Green Bridge Metals Corp. (GRBM:CSE; GBMCF:OTC; J48:FWB) is a junior exploration company building a North American portfolio around copper, nickel, titanium, vanadium, and associated metals that sit right in the center of electrification and defense supply chain priorities.

The company's approach is straightforward: focus on jurisdictions where infrastructure already exists, and advance projects where there is meaningful historic work and a technical foundation, rather than pure "grass roots" exploration.

What has changed recently is the backdrop in the United States. A more aggressive push to secure domestic critical minerals and improve permitting visibility is starting to matter again, and that policy tailwind is showing up first in districts with existing mining history, roads, rail, and power. Green Bridge's Minnesota foothold in the Duluth Complex is designed for exactly this kind of moment.

About the Company

Green Bridge Metals is a Canada-based explorer with projects in both Canada and the United States, positioning itself as a "critical minerals" vehicle with a copper and nickel core. The pitch is that it is easier to create value when you can start with known mineralization, build toward defined work programs, and keep the focus on derisking steps that matter to the market: drill confirmation, metallurgy, permitting progress, and ultimately economic studies.

That matters because the market has been selective. Companies with clear catalysts and the ability to execute funded programs in Tier One jurisdictions are the ones getting attention first.

Key Property That Could Change the Market Capitalization

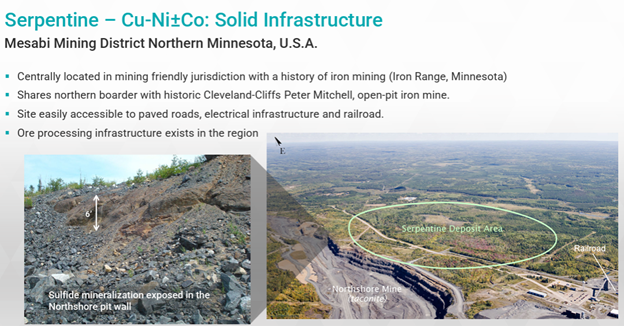

Serpentine Project, Duluth Complex, Minnesota

Serpentine is the cornerstone concept for the company in Minnesota: a large scale magmatic copper nickel sulphide system in a district known for size. The attraction is not just tonnage. It is location.

This part of Minnesota has a long mining history, and the critical advantage for any development story is infrastructure. Serpentine sits in a region with road, rail, and power access, plus an established labor pool, which is exactly what most copper juniors lack when they try to move from "resource" to "real project."

Just as important, the district is already on Washington's radar. Nearby projects have been pulled into federal permitting visibility initiatives, and that creates a stronger argument that Minnesota can matter again for domestic supply chains.

Additional Catalyst Asset in Minnesota

TITAC Project, South Contact District

While Serpentine is the "scale" story, TITAC is increasingly the "news flow" story.

The company has now commenced diamond core drilling at the TITAC Project in Minnesota, targeting copper mineralization associated with the same intrusive package that already hosts a titanium dioxide resource. Management has described this as a systematic copper program, built around historic drilling that intersected copper but was not previously treated as the primary exploration focus.

The Phase 1 plan is six diamond drill holes, roughly 1,800 metres total, designed as a fence across the TITAC South deposit. The company is using modern geophysics and 3D inversions to prioritize targets where conductive and magnetic anomalies overlap, which they interpret as correlating with known mineralization.

This matters because TITAC South hosts an existing published titanium dioxide resource (46.6 million tonnes grading 15% TiO₂), and Green Bridge is now working to demonstrate the copper potential within and around that system.

Management and Technical Team

Green Bridge Metals is led by CEO David Suda, who has emphasized a "known metal" strategy and a North American focus, with the goal of building assets that can be advanced in a disciplined way rather than chasing purely binary exploration outcomes.

The company has also highlighted its technical capacity in Minnesota, which is critical in polymetallic intrusive systems where geology, metallurgy, and permitting details matter as much as the drill holes themselves.

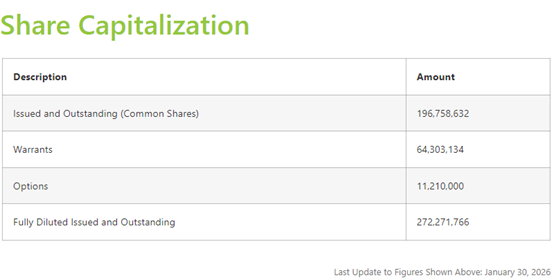

Share Capitalization and Recent Financing

Green Bridge has continued to fund the story, announcing a non-brokered private placement for up to CA$4 million, and then reporting the closing for gross proceeds of CA$4 million.

In a market where many juniors are still starved for capital, that matters because Green Bridge can now execute drills and technical work without immediately having to hit the market again at the first sign of momentum.

Technical Analysis Update: Two Targets Achieved

Green Bridge Metals spent most of 2025 in a corrective base after the 2024 spike. That type of long reset is often what you need before a new upleg can stick. The key technical development now is that the stock has pushed up through the Point of Recognition area and has already met the first two upside objectives at CA$0.20 and CA$0.30. With those levels achieved, the chart is now pointing toward the next logical resistance zone near CA$0.40 as the third target.

From here, the main question is whether the stock can consolidate above the breakout area and build a new platform, rather than giving it back in a straight-up, straight-down junior move. If the company delivers steady drill news flow and the tape stays constructive for copper-linked critical minerals, the chart argues that the next measured move is not fantasy; it is simply the next resistance target on the roadmap.

Conclusion

Green Bridge Metals is starting to check boxes the market tends to reward when it rotates into "development credible" juniors: North American jurisdiction, infrastructure, district-scale targets, active drilling, and a funding runway.

With TITAC drilling underway in Minnesota and the broader U.S. critical minerals policy tone becoming more supportive of domestic supply chains, this has the look of a junior that can stay on the watch list and, if execution continues, potentially graduate into a higher visibility story.

For investors who understand the risks of junior exploration and early-stage development, Green Bridge Metals remains a Speculative Buy, with the technical picture improved after achieving the first two price objectives and the next target zone sitting around CA$0.40, with a bigger picture target emerging if the third target is achieved.

For more information, investors can visit the company website at www.greenbridgemetals.com.

You kind find the first article written can be found here.

| Want to be the first to know about interesting Copper and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Green Bridge Metals Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, between US$3,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Green Bridge Metals Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.