You've heard of the phrase "buy when there's blood in the streets."

Baron Rothschild invented this expression in 1815 during the Battle of Waterloo. While British forces clashed with Napoleon's army, the Baron wagered his entire personal wealth on British government securities.

No one was willing to finance Britain when defeat seemed possible, but Rothschild deployed his capital when the streets were literally covered in blood.

And following Britain's victory over Napoleon, he catapulted to the pinnacle of global wealth rankings.

Rothschild employed one of the most reliable strategies for financial success. He identified an asset everyone avoided . . . Acquired it . . . And patiently waited for sentiment to shift in his direction.

Purchasing a disliked investment is challenging in practice. You'll experience feelings of recklessness. Yet acquiring underappreciated gems frequently leads to substantial returns. Indeed, numerous revolutionary market leaders share an unusual characteristic — they were initially disliked.

Consider Netflix

We recognize Netflix Inc. (NFLX:NASDAQ) as the innovator that created online streaming. But previously. . .

Netflix began as the pioneer in digital DVD rental services. Remember ordering films online and receiving discs in your mailbox days later? Americans adored the original Netflix. You enjoyed unlimited films for merely $10 monthly.

Netflix eliminated the worst aspect of movie rentals: late penalties. In fact, it was so popular that many Americans barely noticed when Netflix introduced streaming in 2007. They preferred physical discs! By 2011, Netflix had surpassed 20 million subscribers. And they continued shipping millions of DVDs in their signature envelopes daily.

Additionally, they were spending $600 million on postal expenses. Netflix CEO Reed Hastings developed a strategic plan to transition customers away from physical media.

He recognized streaming would eventually eliminate physical formats. So Hastings decided it was time to make a decisive move toward streaming. Against his team's recommendations, he divided Netflix subscriptions. Customers could now stream content for just $8 monthly.

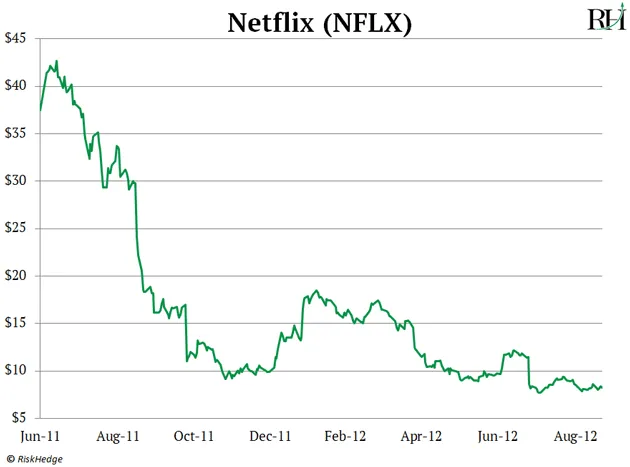

However, those still wanting DVD rentals would need to pay $16 monthly — a 60% increase. While Netflix was prepared to commit fully to streaming, customers weren't — and they rebelled. Netflix lost approximately one million subscribers within several months. And its stock value dropped 77%:

Hastings' reputation plummeted. He transitioned from being named Fortune's Businessperson of the Year in 2010 . . . to The New York Times' "Worst CEO" of 2011.

Interestingly, this presented an extraordinary opportunity to acquire Netflix shares. Hastings' transition to streaming proved to be among the most brilliant corporate decisions. As streaming quality improved, most consumers discarded their DVD players.

Indeed, Netflix completely transformed our viewing habits. Physical DVDs now seem prehistoric. Netflix had 20 million paying subscribers in 2011 when they gambled everything on streaming. Today they exceed 300 million. And investors who purchased Netflix in 2011, when most avoided it, have realized enormous profits.

Now, Examine Tesla

During Tesla Inc.'s (TSLA:NASDAQ) initial decade, Tesla exclusively sold luxury electric vehicles exceeding $70,000. But in 2016, Musk unveiled their first mainstream vehicle, the Model 3. Tesla planned to price the Model 3 at just $35,000, making it accessible to millions of middle-income buyers.

This vehicle was poised to revolutionize the automotive industry. Its introduction should have marked Tesla's defining moment. Instead, it nearly bankrupted the company. In 2015, Tesla was manufacturing approximately three vehicles daily.

To successfully produce the mainstream Model 3, they would need to manufacture 5,000 vehicles weekly. Tesla wasn't prepared for this massive production increase and consistently missed targets.

Elon Musk worked 22 hours daily, seven days a week, addressing production challenges. He regularly slept at the factory because he "didn't have time to go home and shower." Yet almost a year after the Model 3 launch, Tesla still struggled to produce even 2,000 vehicles weekly. When earnings declined due to unexpectedly high production expenses, its stock plunged to nearly its lowest point since 2016:

Tesla's shares had stagnated for five years, becoming Wall Street's most despised stock. Investment bank Morgan Stanley reduced its worst-case projection to $10/share. Investors wagered a record $15 billion against Tesla's stock. This was more than twice the amount bet against any other market stock.

Just as collapse seemed imminent, Tesla rebounded dramatically. In late 2019, they surprised Wall Street by delivering a record 97,000 vehicles. Tesla followed with another milestone, shipping over 100,000 vehicles in a single quarter for the first time. Investors who purchased Tesla at its lowest point have been handsomely rewarded.

What's the Key To Investing in Despised Stocks?

Investing revolves around expectations. Stocks frequently rise — and fall — based on performance relative to investor expectations. When people believe a company will dominate globally, it creates a significant threshold that's difficult to surpass.

For instance, in 2006, Alphabet Inc. Class A (GOOGL:NASDAQ) announced a 97% revenue increase. You might assume the stock soared following exceptional earnings, correct?

Instead, it plummeted 16% at market opening. Essentially, Wall Street was disappointed because analysts expected Google to grow revenue by over 100%.

Conversely, when investors dislike a stock, they establish such minimal expectations that exceeding them becomes almost inevitable.

So when a disliked company — like Tesla — delivers more vehicles than investors anticipate, its value skyrockets. Ultimately, if you're seeking substantial returns, you should consider investing in despised stocks.

For more insights, subscribe to our investing letter, The Jolt.

We publish fresh research and analysis on today’s big disruption investing opportunities.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tesla Inc.

- Chris Reilly: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.