As I have written since 2020, Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) is one of the most undervalued junior gold developers on the planet. Now, after IR executive Karen Mate sprinkled her magical pixie dust on the company in 2025, it is finally on the recommended list of Brien Lundin, Jeff Clark, and Dan Oliver of Myrmikan Capital. Yet, despite this welcomed new sponsorship and support, the stock closed out the year trading well below its 2022 peak at CA$0.83 and well below its 52-week high of CA$0.47.

This was my top pick for every year since I launched the newsletter in January of 2020, and as much as I think it is a takeover waiting to happen, it has now been relegated to the third rank in my portfolio of juniors.

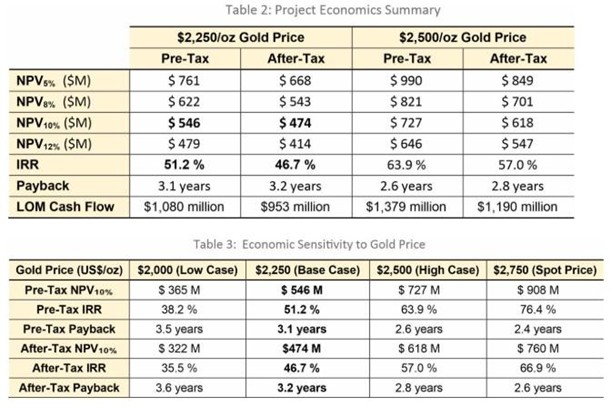

Catalysts for appreciation in 2026 include a) more drilling results from the 2025 program, b) a revised resource estimate, and c) a revised PEA updating the sensitivity analysis from gold price levels between US$2,250-US$2,750 to levels in the order of US$3,250-US$3,750, which seems far more realistic given the current gold price above US$4,400.

Using US$3,750 per ounce, the pre-tax NPV will surely exceed US$1.5 billion, which means that Getchell's current market cap of CA$75 million is one-twentieth of that number, whereas similar companies trade in the order of one-quarter to one-half of after-tax NPV, depending on size and jurisdiction. With the Fondaway Canyon asset being in Nevada, I would suggest that it deserves a much more generous valuation, especially since it is wide open along strike and to depth for possible increases to the 2.317 million ounce resource.

I place a target price of CAD$0.75/US$0.55 for the company in 2026, with the distinct possibility of the company being acquired for US$150 per Fondaway ounce, which would be US$405 million (assuming a 10% increase in the resource from 2025 drilling), which would equate to US$1.50 per GTCH/GGLDF share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Getchell Gold Corp. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.