Two weeks. Six cities. Twenty-five thousand miles were traversed from my recently established residence in Abu Dhabi. RiskHedge publisher Dan Steinhart and I recently concluded a fast-paced journey across the United States.

We convened with 40 preeminent innovators, encompassing no fewer than six billionaires. The groundbreaking individuals we encountered were immersed in pursuits ranging from hypersonic aircraft to miniaturized nuclear reactors, self-destructing drones, and beyond. The foremost subject occupying everyone's thoughts was artificial intelligence (AI).

Three years have elapsed since ChatGPT catalyzed this transformative megatrend. Investors are wary of the AI hype. Inquiries abound, such as "Has the boom concluded?" "Are we ensnared in a bubble?" "Is this a replay of the dot-com era?"

Adopting a pessimistic outlook on AI at present is effortless. It conveys an air of astuteness. However, as we are fond of stating, "Pessimists sound smart; optimists make money."

Over the past decade, one insight I've gleaned is that disruptive megatrends possess the capacity to endure longer than one's ability to sustain interest.

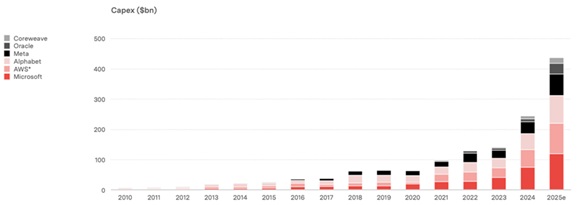

The singular chart I persistently revisit depicts the magnitude of expenditure by major tech corporations in constructing AI infrastructure. As evidenced, that figure continues its upward trajectory:

This torrent of capital persists in bestowing profits upon investors in AI infrastructure entities. A cursory glance at this chart might suggest that AI has reached maturity. However, a deeper examination reveals that fresh victors are emerging consistently.

This stems from the perpetual evolution of the AI trade.

Every few quarters, Wall Street recognizes a newfound bottleneck in the system, and the enterprises positioned at that juncture abruptly ascend to become the most sought-after stocks worldwide.

The inaugural wave of winners was self-evident: GPUs. When the global supply of graphics processing chips was exhausted, Nvidia Corp. (NVDA:NASDAQ) surged by more than 1,000%. It stood as the solitary provider of tools amidst a gold rush. Subsequently, AI encountered its subsequent constraint: power. Training colossal models necessitates immense quantities of electricity. This propelled utilities — historically among the most unexciting sectors — to the apex of performance charts in 2024.

Memory followed suit. As models expanded from billions to trillions of parameters, the system demanded significantly more high-bandwidth memory. Micron Technology Inc. (MU:NASDAQ) and SK Hynix experienced a surge as AI companies acquired every available memory chip. Zooming out reveals a crystal-clear pattern. When AI encounters a bottleneck, funds inundate the companies that alleviate it.

Envisioning AI as a Python ingesting a pig proves beneficial. The bulge progresses gradually through the system, transitioning from one bottleneck to the next. Initially, chips, then power, followed by memory, and presently, data flow. The massive influx of AI spending doesn't confine itself to a single market segment before halting. It persists in its advancement, elevating entire sectors that investors had long ago dismissed. This explains the sudden resurgence of previously overlooked and unfashionable stocks.

We are far from the conclusion of the AI megatrend. Upon closer examination, you'll discern that the subsequent cohort of winners is already beginning to materialize. Fiber optic stocks are experiencing a surge. In the preceding six months, Coherent Corp. (COHR:NYSE) leaped 120%, Ciena Corp. (CIEN:NYSE) skyrocketed 153%, and Lumentum Holdings (LITE:NASDAQ) soared an astonishing 310%. These remnants of the dot-com era, once considered antiquated, have abruptly emerged as some of the premier stocks in the entire market.

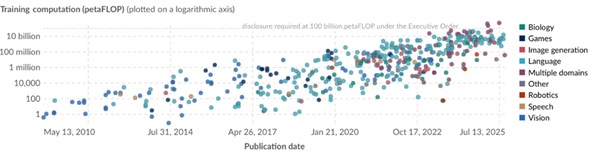

Training today's preeminent AI models entails interconnecting tens of thousands of GPUs into a singular colossal supercomputer. Compute requirements have escalated by an astounding 1,000,000,000,000% (1 billion percent) since 2010:

We possess the capability to accelerate GPUs. We can manufacture more of them. We can inundate them with electricity.

However, all of this is inconsequential if the information cannot traverse swiftly enough between chips.

"Bandwidth" represents the genuine bottleneck in AI at present. Copper wiring, the foundational backbone of electronics for 150 years, has reached its limit. It lacks the capacity to transmit data with sufficient speed between chips for next-generation AI.

This is where fiber optics excels.

Optical cables have historically resided outside the data center.

Contemplate submarine cables, coast-to-coast fiber, and telecom towers. AI is pulling optics into the data center, into the racks, into the network fabric, and even into the connections between GPUs. This transition from long-distance infrastructure to the core of the data center constitutes the most significant development in the AI buildout today.

For an extended period, fiber was a mundane, cyclical industry plagued by abysmal margins and subpar customers. The majority of investors eschewed this sector. However, fiber optics excels at one particular task: rather than transmitting data as electricity via copper wire, fiber optics converts data into laser light and propels it through glass filaments at the velocity of light. To enable tens of thousands of GPUs to function as a unified brain, the data between them must traverse instantaneously — not a few milliseconds later. Nvidia has recently announced that its latest and most advanced racks will abandon copper in favor of optical fiber.

Fiber-optic stocks are poised to shine in the upcoming phase of the AI buildout. Data centers are beginning to encounter size constraints: power, cooling, and even available land. At a certain point, it becomes impossible to cram additional hardware under a single roof. The forthcoming wave of AI infrastructure will not consist of one gargantuan data center. Instead, it will comprise clusters of smaller data centers dispersed across a region, linked together to operate as a unified machine. Industry insiders refer to this as "multi-site" training. To realize this vision, a novel type of fiber cable known as coherent optics is essential.

Coherent optics analyzes the light signal in the fiber with greater precision. Rather than merely measuring the brightness of the light, they also examine its shape and timing. This additional detail enables the transmission of significantly more data through the same glass strand — up to a tenfold increase. Companies possessing genuine expertise in coherent optics are poised to lead from this point forward.

At present, optics represents the most undervalued segment within AI infrastructure. The prevailing misconception is treating this as a repetition of the year 2000 — when we overbuilt fiber, resulting in a crash. The reality is that we are on the cusp of re-architecting the entire data center around optics. The market still perceives the AI narrative as revolving around GPUs and model wars. That constituted Phase 1. The subsequent phase centers on the invisible glass threads that enable thousands of those GPUs to function as a singular brain. I would not be astonished if fiber optic stocks emerge as the top-performing group in 2026.

I get it — AI fatigue is real. But just beneath the surface, a new wave of infrastructure winners is breaking out. If you want to stay ahead of where the money’s moving next, The Jolt is the best way to do it. I’ll send you regular updates on the most important AI trends, so you never miss a thing. Sign up here today.

| If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing. | Go here to join |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Micron Technology Inc.

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.