2026 is poised to be a remarkable year for humanity's extra-terrestrial ambitions.

During my recent voyage, I swung by a startup aiming to extract precious metals from asteroids (more on that in a moment).

I also encountered an enterprise synthesizing pharmaceuticals in zero gravity (no joke).

Even one of the co-founders of the stock trading app Robinhood Markets Inc. (HOOD:NASDAQ) has pivoted to a venture beaming solar energy down from the cosmos.

We're merely in the initial phase of erecting space's digital scaffolding.

The majority of space-focused equities currently soaring will likely flame out. After all, succeeding off-world is no cakewalk!

However, a select few trailblazing ventures will undoubtedly make the cut, and those are precisely the ones I'm keen on backing.

- My colleague Dan Steinhart and I recently embarked on a fortnight-long odyssey across the nation…

Engaging with more than 40 pioneering American innovators and thought leaders.

One standout moment was whiling away a Sunday afternoon with Matt Gialich, the founder and CEO of AstroForge, an asteroid mining upstart based in LA.

Inside a cavernous 30,000-square-foot facility in Seal Beach, Matt and his squadron are assembling satellites destined to extract platinum-group metals from space rocks situated 30 million miles from Earth.

It has the ring of science fiction. I can't say with certainty that it will pan out. But I'm enamored with the sheer audacity. This bold vision is only conceivable because the price tag of rocketing into orbit has plummeted.

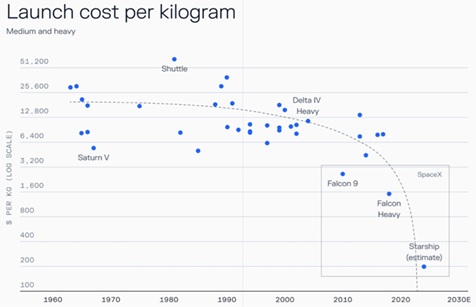

Elon Musk's SpaceX has slashed the cost of breaching Earth's gravity well by a staggering 90% since the turn of the millennium:

Throughout my lifetime, space exploration has been steeped in wistful nostalgia. We gazed back at grainy Apollo mission footage, pondering why we abandoned our celestial pursuits.

The reason? It simply costs too much.

Owing primarily to SpaceX's reusable rocket technology, we're now embarking on space's infrastructure epoch.

- A subtle yet profound shift over the past decade is…

The passing of the baton of frontier innovation from governments to private enterprises. Initiatives that once demanded state backing are now being incubated by corporations.

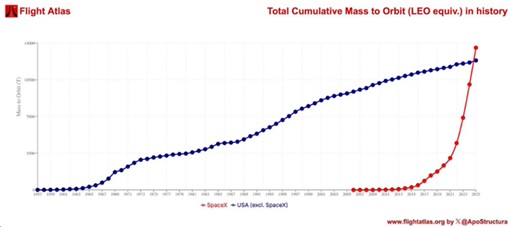

Consider SpaceX as a prime example. It now commands 90% of the orbital launch market. In essence, SpaceX has become the new NASA.

Elon's rocket scientists have propelled more mass into the void since their maiden flight in 2006 than the rest of the US combined throughout its entire history!

SpaceX essentially operates a cosmic shuttle service every few days. Firms eager to set up shop in orbit can hitch a ride on its rockets. Yes, legitimate, profit-generating ventures are being established in space as we speak.

During our stint in Austin, Texas, Dan and I toured Starlink's manufacturing plant. Within its walls, legions of robots churn out 15,000 internet receivers daily.

These Starlink terminals sync up with satellites whizzing overhead, raining down high-speed internet from the heavens.

Half a year ago, while in California, we called on a startup by the name of Varda, which is concocting medicines in microgravity. Freed from the constraints of Earth's pull, Varda can cultivate flawless crystals for drugs like the HIV treatment Ritonavir, a feat that's impossible to replicate on terra firma.

Space startup Muon recently unleashed FireSat, which functions as Earth's thermostat. While existing satellites scan for conflagrations every 12 hours, FireSat does so every 20 minutes—pinpointing wildfires as tiny as a classroom before they spiral out of control.

- One theme I frequently touch on is the "innovation avalanche."

Over the last half-century, technological progress has largely been confined to computers and IT. Now, we're witnessing genuine breakthroughs in the physical realm.

There's no more striking illustration of this pivot than Robinhood co-founder Baiju Bhatt, who transitioned from developing investing apps to satellites. Bhatt's fresh venture, Aetherflux, is engineering satellites to harness solar energy in orbit and beam it back to Earth utilizing infrared lasers.

Even Alphabet Inc. Class A (GOOGL:NASDAQ) declared its intention to erect data centers in space! Your go-to AI, fueled by the sun, 650 km above your noggin.

Again, I can't definitively say if that's a viable business model. But the crux is, for the first time in history, we're observing genuine infrastructure being assembled in space.

Here's my take on investing in the "Space Stack:"

- Tier 0: The tracks. This is SpaceX. It cracked the transportation conundrum. It's the "Union Pacific" of our era.

- Tier 1: The backbone. These are enterprises constructing the warehouses, power grids, and spaceports that rest atop the tracks. This is the investor's "sweet spot" at present.

- Tier 2: The applications. In due course, we'll have data centers and asteroid mines whirling overhead.

Constructing the infrastructure to bring every five-year-old's astronaut fantasies to life is the major moneymaking opportunity of the moment.

- SpaceX is the "FedEx" ferrying cargo to orbit. But it remains a privately-held company… until it goes public later this year.

However, right now, you can invest in the firm that owns the warehouses, the spaceports, and the utilities once you arrive in space.

That's why I'm focusing on the Level 1 companies making space infrastructure possible.

I'll have more to share about today's biggest space disruptors in future issues of The Jolt. If you'd like to follow along with me to learn more about them—and how to invest in them—you can join our mailing list for free.

| If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing. | Go here to join |

Important Disclosures:

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.