It's the Chinese year of the "Flaming Horse," a year of bold moves for freedom. The geopolitical action in Venezuela and now Iran certainly fits the flaming horse bill!

If money managers were still shy about embracing gold based on dedollarization, geopolitics should push them over the fence.

Here's a look at GDXJ, the junior-intermediate gold stocks ETF:

Note the buy signal on the key 14,7,7 series Stochastics oscillator at the bottom of the chart. That's occurring high in the momentum zone (above 50). . .

Indicating tremendous strength!

Most intermediate and senior gold miners have all-in costs of around $1,500/oz, and for silver stocks, it's generally under $25.

In a nutshell, these companies are cash cows (with the real cash being gold itself!), and junior explorers are working hard to get in on the action.

On that note, here's a look at the CDNX long-term chart:

I've been highlighting the buildout of this chart to eager investors for many years. Is the glorious breakout finally here?

Well, the daily chart can provide some insight into this key matter, and here it is:

The breakout is likely to take the form of a multi-week "blowoff" or "mini parabola," and it will probably be followed by a pullback to the immense neckline zone on the long-term chart.

The breakout should usher in the next phase of what I call the gold bull era, which is 100-200 years of citizens of the world being obsessed with… getting ever-more supreme money gold!

This is not a time to "top call" the market. Quite frankly, it's not even a time to focus on fiat money at all.

Having said that, to maintain a state of superb emotional stability, investors need allocations that allow them to enjoy all the coming upside action but also to be able to buy a significant correction with little more than a grimace.

I urge investors to focus on the component stocks of two key CDNX sub-indices, the GI (Gold Index) and the PMI (Precious Metals Index).

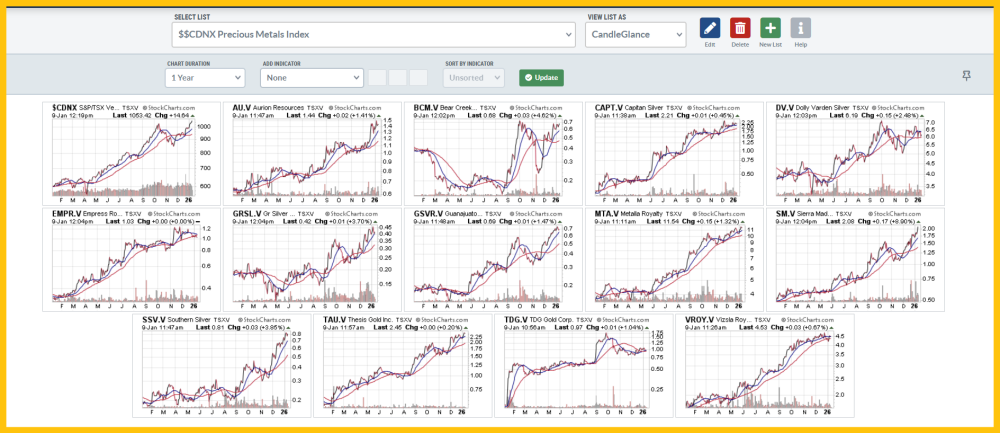

Here's a look at most of the component stocks of the PMI:

This is a snapshot of the past year of action for these exciting juniors, and it shows why I've been so adamant that investors need to own numerous positions rather than trying to cherry-pick just a few.

When an entire sector or market is on the move, it's critical to be invested to mimic the indexes and simply buy the dips because if a big cherry pick fails, the investor is forced to watch most miners soar while theirs does nothing.

I show investors different types of junior miners and different strategies to invest in them because one size does not fit all. Right now, the big key to success is feeling comfortable.

That can involve jurisdiction, company management, shares outstanding, cash/debt position, etc. Investors need to decide what is most important to them and what makes them feel most comfortable. If a stock is poised to outperform, but an investor isn't truly comfortable holding it through drawdowns, the stock may outperform . . . but the investor will not.

Here's a look at one interesting junior that many investors may feel comfortable holding, Thesis Gold Inc. (TAU:TSXV; THSGF:OTCQX; A3EP87:WKN):

This is the daily chart for Thesis Gold. Their operation is in the "super stable" jurisdiction of British Columbia, it's part of the Precious Metals Index, and the chart is technically superb.

Here's a look at the monthly chart:

A move to $3 seems imminent, and after a pause, a surge to $4.50 could be a "done bull era deal."

All in all, it's a spectacular time to be involved with the junior miners, and a portfolio that provides comfort, cash for buying, and outstanding performance is the name of this golden game!

Special Offer for Streetwise Readers: Please send me an Email to freereports@galacticupdates.com, and I'll send you my free "Yellow Cakes & Gold Stock Steaks!" report. I highlight some of the hottest low-priced uranium and gold stocks, with investor buy and sell tactics included in this report! Junior mine stock investing isn't for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you!

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stewart Thomson: I, or members of my immediate household or family, own securities of: GDXJ. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?