In Canada and the U.S., the tax year ends on December 31. This creates a flurry of selling as the year draws to a close. Why? Investors want to realise losses which they can then offset against gains elsewhere and so reduce their tax bill.

This creates considerable selling pressure, especially amongst small-cap stocks, and they can become quite oversold. The selling can be quite indiscriminate in the last few days before Christmas, but it abates as soon as the year ends, and the stocks often rally — particularly if there is a reason for them to rally (such as them being cheap or, better, some positive newsflow or generally better market conditions for the sector in which that company operates: eg Bitcoin rallies a bit, so all Bitcoin related companies rally).

Some years this works better than others, some picks work better than others. But manage your risk — don't take on position sizes which are too large, be prepared to sell if the trade goes against you, etc. — and the trade can work well.

You want to be exiting your positions by February-March, so the trade has a nice structured timescale around it.

Note: Companies often do badly because they are not very good companies, so that means you are often buying not-very-good companies. Be under no illusions.

The trade seems to work particularly well with small-cap Canadian resource stocks, so you will need a broker who deals in such things. I use Interactive Investor. If you want to open an account, use this affiliate link (I get a fee, and you get a year's free trading.)

Anatomy of a tax loss candidate

The ideal candidate wants to have spiked at some point in the last couple of years so that it sucked in a lot of buyers at higher prices. It wants to have been flat or declining for some time, so that buyers will now hate it and want it out of their portfolio, happy to sell at any price just to get rid of the wretched thing.

It wants to be really oversold so there is room for a rebound.

Ideally, they want to have some cash so they are not coming to market for capital in the New Year and thereby killing any rally with a raise.

It's better if the company has genuine assets and is a genuine business, not some lifestyle company. That lowers risk and betters chances of positive, real newsflow in the New Year.

Take a look at this chart of Company Unknown. You can see that three times this year it spiked above $10. Now it is trading at 84c. How many people have lost money, I dread to think. It has been a proverbial clusterfook.

If you bought anywhere above $2 or $3 — and especially up near $10 or $13 - you will HATE this company.

Meanwhile, there is a huge potential loss for you to realise. So you sell it and take the loss.

But look also at the volume — that has been quite high since the sell off (short sellers covering, increased stock coming to market as it became free trading, but also capitulation). There is a story there, too. Note also the volumes when the stock went from 80c to $1.80 in October.

It's tailing off again.

This stock could easily rise 50% — and that would only take it to $1.25, which is nothing in the context of the greater volatility.

I've read the chatboards. Investors hate this stock. It is not a good company. It's even been associated with scams.

But all we are looking for is a New Year bounce.

Imagine owning Company Unknown 2, meanwhile. It's been falling for five years!

It was a $7 stock, now it's 60c. Investors have had five years of relentless grind lower. It's a copper company with resources in the Southwestern U.S. That should be a golden ticket in current markets.

Investors will be furious. No surprise they're selling.

But it's got capital. There's some newsflow coming early next year. It looks like it has made a low around 50c. Could this be a dollar stock by March? Why not? The world needs copper. This company has lots of it.

You get the point.

Selling in my view will climax this Friday, December 19, and Monday, December 22, but you have until New Year's Eve to buy. (Most will have left their desks by Tuesday of next week I'd say).

The timeframe for the exit is February to March.

With all that in mind, here are 10 tax loss selling ideas for 2025-2-26:

I have been on a 2-day marathon scanning charts. Here are the best ten I could find.

This has been a hard year to find candidates, I must say, largely because resource stocks have had such a good time of it.

Crypto Treasury Companies, on the other hand, have had a terrible year, so — with a bit of help from Bitcoin (it needs to rebound) — they could enjoy a nice bounce.

I'll tell you my ideas and then at the end of today's piece, tell you the ones I am going for.

Tech

(NB $ = USD, unless otherwise stated).

1. Strategy Inc. (MSTR:NASDAQ)

Billionaire genius Michael Saylor's Strategy has had a rotten time of it lately. Once trading at a premium to its Bitcoins, it's now trading at a slight discount to them. If you want a long-term position in this company, now might not be a bad time to acquire it.

Trading at or near its lows for the year, it has properly puked.

It will only rally if Bitcoin rallies — and that particular engine has run out of steam — but it's a prime candidate for a rebound.

2. SOL Strategies Inc. (HODL:CSE; STKE:NASDAQ).

To think I was CEO of this company once upon a time, in its earlier incarnation as a privacy company, Cypherpunk Holdings. The company changed focus a year or two ago and is now a Sol staking company.

Basically, it sinks or swims with Solana.

Earlier this year, it got to $34. Now it's under $2. A proper puke job. One to sell and realise a loss. And so one for us to buy.

Like Strategy and Bitcoin, we will need some help from Solana. If it doesn't rally, this remains dead in the water. But if it does, it makes a lovely flip.

This could quite easily go above $5.

3. Strive (ASST:NASDAQ) is the third of my crypto treasury ideas.

That's the one with the chart above — Unnamed Company. I stress this trade is not about quality. It is unfortunately merging with Semler Scientific, which other readers and I hold (Semler is another tax loss candidate by the way, but there are better ones).

Again, with some help from Bitcoin, it could be a nice flip.

Here's another tech-related idea for you.

4. Healwell AI (AIDX:TSX)

Three years ago, this was a CA$3 stock. Now it's 85c. But it's now a top pick of Canadian broker, Haywood Securities, which has put a target of $4.50, now that it has cleaned up its balance sheet and refocused its activities on AI.

We don't need it to get that high. Pick it up in the low 80s and aim to flip at 1.20 is what I am looking to do.

Oil and Gas

I was looking for names in the oil and gas space as I think oil could prove a winner next year, but while oil itself has been weak, the stocks themselves have not been the disaster I have been looking for.

5. Vermilion Energy Corp. (VET:TSX; VET:NYSE) is not a bad option.

It looks like it made its low in April at CA$7. It was a CA$35 stock in 2022, so there are losers over that time frame, and this year it's "only down" about 15% which means it is not a mega tax loss candidate. But if oil and gas rally, so will this.

I see it as quite a low-risk bet, although I don't see mega gains either

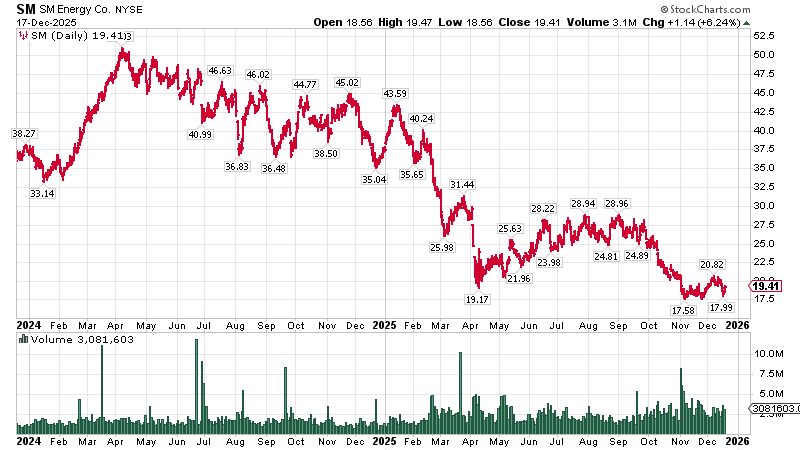

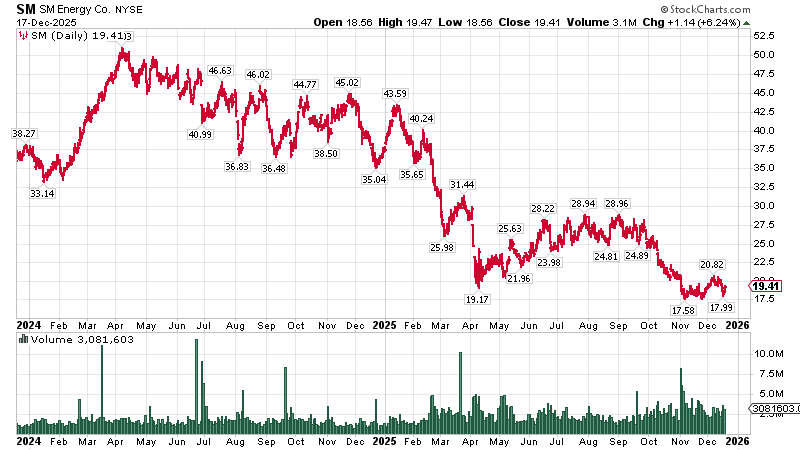

6. SM Energy Co. (SM:NYSE)

This $2 billion market company is perhaps a bit larger than ideal, but its chart — going from $50 to $17 — fits the bill.

The reason for the declines is largely lower oil prices. Its production has increased, though its margins have been compressed, so profitability is in doubt. There are also doubts about its reserves.

Such things need not bother us. We are here for a good time, not a long time.

Just as the treasury companies sink or swim with Bitcoin (and Solana), these will need some help from oil and gas prices, but oil to me looks like it's making a long-term low at $55.

A rally early next year will give this the filip it needs. A decline, though, won't.

Uranium

7. Lightbridge Fuels (LTBR:NASDAQ) has been a big winner for readers.

I think we first wrote it up at $3 or thereabouts, and it was a great tax loss trade last year, too.

This uranium fuel tech company, with a market cap $420 million, is up and down like the proverbial, and it has just had one of its down phases, hence my adding it to this list.

Really, the chart doesn't quite fit the bill, but it sort of does and it keeps on giving, so I include it here, if you can get it in the $12 range, here's hoping in 2026 it will do its thang.

Mining

8. As mentioned, we have a shortage of good mining candidates, but Arizona Metals Corp. (AMC:TSX.V; AZMCF:OTCQX) is a beauty — Company Unknown 2 above.

This CA$80 million cap copper development play has been a right dog, and it has a lot of disgruntled shareholders, but it has some news flow to come early next year in the form of PEA plus about CA$15 million in cash. The chart to me looks like it has bottomed at 50c, which would make an ideal buy point.

I would have expected it to reach there, but it spiked a bit yesterday for some reason, so maybe it won't go back there before year's end.

9. NexMetals Mining Corp. (NEXM:TSX.V; NEXM; NASDAQ) Can't really tell you much about this Botswana critical metals miner, except to say that it was a $50 stock 4 years ago and now it's a $5. No surprise it's now looking for a new CEO.

The declines have been relentless and inexorable, and now it's near its lows. But this CA$180 million market cap company has some $90 million in cash, and some heavyweight promoters, including Frank Giustra, behind the scenes, so it fits our bill well.

Here's the four-year chart of grimness.

10. I really shouldn't be giving airtime to companies like this. It's too small and too illiquid. But South Star Battery Metals Corp. (STS:TSX.V; STSBF:OTCBB) has a humdinger of a chart and plenty of cash — this CA$14 million market company just completed a highly dilutive, full warrants and all, raise CA$6.7 million.

That stock comes free trading in February 2026, so you don't want to be around for that. Exit this one earlier than the others. But at 13c, it's tempting.

What will be the trigger for this graphite miner? Lord knows, but the company could start by updating its presentation, which hasn't been touched since February. What a joke.

Phew. That was some work. I need to go and get some fresh air.

Summary

So there are ten ideas here. Obviously, you can't go for all of them. Maybe pick three or four — one from each category.

The risk with the treasury companies is that Bitcoin itself continues its declines, and we are unfortunately in crypto winter again, so that is not unlikely. Strategy is the safer option; Sol and Strive will see the bigger gains but also the bigger losses if they don't work.

Healwell AI is tempting me too.

Oil-wise, I lean towards SM Energy.

And as for the miners, they all have their allure, but probably avoid South Star unless you are feeling really reckless.

A reminder. Don't chase these things. Leave a stink bid under the market and let the price come to you. You have between now and New Year's Eve to get your limit order filled.

The usual disclaimers all apply, but I should say this. If you are not an experienced trader, you might be better off not playing this game.

As always, watch your position sizes and manage your risk.

Good luck!

If you'd like to read more from Dominic, you can sign up for The Flying Frisby here.

| Want to be the first to know about interesting Technology, Copper, Critical Metals, Uranium and Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of NexMetals Mining Corp.

- Dominic Frisby: I, or members of my immediate household or family, own securities of: Strategy Inc., Sol Strategies, Healwell AI, Vermilion Energy Corp., SM Energy Co., NexMetals Mining Corp., and South Star Battery Metals Corp. . My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Dr. John Wolstencroft: I, or members of my immediate household or family, own securities of: ishares US treasury 1-3 year ETF, Volta, Aberdeen Diversified, Black Rock World Mining, Van Eck global mining ETF, Aberdeen Asian Income.. My company has a financial relationship with:None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Dominic Frisby Disclosures: This letter is not regulated by the FCA or any other body as a financial advisor, so anything you read above does not constitute regulated financial advice. It is an expression of opinion only. Please do your own due diligence and if in any doubt consult with a financial advisor. Markets go down as well as up, especially junior resource stocks. We do not know your personal financial circumstances, only you do. Never speculate with money you can’t afford to lose.