We've just experienced the third consecutive year of gains for U.S. equities. Although this may appear excessive, it's entirely within the norm. On 11 occasions over the past hundred years, stocks have climbed for at least three straight years.

Is a fourth year in a row achievable?

Absolutely. It's occurred seven times since 1928.

January provides an ideal opportunity to reflect and adjust expectations. However, the entire "year ahead outlook" tradition is somewhat absurd.

The calendar turns, and abruptly, everyone assumes they possess the ability to see 12 months into the future. If I genuinely knew what was going to transpire next year, I wouldn't delay mentioning it until January.

We also strive to avoid broad "macro" predictions. There are too many variables at play. Too many self-assured individuals end up being mistaken.

Yet, it would be equally unwise to disregard decades of market history and the select few indicators that truly matter.

Before we delve into our 2026 surprises, here are two overarching factors we're closely monitoring… Midterm elections

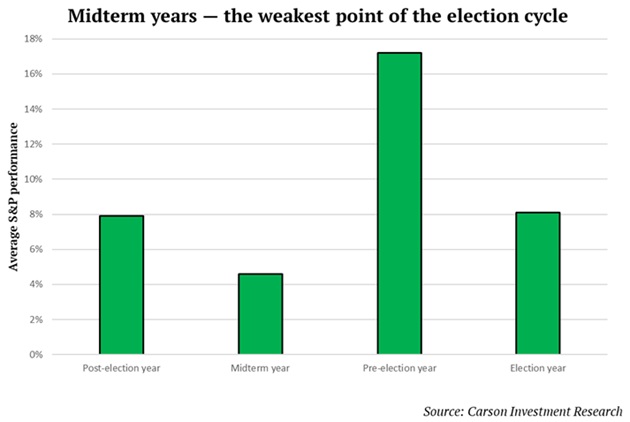

Certain individuals believe that making stock market predictions based on election cycles is mere superstition. However, stocks have adhered precisely to the four-year presidential cycle over the past several years. This pattern was one of our hidden advantages when we emphatically urged buying stocks in late 2022, right when Wall Street's brightest minds were raising red flags. Now the cycle has reset, which likely indicates volatility on the horizon.

The second year of a presidential term historically delivers the weakest returns of the four-year cycle. While stocks still tend to edge higher in midterm years, there's a 42% probability they'll decline instead. It's a toss-up.

The stock market typically follows a "script" during midterm years:

In the lead-up to the election, US stocks usually perform poorly. From January to October in midterm years, they drop an average of roughly 1%.

Then, stocks hit bottom a few weeks prior to the election.

Once the election "fog" lifts, stocks rise an average of 15% over the following 12 months. That's double the return of all non-midterm years during the same timeframe. Takeaway: Anticipate volatility — including plenty of "bear market" commentary — in 2026.

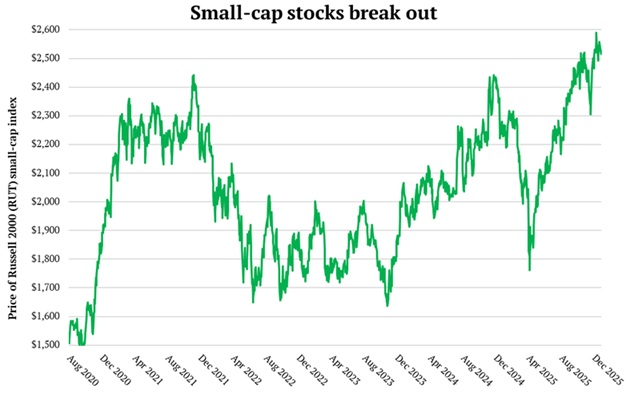

A Breakout in Small Caps

I'm certain you've heard that there are only a handful of enormous tech stocks propelling the market higher.

The most significant development in markets currently is the U.S. small caps breaking out. This is only the fifth Russell 2000 breakout over the past 25 years — and the first of new highs since 2021. When small caps surpass a major multi-year ceiling, it often kicks off a multi-year run for stocks.

After so many false starts, this breakout warrants attention. It tells us the bull market is broadening out. It means investors are sufficiently confident in the real economy, not just artificial intelligence (AI) hype.

Takeaway: With small caps breaking out, expect 2026 to be a stock picker's market.

Our analysis suggests we're in the midst of a long-term bull market. But regardless of how bullish we are, we still invest as if we might be wrong. Allow me to explain…

First, don't lose sight of why we invest in the first place. We invest so we can live comfortably… provide our children with the best possible opportunities… enjoy amazing vacations… and eventually experience fulfilling retirements.

We invest to build enduring wealth.

We've generated substantial profits in the stock market over the past three years. To make the most of the new wealth you've created, you must avoid significant losses. In my experience, this is the #1 thing that distinguishes investors who grow rich from those who see mediocre results. There are many "one-hit wonder" investors who hit it big during a stock market rally... only to give it all back on the other side.

We must respect the market and remember that stocks fluctuate. The investing gods spoiled us with 95 new highs over the past two years. They won't always be this generous.

So, what's the plan of action?

First, declutter. If you own stocks, you only "kinda, sorta" like, now's the moment to sell. With markets near record highs, this is a golden exit opportunity.

That doesn't mean sell everything and head for the hills. Consider this: If you sell everything and stocks drop 20%, will you have the courage to buy back in? Probably not. Fear has a way of paralyzing us at precisely the wrong moment.

Second, continue to invest in great disruptors.

Our edge is owning great, disruptive businesses in long-term megatrends. Over the years, companies solving real problems and generating strong profits march forward regardless of market conditions. They power through volatility.

Whatever 2026 throws at us, Chris and I will be here to guide you every step of the way.

Editor's note: Not a regular RiskHedge reader? Sign up today to get our latest research, analysis, and best moneymaking opportunities we see taking shape in 2026. It's free to join, just click here.

| If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing. | Go here to join |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.