In 2025, I had the pleasure of riding in more than twelve Waymo vehicles across Austin, LA, and San Francisco. For those who are skeptical, I urge you to experience a Waymo firsthand.

A sleek, white Jaguar Waymo approaches, its roof adorned with a whirling sensor resembling a futuristic crown.

As you settle into your seat, the screen greets you personally: "Good afternoon, Stephen. Heading to your hotel now . . . This experience may feel futuristic. . . We'll do all the driving."

With a single tap of the "start ride" button, you're on your way.

After this, taking a regular Uber Technologies Inc. (UBER:NYSE) feels like reverting to an antiquated flip phone.

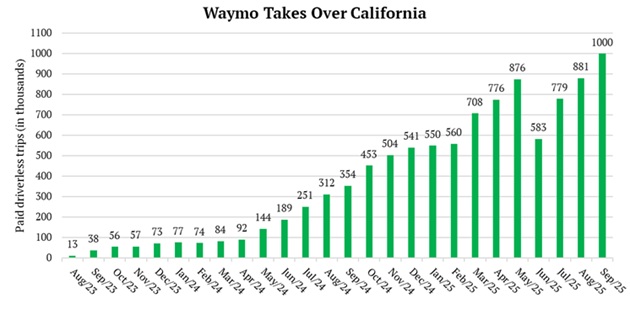

Waymo's journey began as Alphabet Inc. Class A (GOOGL:NASDAQ) autonomous vehicle initiative in 2009, starting with a tiny, single-person rickshaw. Now, it's logging an astounding one million rides monthly in California alone:

Having quadrupled the quantity of autonomous taxis on the streets, Waymo announced its intention to achieve one million rides every week by the close of 2026!

Miami, Dallas, Las Vegas, Tokyo, London

That's merely a glimpse of the numerous new cities Waymo is expanding into in 2026.

Here in Abu Dhabi, Uber collaborated with several self-driving enterprises to introduce autonomous taxi rides to the public.

The other day, I took my children on their inaugural robotaxi ride. Enchanting!

2026 marks the year self-driving automobiles go worldwide.

As with most significant technological shifts, it occurred gradually . . . then abruptly.

Over the past year, self-driving technology transitioned from "hand-coded rules" (if red light, stop) to comprehensive AI models. Just as ChatGPT acquired language by consuming the internet, vehicles are learning to navigate by analyzing millions of hours of video footage.

Based on current deployments, Waymo is clearly leading the autonomous taxi race.

But I believe the Ultimate Victor Will Be. . .

Tesla Inc. (TSLA:NASDAQ).

Waymo has impressively accumulated over 130 million miles of fully autonomous driving.

However, Tesla owners, with "full self-driving mode" engaged, have collectively amassed an astonishing 7 billion miles. That's an immense amount of data to process, which is utilized to enhance precision.

Last year, I had the opportunity to ride in a self-driving Tesla in LA. We journeyed from El Segundo to Long Beach port without the driver needing to intervene once. It was impeccable, albeit a tad assertive.

Again, anyone who doubts the technology's readiness for prime time must experience it firsthand.

A Tesla owner recently completed the first entirely intervention-free coast-to-coast journey. He traveled 2,700 miles from LA to South Carolina. For three consecutive days, the car parked, charged, and drove itself autonomously. A Turing Test moment for driverless vehicles.

Until now, these capabilities were exclusively accessible to Tesla owners.

Get Ready for Tesla's $30,000 Cybercab

Tesla launched its "Waymo competitor" in Austin this past summer. When RiskHedge publisher Dan Steinhart and I were visiting, we observed the robotaxis quietly navigating the streets.

Now they're in the Bay Area too, with approximately 100 Tesla robotaxis zipping from Sunnyvale to San Francisco.

Anticipate Tesla to introduce robotaxis in at least six U.S. cities this year.

Currently, Tesla is gearing up to sell its "Cybercab" robotaxi — devoid of a steering wheel or pedals — for under $30,000. Elon Musk recently announced that Cybercab production will commence in April. I'll take two, please!

I predict that in 2026, investors will cease valuing Tesla as an "automaker" and begin perceiving it as an "energy and robotics" company.

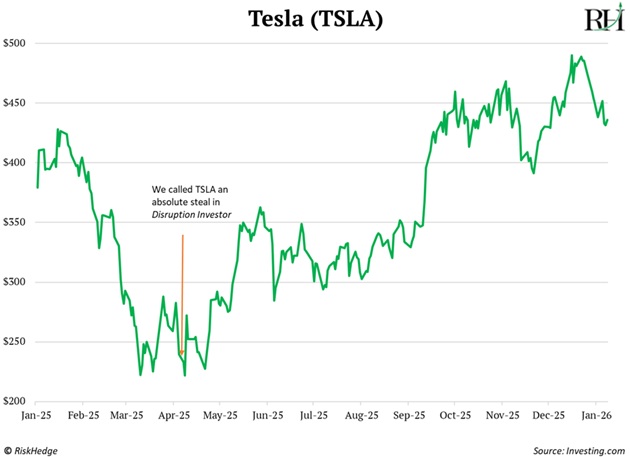

Tesla Just Hit New Highs

Congratulations to Disruption Investor members who acquired Tesla last year after we deemed it an "absolute steal." It has soared around 80% since:

As Tesla's technology progresses from "cool demo" to real-world deployments, investors will flock to the company in 2026.

I anticipate it will ascend into the ranks of the world's five most valuable companies in 2026. It currently holds the #10 position (more on this chart on Monday).

Tesla Doubling Was The Second Biggest Shock of the Year

In this month's Disruption Investor, I've outlined 10 major surprises for the coming year.

Some of them I expect to transpire. Others are long shots. But all of them possess the potential to reshape markets and generate new disruption opportunities.

For each event, I've included a Disruption Score to help you assess both the probability and the potential market impact.

I believe 2026 is shaping up to be a massive year for disruption. I cover the biggest trends — and the best investing opportunities — in my free weekly letter, The Jolt. You can sign up here.

| If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing. | Go here to join |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tesla Inc.

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.