Junior exploration stories often take shape quietly before the market starts paying attention. Vanguard Mining Corp. (UUU:CSE; UUFF:OTC; SL51:FWB) is one of those situations where the fundamentals, the asset base, and the technical picture are beginning to align.

Vanguard Mining Corp. is a Canadian mineral exploration company advancing a diversified portfolio of uranium, copper, and gold assets across the Americas. The company's projects are located in Paraguay and British Columbia, offering exposure to commodities tied to energy security, electrification, and long-term infrastructure growth.

Vanguard's core uranium assets are situated in Paraguay's Paraná Basin, where the company controls approximately 90,000 hectares adjacent to Uranium Energy Corp.'s Yuty Project. The basin hosts historical uranium mineralization and favorable geology, providing district-scale exploration leverage at an early stage of renewed market interest.

In Canada, Vanguard is advancing copper- and gold-prospective projects in British Columbia, a well-established mining jurisdiction. These assets are prospective for porphyry-style systems, including the Redonda Copper-Molybdenum Project and the Brussels Creek Gold-Copper-Palladium Project, offering leverage to base and precious metals critical to electrification and infrastructure development.

In addition, the company maintains an early-stage lithium brine project in Argentina, providing optional exposure to battery metals tied to electric vehicles and energy storage markets.

In August 2025, the company completed an oversubscribed financing, leaving it funded for upcoming exploration programs and reducing near-term financing risk.

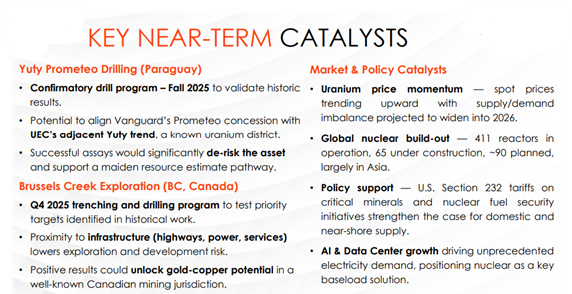

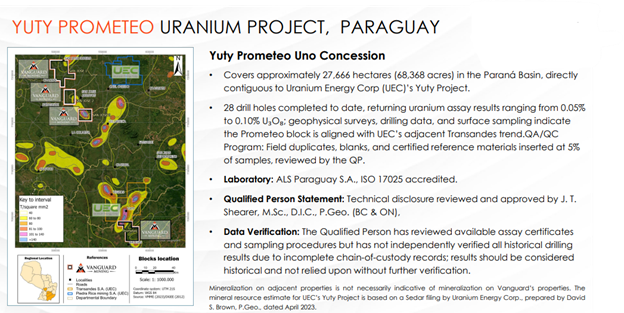

Key Property of Interest: Yuty Prometeo Uranium Project, Paraguay

The asset we believe has the greatest potential to move Vanguard's shares is the Yuty Prometeo Uranium Project in Paraguay.

The project is located in the Paraná Basin and is directly contiguous to Uranium Energy Corp.'s Yuty Project, a known uranium district. Vanguard's Prometeo Uno concession alone covers approximately 27,666 hectares and has seen historical drilling, with 28 drill holes returning uranium grades ranging from 0.05% to 0.10% U₃O₈.

Geophysical surveys, drilling data, and surface sampling suggest Vanguard's ground aligns with the same regional trend that hosts UEC's mineralization. While historical data requires confirmation, the geological setting is compelling. Planned confirmatory drilling represents a clear near-term catalyst that could materially de-risk the project.

In addition, the larger Prometeo San Jose concession spans more than 62,000 hectares and hosts multiple radiometric anomalies identified through car-borne surveys. Together, these concessions provide district-scale exposure in a basin that has already demonstrated uranium endowment.

Management and Advisors

Vanguard is led by David Greenway, President, CEO, and Director, who brings more than 20 years of experience in building, financing, and managing public companies. His background in the resource sector and capital markets has been central to assembling Vanguard's current asset base.

Richard Robins, Chief Financial Officer and Corporate Secretary, contributes over two decades of senior financial leadership, including prior roles as CFO of International Battery Metals and senior positions at TD Bank and Citibank. His experience in public company finance and balance-sheet management adds an important layer of discipline.

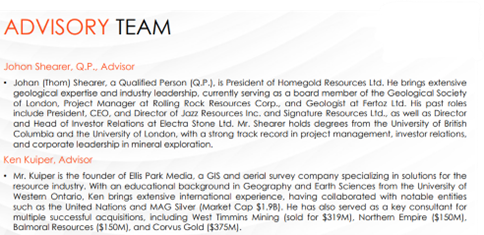

The technical team includes Larry Segerstrom, a professional engineer and geologist with nearly four decades of experience in porphyry copper-gold systems, and Johan Shearer, a Qualified Person with extensive geological and project management credentials. The advisory team is complemented by Ken Kuiper, whose background in GIS, aerial surveys, and M&A adds practical execution expertise.

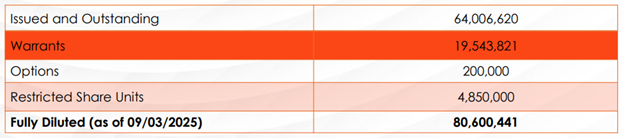

Share Capitalization

As of early September 2025, Vanguard Mining has approximately 64.0 million shares outstanding, with 80.6 million shares fully diluted. At recent prices around CA$0.17–CA$0.18, the company carries a market capitalization of roughly CA$13–14 million.

Following the August 2025 financing, Vanguard appears to be funded for near-term exploration activity. While warrants and restricted share units exist, the capital structure remains reasonable for a company at this stage and offers leverage to exploration success.

Technical Analysis (Updated December 19, 2025)

The updated chart of Vanguard Mining Corp. continues to show a long base forming after the sharp decline seen through late 2023 and early 2024. What stands out most at this stage is the progressive series of higher lows, accompanied by improving volume, suggesting accumulation rather than distribution.

Price continues to trade beneath a clearly defined zone of back-price resistance, marked on the chart by the dashed red line. This level capped rallies earlier in the year and remains the key technical hurdle. A sustained breakout above this zone, supported by expanding volume, would represent meaningful confirmation that the base has resolved higher.

Longer-term moving averages have flattened, downside momentum has slowed, and RSI remains neutral, which is typical during base-building phases. The phrase noted on the chart, "same way down, same way up potential," reflects the symmetry often seen once selling pressure has been exhausted following extended declines.

If the current structure continues to develop constructively, the chart outlines a clear set of upside objectives:

- First target: CA$0.32

- Second target: CA$0.50

- Third target: CA$0.90

- Big picture target: CA$1.50

While still early, the technical evidence supports the view that Vanguard is transitioning from basing into a potential accumulation-driven advance.

Conclusion

With a tight share structure, experienced management, exposure to uranium and copper in proven jurisdictions, and a constructive technical setup, Vanguard Mining checks several boxes for speculative investors looking ahead to the next phase of the commodity cycle. At current prices, I give a Speculative Buy rating to Vanguard Mining at CA$.15.

It's still early, but the groundwork is clearly in place. As always, investors should conduct their own due diligence, but from where we sit, Vanguard Mining deserves a place in risk-oriented portfolios for those seeking a low entry point and leverage to improving uranium and copper fundamentals.

Investors who want to follow upcoming exploration plans and corporate updates can find more information at the company's website here: www.vanguardminingcorp.com.

| Want to be the first to know about interesting Copper, Gold, Uranium and Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Vanguard Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000. In addition, Vangaurd Mining Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Vangaurd Mining Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.