Algo Grande Copper Corp. (ALGR:TSX.V) debuted on Tier 2 of the TSX Venture Exchange (TSX.V) under the ticker symbol ALGR, reflecting its name change from Kenadyr Metals Corp. and uplisting from the exchange's NET board.

Also, the company just consolidated 100% ownership of the Adelita copper-gold-silver project, which required two acquisitions. The second one, for the remaining 20% interest from Minaurum Gold Inc. (MGG:TSX.V), just closed. The first one, for an 80% stake from Infinitum Copper Corp. (INFI:TSX.V), closed previously.

Located in the prolific Sonoran–Arizona copper belt, Adelita hosts a high-grade copper-gold-silver skarn–porphyry system. The project is supported by a technical partnership with Dr. Peter Megaw, founder of MAG Silver, and Minera Cascabel, a Sonora-based geological consultancy with deep regional experience.

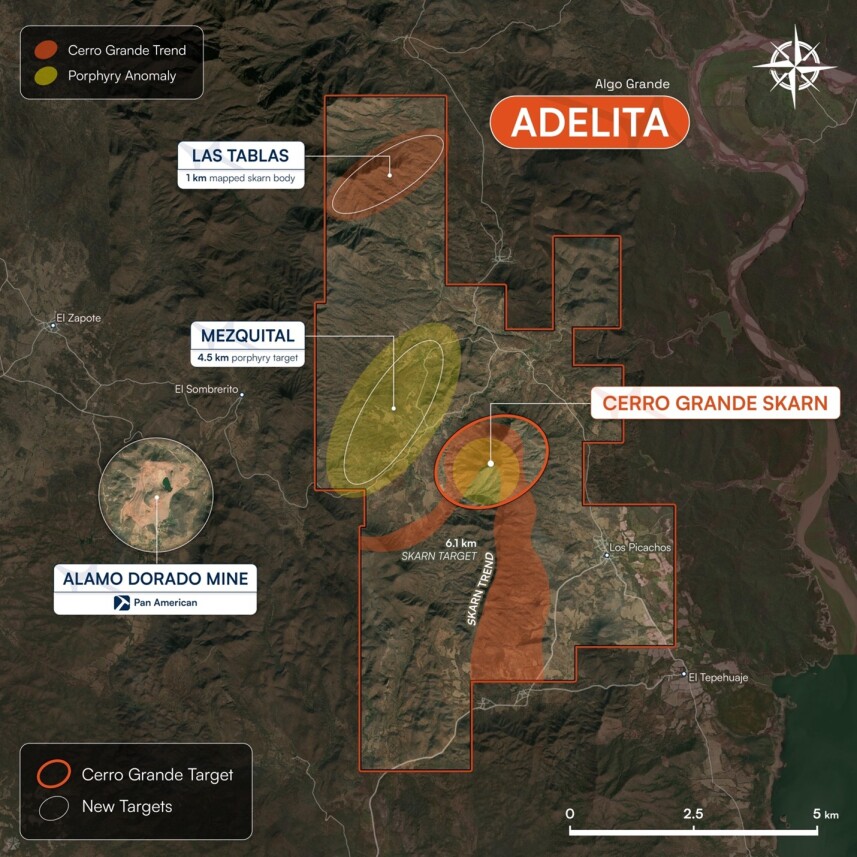

Adelita spans 5,985 hectares in the Arizona-Sonora copper belt in northwestern Mexico. Along with the property, Algo Grande gained extensive data from US$8 million (US$8M) worth of historical exploration work, including 7,000 meters (7,000m) of drilling; license-wide VTEM, induced polarization, and magnetic surveys; surface sampling; and detailed geological mapping.

Key highlights from the company include:

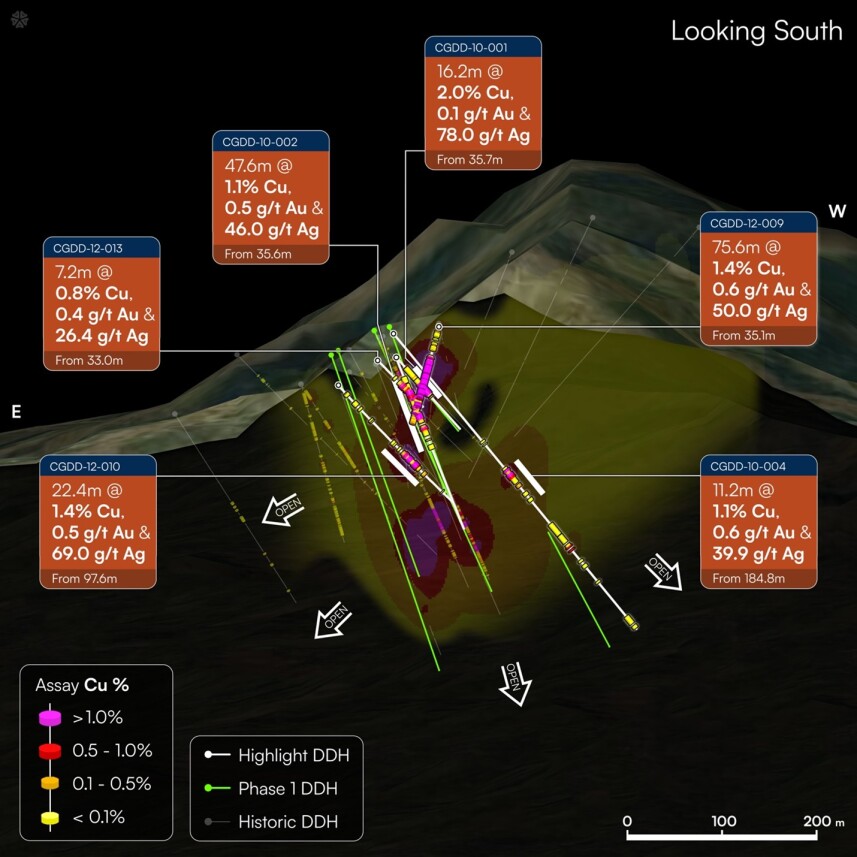

- High-grade skarn intercepts, including 16.15 m at 1.97% Copper (Cu), 0.84 g/t gold (Au), and 78 g/t silver (Ag)

- Skarn mineralization open along strike and at depth

- Large, untested porphyry target beneath Cerro Grande and at Mezquital (25–35 km² footprint)

- Fully permitted for exploration and underground mining, with drilling underway

In other recent news, the third and final tranche of Algo Grande's oversubscribed, nonbrokered private placement closed, generating CA$868M. The amount raised in aggregate from all three tranches totaled CA$3.82M. Kenadyr intends to use the proceeds, once released, to fund payment obligations and exploration expenses at Adelita, and for general working capital purposes.

All of these developments are part of the copper-focused growth strategy the company began executing earlier this year. Other elements were getting reactivated and uplisted to Tier 2 of the TSX.V from its NEX board, changing the company name, appointing a new chief executive officer, and strengthening the board of directors.

Reasons to Invest

Algo Grande Copper Corp., whose Spanish name translates in English to "something big" or "something great," has many compelling attributes from an investment perspective. Headquartered in Vancouver, British Columbia, the copper explorer owns a highly prospective asset in Adelita. The near-surface, high-grade Cerro Grande copper (Cu)-gold (Ag)-silver (Ag) skarn system at the project shows strong continuity along a defined, untested, 6-km-long corridor and remains open along strike and depth, the company explains in its December 2025 Corporate Presentation. Within this corridor are multiple, high-priority, untested skarn targets and a large 4.5-km porphyry-related geophysical and geochemical anomaly.

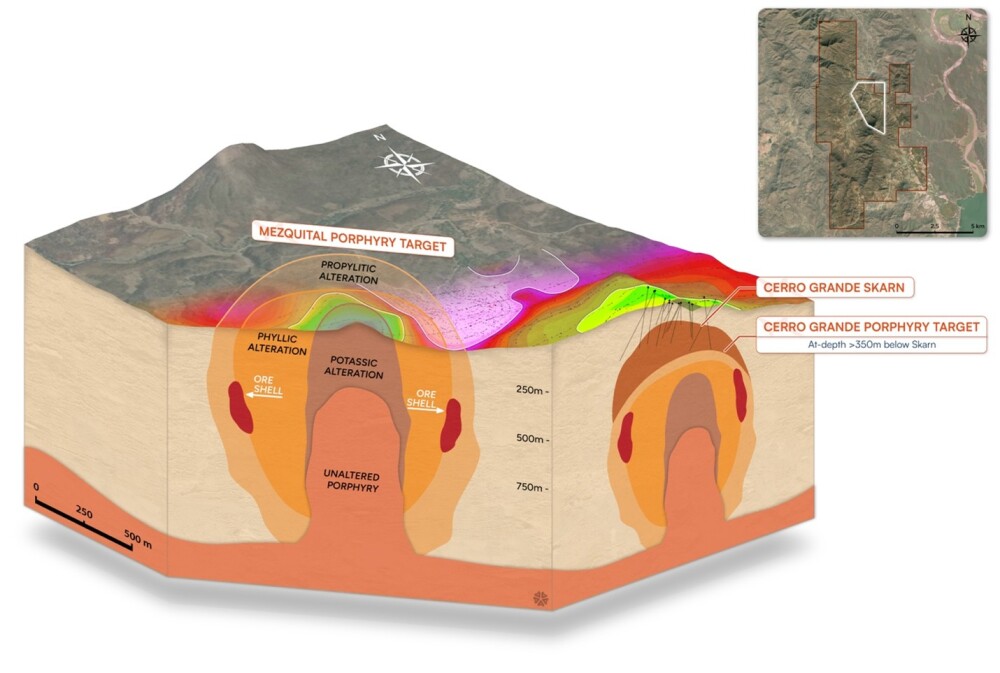

Historical drilling defined high-grade skarn mineralization over about a 300m vertical interval, and recent reinterpretation suggests the system extends beyond 350m downdip. Updated geological modeling indicates the skarn wraps around a northwest-trending structural fold and outlines a potential 1.2-km mineralized trend with additional prospective extensions to the south.

Adelita shows porphyry potential in two areas. At depth beneath Cerro Grande, there appears to be a porphyry feeder system, as evidenced by potassic feldspar veining, feldspar-porphyry dikes, zoned geochemistry, and a high-resistivity magnetic core identified via geophysical reprocessing.

Another large porphyry target exists at Mezquital, defined through modern reprocessing of legacy survey data. There, a chargeability anomaly extends over about 2.3 km.

"Together, these targets outline a possible large-scale, porphyry-skarn system consistent with other major deposits in northwestern Mexico," the company said.

Algo Grande's project is in a jurisdiction with a long mining history. Adelita is in Sonora, the state that accounts for 80% of Mexico's copper production. More specifically, the project is in the prolific Arizona-Sonora copper belt, a significant copper-producing region in North America. As for infrastructure, the Adelita project has road access, grid power, and water nearby. Not far away are the Port of Guaymas and regional smelting facilities that could process Adelita's high-grade copper material.

Algo Grande continues advancing Adelita toward resource definition. Already, the project is fully permitted for exploration, and a phase one exploration program is underway. Components will include diamond drilling, a ground magnetic survey, a soil geochemistry program, and reprocessing of 3D geophysical inversions.

"The objective of phase one will be to increase our understanding of the Cerro Grande skarn, defining precise stepout drill targets and advancing the geological model for the next phase of drilling," the company notes in its Corporate Presentation.

Also stated in the presentation, Algo Grande's management team and board members bring extensive collective technical expertise and capital markets experience to the table. At the helm, as chief executive officer (CEO), is Enrico Gay, whose background includes corporate structuring, finance, project execution, team development, and strategic communications for private and public companies in mining, technology, and other business sectors.

Dr. Peter Megaw, of Megaw Exploration Associates Inc., is Algo Grande's technical team lead and senior adviser. A geologist and expert in carbonate replacement deposits with a long track record of porphyry and skarn discoveries in Mexico, he is the founder of MAG Silver Corp., acquired earlier this year by Pan American Silver Corp. (PAAS:NYSE) for US$2.1 billion.

"With Dr. Peter Megaw and Minera Cascabel as our on-the-ground partners in Mexico, and the company's accomplished capital markets team, we are well positioned to unlock the project's full potential and drive long-term growth with a clear mandate to deliver significant shareholder value," Gay said in a November news release. Minera Cascabel S.A. de C.V. is a private, Mexico-based gold producer.

Copper Outlook Bullish

In 2025, copper prices hit many record highs, most recently US$11,816 per ton (US$11,816/ton) on the London Metals Exchange (LME) on Dec. 12. This is due to supply disruptions, low inventories, tariff fears and a weaker dollar, all of which helped offset softer demand from China, Seeking Alpha's Head of Quantitative Strategies Steven Cress wrote in a Dec. 16 article.

Many experts have a favorable outlook for copper in the near and mid-term. RBC Capital Markets wrote in a note that the mining industry is struggling to build new supply, and that investment in new copper production will require a period of higher prices. As far as demand, RBC commented, "The interplay of artificial intelligence (AI)-driven data center growth, electric vehicle (EV) expansion and a global shift toward dovish economic policy sets up a strong case for copper demand."

Updated production guidance from key copper producers indicates about a 300,000-ton reduction in output, according to Deutsche Bank, CNBC reported on Dec. 14. As such, the bank sees a clear deficit of mine supply in the near term, at its weakest in Q4/25 and Q1/26. Thus, Deutsche expects peak prices and market tightness in H1/26.

Citi analysts see increasing demand, driven by the energy transition and AI sectors, and on the supply side, constrained mine supply and continued hoarding of the physical metal in the U.S. for arbitrage opportunities. Analysts predict copper will reach US$13,000/ton early next year, then leap to US$15,000/ton by Q2/26.

Avatar Commodities CEO Andrew Glass predicts "stratospheric new highs" for copper, in large part due to the continued stockpiling of it in the U.S.

ANZ Group Holdings Ltd. analysts "are bullish on copper and expect the market to move further into deficit in 2026," they wrote in a note, Bloomberg News reported on Dec. 15. "Demand continues to beat expectations, despite concerns over the global economy and the fall in China's economic growth." However, they warned that because copper's performance is tied to the "fate of the U.S. technology boom," it is susceptible to any drops in AI and tech valuations.

Cress pointed out the potential supply-demand disparity in the longer term. Global copper demand could nearly double by 2050 to more than 40 million tons (40 Mt) per year, yet the world's copper undersupply could approach 20 Mt due to potential supply constraints, including declining ore grades, underinvestment, long project lead times, and tight geographical concentration.

The Catalysts: Fresh Exploration Data

Algo Grande noted in its Corporate Presentation that potential upcoming catalysts include results from the phase one exploration campaign at Adelita, including those from drilling.

Ownership and Share Structure

The company has 32 million shares outstanding. Its estimated capital structure is this: 52% insiders and strategic backers, 38% financing, and 10% acquisition consideration.

| Want to be the first to know about interesting Copper investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Algo Grande Copper Corp. and Pan American Silver Corp.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.