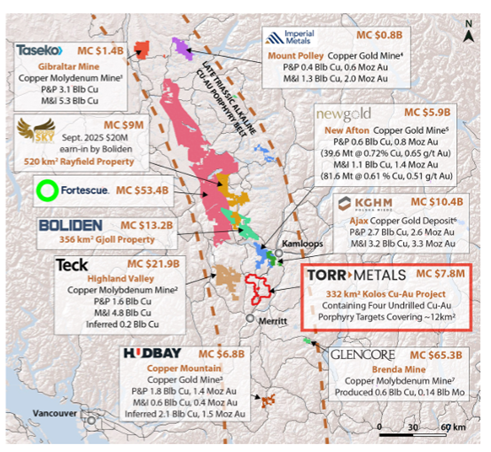

Torr Metals Inc. (TMET:TSX.V) is a junior exploration company focused on copper and gold discoveries in established mining districts with infrastructure, operating mines, and clear strategic relevance to major producers. The company controls three district-scale projects in British Columbia and Ontario, with its current efforts squarely focused on advancing a potential company-making discovery at the Kolos Copper-Gold Project in southern British Columbia.

Torr's strategy is straightforward but disciplined: identify large, underexplored copper-gold systems in proven belts, advance them methodically to drill-ready status, and create discovery leverage in jurisdictions where new deposits are scarce but desperately needed.

That approach is now being tested in real time at Kolos.

The Kolos Copper-Gold Project: A Potential Co. Builder

Kolos is in the Quesnel Trough, Canada's most productive copper belt and host to long-life mines such as Highland Valley, New Afton, Mount Polley, Gibraltar, and Copper Mountain. The project benefits from excellent infrastructure, including direct highway access, power, rail, nearby communities, and proximity to multiple operating mills.

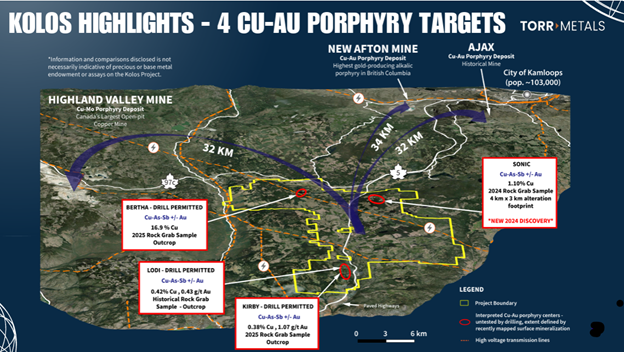

What makes Kolos stand out is not just location, but scale and lack of historical drilling. Despite sitting in the heart of this producing district, Kolos hosts four undrilled copper-gold porphyry targets spread across a 16 km² geochemical footprint, all accessible from Highway 5.

The current focus is the Bertha Target, where Torr completed its first-ever drill program of approximately 2,700 metres, confirming a large, structurally controlled copper-gold-silver system. Drilling intersected broad copper anomalism and alteration consistent with the outer portions of a porphyry system, with vectoring suggesting a potential porphyry core at depth and to the northeast. Importantly, the company is fully funded for a Phase II drill program of up to 6,000 metres planned for 2026.

Beyond Bertha, Kolos hosts additional high-impact targets:

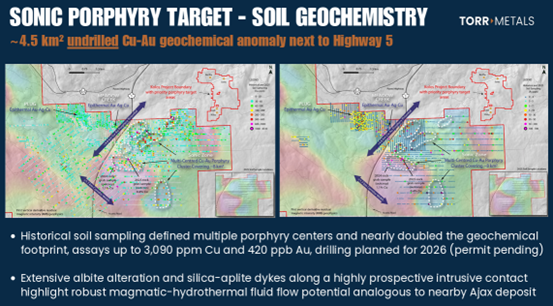

Sonic is a ~8 km² undrilled copper-gold soil anomaly adjacent to Highway 5, with strong geological similarities to the nearby Ajax deposit 24 km to the northeast. Drilling is planned pending permits.

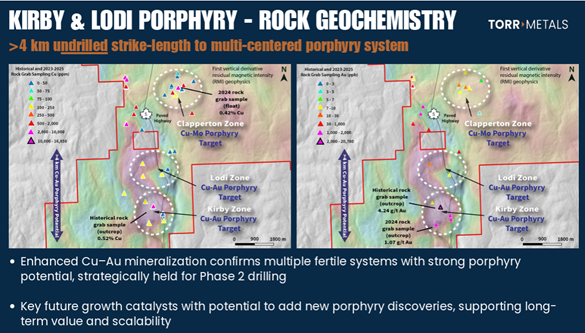

Kirby and Lodi are part of a multi-centre porphyry system with more than 4 km of undrilled strike length, supported by rock geochemistry, soil anomalies, and deep-reaching ZTEM geophysics.

Taken together, Kolos offers both near-term discovery potential and longer-term scalability within a single, consolidated land package.

Portfolio Depth Latham and Filion Add Diversification

While Kolos is clearly the flagship, Torr also maintains meaningful optionality through two additional projects.

The Latham Copper-Gold Project in British Columbia's Golden Triangle provides exposure to one of Canada's most prolific exploration regions. Latham hosts a historical, non-compliant copper resource at its Gnat Pass copper-gold porphyry deposit that remains largely underexplored beyond 200 meters vertical depth, offering longer-term upside should market conditions improve.

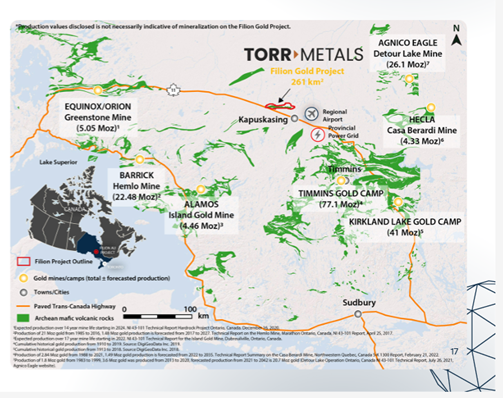

In Ontario, the Filion Gold Project adds a second commodity and geological style to the portfolio. Filion covers a district-scale gold system with year-round access, high-grade historical rock samples up to 91.4 g/t gold, and multiple undrilled targets along a 42 km structure. Only about 17% of the structure has been explored to date, leaving significant room for brand new discovery.

This combination gives Torr flexibility, diversification, and optionality without diluting focus from Kolos.

Management Team

Torr Metals is led by a team with both technical depth and capital markets experience.

Malcolm Dorsey, M.Sc., P.Geo., President & CEO, is an exploration geologist with more than 13 years of experience advancing copper and gold projects across the Americas. Notably, Dorsey completed his Master's thesis on southwest British Columbia, giving him a deep geological understanding of the very belt in which Kolos is located. His career spans major, mid-tier, and junior companies, as well as private project generation, and he has personally been involved in conceptually developing, staking, and advancing Torr's core assets.

John Williamson, P.Geo., Chairman, is a serial mining entrepreneur with over 30 years in the junior mining business. He has founded, financed, and led more than 30 public companies and has been involved in multiple successful discovery and development stories, including Thesis Gold and Benchmark Metals. Williamson's experience in capital markets and company building adds an important layer of strategic oversight.

The board is further strengthened by Gordon Maxwell, P.Geo., former Glencore exploration and business development executive with nearly four decades of global experience, and a supporting team with deep financial and operational expertise.

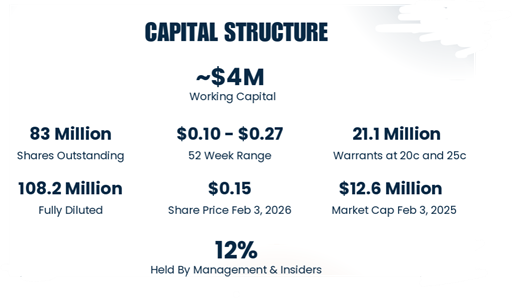

As of early February 2026, Torr has approximately 83 million shares outstanding, about 108 million fully diluted, with insiders and management owning roughly 12% of the company. Working capital is approximately CA$4 million, providing the means to advance its 2026 exploration plans without near-term financing pressure.

Market Capitalization and Share Structure

As of February 3, 2026, Torr Metals is trading at approximately CA$0.155 per share, giving the company a market capitalization of roughly CA$12.6 million based on 83 million shares outstanding. On a fully diluted basis of 108.2 million shares, the valuation remains modest for a company that controls multiple district-scale copper-gold projects in Tier-1 jurisdictions.

Torr also reports approximately CA$4 million in working capital, providing the financial runway to advance follow-up drilling at the Kolos Project through 2026 without immediate dilution pressure. With 21.1 million warrants outstanding at CA$0.20 and CA$0.25, a sustained re-rating could strengthen the balance sheet further while aligning future capital inflows with higher share prices. Management and insiders currently hold approximately 12% of the outstanding shares, maintaining alignment with shareholders as the company moves through its next exploration phase.

Technical Analysis: A Reset within a Developing Uptrend

From a technical standpoint, Torr Metals has already delivered on its initial setup.

The shares reached and exceeded the first technical target at CA$0.145, validating the breakout from the base. During the difficult market conditions of 2024 for junior explorers, the stock corrected sharply but found support at the 0.618 Fibonacci retracement, a level that often marks major corrective lows in emerging trends.

From that level, the chart began to repair itself. Higher lows were established, signaling a developing uptrend. More recently, the shares advanced to and exceeded the second target near CA$0.24, before a sharp gap lower following drill results that the market initially reacted to negatively.

That selloff now appears to have formed an island reversal, a classic technical pattern that often marks panic lows and exhaustion selling. Importantly, the decline once again found support near the 0.618 retracement, reinforcing that level as structural support.

If this interpretation holds, the corrective phase may be complete. The higher targets shown on the chart remain intact, with the mid-range target near CA$0.35 and a larger technical objective near CA$0.48 still valid as long as support continues to hold. As share prices advance, some bigger picture targets can and often reveal themselves later on.

Conclusion

Torr Metals is not a story built on theory alone. It is built on geology, location, and disciplined exploration in one of Canada's most productive copper belts.

With first-ever drilling now complete at Kolos, a fully funded follow-up program planned for 2026, multiple undrilled porphyry targets, and a management team with both technical depth and a history of building exploration and mining companies, Torr offers genuine discovery leverage at a modest valuation.

For investors comfortable with exploration risk and looking for exposure to copper and gold discoveries in proven jurisdictions, Torr Metals remains a speculative buy for discovery focused Investors at current levels of ~CA .155

More information is available on the company's website.

Investors can also read the original November 2025 Streetwise Reports article by John Newell here.

| Want to be the first to know about interesting Copper investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Torr Metals Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Torr Metals Inc.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.