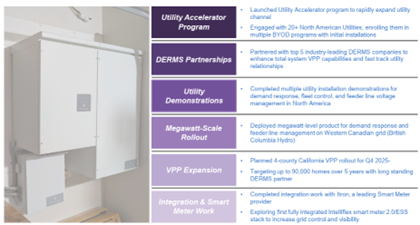

The company has partnered with Itron, one of the world's largest smart-meter manufacturers, with more than 60% market share in North America. Together, they have developed what is described as the industry's first fully integrated smart-meter and battery system.

This matters because smart meters are already installed in millions of homes. By integrating battery storage directly with the meter, utilities gain real-time visibility and control over energy use at the grid edge without relying on third-party communication layers.

The system uses open standards, allowing secure and flexible control while meeting utility-grade requirements. A California investor-owned utility is currently testing the technology, and the solution is being marketed to additional utilities under a co-marketing agreement.

In parallel, Eguana is rolling out virtual power plant programs in British Columbia, Nova Scotia, Vermont, Oregon, California, and Hawaii. One British Columbia project involved a one-megawatt deployment across two feeder lines, making it one of the largest targeted feeder-relief projects in North America.

These deployments demonstrate how distributed batteries can defer expensive infrastructure upgrades while improving reliability for homeowners.

Simplifying Eguana: A Power Storage for the Modern Grid

At its core, Eguana designs battery systems that store electricity and release it when needed. Think of it as a highly efficient backup generator for your home that also helps utilities manage peak demand without building new power lines or substations.

What began as a focus on reliable backup power has evolved into a broader strategy aimed at modernizing the “grid edge,” the point where electricity meets homes and businesses.

Eguana's systems are vertically integrated, meaning the company controls both the hardware and the software that networks batteries into fleets. This allows utilities to remotely manage groups of batteries, creating virtual power plants that can respond to grid needs in real time.

As global electricity demand is expected to rise sharply over the coming decades, and traditional infrastructure struggles to keep up, Eguana's technology offers a faster and more cost-effective solution. The company manufactures in North America, emphasizing reliability and compliance with local standards.

The Standout Project: Smart-Meter Integration and VPP Rollouts

Eguana's integration with smart meters remains its most compelling strategic advantage.

In partnership with Itron, the company has created a combined smart-meter and battery platform using open standards such as IEEE 2030.5, enabling secure, real-time control at the grid edge. The system is currently being tested with a major California utility and promoted to others.

Beyond this, Eguana is actively deploying virtual power plant programs across multiple jurisdictions. A megawatt-scale deployment with BC Hydro demonstrates how fleets of Eguana batteries can manage demand response, shift electricity use to off-peak hours, and relieve congested feeder lines.

A planned expansion across four California counties could reach up to 90,000 homes over five years through a long-term Distributed Energy Resource Management System partner. Eguana is also integrated with all five leading DERMS providers, strengthening its position in utility procurement processes.

The market opportunity is substantial. The U.S. Department of Energy projects 137 gigawatts of distributed storage by 2030, representing a US$250 billion market growing at more than 16 percent annually. Eguana's focus on utility-owned and bring-your-own-device programs positions it to capture a meaningful share of this growth, particularly as utilities face multi-year delays for traditional equipment.

Management Team

Eguana's leadership team combines technical depth with operational experience, a critical mix in the regulated energy sector.

Justin Holland, Chief Executive Officer, brings more than 30 years of experience in operations and supply-chain management, with senior roles at Pepsi Canada, General Mills, Apotex, and Christie Digital.

Brent Harris, Chief Operating Officer and founder, is the inventor behind Eguana's core technologies. A Queen's University applied science graduate, he began his career as an instrumentation engineer on international oil and gas projects.

Neil D'Souza, Vice President of Engineering, has more than 20 years of experience across energy storage, renewables, telecommunications, and grid infrastructure. He holds a master's degree in electrical engineering from Concordia University and an MBA from the University of Calgary.

The board adds further depth, including Chairman George Powlick, a venture capitalist with experience at Intel and Astanor Ventures; Karen Hayward, a marketing strategist and author; and Michael Carten, an energy finance veteran with experience at Nesbitt Burns and Bennett Jones.

The company has also secured partnerships with organizations such as Mercedes-Benz, Duracell, and Itochu Corporation, which owns approximately 24.4% of the company.

Market Capitalization and Share Structure

As of February 6, 2026, Eguana Technologies has a market capitalization of approximately CA$7.7 million, based on a current share price of CA$0.10.

The company has approximately 45.2 million shares outstanding, with a fully diluted count of roughly 48.2 million shares. Itochu Corporation is the largest shareholder at 24.4%, providing strategic backing. Insider ownership remains modest.

The balance sheet includes secured debt and convertible debentures, which introduce dilution risk but also reflect continued creditor and partner support during a difficult period for clean-energy equities.

Milestone's

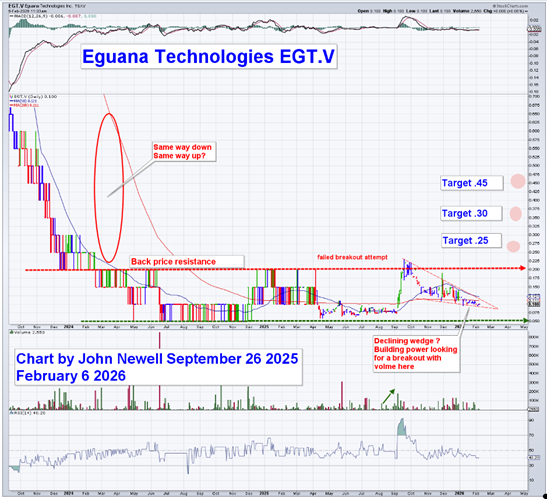

Technical Analysis: Basing Action After a Full Cycle Decline

The updated chart shows that EGT.V has completed a full downside cycle and is now working through a prolonged basing process following a steep and largely uninterrupted decline. This type of move is typical of small-cap clean-energy names that lost institutional sponsorship as capital exited the sector. That phase now appears complete.

Over recent months, price action has compressed into a much narrower range, volatility has declined, and downside momentum has slowed materially. The stock is no longer making lower lows, and the declining trendline from the 2024 highs is beginning to flatten. Together, these features suggest selling pressure has largely been exhausted, and the shares have transitioned from distribution into stabilization.

A key technical feature remains former price support turned resistance in the CA$0.18–CA$0.20 zone. This level rejected the most recent rally attempt and continues to represent the primary overhead supply area. A decisive reclaim of this zone would be required to confirm a broader structural trend change.

The most recent price action also suggests the shares may be forming a declining wedge, a pattern that often precedes a trend reversal when confirmed by expanding volume. While trading remains thin, volume has begun to improve modestly during rally attempts, an early indication that demand may be starting to return.

Should a breakout occur, the CA$0.18–$0.20 level remains the first major test. A successful move through this area would materially improve the technical picture. Using the prior decline as a reference, upside technical objectives could then emerge in stages, with potential targets in the CA$0.25, CA$0.30, and CA$0.45 range if momentum and participation continue to build.

Until such confirmation occurs, this should be viewed as an early-stage basing and accumulation setup, not a confirmed breakout. Thin liquidity increases risk but also creates the potential for sharp percentage moves if volume returns.

Conclusion

Eguana Technologies Inc. represents a Speculative Buy at its current share price of CA$0.10.

With proven technology, deep utility integration, and exposure to a rapidly growing energy-storage market, the company offers asymmetric upside tied to grid modernization. Risks remain, including execution timing, competition from larger players, balance-sheet complexity, and thin trading liquidity.

For investors comfortable with micro-cap risk, Eguana is the type of under-the-radar opportunity that can deliver meaningful upside if adoption accelerates.

Additional information is available at the company's website.

| Want to be the first to know about interesting Special Situations and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Eguana Technologies Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000. In addition, Eguana Technologies Inc. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Eguana Technologies Inc.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.