I've been writing about silver for years, often when it was out of favor, under-owned, and widely dismissed as the "forgotten metal."

In Silver Tarnished No More (found here), the case was straightforward: silver didn't need excitement; it needed time. A long base, tightening supply, and a slow but powerful shift in demand were laying the groundwork for a move that would feel obvious only after it happened.

That move is now well underway.

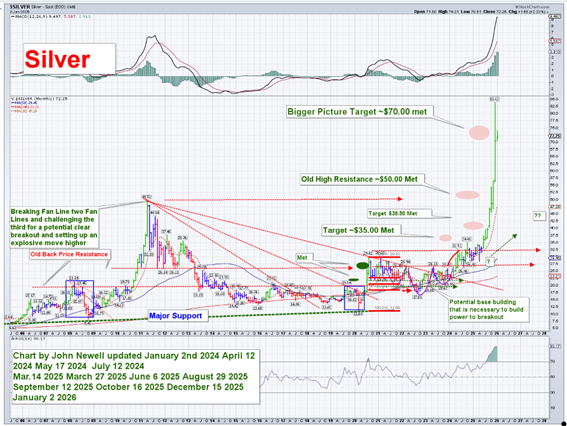

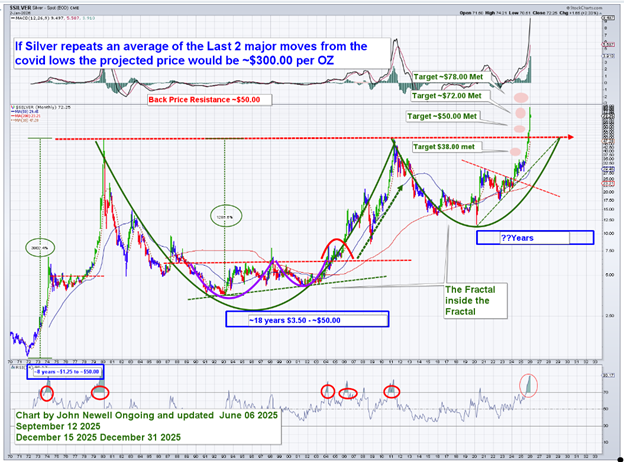

What makes this moment different is not just price. It's confirmation. Silver has now achieved every major upside objective that was identified along the way. Targets at US$35, US$50, US$72, and US$78 were reached, one by one, through volatility, skepticism, and repeated pullbacks. Markets don't do that by accident.

They do it when the underlying math is right.

Supply Is Still the Constraint

Silver's supply story has not improved. In fact, it has tightened.

Mine production has struggled to grow meaningfully despite higher prices. Grades continue to decline, new discoveries are scarce, and permitting timelines remain long. Because most silver is produced as a byproduct of base-metal mining, higher silver prices do not immediately result in higher silver output. That structural reality hasn't changed.

What has changed is demand.

Industrial demand has become the dominant force in the silver market. Photovoltaics, electrification, electronics, power grids, and advanced manufacturing all require silver, and there is no scalable substitute. Solar alone has driven a dramatic increase in consumption over the past decade, and that trend continues. The result has been consecutive years of supply deficits, even before factoring in investment demand.

This is not a short-term imbalance. It's structural.

A Structural Market, not a Cyclical One

When a market with constrained supply meets durable, non-financial demand and confirms a multi-decade technical breakout, price becomes the mechanism that restores balance

One of the most misunderstood aspects of today's silver market is the assumption that supply will eventually "catch up" to price. That assumption has been wrong for years.

Silver is not like gold. Almost every ounce of gold ever mined still exists. Silver does not enjoy that luxury. A growing portion of global silver production is consumed, dispersed, and effectively removed from the market. Once silver is embedded in a solar panel, an EV, a medical device, or advanced electronics, it is not coming back in any meaningful quantity. Recycling helps at the margin, but it does not scale.

At the same time, the nature of silver supply makes rapid production growth unlikely. The majority of global silver production comes as a byproduct of copper, lead, and zinc mining. That means silver output is dictated by base-metal economics, not silver prices. Even at higher prices, silver supply cannot be quickly expanded without major new base-metal projects coming online, which typically take a decade or more from discovery to production.

This creates a fundamental mismatch: demand that grows steadily and predictably versus supply that is slow, rigid, and largely unresponsive to price.

What makes this cycle different from past silver bull markets is the quality of demand. Much of today's demand is non-discretionary. Electrification, power infrastructure, and solar deployment are policy-driven and capital-intensive. These sectors don't pause because silver prices are higher. They absorb the metal because they must.

That's why recent supply deficits matter. They are not being driven by speculative excess or temporary shortages. They reflect a market that is structurally undersupplied before investment demand even enters the picture in size.

This is the backdrop against which silver's long-term breakout is occurring.

The Chart Has Been Telling the Same Story

From a technical perspective, silver's long-term chart remains one of the cleanest I've ever worked with. The breakout from a multi-decade base was the hard part. Once that occurred, the roadmap became clearer.

Each prior target looked aggressive when first outlined. Each was met.

What stands out now is structure. Silver has absorbed corrections without breaking trend, respecting key support levels and continuing to build higher lows. The fractal behavior mirrors previous bull cycles, but with a crucial difference: this cycle is underpinned by persistent physical demand rather than excess speculative leverage.

Based on the size of the base, the symmetry of prior advances, and historical behavior during comparable bull phases, the next major measured move points toward the US$120 level. That is not a short-term call. It is a big-picture target that reflects what silver has already demonstrated it can do when supply cannot keep up.

Silver Equities Are Beginning to Respond

As silver has moved, select silver equities have started to confirm the broader thesis. The key, as always, is focusing on companies with real assets, scale, and leverage to the metal.

The three companies were not chosen at random. Each represents a different way to gain leverage to a rising silver price cycle: district-scale resource expansion, discovery-driven exploration in a proven camp, and disciplined accumulation of silver ounces with embedded optionality. Together, they reflect the parts of the silver equity spectrum that historically respond first and most decisively when a sustained bull market takes hold.

Eloro Resources Ltd.

Eloro Resources Ltd. (ELO:TSX; ELRRF:OTCQX; P2QM:FSE) is advancing one of the most significant undeveloped silver systems discovered in the past decade at its flagship Iska Iska Project in southern Bolivia. What began as a grassroots exploration play has evolved into a caldera-scale, multi-metal system hosting a silver-equivalent resource exceeding one billion ounces, with meaningful upside still being defined. The project is notable not just for its size, but for its improving quality. Recent drilling has continued to enhance grade continuity in the near-surface silver-zinc-lead mineralization while expanding the deeper, higher-temperature tin domain, which adds an important strategic metal component to the story.

Infrastructure is another key differentiator. Iska Iska benefits from road access, power, water, and proximity to rail and ports, significantly reducing development risk compared to more remote discoveries. As silver and tin regain attention as critical and strategic metals, Eloro stands out as a rare large-scale development asset with both bulk-tonnage potential and long-life optionality, positioned to benefit disproportionately from higher silver prices.

Here is my previous article on the company.

Silver North Resources Ltd.

Silver North Resources Ltd. (SNAG:TSX.V; TARSF:OTCQB) is focused on discovery-driven silver exploration in Yukon's Keno Hill District, one of Canada's highest-grade historic silver camps. The company controls the 100% owned Haldane Project, where past-producing mines and high-grade drill results confirm the presence of multiple silver-bearing structures that remain largely underexplored by modern methods. Importantly, Haldane sits in a proven jurisdiction with existing infrastructure, a skilled workforce, and a regulatory framework supportive of responsible mining.

From a market perspective, Silver North fits the profile of an underfollowed junior emerging from a long consolidation phase. The share structure remains tight, insider ownership is meaningful, and recent exploration progress has coincided with a decisive shift in the stock's technical profile. As silver prices strengthen and risk capital begins to rotate back into early-stage explorers, companies with credible discovery potential in established districts like Keno Hill often re-rate quickly.

Here is my previous article on the company.

Honey Badger Silver Inc.

Honey Badger Silver Inc. (TUF:TSXV; HBEIF:OTCQB) has taken a different approach from many junior explorers, focusing on acquiring silver ounces in the ground at minimal cost while maintaining strict capital discipline. The company holds 100% ownership of a portfolio of silver projects across the Yukon, Northwest Territories, and Nunavut, including the high-grade Plata Project and land surrounding the historic Nanisivik Mine area. These assets provide direct, unhedged leverage to rising silver prices without the burden of large-scale development spending.

What further distinguishes Honey Badger is its business model. Management has demonstrated a willingness to spin out non-core assets while retaining royalties, creating long-term optionality without diluting shareholders. Insider ownership remains significant, and the share structure is tightly controlled. From a technical standpoint, the stock has already met its initial breakout objective and is now consolidating at higher levels, a pattern that often precedes the next advance as broader market interest returns to the silver space.

Here is my previous article on the company.

Aftermath Silver Ltd.

Back in September 2024, I wrote an article for Streetwise Reports that featured Aftermath Silver Ltd. (AAG:TSX.V; AAGFF:OTCQX; FLM1:FRA) as a strategic bet on world-class silver assets, noting its high-quality projects in Chile and Peru, strong backing from Eric Sprott, and a textbook multi-year base on the chart.

Fast forward to January 2026: Aftermath has delivered on the technical promise and strengthened its fundamentals dramatically.

With full ownership of Berenguela, a clear development strategy, and exploration underway at multiple projects, Aftermath is transitioning from explorer to advanced-stage developer, at a time when silver fundamentals are tightening, and institutional capital is returning to the sector.

Meanwhile, the chart has validated the bullish thesis laid out in 2024. Higher lows, rising volume, and trend acceleration all suggest that the technical path remains open toward CA$2.50, particularly if silver regains momentum in 2026.

With its large and growing resource base, it is now placing it among the Top 10 undeveloped silver companies in the world. Aftermath Silver is emerging as a standout in the silver development space. The company's exposure to critical co-products like copper and manganese, combined with its fully owned Berenguela project and an expanding pipeline in Chile, gives it the scale and optionality many juniors lack.

Technically, the stock has broken out of a multi-year base and exceeded three price targets. Shares remain well below their previous highs, but they are no longer below the radar.

A Market That Rarely Gives Second Chances

I've seen silver frustrate investors for long stretches. That's what long bases are designed to do. They test patience and conviction. But when silver finally moves, it tends to move faster and further than expected.

This cycle feels different because the demand is real, visible, and non-financial. Solar panels don't wait for sentiment. Power grids don't care about positioning. When constrained supply meets accelerating industrial demand and a confirmed long-term breakout, the market doesn't need hype to do its work.

Silver doesn't need a new story. It already has the math.

Every major upside milestone identified along the way has now been met. With supply tight, demand growing, and the chart behaving exactly as it has in past bull cycles, the next chapter points higher. Potentially a lot higher

The US$120 target is not a prediction. It's a logical extension of what silver has already proven it can do.

https://www.streetwisereports.com/article/2025/09/02/a-solid-silver-story-with-fresh-catalysts.html

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Eloro Resources Ltd. and Silver North Resources Ltd. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd.

- John Newell: I, or members of my immediate household or family, own securities of: Aftermath Silver. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.