At the dawn of the new year, I prophesied in Disruption Investor: "2026 will be the year investors cease appraising Tesla Inc. (TSLA:NASDAQ) as a mere 'automaker'... and commence valuing it as an energy and robotics enterprise."

Just days ago, Elon Musk essentially validated that metamorphosis.

Tesla unveiled intentions to halt fabrication of the legacy Model S and Model X, the duo of vehicles that signified its inaugural foray into mass production. Those assembly lines aren't being decommissioned. They're being redeployed. Tesla is transforming them to construct "Cybercabs" and to amplify manufacturing of Optimus, its anthropomorphic automaton.

Musk is pivoting away from crafting automobiles and toward engineering autonomous systems. As investors commence grasping Tesla's new identity as a robotics firm, I forecast Tesla's shares will surge twofold in 2026.

Mere weeks prior, a Tesla proprietor…

Accomplished the inaugural fully autonomous coast-to-coast expedition. He voyaged 2,700 miles from LA to South Carolina. For a trio of days uninterrupted, the vehicle parked, recharged, and navigated autonomously. No mortal intervention required.

Enter the epoch of autonomy.

Tesla's full self-driving (FSD) 14.2 is a minimum of 2X more secure than human operators. Hence, Tesla's scheme to proffer a novel breed of insurance acknowledges this disparity. Miles traversed in FSD mode will be half the cost of human-piloted miles. Tesla lately divulged that active FSD subscriptions have just surpassed 1.1 million. Until recently, these capabilities were solely accessible to Tesla owners.

Now, Tesla robotaxis are permeating the mainstream. Tesla debuted its "Waymo rival" in Austin this past summer. When RiskHedge publisher Dan Steinhart and I visited, we observed the robotaxis discreetly roaming about. Now they're cruising the Bay Area too, with approximately 100 Tesla robotaxis zipping from Sunnyvale to San Francisco.

Anticipate Tesla launching robotaxis in no less than six US metropolises this year. Tesla is also gearing up to unveil its Cybercab robotaxi—devoid of steering wheel or pedals—for under $30,000. Elon Musk recently affirmed Cybercab production will commence in April. I'll take a pair, if you please!

Robotaxis are essentially airborne drones, aka robots, on wheels.

They perceive their environs. They decipher data instantaneously. They formulate autonomous judgments. And they traverse physical terrain sans human guidance.

The solitary distinction is the form factor.

Rather than soaring through the skies like a drone or ambulating on two appendages like a humanoid robot, they glide on four wheels through urban byways.

That alone renders Tesla the preeminent robotics and automation enterprise worldwide today.

It commands millions of autonomous machines operating in authentic settings. They've accrued billions of miles on communal roads: in inclement weather… across construction zones… alongside erratic drivers… and during unforeseen scenarios no lab can replicate.

And vitally, Tesla employs a unified software stack. Every enhancement propagates across the entire fleet simultaneously. A solitary update instructs every car how to better detect a child disembarking a curb. How to converge into traffic unhesitatingly. And how to reroute instantaneously when a thoroughfare is obstructed. No conventional robotics company functions in this manner. Most robotics firms train systems in narrow, foreseeable settings. Envision factories, warehouses, or geofenced pilots. Tesla trains in the wild. Every mile driven is a live experiment. This is why robotaxis matter more than almost anything else Tesla is building. Once full autonomy functions dependably in one city, it can be scaled to dozens more at the press of a button.

Going "all in" on energy is classic Elon.

Ahead of the curve once again. Elon brought electric vehicles (EV) to the mainstream over a decade ago when nobody else was doing it.

Now EV sales are slumping, with the fewest EVs sold in America since 2022.

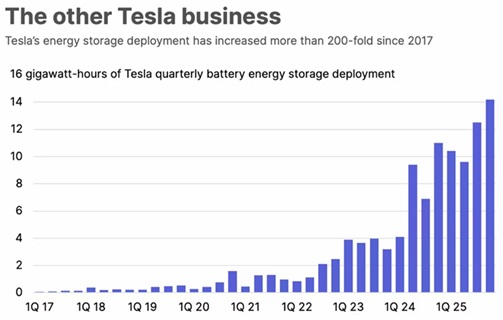

That's why Tesla is going "all in" on energy systems, with sales tripling in the past few years.

Batteries are now Tesla's fastest-growing business. This includes "Megapack," a container-sized battery designed for utilities… and "Powerwall," a home battery system.

I'm less bullish on Optimus, Tesla's humanoid robot.

General-purpose humanoids are likely years away from being cheap, useful, and scalable. They're also the wrong form factor for most real-world jobs. Specialized robots already dominate Tesla's factories. They're faster, cheaper, and more efficient than any humanoid could be in the near term. None of this really matters for the stock. Elon Musk is exceptional at pulling future value into the present. Tesla stock soared for years before the company was meaningfully profitable in EVs. The hype around Optimus will result in the same. It doesn't matter whether they're ready or not. As excitement around humanoid robots builds, Tesla will be the only major public company investors can buy to express that belief. It's the clearest, most liquid proxy for the entire robotics narrative.

I expect Tesla—which we called an "absolute steal" in Disruption Investor last April—to break into the world's five most valuable companies in 2026. It currently sits at #9. If you don't own it already, buy Tesla stock today. The recent dip is a huge buying opportunity.

I write about disruptor stocks like TSLA in my free investing letter, The Jolt. It goes out on Mondays and Fridays. Go here to if you’d like to join today.

| If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing. | Go here to join |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tesla Inc.

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.