Buckle up for the most monumental public offering in financial history!

SpaceX is gearing up to go public in 2026, targeting a jaw-dropping US$1.5 trillion valuation that would eclipse every IPO before it. This announcement has electrified the celestial investment landscape.

Aerospace stocks are skyrocketing:

- Mercury System (MRCY:NASDAQ), specialized in orbital computing hardware, rocketed up 41%

- Firefly Aerospace (FLY:NASDAQ), the pioneering commercial lunar landing outfit, surged 49%

- Space infrastructure player Redwire Corp. (RDW:NYSE)blasted off with a 54% gain

Is humanity's ultimate frontier finally becoming a legitimate investment playground?

For generations, space has been a nostalgic narrative. We'd gaze at grainy Apollo mission footage and wonder why exploration stalled. The brutal answer: astronomical costs.

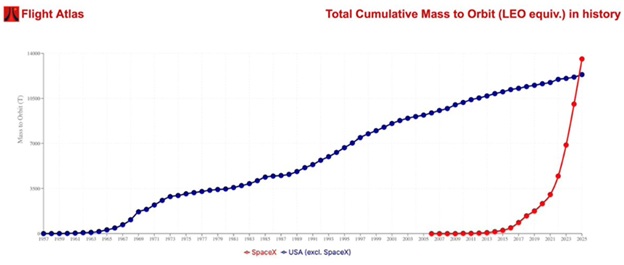

Enter SpaceX's game-changing innovation: reusable rockets that decimated space travel expenses by 95%. Elon Musk's rocket engineers have essentially become the new NASA, launching more mass into orbit since 2006 than the entire United States had accomplished throughout its entire history.

In 2025, SpaceX shattered records with over 170 launches — roughly a rocket ascending every other day. What was once an extraordinary event has become routine.

SpaceX single-handedly unlocked the cosmic economic potential. It's essentially operating a celestial transit system, allowing businesses to hitch rides beyond Earth's atmosphere.

During a recent California trip, RiskHedge's Dan Steinhart and I encountered fascinating space ventures:

- Varda: Manufacturing pharmaceuticals in zero gravity, creating perfect crystal structures impossible on Earth

- Muon: Launching FireSat, a hyperactive wildfire detection system scanning every 20 minutes

- Aetherflux: Designing solar-harvesting satellites that beam energy back using infrared lasers

But the most explosive space business? Starlink.

In Austin, we witnessed a factory where robots manufacture 15,000 internet terminals daily. These devices connect with orbital satellites, beaming high-speed internet from the heavens.

This technology is revolutionary in regions with constrained digital access. During Iranian protests, Starlink terminals maintained communication after government internet throttling. Similar scenarios unfolded in Ukraine, disaster zones, and remote territories.

Starlink now serves 8 million users across 150+ countries. In 2025, SpaceX generated $15 billion in revenue, with a staggering $12 billion from Starlink subscriptions alone.

The future? Potentially space-based data centers, as Google and xAI are exploring. Imagine artificial intelligence powered by solar energy, operating 650 km above Earth.

While the immediate commercial applications might be limited, we're witnessing genuine space infrastructure development. Historical technological revolutions follow a similar pattern: infrastructure precedes transformative applications.

The initial space pioneers will likely be:

- Pharmaceutical companies leveraging microgravity's unique manufacturing conditions

- Advanced material producers creating pristine, defect-free products

- Precision hardware manufacturers benefit from a dust-free, corrosion-free environment

But investor beware: Not every space startup will survive. I'd estimate 80-90% might collapse, much like previous technological gold rushes.

The key is distinguishing between genuine businesses and mere dream merchants.

The final frontier is open for business — are you ready?

The best way to make sure you don't miss it is to join our mailing list.

When you sign up, you'll get twice-weekly Jolt articles breaking down the biggest disruptive trends like space and how to invest in them.

| If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing. | Go here to join |

Important Disclosures:

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.