Most junior mining stories ask investors to wait. Wait for drilling. Wait for a discovery. Wait for permits. Wait for financing. What makes this situation different is that the first value driver is not a drill bit, but cash flow, and exploration comes second, funded internally rather than by dilution.

ESGold Corp. (ESAU:CSE; ESAUF:OTCQB; Z7D:FSE) is advancing a past-producing gold and silver asset in Québec with a rare combination of attributes: a fully permitted, low-capex tailings reprocessing operation already under construction, paired with district-scale exploration potential that has never been tested with modern geological tools.

This is not a Greenfields gamble. It is a clean-up and restart story with meaningful upside if exploration delivers.

Why This Matters Economically

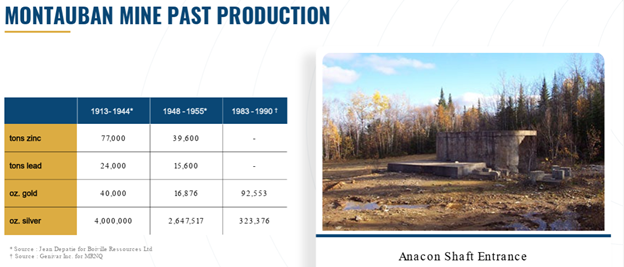

The Montauban mining camp produced for decades, yet it shut down for economic reasons, not geological ones. Historic operators focused on lead and zinc, with gold and silver treated largely as by-products. When gold prices collapsed in the late 1980s, the mine closed despite leaving substantial value behind.

Today, ESGold's strategy is simple and capital-efficient. Historic tailings sitting on surface are reprocessed to generate near-term revenue while simultaneously addressing a legacy environmental liability. That cash flow is then redirected into systematic exploration across a large, contiguous land package in one of the world's most mining-friendly jurisdictions.

The result is a dual-track model that bypasses the traditional Lassonde Curve dip, allowing exploration to be funded internally rather than through repeated equity raises.

The One Project that could Move the Market Capitalization

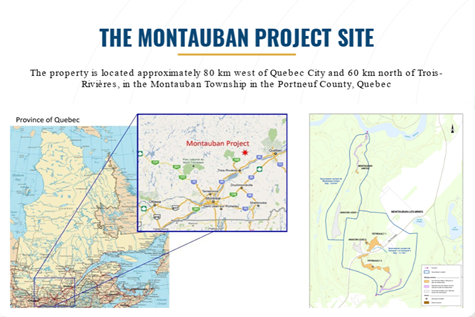

The Montauban Project, located roughly 80 kilometres west of Québec City, is the engine of the entire investment thesis. Infrastructure is already in place: road access, low-cost hydroelectric power, a completed 20,000-square-foot milling facility, and all major permits required to begin processing tailings.

The initial phase focuses on reprocessing multiple historic tailings piles located directly within the town of Notre-Dame-de-Montauban. These tailings are well defined, drilled, and modeled, with a published PEA outlining gold, silver, and mica recoveries at operating costs that are exceptionally low by industry standards.

What elevates Montauban beyond a simple tailings story is the exploration potential. Ambient Noise Tomography and VTEM geophysics have identified vertically extensive structures down to approximately 1,200 metres, far deeper than any historic mining ever tested.

The geological model now emerging points toward a stacked, multi-lens VMS system, comparable in style to Broken Hill-type deposits. This reinterpretation is supported by modern 3D modeling that integrates historic workings, surface data, tailings, and deep geophysical responses, something previous operators never had the tools to do

In short, Montauban offers near-term cash flow and long-term discovery optionality on the same property.

Management: Built for Execution, Not Promotion

Execution matters when moving from construction to production, and ESGold's management team reflects that focus.

Chief Executive Officer Gordon Robb leads the company with a clear mandate: get the mill operating, generate revenue, and then scale exploration responsibly. Chief Operating Officer Paul Mastantuono, the project's founder, brings more than 15 years of hands-on experience at Montauban, providing continuity and deep operational knowledge.

On the technical side, director and geologist André Gauthier has been instrumental in advancing the modern exploration thesis, including the application of Ambient Noise Tomography and 3D geological modeling. The broader team includes seasoned engineers and financial leadership with direct experience in permitting, construction, and mine operations in Québec. This is a group focused on delivery rather than storytelling.

Market Capitalization and Share Structure

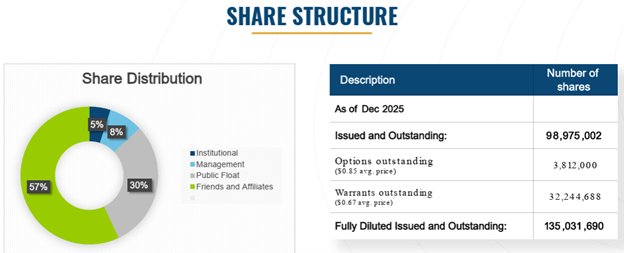

As of December 2025, ESGold Corp. has approximately 99.0 million shares outstanding, with a fully diluted count of roughly 135.0 million shares. Importantly, a significant portion of the stock is held by management, friends and affiliates, and long-term supporters, with institutional ownership beginning to emerge.

This structure reflects a company that was bootstrapped for years before attracting broader market attention. With construction largely complete and funding in place, the risk profile is now shifting from financing to execution.

Technical Analysis: The Market Is Starting to Agree

From a technical standpoint, ESGold Corp. has completed a long basing phase and is now consolidating within a constructive continuation pattern following a sharp advance.

The chart shows a series of higher lows supported by expanding volume, a classic sign of accumulation rather than distribution. After the initial breakout, shares pulled back in an orderly fashion and found support near the 0.618 Fibonacci retracement, a level that often acts as a key decision point during healthy corrections within an emerging uptrend. The stock has since stabilized and begun to turn higher from that area.

Upside targets remain clearly defined at CA$1.40, CA$2.00, and CA$2.25, with a longer-term, big-picture target near CA$3.50 if execution milestones are met and momentum continues to build.

Momentum indicators remain constructive, and price is holding above rising medium-term moving averages, reinforcing the view that pullbacks are being absorbed rather than sold aggressively.

In plain terms, the chart supports the fundamental thesis rather than contradicting it.

Conclusion: A Speculative Buy with a Clear Catalyst Path

ESGold Corp. is not a typical exploration story. It is a near-term producer in the making, with cash flow visibility, infrastructure in place, and a credible path to internally funded exploration.

The combination of ESG-driven tailings remediation, low-cost production, and district-scale discovery potential is unusual in the junior space. While execution risk remains, as it always does, the reward-to-risk profile is compelling at current levels.

For speculative investors who understand the risks inherent in junior mining equities, ESGold Corp. is rated a Speculative Buy at CA$0.77.

More information can be found on the company's website: https://www.esgold.com.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- ESGold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of ESGold Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.