Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCQB; LLJA:FSE) released more promising drill results from the El Cura deposit at its flagship Iberian Belt West (IBW) project in Spain, reported Canaccord Genuity Analyst Dalton Baretto in a Nov. 14 research note.

"We reiterate our Speculative Buy rating on Emerita as well as our CA$2.50 per share target price on the company," Baretto wrote.

92% Potential Upside

At the time of Baretto's report, the Canadian explorer was trading at about CA$1.30/share, the analyst noted. From this price, the return to target is 92%.

The company has 289.5 million shares outstanding. Its market cap is CA$376.3 million. Its 52-week range is CA$0.56–2.00/share.

Review of the Results

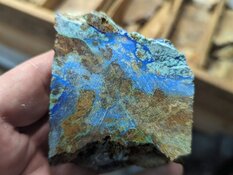

Baretto presented Emerita's newly announced drill results and highlighted their grades. The data are for five holes (ECO72, ECO76, ECO78, ECO79 an ECO82) drilled at El Cura, one of three deposits comprising the explorer's IBW project. El Cura, rich in copper, sits between La Romanera to the west and La Infanta to the east, both zinc and lead rich.

Of the quintet of reported holes, ECO72 was the highlight, having returned 9.6 meters (9.6m) of 2.7% copper, 0.4% lead, 0.5% zinc, 1.85 grams per ton (1.85 g/t) gold and 27.08 g/t silver. ECO72 was one of three stepout holes, along with EC078 and EC082, aimed at extending the deposit downplunge to the west.

"El Cura continues to prove out downplunge to the west, and we anticipate further extensions in this direction," Baretto wrote.

The two others, ECO76 and ECO79, were shallow delineation holes placed in La Cura's central portion, noted the analyst. ECO76 demonstrated 1.2m of 0.5% copper, 0.9% lead, 0.5% zinc, 1.2 g/t gold and 38 g/t silver. ECO79 showed 6.9m of 1.4% copper, 0.9% lead, 2.4% zinc, 1.32 g/t gold and 48.22 g/t silver.

"We note high-grade intercepts both in the stepout drilling as well as in the shallow delineation drilling," Baretto wrote. "We note the elevated precious metal grades in all the intercepts, which appear to be directly correlated to the copper grade."

True widths were estimated at 90–95% of reported widths, Baretto wrote.

A sixth hole, ECO74, was geotechnical, not an exploration or delineation hole, and did not return a significant assay.

The analyst pointed out that Emerita could revise its mine plan to mine El Cura before La Romanera and by doing so, reduce the amount of required initial development capex.

Imminent Key Event

Baretto again highlighted that a final court decision regarding the Aznalcollar project tender dispute is expected to be announced soon, and the outcome "could be a major catalyst for EMO shares."

| Want to be the first to know about interesting Gold, Copper, Silver and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |