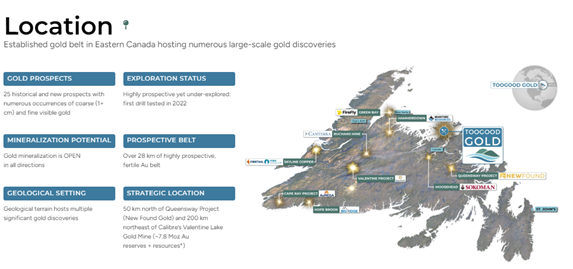

Toogood Gold Corp. (TGC:TSVX; TGGCF:OTCQB) is advancing a high-grade gold exploration story in Newfoundland that has quietly matured from early discovery into a growing, district-scale opportunity.

Anchored by the Quinlan Gold Discovery and strengthened by recent strategic land consolidation, the company controls a large, highly prospective land package in one of Canada's most mining-friendly jurisdictions.

What differentiates Toogood at this stage is not just grade, but continuity, scale, and the growing number of discovery vectors now being defined across the broader property. In a market increasingly focused on quality ounces and credible geological systems, Toogood is positioning itself as a high-grade exploration company with multiple paths to value creation.

About the Company

Toogood Gold is a Newfoundland-focused exploration company with a clear mandate: advance high-grade gold discoveries in a Tier-1 jurisdiction using systematic drilling, modern geophysics, and disciplined land consolidation.

The company's flagship Toogood Gold Project now covers approximately 164 km², hosting more than 28 kilometres of highly prospective gold trends along and adjacent to major regional structures.

Since its first drill campaign in 2022, Toogood has steadily transitioned from proof-of-concept exploration to defining a coherent gold system with demonstrated continuity and expansion potential.

Quinlan Gold Discovery, Newfoundland

The Quinlan Gold Discovery is the clear value driver for Toogood Gold. First drill-tested in 2022, Quinlan delivered a high-grade, near-surface gold discovery that immediately stood out for visible gold, continuity, and structural control. Early results included intercepts such as 23.90 g/t Au over 3.65 metres, 18.27 g/t Au over 4.25 metres, and 9.40 g/t Au over 3.18 metres, confirming the presence of a robust high-grade system from the outset.

Follow-up drilling in 2025 significantly advanced the story. A 2,000-metre, 33-hole drill program was completed safely, on time, and on budget, with every hole intersecting gold-bearing mineralization. Visible gold has now been logged in 25 of 49 drill holes completed at Quinlan to date, an unusually high ratio that speaks to system continuity rather than isolated high-grade shoots.

Importantly, drilling has expanded the known mineralized footprint substantially. The drill-defined strike length has increased by approximately 75% to ~350 metres, while down-dip continuity has doubled to roughly 240 metres, with mineralization remaining open in all directions. Deep-penetrating ground-penetrating radar (DGPR) has imaged the mineralized felsic dyke at depth and under cover, suggesting continuity well beyond the limits of current drilling.

Beyond Quinlan itself, the company has also identified a new prospective corridor along the Mélange Contact, where all three first-pass drill holes intersected gold-bearing mineralization. This development supports the interpretation of a broader district-scale gold system rather than a single isolated discovery.

Management

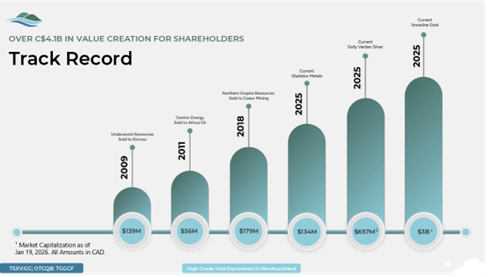

Toogood Gold is led by a management team with a strong technical foundation and practical experience in advancing exploration-stage assets. The team has demonstrated a disciplined approach to drilling, land acquisition, and capital deployment, prioritizing geological understanding and continuity over promotional activity.

Management's execution to date is evident in the steady expansion of the Quinlan discovery, the efficient completion of drill programs, and the strategic acquisition of the Golden Nugget Property in 2025. This acquisition added more than 12 kilometres of fertile gold trend, consolidating contiguous ground and increasing the company's control over the broader mineralized corridor

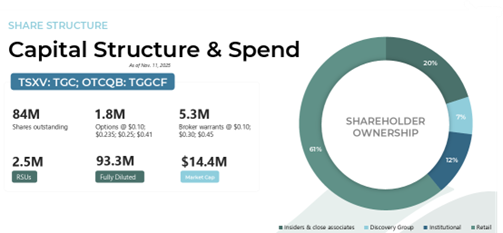

Market Capitalization and Share Structure

At recent trading levels near CA$0.12, Toogood Gold Corp. carries an approximate market capitalization of CA$14.4 million, based on 84 million shares outstanding. On a fully diluted basis, the company has approximately 93.3 million shares, reflecting a capital structure that remains reasonable for a discovery-stage exploration company.

For a company that has already delivered a drill-confirmed high-grade gold discovery at Quinlan and continues to demonstrate continuity along strike and at depth, the current valuation appears to reflect early-stage status rather than a lack of geological substance. The market capitalization remains modest relative to the scale of the land position and the growing body of technical evidence supporting a meaningful gold system.

The share structure itself is straightforward. As of November 11, 2025, Toogood has approximately 1.8 million options, 5.3 million broker warrants, and 2.5 million RSUs outstanding, with exercise prices spread across multiple levels. Insider and close-associate ownership remains meaningful, aligning management interests with shareholders and reinforcing a long-term value creation approach.

Overall, the capital structure preserves leverage to exploration success while avoiding excessive dilution. With a fully diluted valuation that remains modest compared to peers at a similar stage of discovery, Toogood Gold is positioned to benefit materially from continued drilling success and incremental market recognition as the Quinlan project advances.

Technical Analysis

From a technical standpoint, Toogood Gold Corp. appears to be completing a prolonged corrective phase following its strong 2024 advance. After peaking near the CA$0.45 area, the stock entered a deep but orderly retracement that has now evolved into a multi-month basing structure.

The chart shows price holding above a well-defined support zone in the CA$0.14–0.15 range, an area that has repeatedly attracted buying interest. Recent trading around CA$0.16–0.17 suggests stabilization and the early stages of accumulation, rather than continued distribution. This basing action has occurred on declining volume, a constructive sign that selling pressure has largely been exhausted.

Momentum indicators are turning supportive. RSI has recovered from oversold conditions and is now trending higher, while MACD is flattening and beginning to curl upward, consistent with a transition from correction to basing. The overall price structure resembles a rounded bottom following a sharp prior move, a pattern frequently observed ahead of renewed advances in junior exploration stocks when fundamentals remain intact.

From a resistance perspective, the CA$0.20–0.21 area, near the rising 200-day moving average, represents the first key technical hurdle. A sustained move above this level would serve as confirmation that the base has resolved to the upside.

If that breakout occurs, the chart defines a clear upside roadmap. Initial resistance sits near CA$0.24, followed by higher targets at approximately CA$0.33 and CA$0.45, corresponding to prior congestion zones and the 2024 highs. Achieving these levels would likely require continued exploration success at Quinlan and improving sentiment toward junior gold explorers, but the technical structure now supports that possibility.

In short, the chart has shifted from corrective to constructive. The longer Toogood Gold continues to hold above the mid-teens and build volume through the base, the more meaningful any upside resolution is likely to be.

Conclusion: Speculative Buy

Toogood Gold Corp. has evolved into a credible high-grade gold exploration story anchored by the Quinlan Gold Discovery and supported by a growing district-scale land position in Newfoundland. Drill results to date confirm continuity, expanding scale, and multiple discovery vectors, while geophysics and step-out drilling suggest the system extends well beyond current limits.

At a current share price of approximately CA$0.16, Toogood Gold remains firmly in the speculative category. Continued drilling success at Quinlan, results from regional targets such as the Mélange Contact corridor, and ongoing work at the Golden Nugget Property represent meaningful catalysts over the next exploration cycle.

For investors who understand the risks associated with junior exploration, managed by proven exploration geologists and successful mining entrepreneurs, Toogood Gold Corp. is considered a Speculative Buy, offering leverage to high-grade discovery potential in a Tier-1 jurisdiction.

Additional information on the company and its projects can be found at:

https://toogoodgoldcorp.com

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of TooGood Gold Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.