West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB; FRA:UJO) is making significant progress toward becoming Canada's next premium-grade gold producer.

On August 6, 2025, West Red Lake Gold Mines shared their latest progress on operations at the Madsen Mine in Red Lake, Ontario. Throughout July, the processing facility achieved an impressive 94% recovery rate while handling between 500-800 tonnes daily. Furthermore, ore extracted during sill access development contained gold concentrations significantly exceeding projections on multiple occasions. These factors combined enabled Madsen to produce 3,800 ounces during July. From this total, 3,595 ounces were marketed at an average price of US$3,320 per oz, generating US$12 million (CA$16.4M) in earnings.

I interviewed West Red Lake Gold VP of Corporate Communications, Gwen Preston, regarding the progress at Madsen and the successful strategies at West Red Lake Gold.

Madsen Mine Performance Overview — I emphasized the noteworthy figures from the recent Madsen mine operations announcement, including processing capabilities reaching 800 tons daily, yielding 3,800 ounces of gold in July, and attaining 94% recoveries. Gwen Preston clarified that these outcomes resulted from directing miners toward sill development, which, despite being a lower-volume activity, unexpectedly produced exceptionally mineralized material, with an average mined sill grade of 8.9 grams per ton (00:03:16). They observed that the sills, positioned at the boundaries of the targeted area, had reduced confidence in their geological model, making the elevated grades an unexpected benefit (00:02:30).

Production Status and Future Projections — Gwen Preston indicated that West Red Lake hasn't officially announced commercial production, despite meeting the 75% targeted throughput requirement, because additional data is necessary to confidently provide production forecasts (00:06:00). They elaborated that further months of information are needed to comprehend the long-term relationship between premium-grade zones, typically identified with closer drilling, and surrounding mineralization from expanding the target area, which will shape future grade expectations (00:06:51). I noted the remarkable earnings of US$12 million for the month, which Gwen Preston acknowledged was partly due to advantageous market timing (00:07:49).

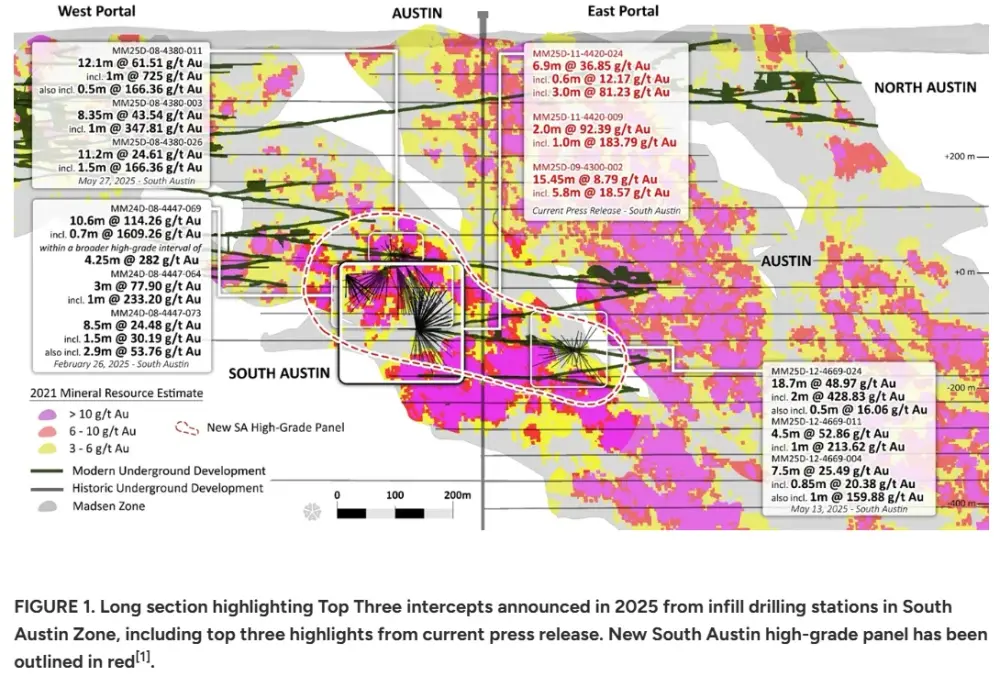

South Austin Zone Importance — I underscored that South Austin represents the prospective foundation of West Red Lake Gold's Madsen Mine, with recent premium-grade samples confirming its potential (00:09:14). Gwen Preston characterized South Austin as remarkably promising, noting that it's evolving into a several-hundred-meter extension of robust mineralization and is fundamental to the Madsen project's capability for expansion beyond its existing deposit. They further mentioned that concentrated exploration efforts, which have been absent for decades, are revealing additional premium-grade sections within the deposit, supporting the company's theory of discovering substantial mineralization around established areas (00:010:08).

South Austin Development Timeline and Operational Requirements — Gwen Preston explained that extraction in the premium-grade sections at South Austin is anticipated to commence in late 2024 and accelerate in the first half of 2025, with development access being a primary focus for September, October, and November (00:12:18). They also addressed continuing challenges and requirements for sustaining momentum, including following a detailed daily, weekly, and monthly schedule, and implementing infrastructure projects like the Cemented Rock Fill (CRF) facility underground to enhance efficiency by decreasing waste transportation (00:13:18). Additionally, Gwen Preston emphasized the priority on boosting shaft capacity to transport material more effectively and ensuring ongoing support for the mine through personnel, energy, mechanics, and ventilation (00:14:27).

Financial Market Approach and Exchange Listing Plans — I questioned about West Red Lake Gold's financial market approach, specifically regarding a potential transition to a major stock exchange, given their increasing market value (00:16:33). Gwen Preston confirmed that they are actively working toward meeting criteria for inclusion in larger investment funds and are evaluating a move to the primary board in Canada, which they consider achievable without significant obstacles (00:17:29). However, they explained that listing on a major U.S. exchange such as the NYSE or NASDAQ, while beneficial for accessibility to investment funds, involves considerable expenses and additional accounting and legal capabilities, making it a goal for 2026 rather than immediately (00:18:25).

Upcoming Announcements and Sector Perspectives — Gwen Preston mentioned that another exploration-related announcement is expected before the Beaver Creek event, which will highlight new areas the company is investigating.

You can read more from Robert Sinn of Goldfinger Capital here.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- West Red Lake Gold Mines Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Red Lake Gold Mines Ltd.

- Robert Sinn: I, or members of my immediate household or family, own securities of: West Red Lake Gold Mines Ltd. My company has a financial relationship with: West Red Lake Gold Mines Ltd. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Robert Sinn Disclosures

Disclosure: Author owns shares of West Red Lake Gold at the time of publishing and may choose to buy or sell at any time without notice. Goldfinger Capital has been compensated for production, editing, and dissemination of this interview.

Disclaimer: The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. West Red Lake Gold Mines Ltd. is a high-risk venture stock and not suitable for most investors. Consult West Red Lake Gold Mines Ltd’s SEDAR profiles for important risk disclosures.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.sedarplus.ca for important risk disclosures. It’s your money and your responsibility.