Zonte Metals

Recent Price CA$0.09

Entry Price CA$0.09

Opinion – Strong Buy to $0.105

The market has changed, and Zonte Metals Inc.'s (ZON:TSXV; EREPF:OTC) shares have been moving up in price. This will be a bit lengthy, focusing on the stock action, Cross Hills, and Gramalote.

I have given previous updates when the stock was 5 cents or so, to accumulate with bids. You will not be able to do this anymore, as the Banksters on the other trading platforms want to cover a huge short position, so they will front-run your bids if a seller comes out.

Somebody or somebodies have been aggressively accumulating the stock over the past month, volume really picked up, and the stock has moved from CA$0.045 to CA$0.09. The funds with their flow through shares have been mostly bought up, so no more or little selling left there.

The junior miners have been in a long bear market so the Banksters and Hedge funds used their computer algos to continuously short the stocks and buy back or cover at lower prices. In many cases, just making a penny or half penny, but doing this on thousands of stocks and millions of trades per day. This all happens invisibly to the majority of retail traders. I pay about $120 per month at Stockwatch so I can see the trades, data, and actions.

As these new buyers came into Zonte, the shorts kept going shorter and shorter figuring it is business as usual. It is just a computer program doing what it was told too. However, as the short position became to large and they were not able to cover, they stopped shorting and are now trying to cover a large short position, I estimate at 500,000 to 1 million shares, and now the flow through funds have no stock left to sell, we could see a short squeeze sending the stock a lot higher.

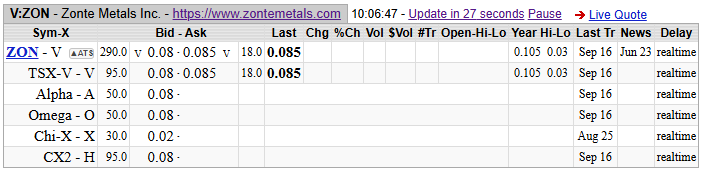

Above is a screenshot at 10 am yesterday, showing the bids that include the other platforms. Alpha is bidding for 50k, Omega for 50k, and CX2 for 95k, all at 8 cents. If somebody buys the CA$0.085 and the bid goes there, all these platforms will move up to CA$0.085. They show a small a bid as possible for those that get this data, they don't want to make the market look too strong. The other point, for some time now they have not been putting up any offers. They don't want to increase their short position any larger.

Retail investor don't see these alternate platforms when they ask for a quote, unless they pay the bucks as I do. They are relying on retail investors to sell and hit the bid at CA$0.08. At the same time Research Capital and Anonymous are bidding on the TSXV at CA$0.08, but if a seller comes around, these alternate trading platforms can front run and take the sellers stock to cover shorts.

Most likely, the Anonymous buyer on TSXV is part of the shorts, trying to cover.

In conclusion, there is a large short position trying to buy and cover; a short squeeze could happen.

My next point is that the market has changed from Bear to Bull.

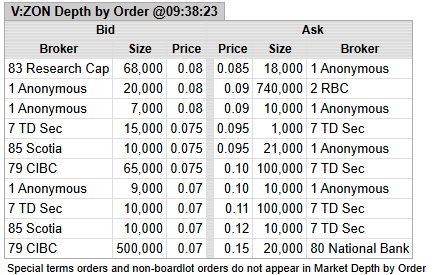

Many times, there are well over 1 million orders for shares to buy. We have not seen this in the market for many years. Below is a snapshot around 10 a.m. It only shows 10 orders on each side. I want to highlight that RBC is offering 740k at 9 cents. I believe this is the last chunk of any size that is left for sale, so once that is gone, the stock could easily move to the CA$0.20 area quickly.

So there is the picture on the stock trading and the big change in the market. Now some highlights on Cross Hills.

What makes this such a compelling investment is that Zonte is on the verge of discovering a new copper belt, not just a copper deposit. This has not happened in decades and it is in a mining friendly jurisdiction. The Fraser Institute's last ratings show only Saskatchewan and NFLD in the top 10 jurisdictions in the world. NFLD is rated at #6 in the world.

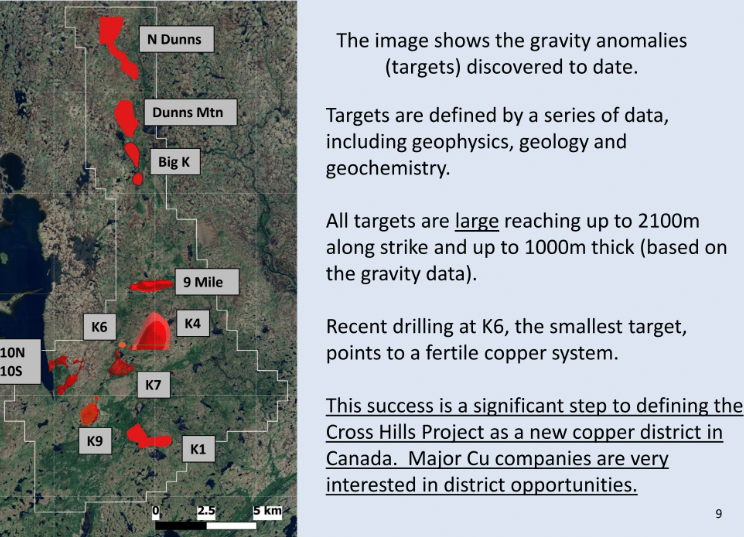

The Cross Hills property has excellent infrastructure and can be worked year-round. Road access, close to tide waters, major power line at north end of the property and there are no Indigenous issues or peoples in the area. What is most stunning is the number of huge targets now defined.

This graphic from the Zonte Presentation gives a great snapshot:

Most junior exploration companies have one or two targets on their property and some three or four. Zonte has 10 and still probably find more. Not only that, they are huge in size. And this is an IOCG system, they tend to produce large targets/deposits like we see and above average grades in the 0.5% to 1% copper range, plus gold.

At 9 cents, Zonte is very cheap compared to it/s peers. The market cap is only CA$7.3 million. Here is the market cap of other copper plays on our list:

- Fitzroy Minerals $79 million

- Midnight Sun $198 million

- Element 29 $77.5 million

- GSP Resources $4.6 million

A few others on my watch list:

- Coppercorp Resources $12 million

- Kodiak Copper $64.5 million

Once Zonte hits a decent drill hole, the stock is going to move up in line with the others, a CA$70 million market cap making a 10 bagger from today's price.

I believe GSP Resources has a low value, its project is small, and they need to announce some drill results in this better market.

For years, B2Gold was putting off the Gramalote project, but now with higher gold prices and their Goose mine construction is done, Gramalote is the next mine B2Gold will build.

On July 14, B2Gold announced a very positive feasibility study for Gramalote and this was at a modest $2,500 gold price. They will have to modify permits for this smaller mine and they estimated that will take 12 to 18 months.

We now have the timeline that they will have to deal with Zonte and 12 to 18 months goes pretty fast.

The other important aspect in the feasibility they provide a $ estimate to deal with Zonte and others. In the feasibility they said next they will advance resettlement programs, establish coexistence programs for small miners.

In the feasibility they have allocated US$55 million for resettlement and other programs. They also have $81 million in contingency and a total construction estimate of $740 million.

I can't see B2Gold having to spend more than a few million on relocating some residents in the mine area. Housing is only around $100,000 to $200,000 and that is in major cities. Most of their allocation will go to the small miner issue. Zonte;s claims are optioned from four small miners, it is these Colombian nationals on the title. Just because B2Gold has allocated these funds does not mean that's what Zonte will settle for.

However, for arguments sake, lets say Zonte got $35 million of the $55 million B2Gold allocated. After all Zonte's claims are numerous and right in the middle of the planned open pit mine, but that is still a considerable sum.

US$35 million = about $48.5 million Canadian. Zonte has 81 million shares out so that is about 60 cents per share or over six times the current share price.

It is too bad this was not a bankable feasibility because B2Gold would have to go into a lot of detail on resettlement and small miner claims. This is no big deal for B2Gold to finance themselves with cash on hand, existing credit facilities and cash flow that will ramp much higher with the new Goose mine. Last financial s show US$330 million cash on hand.

And lastly a stock chart. The CA$0.105 level is the key level to break, once through this, the stock can easily run to the CA$0.20 area.

| Want to be the first to know about interesting Gold and Copper investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals and Midnight Sun Mining.

- Ron Struthers: I, or members of my immediate household or family, own securities of: Zonte Metals. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.