For most of my adult life, which means after the age of 24 when I took a long spike, hammered it into the garage wall, and hung upon it a pair of well-worn hockey skates called "Tacks," I have loved the entire notion of owning silver. Ever since my former Finance Professor from Good Ol' St. Louis U. (Fred Yeager) sat down and told me over sips of black coffee and a non-filtered Camel the wonderment of precious metals ownership, I was hooked on the entire thought of saving wealth by way of a "stack" of silver and gold coins in my old wall safe hidden behind the poster of Farrah Faucett.

As I watched today's global March of Celebration toward $100 silver, I was reminded of Dr. Yeager's remarks that fateful morning in 1976. I was having difficulty with a certain section of the finance course, which was the last compulsory credit remaining between a double major in marketing and finance and a single major in marketing, which I had already achieved after junior year. I started out in freshman year taking the instructions of the coach of the hockey team, who ordered us all to major in accounting, which, for me, was like sitting in a closed room, handcuffed to my seat while a lady with very long and very sharp nails raked them down and across a blackboard. I needed six credits over four years to get the compulsory credits for a minor in accounting, which, for graduates of the Business School, was mandatory, so naturally, they were the most difficult courses in my entire sojourn at SLU.

I recall one particular Monday morning after the team had just returned from a week playing the Big Eastern ECAC schools like Boston U., Boston College, and Harvard. We had swept them all in my sophomore year as SLU was ranked fifth in the country at the time, so a late-night Sunday arrival back to Lambert field meant we had little time for either sleep or homework by the time the Cost Accounting class at 8:00 am opened its doors. The professor was a short little fireplug of a priest called "Brother Pius" who had not only a very high-pitched voice but also a high-pitched sense of his own power as he grilled the class for answers on subjects about as interesting as those long fingernails screeching across the blackboard. There was a rather large and quite portly black man seated conveniently in front of me, making it easy for me to hide from the heat-seeking missile known as "Brother Pius" to the extent that I was actually contemplating nodding off for a quick thirty winks when the "Voice from Purgatory" came wailing across the room.

Brother Pius: "Mr. Ballanger, what was your answer to question 11 of the Dealy Package Liquor Store case study?"

Me: "Sir, I was not able to complete the section as we returned late from the East Coast last night."

Brother Pius: "I assume there was no light on the aircraft?"

Me: "There was light."

Brother Pius: "What about during the period between games? Was there an opportunity to complete the case study on the Dealy Package Liquor Store?"

Me: "I guess so, but I forgot."

At that point, the red face of the class proctor started to twitch, at which point he instructed me to come to the front of the class."Bend over my desk, Mr. Ballanger." He then grabbed an old "switch" from the corner of the room, a torture tool used by the old Jesuits back in the 1800s to punish wayward truants or homework evaders.

Flexing the wicked branch four or five times for maximum audible impact, he shouted, "You will have your homework completed in the future, will you not, Mr. Ballanger???" at which point I found myself bracing for impact. After a few seconds (that felt like minutes) of both silence and absence of pain, the class began to laugh as Brother Pius tapped me on the shoulder and announced, "Corporal punishment at this institution ended after WWI."

Sweating but relieved, I returned to my seat. As goofy as it sounds, I never forgot that lesson taught brilliantly not only to me but also to the entire class because every student observing it thought, "if he can do that to a Canadian hockey player with six inches and 40 pounds on him, he can darn well do it to me." The Jesuits taught me an awful lot in those four years. . .

As I segway back to the topic of Dr. Yeager, he was collecting silver coins from the pre-Kennedy era when dollar coins were 90% pure silver. This was long before the craziness of the 1978-1980 period, but after gold prices had been freed from the shackles of the $35/ounce "fix." After France's Charles de Gaulle demanded gold in place of dollars whenever a bond issue matured, this practice of the late 1960s was largely the reason U.S. President Nixon eliminated the convertibility of dollars into gold in 1971. Had it been allowed to persist, the 8,133.5 metric tonnes held by the U.S. Central Bank would today be substantially less.

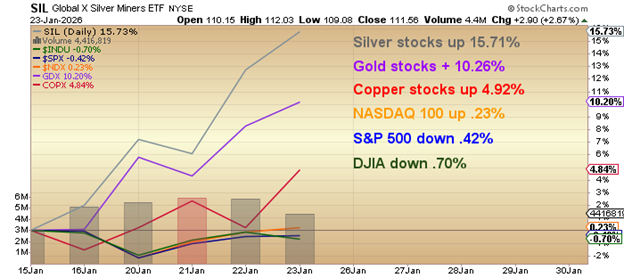

I have owned silver bars since just after the Sunday Night Massacre in 2014, when the bullion bank behemoths took it down into the $15 range and have not had as much as a passing thought about selling them — until today — with silver eclipsing the ever-elusive US$100 per ounce mark. I also own two junior silver deals, and while I am ahead on both, I am surprised that the silver equities have not held pace with the moonshot that has been the spot price for physical silver. It is not that they gave failed to move as the Global X Silver Miners ETF (SIL:US) today hit a record high but since the gurus would tell you that you should own shares for the leverage play over the physical, the chart shown above shows a small advantage for the miners as they are up 254.50% versus physical silver up 232.97% since the start of 2025.

I have no advice for subscribers this week, at least on the topic of silver, other than you should all have the courage to take your basis out of the trade — meaning — take profit to recoup your original investment in silver or the miners and then let the market tell you when to ring the register for good.

TACO

Stocks had a volatile week with more tariff threats weighing heavily until the Davos Billionaire Brunch, where everyone pulls out their net worth statements and compares notes just like young boys in the locker room for the first time. The one word I kept hearing was "T-A-C-O" — as in "Trump-Always-Chickens-Out" — in reference to his unwillingness to follow through on his tariff threats.

Markets have learned how to deal with these threats; just take the S&P 500 down over 2% in response to a European threat, or a Greenland threat, or a Canadian threat, and the American president will quickly backtrack because the performance of the S&P 500 and the NASDAQ are his personal scorecards for "Presidential Performance."

Say what you will about the Commander-in-Chief, he gets things moving, and when compared to the limp-wristed, sashaying incompetents that lead the EU (or Canada, for that matter), Donald Trump is a breath of fresh air, even if somewhat tainted by overstatements and factual inaccuracies. He is fulfilling his campaign promises — period.

Stocks ended the week with the DJIA and S&P 500 modestly lower, but with the NASDAQ modestly higher. The big winners on the week were the silver stocks (+ 15.71%), followed closely by gold miners (+10.26%), with copper (+4.76%) a distant third. Non-metal equities included the NASDAQ 100 (+0.23%), but the S&P 500 (-0.42%) and the DJIA (- 0.70%) were both lower.

Surprisingly, the Russell 2000 was all that the CNBC anchors could rave about for at least four days of the week, lauding and applauding the "broadening out" of the equity market rally while choosing to sidestep the performance of the Mag Seven and the QQQs that have dominated since the COVID pandemic stimulus-driven recovery lifted all boats.

Those cheers turned to tears by the end of the week as the Russell 2000 gave back all of its gains to close down 1.82% on the day and less than 1% on the week. The week ended with literally nothing to rejoice in other than the continuing and maddening saga of the precious metals, which are clubbing tech and crypto into submission after taking it on the chin for four long and impossible years during which the Bitcoin Billionaires rubbed salt in every minor laceration endured by gold bugs the world over.

What still irks me to no end was the orchestrated campaign led by Bitcoin maven Michael Saylor, whose Strategy Inc. (MSTR:NASDAQ) is down 62.12% since last summer, whereby he recruited all of social media literally to pile on the "Sell gold and silver; buy Bitcoin!" mantra.

If there ever was a true embodiment of the term "Divine Retribution," it is the plight since July 16 of last year. It is one thing to promote one's book, but to try to poach an entire sub-sector because of its well-deserved rebound after years of torment and abuse was simply "out of bounds."

So, now that his overleveraged, overhyped speculation on the future price of Bitcoin is getting pummelled by the gold and silver miners, I say "Karma's a b!" and leave it at that.

The Never-Ending Bid

The consensus view is that the "Great Mindless Robot" that provides a never-ending bid for stocks with particular attention to the ones that carry most of the weighting in the major averages remains the singular most bullish catalyst for stocks for 2026. Experts like Michael Howell and Mike Green, who track "fund flows," seem to believe that the endless bid for stocks that keep the averages elevated is directly tied to the U.S. unemployment rate, which is currently at 4.4%.

There is a number they have that remains around 6% (rumour only) that will mark the reversal in the flow of funds from "net buyer" to "net seller," and when that happens, the major question is whether there will be enough liquidity to support a "perpetual seller" of American common stocks. Also weighing upon this entity is demographics, as the Boomers are rapidly leaving the benefits line for company-matched contributions to employee stock savings plans and pension contributions that are the drivers for that endless pool of capital constantly buying the megacap tech stocks.

The Buffett Ratio, as well as the CAPE ratio, once fairly reliable tools for gauging risk and therefore portfolio allocations in the pre-robot era of portfolio management, are now rendered powerless to defend against this constant, incessant, pounding bid that engages with every dip regardless of the economic or geopolitical backdrop.

As I look back at 2025 (ever so briefly), I note that after the "Liberation Day" hijinks of April 2025, the U.S. economy has grown at a rate roughly equal to the rate of inflation which is once again a true and lasting testimonial to a phrase I learned in the very late 1970s and one which you have all heard before: "NEVER (and I mean NEVER) underestimate the replacement value of stocks within an (hyper) inflationary spiral."

Not only should one never short a "cult" (like Tesla or silver or Bitcoin), one should never try to short the American economy when the Masters of Finance are doing everything in their power to destroy the currency.

Stock Picks

The only two stocks to which I added this week were Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) and Grafton Resources Inc. (GFT:CSE; PMSXF:OTC), both operating in Chile, with one in the hunt for copper and the other in the hunt for gold.

News is expected for both next week. I own lots of both and am excited for their futures, proving once again that book-pumping is a necessary evil in the world of high (or low) finance.

With the Polar Vortex being delivered into Texas tonight, I want to welcome my American friends to OUR world. We in the Great White North have got a lot more where that came from. . .

| Want to be the first to know about interesting Silver, Gold and Copper investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc. and Grafton Resources Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. and Grafton Resources Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.