Dakota Gold Corp. (DC:NYSE American) engaged Forte Dynamics in Colorado to carry out a comprehensive metallurgical testing program at the explorer-developer's Richmond Hill open-pit, heap-leachable oxide gold project in South Dakota, reported Andrew Mikitchook, analyst at BMO Capital Markets, in a Sept. 24 research note.

"The metallurgical testing program is scheduled for Q4/25–Q3/26, with staged testing and reporting milestones throughout," Mikitchook wrote.

91% Return Implied

BMO maintained its $9 per share target price on the South Dakota-based gold junior, trading at the time of Mikitchook's report at about $4.71 per share, the analyst noted. From this price, the return to target is 91%.

Dakota Gold remains rated Outperform.

Notable Grades Returning

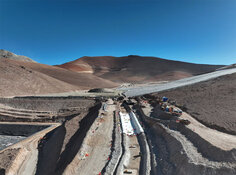

For its 27,500 meter (27,500m) drill campaign at Richmond Hill this year, Dakota Gold has three rigs active, Mikitchook reported. Two of them are core rigs being used to collect metallurgical samples, do condemnation drilling, and where the resource remains open, carry out infill and expansion drilling.

Results from the drill program released thus far returned grades that are higher than the average resource grade, the analyst highlighted. This suggests potential to grow the resource.

Drilling continues, and more results are expected this year.

Regarding metallurgical drilling specifically, highlight intercepts include 33m of 2.25 grams per ton (2.25 g/t) gold and 20m of 1.44 g/t gold. For context, the heap-leachable Measured and Indicated resource outlined in the February 2025 update is 3,650,000 ounces (3.65 Moz) of 0.46 g/t gold. The Inferred resource is 2.61 Moz of 0.35 g/t gold.

Scope of Met Work Ahead

Mikitchook noted that the metallurgical test work Forte Dynamics will do includes ore characterization and preliminary testing, column leach testing, comminution and crushing studies, process optimization and recovery, and deleterious elements and environmental testing. The overall purpose is to characterize the oxide ores and define criteria for a process that supports heap leaching.

The results of Forte's work will inform the Richmond Hill feasibility study and the project permitting and economics. Mikitchook reiterated that the Initial Assessment with Cash Flow (IACF) of Richmond Hill, released last month, outlined an operation producing 153,000 ounces of gold per year over 17 years at a $1,047 per ounce all-in sustaining cost and with $380 million of initial capex. The IACF indicated gold recoveries of about 85%, based on results of 31 historical column tests.

Dakota Gold expects a final report from Forte in H2/26 and intends to release the Richmond Hill feasibility study in early 2027.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |