Regency Silver Corp. (RSMX:TSX.V; RSMXF:OTCQB) announced that drill hole REG 25-26 has encountered multiple intervals of sulphide-specularite-supported breccia across a discontinuous ~240-meter section.

The breccia intervals, which range from 5 to 50 meters in size, are associated with a series of Quartz-Feldspar porphyries. These breccias share similarities with the gold-copper-silver (Au-Cu-Ag) mineralized breccia in drill holes REG-22-01, REG 23-21, and REG 23-14, as well as the Ag-dominant breccias found at the company's fully owned Dios Padre silver mine project in Sonora, Mexico. The intersection is situated approximately 150 meters down-dip from the historical Dios Padre silver mine workings and roughly 225 meters up-dip from drill hole REG-25-25. Previous drill results include 38 meters at 7.36 g/t gold in REG 23-21, 35.8 meters at 6.84 g/t gold, 0.88% copper, and 21.82 g/t silver in REG-22-01, and 29.4 meters at 6.32 g/t gold in REG 23-14.

REG 25-26 was the concluding hole of the 2025 segment of Regency's ongoing drill program, which commenced on October 10, 2025. Being the fifth hole in the program, REG 25-26 successfully identified an extension of the deep breccia at shallower depths, up-dip towards the historical Dios Padre silver mine.

In light of the release, Director and Head Geologist Mike Tucker commented, "Drill Hole REG 25-26 is a very significant development for the Dios Padre project. We have hypothesized that the deeper, porphyry-controlled breccia should extend and continue to the old mine site at surface. This breccia intersection helps to validate our hypothesis in observing multiple porphyry dykes with adjacent sulfide-specularite supported breccias almost exactly in-between the deep breccia and the mine site."

Since the drilling program resumed in October, a total of five drill holes, amounting to 3,723 meters, have been completed.

400 Years of Mining History

The mine is a historic silver producer with 400 years of mining history, reportedly extracting around 16 million ounces (Moz) silver from 500,000 tonnes of ore.

The company told Streetwise Reports it is fully financed for an ongoing drill program at the project.

Analytical results for the intervals from the 2025 drill program are not yet available, so there is no assurance when comparing the potential assay quality of these intersections to REG-22-01, REG-23-14, and REG-23-2, the release noted.

"However," the company has commented in the past that, "in terms of geology, alteration, mineral species, and abundance, the zones appear to compare favorably."

A 'Compelling Exploration Play'

1Dios Padre is a high-sulfidation/porphyry mineralized system with the potential for substantial size, John Newell of John Newell & Associates wrote in an article detailing his optimistic view on this exploration company.

Based in Vancouver, British Columbia, Newell described the exploration company as a "compelling exploration play."

"With experienced leadership advancing a gold-silver discovery during a historic precious metals bull market, Regency Silver stands out," Newell wrote.

Regency has numerous pathways for value creation, given the trio of metals (gold, silver, and copper) at Dios Padre, he said.

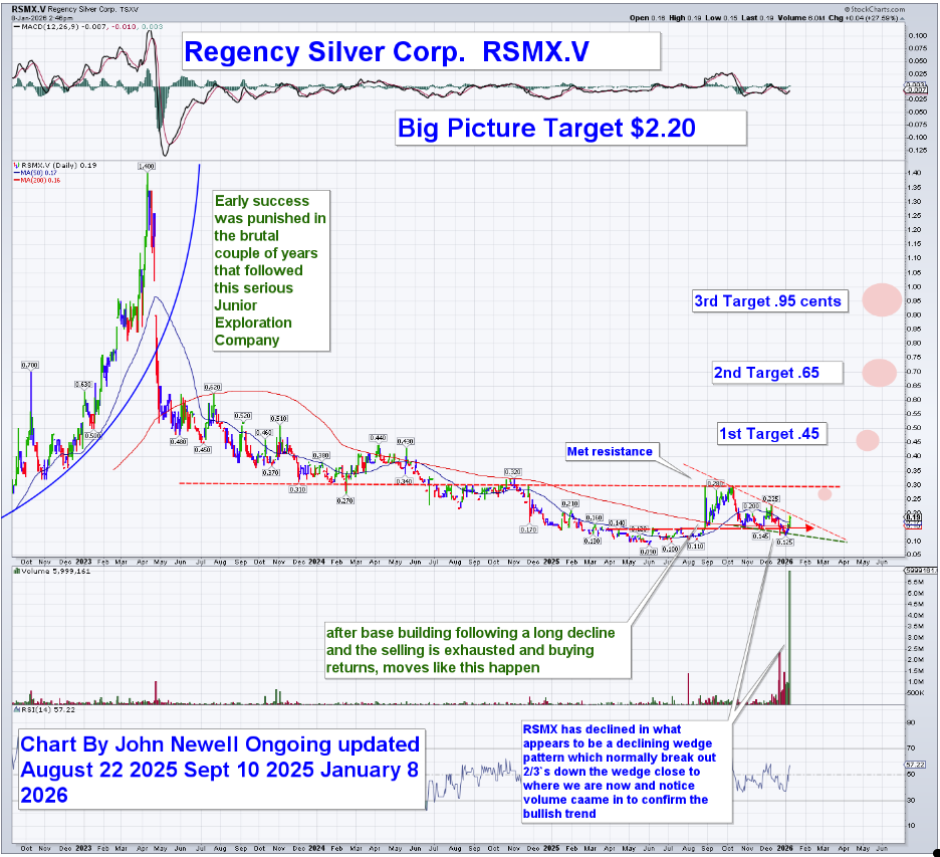

After the issue of the new release, Newell updated Streetwise Reports on the status of the company's chart (see at left): "After a long decline and base-building phase, Regency Silver appears to be breaking out of a declining wedge, a pattern that often marks the start of a new uptrend. The pickup in volume as price turns higher suggests selling pressure is exhausted and buyers are beginning to reassert control."

The company's founder, CEO, and director, Bruce Bragagnolo, mentioned in a November 20 video that Regency's current emphasis is on gold. The project already boasts a significant amount of silver, as demonstrated by the 2023 NI 43-101-compliant estimate showing an Inferred resource of 11,375,000 ounces of silver equivalent (Au eq), represented by 1,384,000 tons at 255.64 g/t of Ag eq.

According to Regency's Investor Presentation, historical drilling at Dios Padre uncovered several zones of extensive, high-grade silver mineralization. For instance, hole FMR 12-06 revealed 32.5 meters at 408 g/t Ag, including 1.9 meters at 3,220 g/t Ag. Hole FMR 15-06 returned 28.8 meters at 467.8 g/t silver. When copper is also present, it often signifies a large mineralized system, the CEO noted.

"And this is a type of system that becomes a mine just because of the sheer size and grade of it," Bragagnolo added. "This is exactly what we're pursuing at Dios Padre. We believe this system could host a multimillion-ounce gold, silver, copper deposit."

The company announced in December that it had completed an oversubscribed CA$4.1 million financing.

"Regency is very pleased to have successfully completed this oversubscribed financing," Chief Executive Officer Bruce Bragagnolo said at the time. "Centurion One Capital anchored the financing and, through disciplined execution, brought together a high-quality group of long-term strategic investors, enabling us to complete the offering on an upsized basis. The net proceeds from the financing will allow us to keep the drill turning at the Dios Padre Project and further enhance shareholder value."

The Catalyst: Geopolitical Risks Still Driving Safe-Haven Plays

Gold and silver prices declined on Wednesday following recent strong gains, as investors began to shift their focus away from geopolitical issues, reported Alex Kozul-Wright for Barron's on January 7.

Although geopolitical tensions remain high, President Donald Trump announced that Venezuela would deliver up to 50 million barrels of oil to the U.S. Additionally, the White House did not dismiss the possibility of military action to acquire Greenland. However, traders seem to have redirected their attention, at least for the moment.

The Institute for Supply Management's Purchasing Managers Index registered at 47.9 for December, down from 48.2 in November and below economists' expectations of 48.7, according to FactSet, Kozul-Wright wrote. A reading below 50 indicates a contraction. Further signs of a slowing U.S. economy could influence expectations regarding monetary policy.

Looking ahead, investors will be closely monitoring the December jobs report, set to be released on Friday, he said. The market currently sees an 88% chance that the Federal Reserve will maintain interest rates when it meets later this month, according to the CME's FedWatch tool. However, labor market data could alter that outlook. If unemployment continues to rise, it might increase the likelihood of a rate cut on January 28, making gold and silver more appealing as other risk-off assets, like bonds and cash, become less attractive.

"On top of that, the geopolitical risks that helped drive precious metals higher earlier this week haven't gone away — they could come back just as quickly," he wrote.

Silver has experienced a significant surge over the past year, rising from just US$29 per ounce at the beginning of 2025 to nearly US$80 per ounce by the year's end, according to Aly J. Yale, writing for CBS News MoneyWatch on January 6.

As of January 6, silver was priced at US$80.62, according to American Hartford Gold, the article noted.

"Prices were up roughly 150% in 2025, reflecting a market responding to tightening fundamentals rather than a one-off event," Hiren Chandaria, managing director at Monetary Metals, told Yale. Chandaria noted that demand in the silver market has consistently outpaced supply.

However, volatility continued throughout the week as traders considered the effects of index rebalancing sales, supply limitations, and the threat of potential US tariffs. Gold also saw a decrease, according to a Bloomberg piece published on Mining.com on January 7.

While silver fell by up to 6%, it remained higher for the month so far. Silver had surged to a record high above US$84 an ounce in late December, driven by strong retail investor interest, especially in China, which influenced prices during the thin trading of the holiday season.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Regency Silver Corp. (RSMX:TSX.V; RSMXF:OTCQB)

Gold and palladium also declined alongside other precious metals in anticipation of an annual rebalancing of broad commodity indexes, the piece noted. This rebalancing can sometimes depress prices as passive tracking funds sell off commodities that have seen significant gains to align with new weightings.

"We expect large-scale selling activity to kick off amid significant rebalancing flows from broad commodity indices," TD Securities strategist Daniel Ghali wrote in a note, according to Bloomberg, noting that silver had experienced a "devilish blow-off top."

Ownership and Share Structure2

Members of Regency Silver's management team and its board own about 5% of the company. Of this total, CEO Bragagnolo, the largest shareholder overall, owns 3.3%. One institution, Palos Management Inc., has 0.42%. Retail investors hold the rest.

After the December financing, Regency Silver has 120 million shares outstanding. Its market cap is CA$25 million. Its 52-week range is CA$0.09–0.30 per share.

| Want to be the first to know about interesting Copper, Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Regency Silver Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000. In addition, Regency Silver Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Regency Silver Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Disclosure for the quote from the John Newell article published on September 10, 2025

- For the quoted article (published on September 10, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.

2. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.