Streamex Corp. (STEX:NASDAQ) is attempting something ambitious but timely: building institutional-grade infrastructure that allows real-world commodity assets, starting with gold, to move on-chain in a regulated, yield-bearing format.

The company was formerly known as BioSig Technologies, Inc. and completed its name change to Streamex Corp. in September 2025, signaling a strategic pivot toward tokenization and digital commodity markets.

Unlike many early blockchain ventures, Streamex is not positioning itself as a consumer app or speculative crypto project. The company is focused on institutional clients, accredited investors, and regulated capital markets, with an emphasis on compliance, custody, and infrastructure.

Its core thesis is straightforward: trillions of dollars in commodity value remain trapped in inefficient structures, and tokenization offers a cleaner, more flexible way to unlock liquidity, yield, and transparency.

About the Company

Streamex Corp. is a vertically integrated technology and infrastructure company focused on the tokenization of real-world assets. The platform is designed to bring traditional commodities on-chain through secure, regulated, and yield-bearing financial instruments that can be accessed by institutional investors.

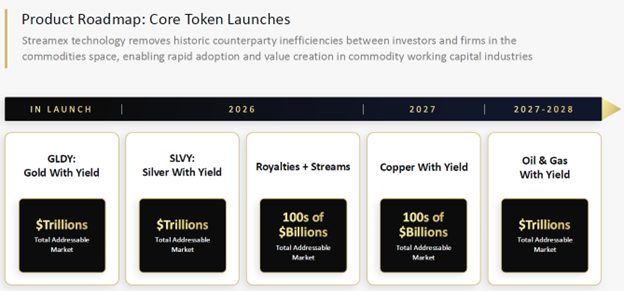

Gold is the initial focus, but the longer-term roadmap extends into silver, royalties and streams, copper, and oil and gas. Management's view is that tokenization is not about replacing physical commodities, but about modernizing how they are financed, owned, and traded. The company's approach emphasizes regulatory alignment, audited reserves, institutional custody, and transparent price discovery.

According to the January 2026 corporate presentation, Streamex is building what it describes as institutional-grade tokenization infrastructure, capable of supporting large-scale issuance, secondary trading, and integration with existing financial products

Why GLDY Changes the Economics of Gold Ownership

For decades, gold has served as a monetary hedge and store of value, but it has carried a structural disadvantage for institutional investors: it does not yield. Physical bullion incurs storage and insurance costs, while gold ETFs charge annual fees and still offer no income. In an environment defined by rising sovereign debt, persistent inflation risk, and weakening real yields, that limitation has become increasingly problematic.

This is the gap Streamex Corp. is targeting with its flagship product, GLDY.

GLDY is designed to combine direct exposure to physical gold with an annualized yield, paid in additional gold rather than fiat currency. Each GLDY token represents a non-voting interest in a special purpose vehicle that holds allocated physical gold, typically one troy ounce per token. That gold is leased through established Monetary Metals programs to commercial users, generating yield that accrues back to token holders in the form of additional GLDY.

The result is a gold-backed instrument that behaves less like a traditional commodity holding and more like a productive monetary asset.

From an economic standpoint, this is a meaningful shift. GLDY allows investors to maintain exposure to gold prices while earning a targeted yield of approximately 4%, without the storage, security, or carry costs associated with bullion, and without the management expense drag of ETFs. In contrast, large gold ETFs typically charge annual fees of roughly 0.40% and provide no income.

Equally important is how this structure scales for Streamex. The company operates a largely fixed-cost model built around software, compliance, custody, and administration. As gold prices rise, assets under management increase automatically, fee revenue grows, and the value of the gold-denominated yield rises in U.S. dollar terms, while operating costs remain relatively stable. In effect, higher gold prices improve platform efficiency and expand margins.

This creates a form of embedded operating leverage that is uncommon in traditional precious metals exposure and more reminiscent of streaming, royalty, or exchange-based business models.

GLDY is offered exclusively to accredited and institutional investors and is fully KYC-compliant. It is structured as a regulated security rather than a retail stablecoin, aligning it with evolving U.S. regulatory frameworks around real-world asset tokenization. That distinction is critical for institutions that require compliance, transparency, and audited reserves before allocating capital.

While adoption remains early and distribution is still limited, that is precisely what defines the opportunity. As institutions increasingly seek yield-bearing alternatives to non-productive bullion in an inflationary, high-debt global environment, GLDY represents a new category of gold ownership that addresses a long-standing structural flaw in the market.

In that context, Streamex is not merely tokenizing gold. It is changing how gold functions within an institutional portfolio.

The Initiative that could move the Market Capitalization

The flagship initiative that could materially change Streamex's valuation is GLDY, a physical gold-backed, yield-bearing token. GLDY is structured as a regulated security available to accredited investors, with each token representing one fine troy ounce of physical gold.

Unlike traditional gold ETFs or vaulted bullion, GLDY is designed to generate yield through gold leasing, with returns paid in additional gold.

This is an important distinction. Most gold investment products provide price exposure but no income. GLDY is structured to offer both spot gold exposure and an annualized yield, currently guided at up to 4%, paid in gold rather than cash. Management positions this as a fundamentally different value proposition for investors who want to hold gold as a monetary asset but are also sensitive to opportunity cost.

The pre-sale for GLDY began in November 2025, with an initial issuance target of US$100 million. Non-binding indications of interest reportedly exceeded US$100 million, and Streamex has committed a minimum of US$5 million of its own capital to the launch. The company expects the first closing and token issuance in the first quarter of 2026.

If GLDY gains traction, it establishes a recurring fee and yield-capture model for Streamex that scales with both assets under tokenization and secondary market trading volume. Management materials outline long-dated net present value scenarios that grow meaningfully as issuance and trading activity increase, underscoring why this product is viewed internally as the foundation of a much larger platform.

Management and Advisors

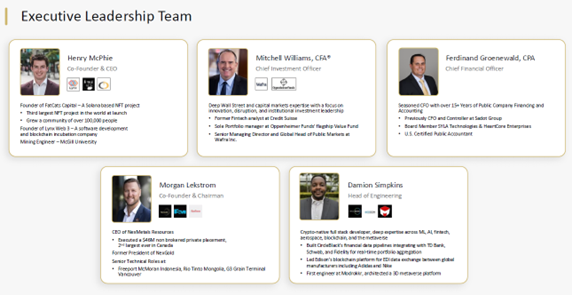

Streamex's leadership team blends capital markets experience, commodity expertise, and blockchain engineering.

The company is led by co-founder and CEO Henry McPhie, a mining engineer by training with experience building and scaling digital assets and blockchain-based platforms. Chief Investment Officer Mitchell Williams, CFA, brings deep institutional experience from Credit Suisse, Oppenheimer Funds, and Wafra, where he served as Global Head of Public Markets. The board is chaired by Morgan Lekstrom, a resource executive with experience executing large financings and operating in complex commodity environments.

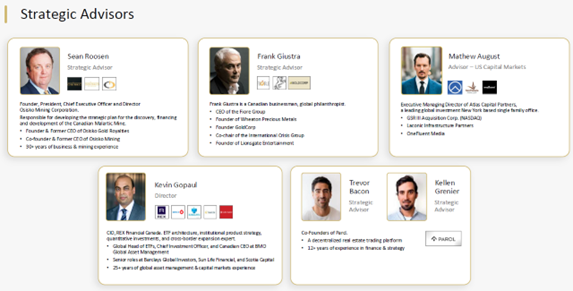

The advisory bench is unusually strong for a company at this stage. Strategic advisors include Sean Roosen, founder and CEO of Osisko Mining, and Frank Giustra, founder of Wheaton Precious Metals and Goldcorp. Their involvement does not guarantee success, but it does add credibility and industry context as Streamex attempts to bridge traditional commodity markets and digital finance.

Market Capitalization and Share Structure

At approximately US$3.30 per share, Streamex trades at a market capitalization that reflects early-stage execution risk but also optionality. The company is still in the transition phase, moving from development into initial commercialization, and revenues from GLDY and future tokenized products have yet to be fully realized.

Investors should view the current valuation through a venture-style lens rather than near-term earnings metrics. The key variables to monitor over the next 6 to 12 months are successful completion of the GLDY launch, regulatory clarity, asset growth under tokenization, and early indications of secondary market liquidity. Positive execution on any of these fronts could materially change how the market values the platform.

Technical Analysis

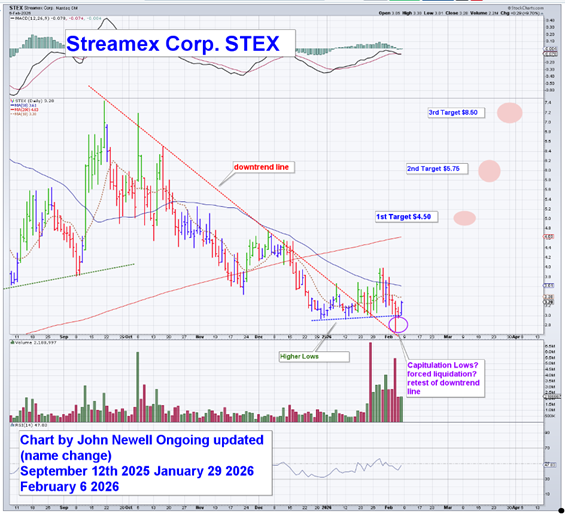

The chart for Streamex Corp. shows a stock that has already completed its initial breakout phase and is now consolidating in a well-defined structure above support.

Following the advance into the US$4.50 area, which marked the first upside target, the shares entered a corrective phase that developed along a clearly defined descending trendline. This pullback was orderly and occurred on declining volume, a pattern typically associated with consolidation rather than distribution.

Recent price action shows higher lows forming in the US$3.00–US$3.30 range, suggesting downside momentum has been arrested, and a base is taking shape. The brief flush into early February, accompanied by a spike in volume, appears consistent with capitulation or forced liquidation, followed by a successful retest of the lower boundary of the base and the underside of the prior downtrend line.

This behavior strengthens the interpretation that selling pressure has been largely absorbed. The US$3.00–US$3.30 zone now represents near-term support, reinforced by prior price congestion and moving average interaction.

The stock is currently trading just below short-term resistance defined by the descending trendline and nearby moving averages. A sustained move above this resistance would signal a transition from consolidation to a renewed uptrend.

Based on the width of the prior advance and the structure of the current base, the chart supports an upside target of US$5.75, followed by a longer-term target near US$8.50 if momentum accelerates and volume expands.

Momentum indicators are stabilizing near neutral levels, suggesting selling pressure has been absorbed, and the risk profile is improving. From a technical standpoint, Streamex appears to be building a base above support, with clearly defined risk and favorable upside asymmetry should a breakout occur.

Conclusion

Streamex Corp. sits at the intersection of gold, institutional finance, and tokenization. The company is early, execution risk is real, and regulatory complexity should not be underestimated. That said, the prize is large. A functioning, regulated, yield-bearing gold token has the potential to disrupt a portion of a market measured in the trillions of dollars.

At approximately US$3.30 per share, Streamex offers speculative exposure to that upside with a defined product roadmap and a management team that understands both commodities and capital markets. For investors comfortable with early-stage platform risk and interested in the evolution of real-world asset tokenization, Streamex Corp. is considered a Speculative Buy at current levels.

Additional information can be found on the company's website.

| Want to be the first to know about interesting Gold and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Streamex Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.