It was nearly one year ago that I sat down at my desk on a Sunday evening pondering the idea of backing up the pick-up truck and loading it fully to the gunnels with long-dated call options on Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), arguably the finest-run mining company on the planet which I had historically reserved for my beloved Freeport-McMoRan Inc. (FCX:NYSE).

I took a look at the chart at the time and was obsessing about the huge move we had just experienced in the past year (2023-2024) up a staggering 93% and fearful that I was "chasing it."

So, I refrained from the trade and skulked away from my computer in a blue funk because I lacked the intestinal fortitude to pull the trigger but secretly relieved because of the prior two years of chasing poor Fido around the house with a Taiwanese claw hammer feeling like I was in a dentist's chair undergoing root canal surgery without the benefit of nitrous oxide or Novocain. In fact, the period from August 2020, with gold at $2,186, to the lows in September 2022, with gold at $1,812, was so psychologically punishing that there was nary a trader to be found willing to speculate in call options on gold miners.

Fast forward to a 2025 and as I look into the mirror of life, I see a battered and bruised psyche in a man pummeled by inaction from the prior year due to indecision and inaction, an embodiment of the aging senior who looks back at the chance he might have taken on a piece of and whilst in his 30's that was thwarted by a form of prudence known as "cold feet."

So here I am a year later, and gold is now higher by 46% than it was a year ago when I sat there staring at my computer like a grade-school dropout tormented by multiple failed Pac-Man attempts with AEM up another 99.3% and about to post record earnings and record net free cash flow while posting the lowest AISC of all the majors.

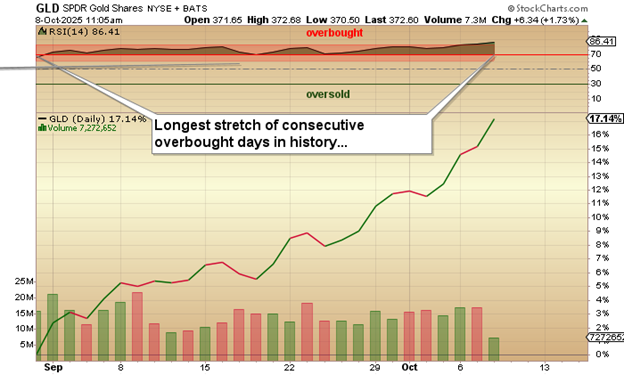

Every gold guru from Boca Raton to Geneva to Alice's mom's basement is calling for a correction in the miners and in gold. Even I put out an Email Alert this week that points to the period of July 21 to August 10, when the relative strength index for gold moved above the overbought "70" level and stayed there for 19 consecutive days, during which gold advanced 15.6% after which the entire precious metals complex fell apart like a Japanese kite during an Atlantic hurricane.

After topping out on August 6, 2020, it took three and a half years to surpass the 2020 peak. Squeezed in between that expanse was the matter of a 21.28% bear market decline that lasted until October 31, 2022. The senior and intermediate gold miners were also punished with GDX:US dropping 44.51% and the GDXJ:US dropping 52.33%.

As of last Wednesday, when it peaked at $4,080, GLD:US had remained overbought (RSI above 70) for forty-one (41) consecutive days and had advanced 17.14% in the same time period. This kind of a move, while exhilarating if you are long gold and silver, was absolutely unprecedented. I bought a boatload of GLD:US put options as well as a few shares in JDST:US (Junior Miner "bear" ETF) just to see if "by recalling the past I could possibly profit in the future" (to coin a corny phrase).

Any way you slice and dice it, the gold and silver markets were ready for a) a "well-earned pause", b) a "healthy correction", or c) a "crash" brought on by the blow-out we just witnessed from August 27 until October 8. Take your pick.

Here is where it gets scary from a risk management viewpoint. I can see prices correcting over a 3-6-month period back to the 100-dma without too much of a problem. While constituting a 14.7% correction, it really is nothing when you consider where gold was at the beginning of this bull market in March 2020, which was at around $1,450.

The 100-dma started the year at around $2,625, so if one's knees start shaking at a correction back to $3,465, one should not be in the gold market.

Seen another way, look at the chart dating back to March 2020 at the nadir of the Covid Crash.

This market could correct back to $2,300 and still be in a bull market, albeit the secular bull as opposed to the cyclical bear that would be the short-term move down from 4,080.

I have advised subscribers that rallies in gold and gold miners are to be sold with a buy-stop on a 3-day close above $4,100. Stated another way, I am wagering that we will see the 100-dma before $4,100 keeping in mind that if gold simply trades sideways in a narrow range for the next few months, the X-axis will take the 100-dma up towards the flatlining gold price in order to fulfill the prophecy.

Near-term, the trade favors put options on GLD:US and long positions in the following:

- DUST:US: double leverage bearish bet on the Senior gold stocks.

- JDST:US: double leverage bearish bet on the Junior gold stocks.

- GLL:US: double leverage bearish bet on the GLD:US.

The past 41 days of excessive bullishness were a true illustration of the "Golden blow-out," where the "uncontrolled release of gold and silver and/or physical gold and silver from portfolios after their pressure control systems have failed."

Tariffs

For those of us who were being buried by this incessant, never-ending bid for stocks in all sectors, sizes, and shapes, we tip our hats to the President of the United States, Donald Trump, who turned a S&P 75-point rally into a 123-point decline with the mere mention of "massive tariffs" about to be unleashed upon China. In a long social media post, the U.S. President launched a tirade against Chinese foreign policy and "Export controls" imposed around the world. The full story and content of the Trump Tweet can be found here.

Stocks got blasted for the biggest one-day drop since April 10 just after the American President made his fateful pivot and decided to "grow his way out of sovereign debt problems" instead of managing his twin deficits with austerity measures (DOGE). The S&P 500 lost 2.71% with the NASDAQ getting smoked for 3.56% while gold and silver clawed their way back from Thursday's "devastating losses" (give me a break).

These fuzzy-cheeked traders are so used to making money by "buying the EFFING dip" that the first session in five months that fails to hand out free candies at the door results in the clowns over at CNBC trotting out the "Markets in Turmoil" banner along with an army of defiant bulls doing everything in their "perma-bull manuals" to soothe the panicking throng of basement-dwelling day traders suddenly finding themselves under the surface of the "Waters of Solvency" and in the jaws of millions of losing trades ironically on the last day before Thanksgiving.

It got even worse in the after-hours markets on Friday after the President confirmed 100% tariffs and export controls on China while refusing to even meet with Xi at any time in the immediate future.

They used to say back in the late 1980's that Japan's Nikkei Index was "a bug in search of a windshield" and while I laughed at it back then, I can say that the U.S. equity markets are an across-the-board "Interstate 70 with all vehicles moving at 100 mph moving into an Illinois ice storm."

I care not whether I could ever listen to CNBC with a serious intent to glean an actionable trading idea unless it is from the contrarian bent. Everyone on that despicable platform, with few exceptions, says anything that is not "talking their book" or "pumping their firm."

Have any of you heard anyone on CNBC warning of a major policy-shift from President Trump in the past five months?

Copper Policy shift

Copper has been my favorite metal for the better part of five years, with a brief interval in 2025 when I suspected that the spread between Comex copper and LME copper was too large. As a result, I took copper down from #1 to #3 and moved gold to #2 and silver to #1 about a month before President Trump removed the tariff on "raw imported copper," which eliminated the $1.50 premium on the Comex. Since most of the North American equities were priced off Comex copper at $5.90 rather than LME copper at $4.40, that pen stroke took the Comex price down 20% in one trading session and the equities all along for the ride lower as well, allowing me to then replace gold and silver with copper at the top of the heap as the #1 metal for investment in 2025 and beyond.

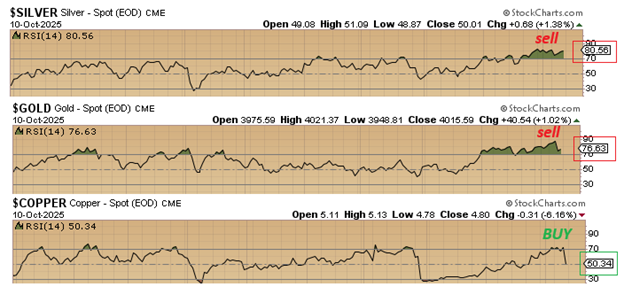

However, the prospect of a global trade war hit the copper market today and accelerated after the close when President Trump torqued up the geopolitical slugfest with the new tariff threats causing it to go out at US$4.84/lb. down 8% from the highs seen earlier this week. RSI for copper went out at a completely neutral 50.34 versus gold at an overbought 76.64 and silver at a seriously overbought 80.56.

Note the three charts shown below displaying the RSI for silver, gold, and copper, and ask yourself which of the three metals you want to own if we go into a global trade war. A global trade war will be a deflationary event that causes critical disruptions in the global supply chains, which will not be inflationary, as it will cause a massive drop-off in monetary velocity.

If less money is changing hands, then prices are going to be hard-pressed to advance, and with inventories ballooning, the prices of those inventories will be moving down the curve to find the price point where they clear. At this point, it is a clear case of demand and supply, a battle that only copper can win and win decisively.

There is the matter of restricted supply from shutdowns at Kamoa-Kakula, Grasberg, and El Cobre, and accelerated demand from AI, electrical grid expansions, and data farm build-outs. Gold and silver have literally NO supply issues (despite what you read and hear on the internet) as the base metal miners can mobilize silver in a heartbeat should they choose to do so, while the number of new gold projects being fired up with gold at $4,000/ounce is staggering. I can safely tell you that the greatest risk to the current gold price is the margins enjoyed by the producers these days. More importantly, there are literally dozens of 3-5 million ounce resources that are now demonstrating positive economics by way of "robust" PEA's or Preliminary Feasibility Studies that demonstrate positive fully-discounted ROI's. The same condition exists for the silver developers, only less robust than in gold.

Trade wars benefit no one. There is nary a country on the planet that can safely assert that history would prove that out. The Smoot-Hawley Tariff Act was passed on June 17, 1930, when President Herbert Hoover signed it into law. The legislation had been passed by both the Senate on June 13 and the House on June 14, 1930, just a few months after the stock market crash of 1929. It is widely believed that it contributed to the arrival of the Great Depression, and when similar bills were proposed over the years, the issuing country suffered greatly.

President Trump has recently established copper as a "critical metal" and will treat it as such until he leaves office. This is strongly bullish for domestic copper deals and particularly bullish for districts such as the Iron Range of northeastern Minnesota recently established copper as a "critical metal" (Duluth Mining District) where President Trump's Fast 41 bill has placed the Glencore-Teck JV on the New Range Project at the front of the pack.

Over the past 100 years, there has never been any issue concerning the existence of the undeveloped mineral wealth within the district. The only issue has been the opposition from the liberal left and environmentalists who oppose mining at or near the "boundary waters" of the state.

While one can and must never underestimate the power of the liberal left in defeating support for otherwise economically viable mining projects anywhere in the U.S., it is my conviction that jobs and household opportunity will win out over politically correct and very much "WOKE" politics, especially under the Trump presidency.

With the U.S. electrical grid desperately in need of upgrades and expansion, copper will be a much-sought-after “critical” metal, providing a dynamic tailwind behind the copper developers and producers within the domestic U.S.. One such name that I am following is Green Bridge Metals Corp. (GRBM:CSE; GBMC:OTCQB), whose presence in the Duluth Mining District is not only strategic, it is adjacent to the Glencore-Teck JV on their New Range Project.

Capped at a mere $21m (fully-diluted post-money), a shift in the political winds in this part of the world will create an undeniable tailwind to market cap advancement.

Public companies have been emaciated trying to develop mineral wealth in this part of the state since 2016 and particularly under the Biden Administration, but under the DJT leadership, a renaissance is in the making.

| Want to be the first to know about interesting Gold, Silver and Copper investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Agnico Eagle Mines Ltd.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.