Liberty Gold Corp. (LGD:TSX; LGDTF:OTCQX) announced results of the feasibility-level, phase 5B metallurgical program for its Black Pine project in Idaho, and they demonstrated "favorable leach metrics," reported Philip Ker, analyst at Ventum Capital Markets, in a Sept. 24 research note.

"Results from the phase 5B program indicate robust recovery levels across a wide range of crush sizes in lab testing," Ker wrote.

61% Return Implied

Ventum reiterated its CA$1 per share target price on the U.S. explorer-developer, trading at the time of Ker's report at about CA$0.62 per share, the analyst noted. From this price, the return to target is 61%.

Ker pointed out that LGD remains "a significant value compared to other gold developers within our coverage universe," as it is trading at a price:net asset value metric of 0.15x versus peers a 0.31x.

Liberty Gold remains a Buy.

The company has 455.2 million basic shares outstanding. Its market cap is CA$282 million. Its 52-week range is CA$0.25–0.64 per share.

What the Results Mean

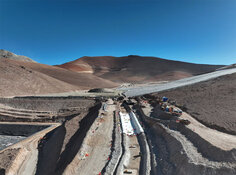

The purpose of the Phase 5B metallurgical program was to expand sample coverage and confirm consistency of gold extraction rates in multiple rock units throughout the interior of the Rangefront and Discovery deposits. Accordingly, 22 column leach tests were done.

The findings showed an "impressive" average recovery of 81.9% at an average head grade of 0.65 grams per ton gold. Recovery of material from Rangefront averaged 85.2% and from Discovery, 80.5%.

Also, results demonstrated rapid leaching, with more than 80% recovery in 10 days.

Bottle roll tests done at a smaller crush size, about 2 millimeters versus 20, returned comparable recovery, of 78.4%. This reinforces Black Pine's insensitivity to ore size, and thus supports the potential for a low-cost, run-of-mine (ROM) heap-leach process to be employed, Ker highlighted.

Considering all of the metallurgical program phases completed thus far at the project, the analyst commented: "With ongoing metallurgical test work continuing to showcase the robust recovery potential at Black Pine, we see ongoing results setting a solid foundation for the much-anticipated 2026 feasibility study and support our thesis of Black Pine delivering robust economics around a potential ROM processing scenario."

More Phases Ahead

Liberty has additional metallurgical test work at Black Pine planned to refine its recovery model, and continues to move through each program. Three phases remain.

Phase 6 is a bulk sampling program across variable rock units. Phase 7 involves cutoff-grade variability test work. In phase 8, material from the legacy heap-leach pad will be tested to determine its potential for reprocessing and reuse.

What to Watch For

Potential catalysts for Liberty include the release of additional metallurgical program results on an ongoing basis throughout H1/26 and completion of the subsequently feasibility study expected in Q4/26.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |