Charlie Munger, the iconic investor and longtime partner of Warren Buffett, left an indelible mark on the world before his passing two years ago at the age of 99. More than just a billionaire capitalist, Munger was a wellspring of lucid insights and perennial truths.

Today, let's revisit the invaluable lessons he imparted and explore how we apply them to investing at RiskHedge.

The cardinal principle is this: Exceptional investors must constantly evolve.

In Berkshire Hathaway's (BRK.B:NYSE) early days, Buffett pursued "cigar butt" stocks, companies teetering on insolvency, trading below their cash reserves.

Munger transformed that approach. He convinced Buffett to back enterprises poised for long-term dominance rather than those offering "one last puff."

Pre-Munger: Acquire decent businesses at fantastic prices.

Post-Munger: Acquire fantastic businesses at decent prices.

Buffett credits this pivot for propelling Berkshire into the trillion-dollar titan it is today. As one RiskHedge analyst put it, "Munger taught Buffett to be more optimistic and focus on the quality and potential of businesses. This shift was critical to Berkshire's long-term success."

Yet, even Munger conceded that he and Buffett missed the technology wave...

Since the 2008 crisis, the tech-centric Nasdaq has outpaced Berkshire twofold.

Consider Amazon.com Inc. (AMZN:NASDAQ), which has expanded revenue by 30% annually on average, now exceeding half a trillion dollars yearly. Its shares have soared over 7,000% since 2000.

Nevertheless, many investors passed on Amazon due to its seemingly lofty valuation. A costly error.

Here's what I believe Munger would advise if starting anew today:

Victors keep winning. Fresh peaks often serve as mere stepping stones to greater heights.

Companies that sustain rapid growth for decades represent a novel breed, justifying their premium valuations.

So how can we apply this to the current market?

The takeaway: Invest in swiftly growing firms while they still trade at sensible multiples.

That's precisely our strategy at Disruption Investor, and our performance speaks volumes.

Consider Nvidia Corp. (NVDA:NASDAQ), a Disruption Investor Hall of Famer.

When we bought NVDA in September 2020, it boasted a $320 billion market cap. Recently, it became the first company ever to reach $5 trillion.

We recognized the AI boom early, taking profits on NVDA twice as it catapulted higher. We're currently enjoying a 602% return — a sixfold gain on every dollar invested.

We've just added new positions in companies fueling the next AI phase, as well as pioneers in the robotaxi revolution and nuclear energy.

Each one trades "inexpensively" relative to its growth trajectory — and each could emerge as the "new Nvidia" within its respective industry.

A few parting "Mungerisms"...

It's never too late to attain wealth: Munger didn't join forces with Buffett (and strike it rich) until his mid-50s. If you desire something, go after it. It's never too late.

Skip the estate: Charlie resided in the same modest home for seven decades. He believed relocating to a mansion would have damaged his children. A vital lesson there!

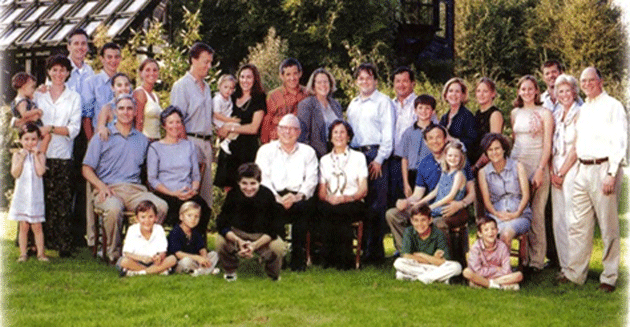

Stay optimistic: Early on, Charlie lost his son to cancer, divorced, and relinquished everything in the split — including his house. Yet he went on to amass a $2 billion fortune and a large, joyful family.

Here he is (center, white shirt) with his wife Nancy, their nine kids, and numerous grandkids:

What an extraordinary existence.

Charlie surmounted unthinkable adversity by discovering his calling and toiling relentlessly to become one of America's wealthiest individuals.

If Charlie can realize his ambitions, what's holding us back?

We won't make it out of here alive. Let's seize the day while we still can.

Munger always said, “Spend each day trying to be a little wiser than you were when you woke up.” That’s what I aim to do with The Jolt: share ideas that sharpen your thinking, improve your investing, and leave you a little wiser each week.

If you’d like to become a regular reader, you can sign up for free here.

| If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing. | Go here to join |

Important Disclosures:

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.