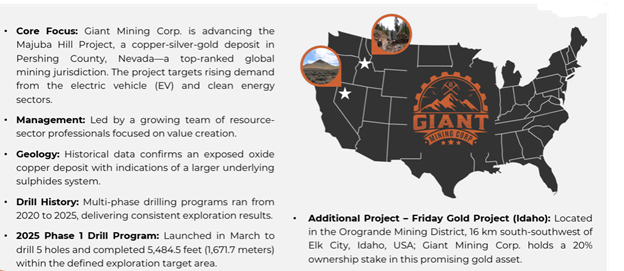

Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) is a U.S.-focused copper exploration company listed on the CSE, with its primary asset being the Majuba Hill Copper Project in Nevada.

The company has spent several years methodically advancing this project through drilling, geophysics, and geological modeling, steadily building a large technical dataset while operating in one of the most mining-friendly jurisdictions in the world.

What makes Giant Mining interesting at this stage is not just the copper exposure, but the timing. The company is positioned at the intersection of rising copper demand, renewed U.S. strategic interest in domestic metals supply, and a share price that appears to be emerging from a prolonged base.

The Project That Can Move the Needle

Majuba Hill is a large, porphyry-style copper system located in Pershing County, Nevada, roughly 70 miles southwest of Winnemucca. The project benefits from excellent infrastructure, road access, nearby power, and a long history of mining activity.

Historic underground production at Majuba Hill dates back to the early 1900s and includes copper, silver, gold, and tin. Importantly, this past production came from high-grade zones near surface, while modern drilling has increasingly pointed to the presence of a much larger underlying system.

Over multiple drill campaigns from 2020 through 2025, Giant Mining has completed more than 100 drill holes totaling over 80,000 feet of drilling. Recent programs have focused on expanding known copper mineralization, testing deeper sulphide targets, and following up on resistivity anomalies generated through modern geophysics and AI-assisted targeting.

The current technical work suggests Majuba Hill has the scale potential investors look for in a porphyry system. While still at the exploration stage, success here would be meaningful relative to the company's current market capitalization.

Where Project Vault Fits In

Project Vault, the newly announced U.S. strategic critical minerals reserve, is not a subsidy program or a fast track to production. But it does matter.

At its core, Project Vault signals that the U.S. government is now treating copper and other critical metals as strategic assets, similar in concept to how oil has been treated through the Strategic Petroleum Reserve. The intent is to reduce reliance on foreign supply chains, particularly from jurisdictions that dominate global processing and supply.

For companies exploring copper in the United States, this policy shift improves the long-term backdrop. It increases the strategic value of domestic projects, supports capital formation in U.S. jurisdictions, and reinforces the idea that future copper supply will need to come from stable, politically aligned regions.

Majuba Hill fits squarely within that framework. It is not about immediate government funding, but about positioning. Over time, projects like this tend to attract greater interest from majors, strategic investors, and potential partners as the policy environment evolves.

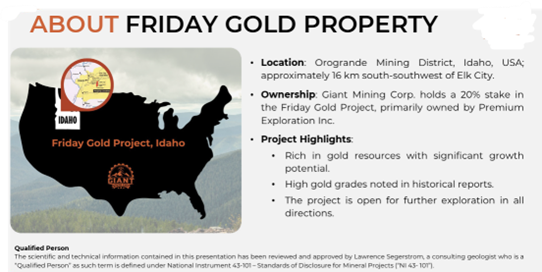

Friday Gold Project, Idaho

In addition to Majuba Hill, Giant Mining Corp. holds a 20% ownership interest in the Friday Gold Project, located in the Orogrande Mining District of Idaho, approximately 16 kilometres south-southwest of Elk City. The project is situated in a historically productive gold camp and hosts a historical NI 43-101 mineral resource estimate totaling more than 1.2 million ounces of gold across indicated and inferred categories at grades near 1.0 g/t gold, based on a 2013 technical report.

While Giant Mining is not the operator and Friday Gold is not the company's primary focus, the interest provides meaningful optionality and exposure to gold alongside the company's core copper strategy. For investors, the project represents additional upside that is largely not reflected in the company's current market capitalization, while allowing management to remain focused on advancing Majuba Hill.

Management and Advisors

Giant Mining Corp. is led by a management team that combines capital markets experience with deep technical and operational expertise in copper exploration and development.

David Greenway, CEO and Director, brings more than 20 years of experience in building, financing, and advancing public companies, with a strong emphasis on the resource sector. Over his career, Greenway has been involved in structuring financings, guiding companies through multiple market cycles, and advancing assets from early-stage exploration through value-creation milestones. His background is particularly relevant for a company like Giant Mining, where disciplined capital allocation, strategic messaging, and long-term vision are required to advance a large copper system through successive stages of technical de-risking.

The company's financial oversight is led by Natasha Doe, BCom, CPA, Chief Financial Officer. Doe holds dual CPA designations in Canada and Australia and has more than a decade of experience in senior finance roles across mining, retail, and technology sectors. Her background includes financial reporting, internal controls, and public company compliance, providing Giant Mining with the financial discipline required as it advances Majuba Hill through ongoing exploration and potential future development stages.

The board of directors adds additional depth, particularly in legal, technical, and strategic oversight.

Bradley J. Dixon, B.Sc., JD, Director, is a partner at Givens Pursley LLP and serves as co-chair of the firm's litigation group. With over 20 years of experience in complex commercial litigation, Dixon brings valuable expertise in regulatory, land tenure, permitting, and natural resource–related legal matters. His background is particularly relevant for U.S.-based projects operating on federal and private lands, where legal clarity and permitting strategy can materially impact project timelines and valuation.

Larry Segerstrom, MSc., MBA, Director, is a bilingual professional engineer and geologist with more than 38 years of experience spanning technical, operational, and business roles in the mining industry. Segerstrom has been directly involved in the discovery and advancement of numerous porphyry copper-gold projects and is widely respected as a Qualified Person under NI 43-101. His combination of deep geological knowledge and project-level experience provides critical technical oversight as Majuba Hill is advanced toward potential resource definition.

Giant Mining is further supported by a seasoned advisory board with a strong track record in copper and gold discovery.

Leo Hathaway, B.Sc., M.Sc., Advisory Board member, is a distinguished economic geologist with experience ranging from grassroots exploration through feasibility-stage development. He currently serves as Senior Vice President of Lumina Gold Corp. and has held senior leadership roles, including Chief Geological Officer of Lumina Copper Corp and Vice President of Exploration for Northern Peru Copper Corp, Regalito Copper Corp, Global Copper Corp, and Lumina Resources Corp. Hathaway's career includes extensive work with Inmet Mining across Europe, Australia, Central America, and South America. He is also a former partner at Lumina Capital LP, giving him a rare blend of technical and investment perspective.

John Ryan, B.S., JD, Advisory Board member, brings more than two decades of experience as an entrepreneur and mining engineer in the resource sector. He has served as an officer and director of several mining companies, including Bunker Hill Mining, Premium Exploration, Cadence Resources, High Plains Uranium, U.S. Silver Corporation, and Western Goldfields, Inc. Ryan's experience across both operating and capital markets roles adds practical insight as Giant Mining advances its projects in the United States.

Taken together, Giant Mining's management, board, and advisory team provide a balanced mix of capital markets experience, technical depth, and U.S.-focused operational knowledge, which is essential for advancing a large-scale copper project in a disciplined and credible manner.

Share Capitalization

From a capital structure standpoint, Giant Mining has approximately 105 million shares outstanding and roughly 123.4 million shares fully diluted, based on the most recent disclosure.

At recent prices, this places the company in the sub-CA$30 million market capitalization range, which is modest for a Nevada-based copper exploration story with this level of technical work completed.

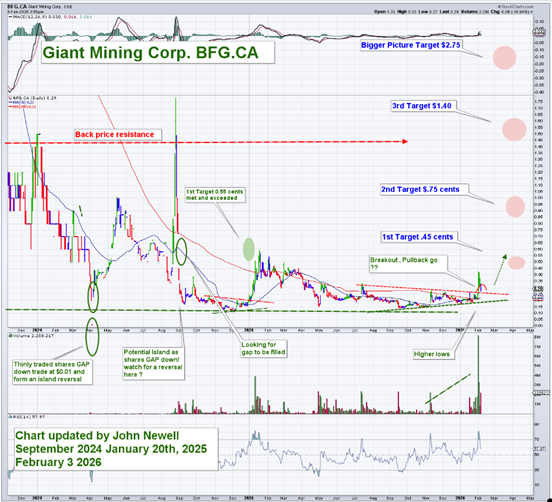

Technical Analysis: An Early Turn After a Long Base

The updated chart tells an important story.

After a sharp move higher in 2024 that carried the shares to a peak near CA$1.78, Giant Mining spent much of 2025 correcting and consolidating. That correction was painful, but it also served a purpose. The stock worked off excess, built a base, and began forming a series of higher lows into late 2025 and early 2026.

On the current chart, price appears to be breaking out of a triangle pattern over the descending trendline, supported by improving volume and momentum. The first technical target, at approximately CA$0.45, has been identified as initial resistance. A move through that level opens the door to a second target near CA$0.75, followed by a third target around CA$1.40 if momentum can accelerate.

On a bigger-picture basis, a successful breakout and continuation could ultimately support a longer-term target near CA$2.75, which would still be consistent with prior trading history and comparable moves seen in other copper explorers at similar stages.

As always, technical targets are not predictions, but they do provide a framework for risk and reward.

Conclusion: A Speculative Copper Opportunity in the Right Place

Giant Mining Corp. is not a story built on headlines. It is built on geology, jurisdiction, and patience.

The Majuba Hill Project offers scale potential in a proven mining state, at a time when copper is increasingly viewed as a strategic metal by policymakers, manufacturers, and investors. Project Vault reinforces that narrative without needing to be over-interpreted.

With a strong and improving technical chart, an active exploration program, and a market capitalization that still reflects skepticism rather than success, Giant Mining Corp. remains a speculative buy at the current level of CA$0.30

More information can be found on the company's website.

Investors may also wish to review my previous Streetwise Reports articles on Giant Mining Corp.

| Want to be the first to know about interesting Copper and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Giant Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.