Can you identify the top-performing stock among the "Magnificent 7" this year? It's not Nvidia Corp. (NVDA:NASDAQ), Apple Inc. (AAPL:NASDAQ), or Tesla Inc. (TSLA:NASDAQ).

The crown goes to internet search monarch Alphabet Inc. Class A (GOOGL:NASDAQ).

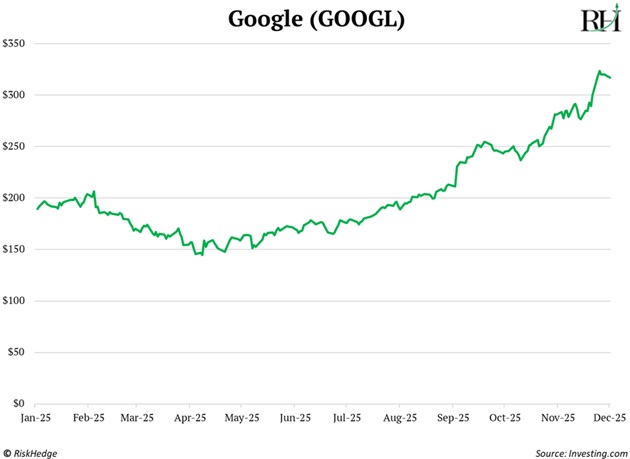

The company's stock has ascended 67% year-to-date, quadrupling the returns of the S&P 500.

Google now commands a gargantuan $3.8 trillion market cap!

I hypothesized that artificial intelligence (AI) would upend Google's dominance.

I previously devoted hours daily to navigating Google's 10 blue links. For myself and countless others worldwide, it served as the internet's front page.

Nowadays, I scarcely utilize Google. Rather than endlessly clicking to unearth answers, I simply query an AI chatbot akin to ChatGPT.

Google is doomed, correct?

False.

While traditional search is becoming obsolete, Google rallied and debuted its own ChatGPT rival, Gemini. Gemini's initial iterations were abysmal. Recall this debacle from early 2024?

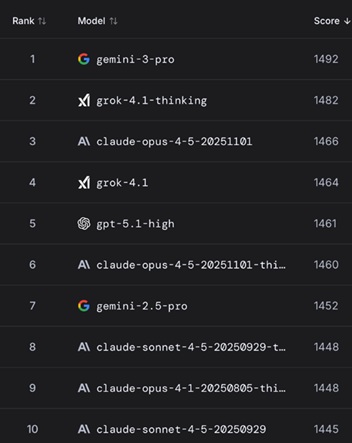

Google got rid of almost all of its politically incorrect waste and has one of the best AI models in the world. Its updated AI Model Gemini 3 is now at the top of the AI billboard, soaring ahead of Chat GPT 5 and its over competitors. I have personally used it and can confirm it is incredible.

Google is triumphing in AI's most crucial contest…

Cost efficiency.

We interface with ChatGPT via a screen. However, behind the curtain, immense infrastructure is being constructed to enable this.

The AI buildout represents history's most extensive infrastructure undertaking.

Amazon, Microsoft Corp. (MSFT:NASDAQ), Oracle Corp. (ORCL:NYSE), Meta Platforms Inc. (META:NASDAQ), and Google will invest over $400 billion this year in erecting AI data centers.

In a single year, AI infrastructure expenditure has ballooned to rival the entire Apollo program or the Interstate Highway System.

To date, the lion's share of that capital has been funneled into crafting AI models like ChatGPT, Gemini, or Perplexity. Enhance their intelligence. Expand their scale. Bolster their reasoning capabilities. This constituted the "training" phase.

We're now venturing into a novel era...

The inference era. When you pose a query to ChatGPT, and it responds, that's inference. That's the model "in action."

You, I, and virtually every enterprise, pupil, agency, and programmer are now perpetually leveraging AI models—all day, every day. Training occurs once. Inference transpires trillions of times daily, in perpetuity.

As AI's sophistication soars, so does the intricacy of tasks it can tackle… the volume of cognition required… and the chips, compute, and electricity it will devour to actualize it all.

In the SaaS era, software bore zero marginal replication costs. In the AI era, each individual answer carries a tangible, physical cost in electricity and computing.

Cost reigns supreme. Whoever can generate the most economical AI "tokens" wields an immense advantage. Here, Google shines as the sole entity fabricating its own AI models and chips, turbocharging efficiency.

Google has been producing its proprietary chips, TPUs (Tensor Processing Units), for over a decade.

TPUs propel nearly every Google AI endeavor — from Gemini to YouTube recommendations to real-time translation. Envision them as the "Formula 1" race cars of the chip realm. Purpose-engineered to execute one task (run AI) with unparalleled proficiency.

Google's edge extends well beyond chips.

The tech titan commands the entire AI stack, from zenith to nadir.

It possesses its own data centers, among the most energy-efficient on the globe. It boasts its own models. Gemini now ranks as one of the mightiest AIs on the market.

Google also presides over the apps where AI is deployed to billions: Google Search, YouTube, Android, Maps, Gmail, Workspace, and Waymo. Each of these offerings can instantaneously embed and monetize AI. No other enterprise approaches this echelon of vertical integration. Everyone else either leases chips, data centers, distribution, or content. In an epoch where each minuscule enhancement in AI's intellect dramatically inflates inference costs, owning the entire stack confers an immense advantage. It's akin to Walmart Inc. (WMT:NYSE) hawking identical groceries at half the price of rivals.

Longtime RiskHedge readers know I haven't been a fan of Google stock in the past.

Google epitomized how incumbents get blindsided by disruption. It had a functional chatbot two years pre-ChatGPT and was too timid to unveil it.

It permitted OpenAI to sashay in unimpeded and pilfer users at scale. But the tide is turning. Google finally stirred and now appears poised to be a major contender in the AI race, which will reign supreme over the next 5–10 years.

But despite my admiration for Google's resurgence, far more lucrative opportunities beckon elsewhere.

Google already looms as a $3.8 trillion colossus. Could it nearly triple to $10 trillion? Absolutely.

But lesser-known AI victors harbor far greater upside potential. From the outset, I've maintained that you want to own the companies on the receiving end of the AI spending boom — not those doing the spending.

In other words, own the winners from the AI infrastructure boom. That's proven wildly successful for Disruption Investor members who doubled their money (or more) on multiple AI winners.

AI is changing fast. The Jolt helps you keep up with the moves that actually matter. Go here to join and get it delivered straight to your inbox every Monday and Friday morning.

| If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing. | Go here to join |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tesla Inc. and Apple Inc.

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.